Summary:

- Abbott Labs spun off AbbVie in 2013.

- AbbVie has lost patent protection on its largest selling product Humira.

- AbbVie has better financial metrics and dividends.

May Lim/iStock via Getty Images

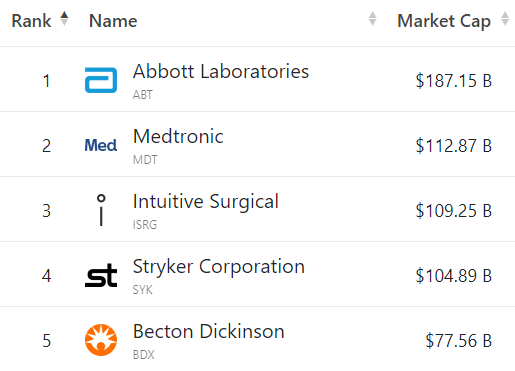

Abbott Labs (ABT) and AbbVie (NYSE:ABBV) are two of the largest medical products companies in the world with an MV (Market Value) of $189 billion and $263 billion respectively. Both companies are based in the Chicago, IL suburbs.

From an MV point, Abbott is the largest medical device company in the world.

companiesmarketcap.com

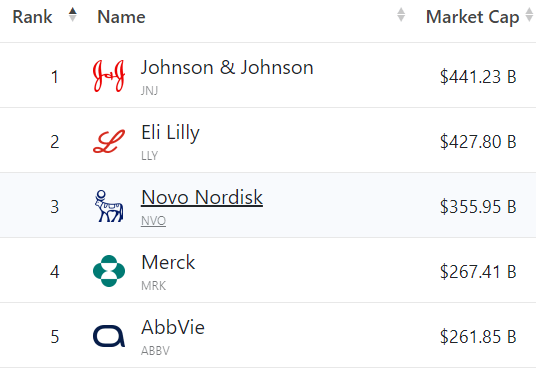

AbbVie is the fifth largest pharmaceutical company in the world by MV behind such stalwarts as Johnson & Johnson (JNJ) and Eli Lilly (LLY).

companiesmarketcap.com

An interesting contrast between these two investment opportunities lies in the fact that AbbVie was spun off from Abbott in 2013 and since then both have been hugely successful with their share price up over 200%.

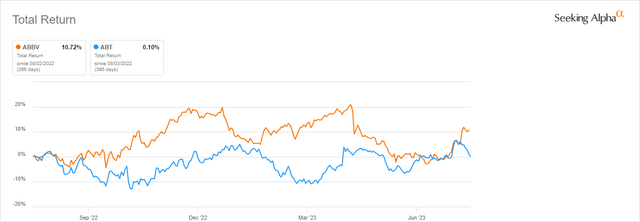

Seeking Alpha

But in January of 2023, AbbVie lost its exclusive patent to sell its most profitable product Humira. Humira has generated over $200 billion in revenues for AbbVie over the last 10 years but Humira’s future sales will almost certainly be less than they have been. Humira is indeed the largest-selling drug in history.

Looking at the Total Return (including dividends) over the last year, ABT has done better with an increase of 11% versus ABBV’s increase of 0%.

Seeking Alpha

It looks like Mr. Market is not enthralled with either Abbott or AbbVie.

In this article, I will compare both companies to determine which one represents the best investment opportunity going forward.

Here are four points to consider before investing in either Abbott or AbbVie.

1. Financial metrics

Looking at ABT and ABBV individually, they both have performed quite well over the last 12 months.

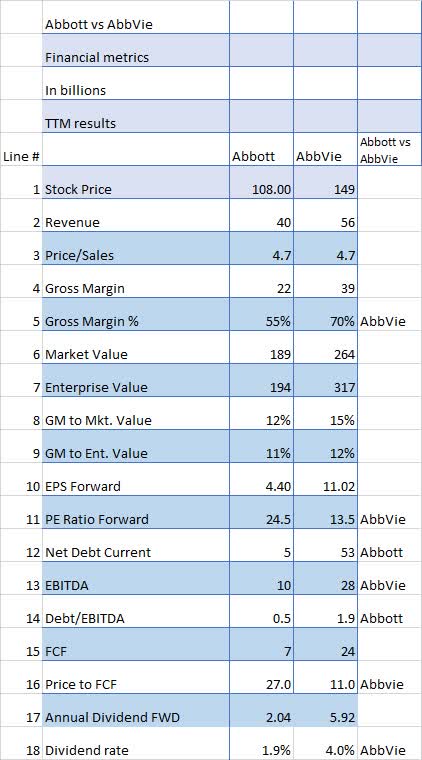

Seeking Alpha and author

The first item is the Price/Sales ratio (Line 3) where AbbVie’s ratio, 4.7x, is exactly the same as Abbott’s. This would imply that the market is pricing both companies about the same.

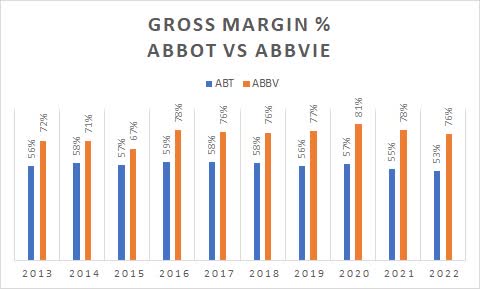

But moving on to Gross Margin percentage (Line 5) which shows ABBV with a rather large advantage of 70% to ABT’s 55%. The chart below shows ABBV has had better margins over the last decade relative to ABT.

Seeking Alpha and author

Obviously, over the last 10 years, ABBV has consistently shown greater GM than ABT. AbbVie has consistently exceeded 70% GM over the last 10 years compared to Abbott’s high GM of 58%.

The question is how much of that margin is due to Humira and how much margin compression will result from that loss of patent rights?

Other financial metrics of interest include the PE Ratio (Line 11) which shows AbbVie at 14x versus ABT’s rather lofty 25x. This may indicate that the market has already built in lesser revenue and margins from Humira by lowering ABBV’s PE ratio.

However, on Net Debt (Line 12), Abbot’s is much lower than AbbVie’s $53 billion to $5 billion. This would imply that Abbot has a much stronger balance sheet than AbbVie.

Offsetting the huge Net Debt number is ABBV’s much larger EBITDA (Line 13) coming in at $28 billion to ABT’s $10 billion. This means AbbVie would most likely be able to handle its larger debt profile.

We can also see that ABBV has a much higher FCF number (line 15) $24 billion to $7 billion. This makes ABBV’s Price to FCF Ratio (Line 16) much lower than ABT’s 11x to 27x. This is another indicator that the market may be pricing in the lower volumes expected by AbbVie’s Humira.

And finally, in terms of dividend rate, AbbVie is a solid 4% versus Abbott’s 1.9%.

Advantage: AbbVie

2. What do analysts think?

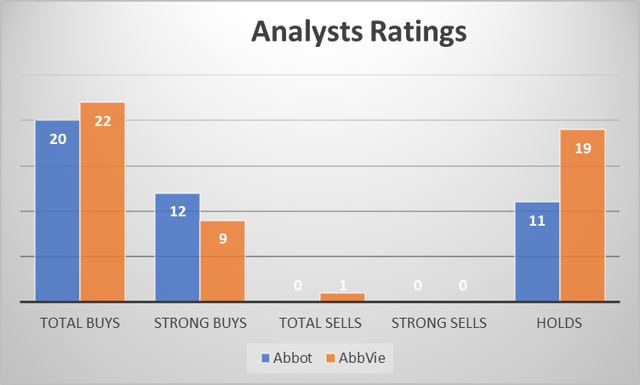

Looking at how Wall Street analysts have rated the two shows both companies with very strong Buy ratings. With a combined 42 Buy ratings, including 21 Strong Buys, analysts are very upbeat on both companies.

Seeking Alpha

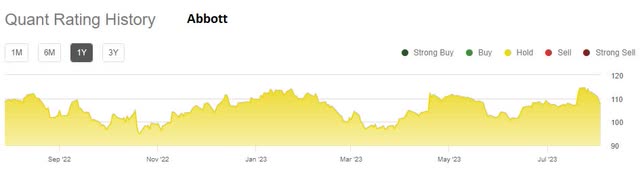

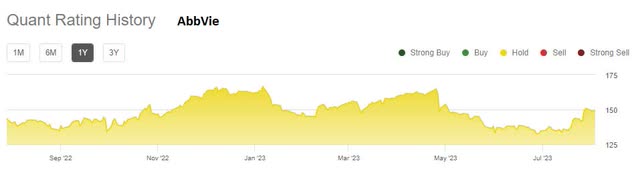

When it comes to the quant ratings, they currently have both Abbott and AbbVie as a Hold. And the Hold quant rating has been consistent for the entire year.

Thus the quant ratings are not enamored with either company.

Seeking Alpha

Seeking Alpha

Advantage: Neither

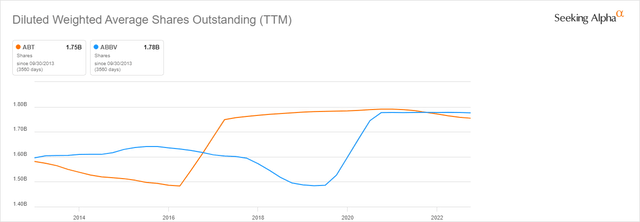

3. Share buybacks are not a priority for either company

With their enormous financial capabilities, both companies have decided that share buybacks are not a priority.

This can be seen in the following chart showing both companies have actually increased their share count over the last 10 years.

Seeking Alpha

Advantage: Neither

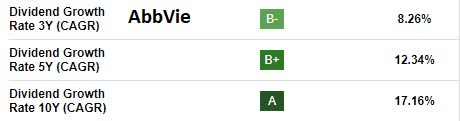

4. Dividend increases are coming for both Abbott and AbbVie

Both Abbott and AbbVie have increased their dividend every year for the last nine years.

Looking at the rate of increase over the last 3, 5 and 10 years shows Abbot with a higher rate of increase than AbbVie’s over the last 3 and 5 years but over the last 10 AbbVie wins.

Seeking Alpha

Seeking Alpha

But as can be seen in the Financial Metrics chart above, Abbott’s current dividend rate of only 1.9% is far below AbbVie’s current rate of 4%.

Advantage: AbbVie

Conclusion:

One of the prime risks in any medical field investment such as pharmaceuticals and medical equipment is obsolescence or patent expirations. As can be easily seen in the above analysis, AbbVie is facing a huge problem with the loss of patent protection on its largest-selling product Humira.

To show you how much Humira’s sales mean to AbbVie’s bottom line, in fiscal year 2022 Humira’s revenue was $21.2 billion or 38% of ABBV’s total revenue of $56 billion.

Comparing Abbott to AbbVie shows several differences, especially in the area of financial metrics.

AbbVie shows superior PE Ratio, EBITDA, and FCF compared to Abbott. But AbbVie also has a much higher debt load than Abbott does.

Although AbbVie is a much riskier choice due to the loss of patent protection on Humira, it also has superior financial metrics and a dividend that is more than twice Abbott’s.

AbbVie is a Buy for investors with at least some risk tolerance.

Abbott is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.