Summary:

- AbbVie agreed to acquire biotech company ImmunoGen for $10.1 billion in an all-cash transaction, sending ImmunoGen’s stock soaring 83%.

- ImmunoGen’s ovarian cancer drug Elahere has a consensus revenue target of $375 million this year, with the potential to reach nearly $1 billion in sales by 2026.

- AbbVie’s acquisition of ImmunoGen is aimed at expanding its drug pipeline and utilizing its marketing machine to grow sales and expand approved medical conditions.

- The stock trades below 13x 2024 EPS targets while offering a 4.4% dividend yield, and the deal will push AbbVie back into growth mode.

Chinnapong/iStock via Getty Images

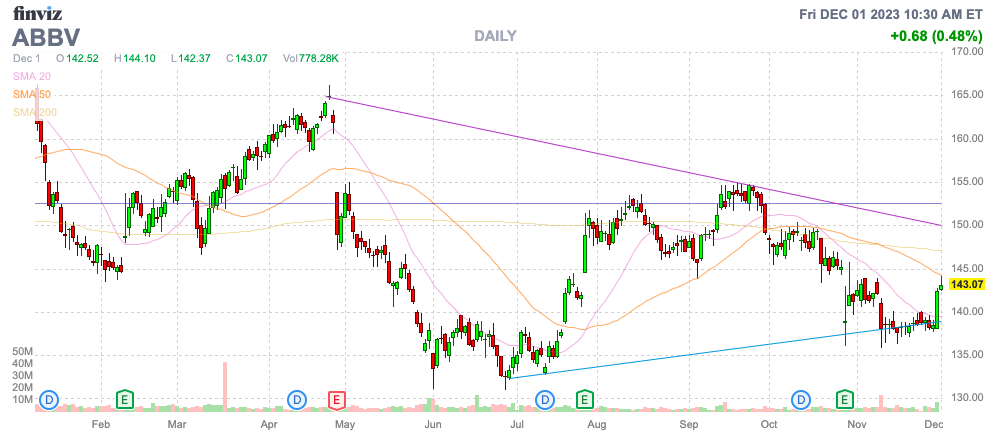

The biopharma space continues to face a lot of pain with the LOE on major drugs. AbbVie Inc. (NYSE:ABBV) is the latest company to acquire a promising biotech in the form of ImmunoGen, Inc. (IMGN) to improve the drug pipeline. My investment thesis is Bullish on the stock, which is trading near the yearly lows despite the strong cash flows.

Finviz

ImmunoGen Deal

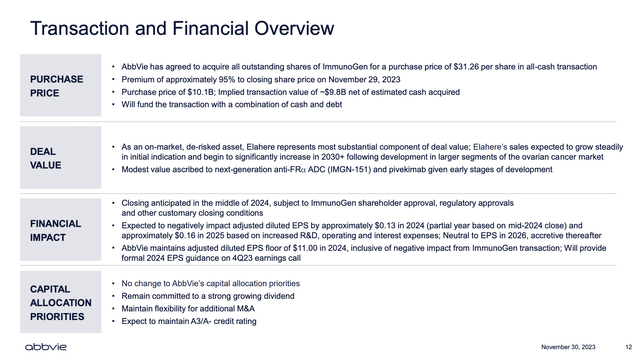

AbbVie reached a deal to acquire ImmunoGen for $31.26 per share in an all-cash transaction valued at $10.1 billion. ImmunoGen got a 95% premium to the prior closing price, sending the stock soaring 83% on the day.

AbbVie ImmunoGen Merger Presentation

The small biotech has the ovarian cancer drug Elahere approved, with a consensus revenue target of $375 million this year and jumping to nearly $1 billion by 2026. The deal is dilutive by $0.13 in 2024 depending on the actual closing date of the transaction.

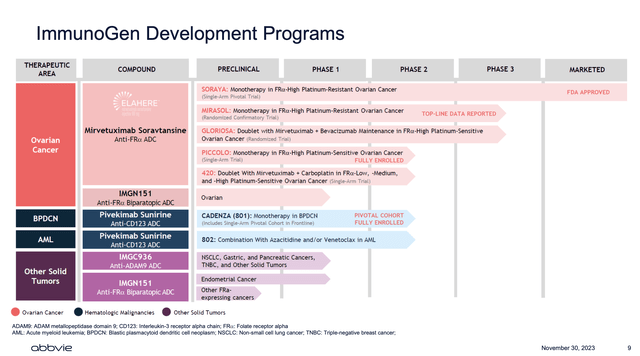

The novel cancer drug in the class called antibody-drug conjugates (ADCs) isn’t a mega-drug currently. AbbVie is buying ImmunoGen for the drug pipeline and for the potential to use the AbbVie marketing machine to grow the drug’s sales profile and expand the approved medical conditions over time via new ongoing trials.

The market forecasts a $3+ billion global market for ovarian cancer with a forecast to double in 5 years and reach $12 billion in 10 years, or 2033. The big key for investors to understand the possibility with Elahere is the market expansion and growth opportunities, not as much for any blockbuster sales in the near term.

ImmunoGen has a solid development program, with drugs targeting solid tumors and hematologic malignancies. The hematologic malignancies drug has several Phase 2 studies ongoing.

AbbVie ImmunoGen Merger Presentation

AbbVie Needs Growth

The large biopharma just reported Q3’23 earnings of $2.95 per share and guided up to an $11.21 EPS for 2023. AbbVie continues to run into issues with revenue declines from LOE of Humira offset by new drug launches.

Back in Q3, Humira revenues were down 36% to $3.55 billion. Overall, AbbVie only reported a 6% dip in revenues to $13.93 billion. A lot of the Humira revenue gains were offset by 50% gains in Skyrizi and Rinvoq, with combined quarterly revenues of $3.24 billion.

The company guided to a 2024 EPS of up to $11.00 for a slight dip from the 2023 level. The ImmunoGen deal will lower the upside EPS target to only $10.87 while revenues will rise based on half a year of sales.

One of the new issues with cash merger deals in the lower interest income or additional debt cost. In the past few years, corporations immediately made positive income on cash deals due to idle cases not generating a return.

AbbVie ended last quarter with a cash balance of over $13 billion and nearly $56 billion in debt. The net debt position is about $42 billion. The interest income jumped to $157 million, while interest expenses were stable at $555 million for a net cost of $398 million.

In essence, AbbVie will pay at least $400 million in additional net interest expenses. The amount includes the loss of interest income from using the existing large cash balance to pay for ImmunoGen.

With 1.8 billion shares outstanding, the guidance for a $0.13 dilutive EPS impact in 2024 is mainly due to the impact to interest expenses. ImmunoGen is forecast to be slightly profitable next year, earning ~$100 million based on a $0.37 EPS target.

AbbVie generates $20+ billion in annual cash flows and spends about half of those cash flows on the dividend, currently yielding around 4.4%. The company will generate enough cash flow to pay for the deal by the time it actually closes.

The additional revenues will help the view of the biopharma, considering the market preference for growth equities. AbbVie will need the ImmunoGen business to reach revenues far beyond the $1 billion range to move the needle on a business already topping $50 billion.

Takeaway

The key investor takeaway is that AbbVie Inc. has a drug deal in ovarian cancer, pushing the company back into growth mode in 2024. The stock isn’t overly cheap, trading at nearly 13x EPS targets while this deal is dilutive in the short term. Ultimately, though, if AbbVie can return to growth and put the Humira LOE in the rearview mirror, the stock will reward shareholders with a strong profit and a large dividend yield.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.