Summary:

- AbbVie’s weak stock price performance in the past quarter is in no way an indication of the progress it has made in recent months.

- Turnaround in revenue growth following Humira’s patent expiration is now evident and recent acquisitions could bolster growth further.

- EPS trends have improved too, while a stable operating income is also encouraging.

- The market multiples assessed in three ways are also more attractive than not, and the dividend yield isn’t bad either.

vzphotos

Since I last wrote about the pharmaceuticals company AbbVie Inc. (NYSE:ABBV) in March, its stock market performance has been underwhelming, with a 3% price decline. This isn’t an entirely surprising short-term movement.

The stock was trading at higher multiples compared with its five-year average levels three months ago. The stock’s price performance was also ahead of that of the S&P 500 Health Care Index, indicating the possibility for comparative attractiveness of other stocks in the sector. Investor disappointment on its first quarter (Q1 2024) earnings report, resulting in the biggest single day price fall in the past 12 months of ~5%, was a downer too.

However, that’s no reason for investors to get jitters about AbbVie. Despite signs to the contrary, both its performance and prospects have actually improved over the past quarter. In fact, there’s even a likelihood of some short-term price uptick now. Here are five reasons why.

#1. Turnaround begins

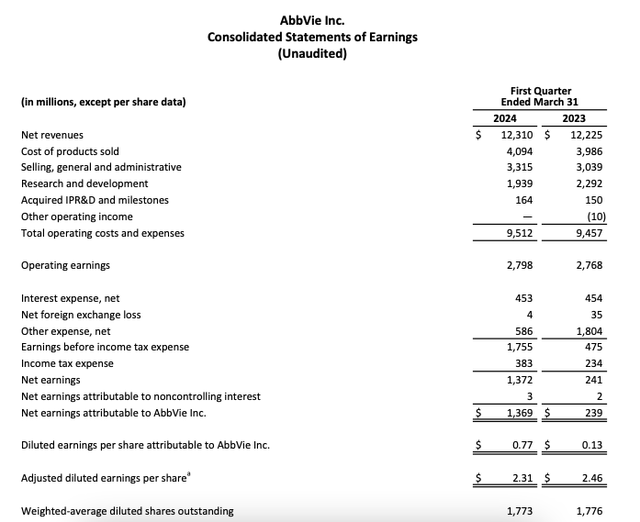

2023 was a poor year for AbbVie’s revenues after the patent expiration for its blockbuster arthritis treatment Humira. The number fell by 6.4%. After seeing four consecutive quarters of revenue contraction, however, the company’s numbers are now showing signs of turnaround. Revenues rose by 0.7% year-on-year (YoY) in Q1 2024, indicating Humira’s fading impact. With a 39.5% fall in revenues in the quarter, the treatment’s contribution to revenues fell to 18.4% from 26.5% for the full year 2023.

#2. Growth ex-Humira and acquisitions

But the real juice is in AbbVie’s revenue growth ex-Humira, which saw a robust 15.6% increase, up from 8.4% for the full year 2023. Neuroscience showed the biggest increase of them all, at 15.9% (see table below). But its other two growth segments, immunology and oncology, are also notable. Here’s why.

- Immunology: The first point to note is immunology ex-Humira’s particularly robust growth of 51.6% as both Skyrizi and Rinvoq showed massive increases. Next, the company acquired Lands Biopharma, which specializes in treating ulcerative colitis and Crohn’s disease. While the company isn’t revenue-generating at present, the prospects for its ulcerative colitis treatment look promising.

- Oncology: A 9% growth in the segment in Q1 2024 isn’t bad to start with. But it can see a further fillip after AbbVie’s acquisition of Immunogen in February. Since the acquisition was completed only mid-way through the quarter, its impact on oncology revenues is also for just half the quarter. But even that’s not trivial. ImmunoGen’s ovarian cancer treatment, Elahere, contributed to 4.2% of oncology’s revenues in Q1 2024. Assuming that its revenues were exactly the same for the remainder of the quarter, the treatment’s actual contribution could be over 8% going forward. Or even higher, considering recent developments in its potential to reach more patients.

Source: Abbvie

#3. Earnings picture improves

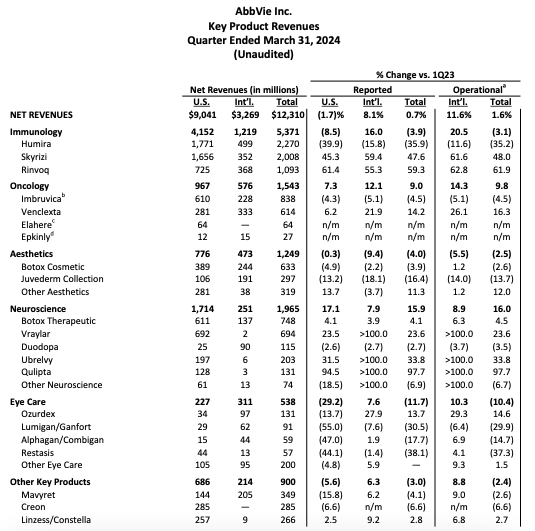

The earnings per share [EPS] trends for the latest quarter were an improvement over the 2023 figures, too. The GAAP EPS figure, in particular, saw a massive 492.3% increase, compared to a 59% fall for the full year 2023. The adjusted diluted EPS continued to decline, much like last year, but by a smaller 6.1% compared with 19.3% in 2023.

Encouraging as this is, I’d de-emphasize the EPS figures for this quarter, since they aren’t impacted by operational activities. For GAAP EPS, much higher other expenses last year resulted in a small net income and a favorable base for this year (see statement below). On the other hand, the adjusted diluted EPS saw a much smaller change in the value of earn-out provision or contingent consideration impacted the figure.

Instead, I’d focus on the operating income, which grew by 1.1%, reflecting a far more stable trend. The operating margin was at 22.7%, slightly below the 23.5% for the full year 2023. But the difference is too small right now to be a cause of concern.

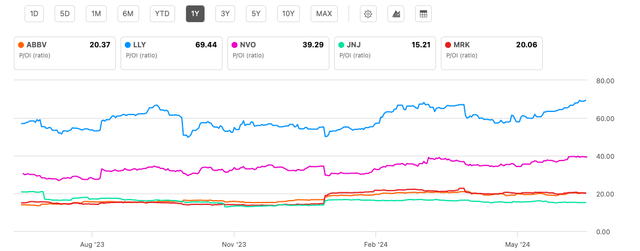

#4. Alternative market multiples

With this as the background, here I look at the market multiples based on the operating income as well. These don’t look bad either. Among the five biggest pharmaceutical stocks by market capitalization, it has a lower trailing twelve months [TTM] price-to-operating income (P/OI) ratio of 20.4x than Eli Lilly and Company (LLY) at 69.4 and Novo Nordisk A/S (NVO) at 39.3x. It’s also just a bit higher than Merck & Co., Inc. (MRK) at 20.1x (see chart below).

The average P/OI for the set is at 32.9x, indicating a 40% upside to ABBV.

Price/Operating Income, Comparison With Peers (Source: Seeking Alpha)

Also, the more traditional forward non-GAAP P/E reflects an improvement. At 15.3x it’s lower since I last checked, when it was at 16x. This is largely because of the price decline in the interim. But also in some part because AbbVie has slightly upgraded its guidance to USD 11.13-11.33 from the earlier USD 11.05-11.25.

The figure also compares favorably with the median ratio for the healthcare sector at 19.3x, much like was the case in March. However, it still remains higher than its own five-year average of 10.7x. On average, however, the three market multiple types considered indicate an upside to AbbVie even now.

#5. The dividend yield isn’t bad

There are dividends to consider as well. ABBV’s forward dividend yield is at 3.65%, which is significantly better than the average of 1.44% level for the healthcare sector. Considering the company has both paid and grown dividends for the last 10 years, they can be seen as safe too. This is especially so as the adjusted diluted EPS in 2024 is expected to be at least slightly higher than last year.

The risk from acquisitions

With the company actively making acquisitions, though, there’s a risk to its earnings. As noted in the section on the earnings picture, earnings have been impacted, both positively and negatively, due to non-operational considerations already.

Further acquisitions could not just yield earnings to even less straightforward interpretation, but also potentially impact them negatively due to cost considerations. The case of Bristol Myers Squibb Company (BMY) is worth mentioning here. The company dramatically reduced its earnings guidance recently precisely due to the impact of an acquisition, which has significantly reduced its stock price prospects for the remainder of 2024. The same can’t be ruled out for AbbVie.

What next?

However, for now, it’s clear that AbbVie is on the path to progress after its revenue setback last year due to the expiration of the Humira patents. The company’s revenue has now stopped declining and revenue growth ex-Humira is rather healthy. With the completion of two acquisitions recently, the company’s revenue prospects look even more improved.

While there are risks to earnings from future acquisitions, so far the EPS trends have also improved from last year too. A stable operating income is encouraging as well. The stock’s market multiples also indicate that there’s more upside to it than not. Additionally, the dividends aren’t bad either. I’m retaining a Buy rating on AbbVie.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABBV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—