Summary:

- AbbVie reported first quarter results and although results were not great, the company managed to set off declining Humira sales.

- Especially, Skyrizi and Rinvoq are expected to keep growing at a high pace and AbbVie made a few major acquisitions that will also contribute to growth.

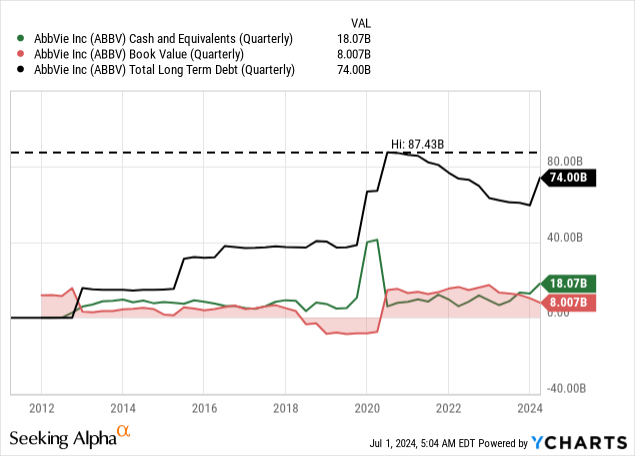

- However, debt levels increased again following the acquisitions.

- We could make the argument that AbbVie is slightly undervalued, but I would be cautious and rate the stock rather as a “Hold”.

vzphotos

It has almost been one year since I covered AbbVie Inc. (NYSE:ABBV) last. In my last article, I was rather bullish about AbbVie and called the stock a “Buy” despite declining Humira sales. In my conclusion, I wrote:

AbbVie is not only a “Buy” due to the lower stock price, but the company remains a recession-resilient pick and I still expect the global economy to enter a recession in the coming quarters. The dividend yield of 4.3% is also tempting in my opinion and the company is still able to generate an impressive free cash flow – even if free cash flow might be lower in the coming quarters due to the patent loss of Humira.

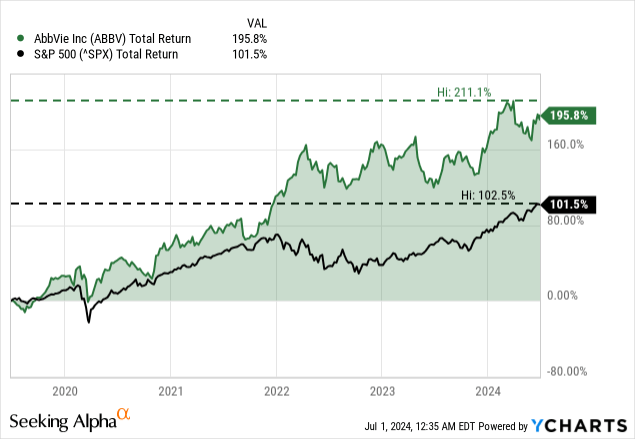

And in the meantime, AbbVie performed great. When including dividends, AbbVie returned about 30% to shareholders since my last article was published, and it also outperformed the S&P 500 (SPY) which increased about 24% in the same timeframe.

As a lot has happened in the last 12 months, let’s take another look at the company and stock and answer the question if AbbVie is still a “Buy” or if we should be rather cautious at this point.

Quarterly Results

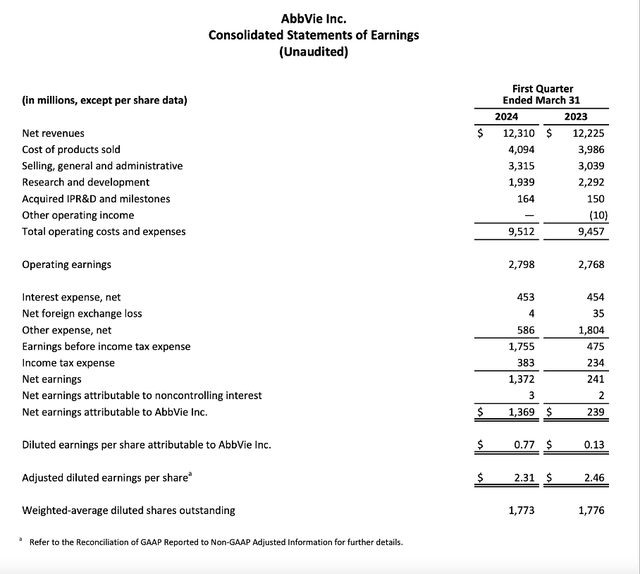

As often in my articles, we start by looking at the last results the company reported. More than two months ago – on April 26, 2024, AbbVie reported first quarter results. Net revenue increased slightly from $12,225 million in Q1/23 to $12,310 million in Q1/24 – resulting in 0.7% year-over-year growth. Operating earnings also increased slightly – 1.1% year-over-year – from $2,768 million in the same quarter last year to $2,798 million this quarter. Diluted earnings per share increased from $0.13 in Q1/23 to $0.77 in Q1/24 – the bottom line therefore quintupled.

Now let’s put these results into context. The quintupled bottom line is mostly the results of extremely low earnings per share in the same quarter last year. When looking at adjusted diluted earnings per share, we see a decrease of 6.1% year-over-year to $2.31.

AbbVie Q1/24 Earnings Release

And when looking at reported year-over-year results, AbbVie looks like a struggling company. However, AbbVie did beat on earnings per share as well as revenue estimates and was exceeding analysts’ expectations. The reason for the struggling top line can be explained quite simple and to understand we must look at the segment results (or the different therapeutic areas).

The most important segment for AbbVie is Immunology, which generated $5,371 million in revenue in the first quarter (44% of total revenue). And while Immunology declined 3.9% year-over-year, Humira generated “only” $2,270 million in revenue in Q1/24 (a decline of 35.9% YoY). The steeply declining sales (due to the loss of exclusivity) of Humira, which was for a long time the most important product of AbbVie, is the main reason for AbbVie currently struggling to grow the top line. However, we must point out that the Immunology segment is able to set off the declines quite well. Skyrizi, which generated $2,008 million in revenue in Q1/24 grew 47.6% year-over-year and Rinvoq generated $1,093 million in revenue (59.3% year-over-year growth).

When looking at the other segments, it is especially Oncology (9.0% year-over-year growth to $1,543 million in revenue) and Neuroscience (15.9% year-over-year growth to $1,965 million in revenue mostly driven by Vraylar, Ubrelvy and Qulipta) that contributed to growth. On the other hand, Aesthetics generated $1,249 million in revenue (a decline of 4.0% year-over-year) and Eye Care generated $538 million in revenue (a decline of 11.7% year-over-year).

Continued Growth

For fiscal 2024, AbbVie is now expecting adjusted diluted earnings per share to be in a range of $11.13 to $11.33 (compared to a previous guidance of $10.97 to $11.17). AbbVie does not offer any guidance for revenue. Compared to $11.11 in fiscal 2023, AbbVie would be able to increase its bottom line slightly.

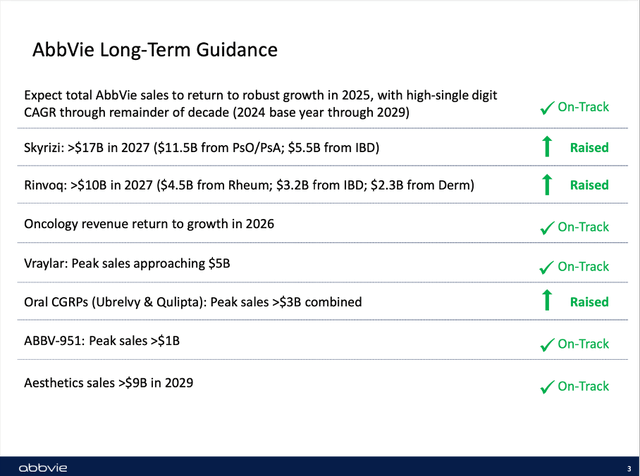

When looking at AbbVie’s long-term guidance, management is expecting sales to return to robust growth in 2025 and for the remaining years of the decade, management is expecting a high-single digit CAGR for growth.

AbbVie Long-term guidance and pipeline update

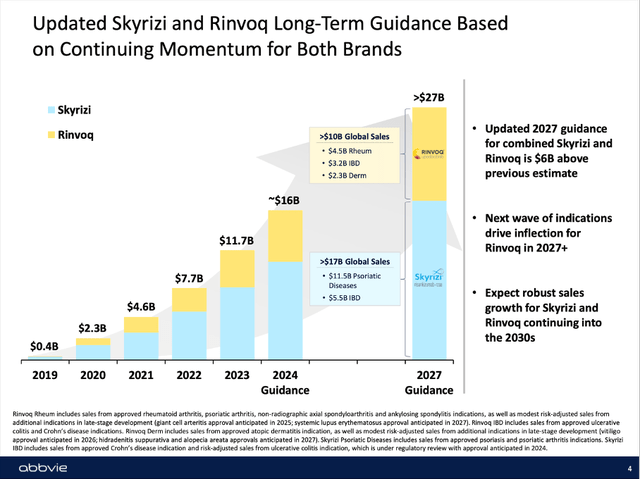

Top line growth in the next few years will especially stem from Skyrizi and Rinvoq, which are already contributing in a major way to top line growth. For fiscal 2024, AbbVie is expecting $16 billion in sales for Skyrizi and Rinvoq – an increase of 37%. And for 2027, management is expecting these two pharmaceuticals to generate $27 billion in revenue. This is not only $6 billion higher than in the previous long-term guidance, but also resulting in a CAGR of 23% between 2023 and 2027.

AbbVie Long-term guidance and pipeline update

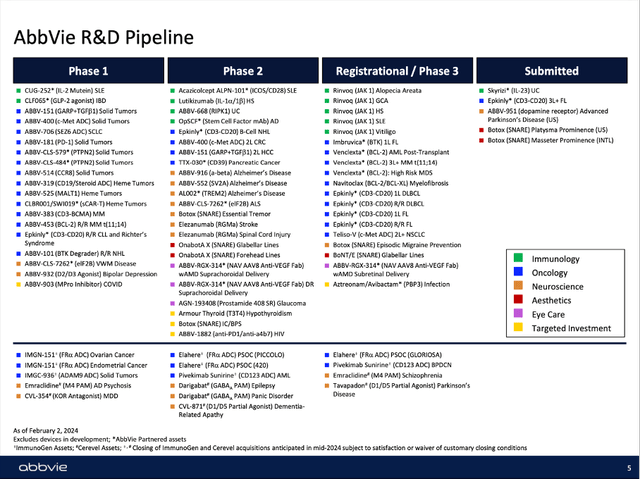

While Skyrizi and Rinvoq will play a major role in the next few years, we should not ignore the pipeline of AbbVie, with countless drugs in phase II or phase III that might also contribute to revenue and growth in the years to come.

AbbVie Long-term guidance and pipeline update

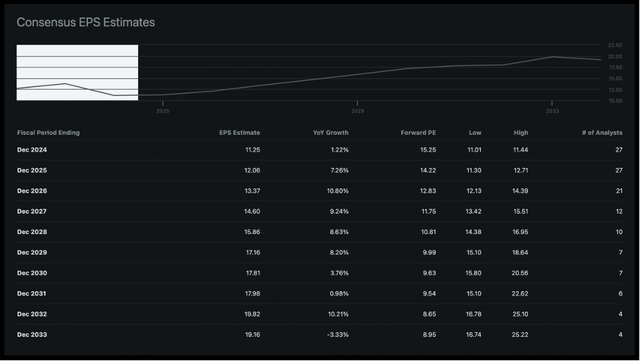

And finally, analysts are rather optimistic for AbbVie in the years to come. When looking at long-term assumptions for pharmaceutical companies, we seldom see consistent growth over 5-10 years. And this is not unreasonable, as it is difficult to estimate revenue in 10 years from now. It is difficult to estimate overall revenue as we must calculate the damage patent losses might cause and especially what revenue new pharmaceuticals might generate – and that is extremely difficult.

Nevertheless, analysts are rather optimistic about AbbVie and expecting earnings per share to grow at a solid pace. Between fiscal 2023 and fiscal 2033, earnings per share are estimated to grow with a CAGR of 5.60%.

Consensus EPS Estimates for AbbVie (Seeking Alpha Earnings Estimates)

Acquisitions and Balance Sheet

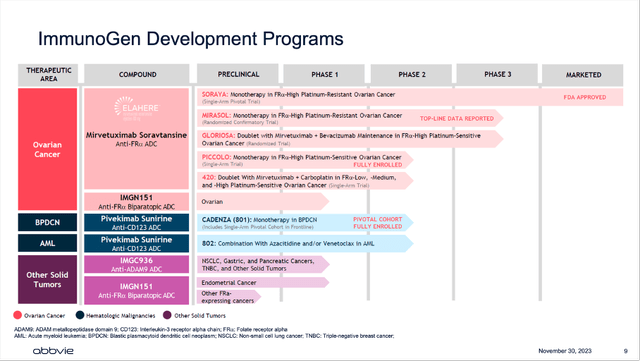

And another way for AbbVie to grow is by acquisitions. And since my last article was published a year ago, AbbVie made two major acquisitions again. One of these two major acquisition was ImmunoGen, which was completed in February 2024. AbbVie spent $10.1 billion, and the acquisition should accelerate AbbVie’s entry into the commercial market for ovarian cancer. Among several products in the pipeline, the company has Elahere, which is already FDA approved and generated slightly above $100 million in revenue in the last quarter in which ImmunoGen reported as a stand-alone company. For fiscal 2024, Elahere is expected to generate about $500 million in revenue and peak sales are expected to be about $2 billion.

AbbVie ImmunoGen Acquisition Presentation

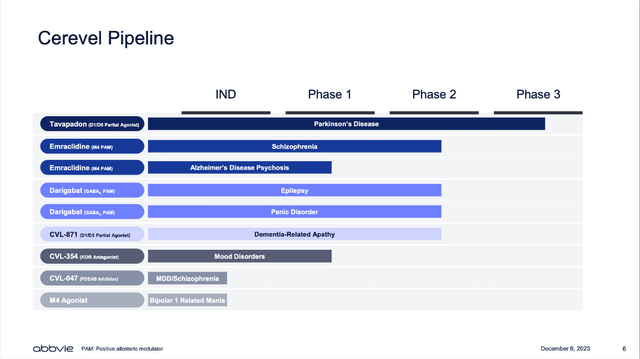

The second major acquisition will be AbbVie acquiring Cerevel Therapeutics (CERE), but this acquisition is still pending. AbbVie is planning to spend a total amount of $8.7 billion on the business. In December 2023, AbbVie announced its intent to acquire the business and the goal is to generate a more robust neuroscience pipeline for AbbVie. We should especially watch Tavapadon, which is already in phase III and will be used to treat Parkinson’s Disease. Additionally, Emraclidine to treat Schizophrenia is promising and could become a major blockbuster for the business.

Cerevel Acquisition Presentation

During the last earnings call, Rob Michael – who succeeded Rick Gonzalez as CEO of AbbVie – commented on the pending Cerevel acquisition:

We also remain on track with the pending acquisition of Cerevel, which we anticipate will close in the middle of the year. Cerevel’s pipeline of differentiated assets will further augment our neuroscience portfolio. In addition, we continue to advance our R&D pipeline and invest for long-term growth. This progress includes the FDA’s full approval of Elahere for FR alpha positive platinum resistant ovarian cancer, a meaningful first in class treatment for patients and a significant long-term growth opportunity for AbbVie in solid tumors.

Of course, acquisitions always have an impact on the balance sheet and on March 31, 2024, AbbVie has $3 million in short-term borrowings as well as $63,805 million in long-term borrowings. And while this seems like extremely high debt levels, we always must put these amounts into context. First, we can compare the total debt to the total equity of a business. In the case of AbbVie, the total equity was $8,047 million, resulting in a debt-equity ratio of 7.93, which is an extremely high ratio and rather indicating that a business is over-indebted. Considering that $33,426 million are goodwill on the balance sheet and subtracting that goodwill would lead to a shareholder’s deficit of $25.4 billion, making the problem even worse.

Another way to look at the debt levels is not to compare it to other items on the balance sheet, but to the cash the company can generate annually. In this case, we can either look at the operating income or free cash flow. But at first, we should also take into account that AbbVie has $18,067 million in cash and cash equivalents on the balance sheet. And usually, we can subtract the cash and cash equivalents, as the company could use this amount to reduce debt levels. However, the acquisition of Cerevel Therapeutics is still pending, and AbbVie will need about $8.7 billion in cash for the acquisition. But the remaining $9.4 billion in cash can be subtracted from total debt. This leaves about $54.4 billion in total debt and when comparing this to about $20 billion in operating income the company can generate annually, it would take a little less than 3 years to repay the outstanding debt.

Summing up, we still must be cautious, and the debt levels remain an issue for AbbVie. But if the company can perform according to its mid-term guidance with high single digit growth rates for the remaining years of this decade, the debt should be manageable.

Intrinsic Value Calculation

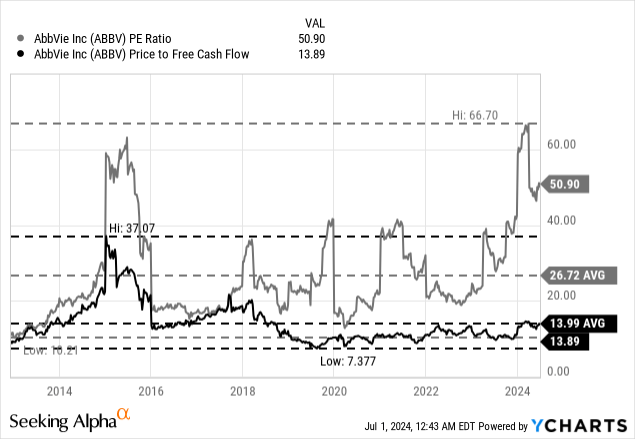

In the end, we must use a discount cash flow calculation to determine an intrinsic value and make a decision if the stock is a good investment at this point. As we often do, we start by looking at simple valuation multiples to get a first clue if the stock is rather expensive or not.

When looking at the P/E ratio, we see the stock currently trading for 50 times earnings, and such a high valuation multiple usually can’t be justified anymore – not even by high growth rates. There are very few companies trading for such valuation multiples and not being overvalued.

But instead of the P/E ratio, we can rather look at the P/FCF ratio, which is usually considered to be the better valuation multiple anyway. And while AbbVie is trading for a rather high P/E ratio, it is trading only for 14 times free cash flow. Although this is slightly above the average P/FCF ratio the stock has been trading for since its IPO, we can certainly see AbbVie fairly valued when trading for 14 times free cash flow.

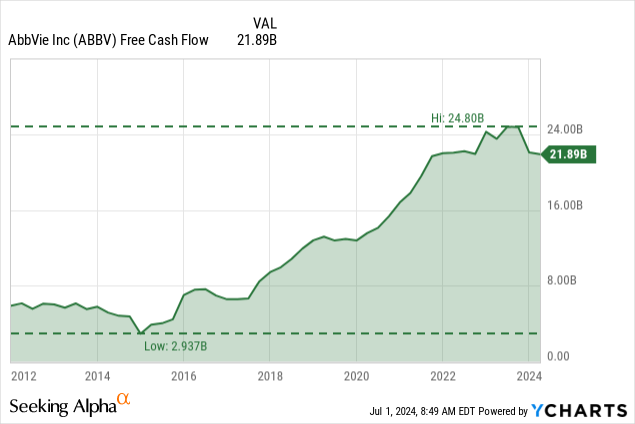

Aside from using simple valuation multiples, we can also use a discount cash flow calculation to determine an intrinsic value for the stock. As basis for our calculation, we can use the free cash flow of the last four quarters, which was $21.89 billion. We are also calculating with the last reported number of outstanding shares (1,773 million) and a 10% discount rate. Trying to determine a reasonable growth rate for the years to come is more difficult, and I would calculate here with 5% growth – a growth rate not too high to be unrealistic (and in line with analysts’ assumptions) but also reflecting the growth potential AbbVie might have. When calculating with these assumptions, we get an intrinsic value of $246.93 for AbbVie, and the stock would still be undervalued at this point.

As already mentioned above, it is extremely difficult to estimate revenue or free cash flow for pharmaceutical companies. And of course, 5% growth till perpetuity is not an extremely high growth rate as expectations for several other companies are much higher. However, we should not ignore that 5% growth till perpetuity (meaning over several decades) is a growth rate most companies won’t achieve. And we certainly have pharmaceutical companies being able to grow at a high pace – Novo Nordisk (NVO) would be an example – but we should be cautious. And at least in the last 10 years, AbbVie could grow revenue with a CAGR of 11.20% and operating income with a CAGR of 8.47%. Earnings per share, on the other hand, fluctuated wildly, and we also must keep in mind that free cash flow is extremely high right now as Humira sales lead to high margins and therefore high free cash flow (for Humira expenses were rather low).

Conclusion

While we could make the argument that AbbVie is undervalued, but due to the several reasons to be rather cautious, I would rate the stock as a “Hold” at this point. Among these reasons are the rather high debt levels of AbbVie, the fluctuating earnings per share in the last ten years and AbbVie having to offset declining Humira sales in the coming quarters.

And finally, I would overall be cautious about the U.S. economy and the U.S. stock market. Although AbbVie can be seen as a rather recession-resilient business and defensive play, we should be cautious about investments in stocks in general. AbbVie would not be the worst investment one can make, but to sit and wait seems a solid strategy at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.