Summary:

- AbbVie presents a strong long-term investment opportunity, driven by its strategic focus on neuroscience and IBD treatments, despite challenges from Humira’s decline.

- Tavapadon and other neuroscience drugs offer substantial growth potential, addressing unmet medical needs in Parkinson’s and other neurological conditions.

- Skyrizi and Rinvoq are rapidly growing, offsetting Humira’s revenue decline, and positioning AbbVie to capture significant market share in the expanding IBD market.

- Despite high debt levels, AbbVie’s strong cash flow, robust pipeline, and strategic acquisitions make it an attractive pick for income and growth-focused investors.

Robert Way

I’ve been keeping a close eye on AbbVie (NYSE:ABBV) (NEOE:ABBV:CA) and based on my in-depth analysis of the company’s recent developments, I believe it presents a strong investment opportunity for long-term growth, especially in its neuroscience and inflammatory bowel disease IBD treatment portfolios. While it faces challenges from the inevitable decline of its flagship drug Humira, AbbVie has shown resilience by developing new avenues that could bolster its financial performance in the coming years.

AbbVie’s strong portfolio in neuroscience bolstered by recent acquisitions presents a significant opportunity for long-term growth. The company’s latest Phase III trial results for tavapadon, a drug targeting Parkinson’s disease, is expanding into unmet medical needs. Additionally, AbbVie’s innovative IBD treatments led by Skyrizi and Rinvoq have exhibited strong revenue growth, positioning it for continued success as the market for IBD therapies expands globally.

In my opinion, AbbVie is well positioned to overcome its reliance on Humira and drive future growth thanks to its strategic focus on neuroscience and IBD treatments.

Neuroscience Pipeline and Tavapadon’s Potential

One of AbbVie’s most promising growth areas is its neuroscience pipeline, particularly in Parkinson’s disease. AbbVie’s acquisition of Cerevel Therapeutics in 2023 brought tavapadon into its portfolio, a drug that could be a game changer for patients with early-stage Parkinson’s. According to AbbVie’s recent Phase III TEMPO-1 trial results, tavapadon significantly reduced disease burden in patients showing statistically significant improvements in both motor and non-motor symptoms over a 26-week period.

Tavapadon’s potential to address a large unmet medical need in Parkinson’s could drive substantial revenue growth for AbbVie, especially considering the limited treatment options currently available for this degenerative disease. The positive results from both TEMPO-1 and TEMPO-3 trials indicate that it could secure regulatory approval and become a first-in-class therapy for Parkinson’s. The $8.7 billion acquisition of Cerevel might seem hefty, but in my view, this was a smart and strategic investment that will pay off in the long run as tavapadon has the potential to generate $673 million in revenue by 2030.

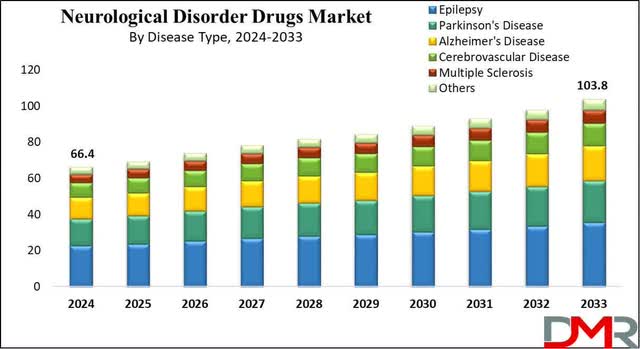

Neurological Disorder Drug Market 2024-2033 (DMR)

In addition to tavapadon the Cerevel acquisition also strengthens AbbVie’s pipeline in other neurological conditions like epilepsy, with drugs like emraclidine and darigabat under investigation. This diversified neuroscience portfolio sets AbbVie to capture substantial market share in the rapidly growing neurological disorder treatment market, which is expected to reach $103.9 billion by 2033.

IBD Treatments Driving Revenue Growth

AbbVie’s Skyrizi and Rinvoq are emerging as key drivers in its IBD portfolio, and I believe these drugs will play a crucial role in offsetting the revenue decline from Humira’s patent expiration. Skyrizi which recently received FDA approval for Ulcerative Colitis, has been growing rapidly with revenue increasing by 44.8% YoY in Q2 2024. Similarly, Rinvoq has shown even stronger growth, increasing by 55.8% YoY, further demonstrating AbbVie’s ability to capitalize on the growing IBD market.

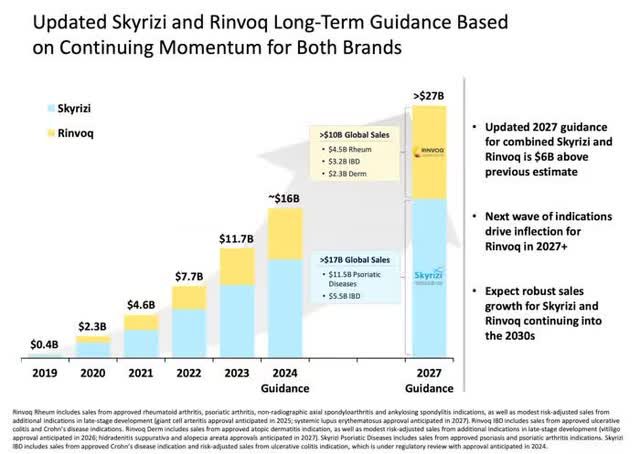

Updated Skyrizi And Rinvoq Long-Term Guidance (Nasdaq)

The global market for IBD treatments is expected to grow at a 5.7% CAGR through 2030 and AbbVie’s dominance in this space should position the company to capture significant market share. Skyrizi and Rinvoq have both been approved for multiple indications beyond IBD, including Plaque Psoriasis and Psoriatic Arthritis, which adds to their long-term revenue potential.

AbbVie’s recent licensing agreement with FutureGen Biopharmaceutical for a next-generation antibody targeting IBD is another positive development. The collaboration aims to drive greater efficacy and less frequent dosing, which could differentiate AbbVie’s IBD treatments from competitors. This acquisition of Celsius Therapeutics and Landos Biopharma, both of which focus on IBD treatments in their clinical stages, shows the company’s proactive approach to expanding its leadership in this high-growth market.

AbbVie’s Edge in Neuroscience and Oncology

AbbVie’s acquisitions of Cerevel Therapeutics and Celsius Therapeutics set it as a leader in these fields, particularly in conditions with unmet medical needs like Parkinson’s disease, schizophrenia, and non-small cell lung cancer.

In the NSCLC space, AbbVie’s Teliso-V stands out as a promising treatment with potential to become a first in class therapy for c-Met protein overexpressing tumors which currently lack effective treatment options. If Teliso-V is approved, it would address a substantial unmet need in a market where NSCLC remains the leading cause of cancer related deaths worldwide. I see this as a key differentiator for AbbVie in oncology, giving it a competitive edge over rivals like Roche and Bristol-Myers Squibb, who are also developing cancer therapies but do not have a targeted approach like Teliso-V for c-Met overexpressing tumors.

Financial Performance and Growth Prospects

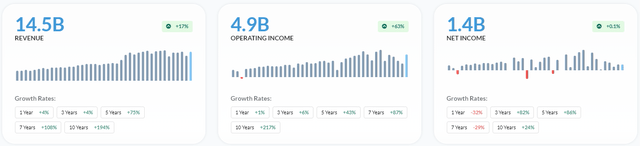

From a financial perspective, AbbVie has faced some headwinds due to the decline of Humira, which accounted for 19.5% of Q2 2024 revenues. But the company’s overall revenue growth has begun to recover, with Q2 2024 revenues growing by 4.3% YoY, the fastest pace in eight quarters. More importantly, revenues excluding Humira have increased by an impressive 18.1% YoY, driven by the growth of Skyrizi, Rinvoq, and AbbVie’s neuroscience segment which grew by 14.7% YoY.

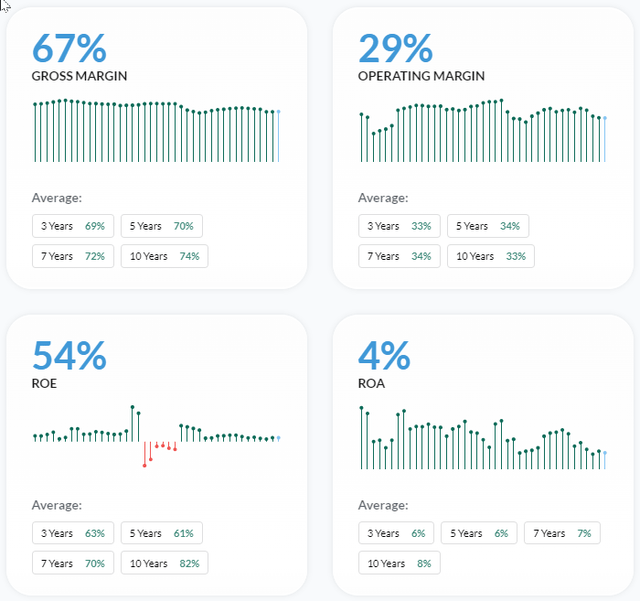

AbbVie’s profitability metrics (Alpha Spread)

AbbVie’s profitability metrics remain strong with an operating margin of 29% and a return on equity ROE of 54.26% demonstrating efficient management and strong returns to shareholders. It also maintains healthy cash flows, generating $18.64 billion in operating cash flow over the last twelve months. AbbVie has consistently delivered a substantial dividend payout, with its annual dividend totaling $6.20 per share. This makes AbbVie an attractive investment for income focused investors as well.

Profitability Metrics (Alpha Spread)

Despite these positive metrics, AbbVie does face challenges including high debt levels of $70.94 billion and a total debt-to-equity ratio of 1,039.99%. This may raise concerns about its financial flexibility, but AbbVie’s strong cash flow generation and strategic investments in high-growth areas like neuroscience and IBD should help mitigate these risks over time.

Valuation Analysis

AbbVie’s valuation reflects both its recent challenges with Humira and the market’s optimism regarding its pipeline. But I think that the market has not fully appreciated the company’s transformation and future potential. Despite the recent miss on EPS by $0.01 in Q2 2024, AbbVie’s revenue of $14.46 billion beat expectations by $434.92 million.

AbbVie’s trailing P/E GAAP of 65.15 may seem high at first glance, but More relevant to forecasting AbbVie’s future is its forward P/E GAAP of 37.1, which suggests that the company is trading at a more reasonable valuation when factoring in expected earnings growth over the next 12 months.

Compared to its peers:

- Johnson & Johnson (JNJ) has a forward P/E of 20.7 but has Lower growth potential in the near term as its pharmaceutical division is facing pricing pressures and competition, especially with biosimilars entering the market.

- Pfizer (PFE) has a forward P/E of 20.6 Although cheaper, Pfizer’s revenue has been largely dependent on COVID-19 vaccines and treatments, which are now experiencing steep declines. Pfizer’s core business lacks the same robust growth drivers that AbbVie has.

- Bristol-Myers Squibb (BMY) has a forward P/E of 30.7, is a strong competitor in oncology and immunology, but its valuation reflects slower near-term growth compared to AbbVie.

In my opinion, AbbVie’s forward P/E of 37.1 places it slightly above its peers, but this is justified due to its strong growth prospects from its neuroscience and immunology pipeline.

To further assess AbbVie’s valuation, I am outlining a rough DCF analysis using its unlevered free cash flow UFCF of $17.78 billion and assuming a growth rate of 3% for the next five years (based on its ABBV revenue growth Guidance).

- UFCF (2024): $17.78 billion

- Revenue Growth rate: 3% over the next five years

- Terminal growth rate: 2% (reflecting steady long-term growth).

- Weighted Average Cost of Capital (WACC): 7.6%, weighted average of its cost of equity and cost of debt, adjusted for tax.

Using these assumptions, the DCF model suggests a fair value range of $355-$372 billion, indicating that the company is fairly valued with slight potential for upside compared to its current market cap of $347.9 billion.

Despite the significant debt burden, AbbVie has the financial strength to continue funding its pipeline and returning capital to shareholders through dividends and share buybacks. With its substantial unlevered free cash flow, UFCF of $17.78 billion.

Given the potential upside from its neuroscience and immunology franchises, I believe AbbVie’s current valuation provides a good entry point for investors.

Potential Risk to Consider

While I remain bullish on AbbVie’s growth prospects, there are several risks that investors should be mindful of. The reliance on acquisitions to fuel growth comes with execution risk. AbbVie will need to successfully integrate its new assets and bring them to market to realize their full potential. The tavapadon and Teliso-V have shown promising results, but there’s always a risk that they may not receive regulatory approval or could face delays. So there is regulatory risk associated with its neuroscience pipeline, particularly as the FDA reviews these key assets. Delays or rejections in the approval process could negatively impact AbbVie’s stock price and growth trajectory.

Another risk factor is the patent cliff in AbbVie’s immunology segment. Skyrizi and Rinvoq are growing rapidly; it will need to continue innovating to offset declining revenues from Humira and defend its market share against competitors.

One key risk is AbbVie’s substantial debt, with a debt-to-equity ratio of 1,039.99%. Although this could be a concern in a high-interest-rate environment, but recent economic trends suggest a stabilizing or decreasing interest rate climate, which may alleviate this pressure. However, the company’s ability to manage this debt load hinges on continued strong cash flow generation from its diverse portfolio of products.

Conclusion

I believe AbbVie is a strong buy for long-term investors seeking both income and growth. It presents a strong investment opportunity driven by its strategic acquisitions, robust pipeline, and diversified revenue streams. The strategic shift away from Humira dependency, driven by the rapid growth of Skyrizi, Rinvoq, and the neuroscience pipeline, positions it for sustained growth and the development of Teliso-V for NSCLC provides a strong foundation for future growth.

AbbVie offers a balanced risk profile. While there are risks associated with regulatory approvals and debt, but the strong cash flow, diversified portfolio and leading market position make it an attractive pick. In my view, AbbVie is well on its way to becoming a leader not only in immunology but also in neuroscience and oncology, providing multiple growth levers for investors in the years to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.