Summary:

- AbbVie delivered Y/Y growth in the second quarter despite Humira’s decline, with Skyrizi and Rinvoq as key growth drivers, achieving 45% and 56% Y/Y growth, respectively.

- I expect Skyrizi to become a bigger product for AbbVie than Humira was at its peak in 2021.

- Skyrizi’s robust efficacy and good safety in psoriasis, psoriatic arthritis, and inflammatory bowel diseases support its strong long-term growth prospects.

- AbbVie’s strategic acquisitions and pipeline assets, including TL1A antibody FG-M701, are set to enhance Skyrizi’s market potential and overall company growth.

honglouwawa/iStock via Getty Images

AbbVie (NYSE:ABBV) is up slightly more than 20% since my late April article, in which I initiated bullish coverage based on better-than-expected performance of several key products and recent acquisition announcements that have resulted in improved long-term growth prospects.

The outlook has incrementally improved after the second quarter results, which I will briefly cover for a more complete overview of the latest developments, but the focus of today’s article is a product that, I believe, is AbbVie’s next Humira – the IL-23 antibody Skyrizi (risankizumab) which continues to exceed sales expectations and which, I believe, will exceed the peak sales of Humira before the end of this decade. Skyrizi is seeing significant use in psoriasis and psoriatic arthritis, and should see increasing use in inflammatory bowel diseases after recent label expansions.

Longer term, I also expect additional increases in long-term use of Skyrizi as part of combinations with other candidates in AbbVie’s pipeline, which should increase the long-term peak sales of Skyrizi and of the other products which will be used in combination with Skyrizi. As such, I see upside to long-term top and bottom-line expectations and expect AbbVie to perform well in the following years.

Q2 earnings review – Humira continues to erode while growth products deliver strong performance

AbbVie delivered a 4.3% Y/Y increase in revenues in the second quarter, beating the analyst consensus by $430 million. The company slightly missed on EPS, but management still increased the full-year EPS guidance range from $10.61-10.81 to $10.71-10.91, and this estimate includes the unfavorable impact of $0.60 per share related to recent acquisitions and milestone payments.

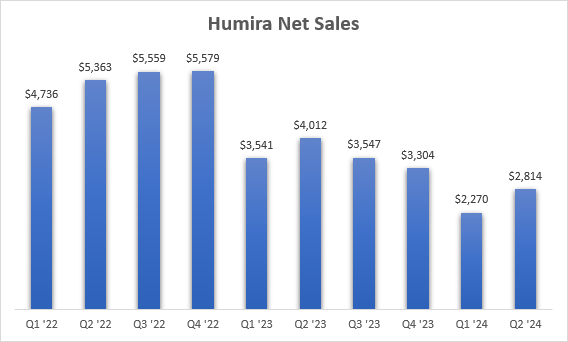

Humira is still a drag on growth rates with a 30% Y/Y decline in net sales in the second quarter.

AbbVie earnings reports

For the full-year, management is guiding for a $4.5 billion negative net sales impact from Humira’s erosion, down from $6.5 billion in 2023. This means they expect Humira to generate approximately $10 billion in global net sales this year. For 2025, the dollar-based erosion is expected to further decline. The revenue “tail” is pretty long here, as AbbVie is lowering the price of Humira to match the prices of biosimilars. This is, of course, a race to the bottom, and nothing but continued sales erosion should be expected going forward.

Total revenues are back in growth mode with 0.7% and 4.3% Y/Y increases in the first two quarters of the year, and we should see up to mid-single digit Y/Y growth in Q3 and Q4.

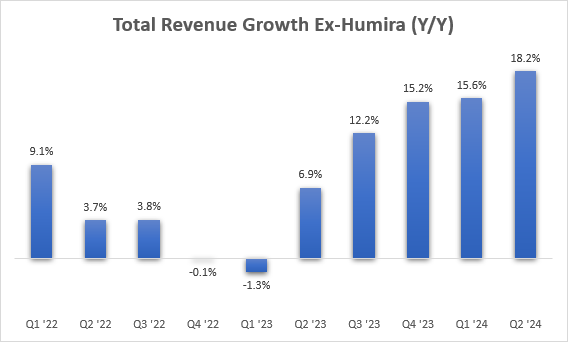

Skyrizi and Rinvoq remain the key growth drivers, with reported Y/Y growth of 45% and 56%, respectively. A good way to look at the health of the business is to exclude Humira. The rest of the business is performing really well, with the Y/Y growth rate hitting 18% in the second quarter, and the growth rate in Q2 is 17% if the recently acquired Elahere is excluded.

AbbVie earnings reports, author’s calculations

Most business segments performed well, and even the immunology portfolio, to which Humira belongs, delivered 2.3% Y/Y growth. The aesthetics business underperformed with 0.5% Y/Y growth.

Overall, it was a good quarter for AbbVie. With the worst of the impact from Humira erosion in the rearview mirror, and with a strong outlook for the rest of the product portfolio, I expect AbbVie to remain in growth mode going forward.

Skyrizi will be bigger than Humira based on strong efficacy in several diseases and as a potential backbone for combination treatments

This is not as conservative a statement as it might sound. AbbVie itself expects Skyrizi’s net sales to reach $17 billion in 2027 with $11.5 billion coming from psoriasis and psoriatic arthritis and another $5.5 billion from inflammatory bowel diseases (‘IBD’) consisting of ulcerative colitis and Crohn’s disease.

I expect Skyrizi to generate more than $17 billion in 2027, to exceed Humira’s peak sales of $21.2 billion from 2021 before the end of the decade (as soon as 2028) and to continue to grow from there.

The reasons for strong uptake and high peak sales expectations are (all data taken from Skyrizi’s product label and Skyrizi’s website, unless otherwise noted):

1. Robust efficacy:

- In plaque psoriasis, after 16 weeks of treatment, 84% to 88% of patients were able to reach “clear or almost clear” skin on the sPGA score (static Physician’s Global Assessment) in the phase 3 trials and PASI90 scores were achieved by 75% of patients (a 90% or greater improvement in the Psoriasis Area and Severity Index, or PASI, from baseline). 37% and 51% of psoriasis patients in the first and second phase 3 trial, respectively, were able to achieve sPGA of 0 (clear skin), and 36% and 51% were able to achieve a PASI100 score (which also means clear skin).

- Skyrizi has also shown superiority in head-to-head trials in plaque psoriasis against other big products such as Otezla, Cosentyx, Stelara, and AbbVie’s own Humira.

- In psoriatic arthritis, Skyrizi achieved much higher ACR20, ACR50, and ACR70 responses compared to placebo (American College of Rheumatology-defined response rates).

- In Crohn’s disease, Skyrizi generated higher clinical remission rates than placebo, and more importantly, it beat Johnson & Johnson’s (JNJ) Stelara in a head-to-head trial by doubling the endoscopic remission rate from 16% for Stelara to 32%, and showing much higher endoscopic response (45% versus 22% at week 48). And it paid no safety penalty for achieving that, and it even had lower rates of serious adverse events than Stelara (14% vs 23.7%), including lower rates of serious infections (3.9% vs 5.2%). Stelara is an IL-12 and IL-23 antagonist with the same subcutaneous dosing regimen as Skyrizi.

- In ulcerative colitis, Skyrizi achieved a 24% remission rate versus 8% for placebo in the 12-week induction study, and it achieved clinical remission rates of 41% and 45% in two phase 3 maintenance trials versus 26% in the placebo group.

2. Good safety. Like any systemic biologic that suppresses a part of the immune system, Skyrizi has higher, but generally manageable infection risk. Other adverse events in clinical trials were similar in incidence to placebo, or slightly higher (headache, fatigue, injection site reactions).

3. Convenience. Skyrizi is administered as a subcutaneous injection and has two induction doses at week 0 and 4, and is then administered every 12 weeks.

This could be one of the best deals AbbVie made in recent history. Skyrizi was in-licensed from Boehringer Ingelheim in 2016 for $595 million upfront (it was called BI 655066 at the time) and additional but undisclosed milestone payments and royalties on net sales.

Significant market share already gained in psoriasis and growing in psoriatic arthritis

Management noted on the Q2 earnings call that Skyrizi’s U.S. biologic market share in psoriasis and psoriatic arthritis reached 38% and 15%, respectively. Given its robust efficacy profile and no signs of waning momentum, I expect these metrics will only improve in the following quarters and years and that the U.S. biologic market for these diseases will continue to expand, driven by Skyrizi itself, but also by the introduction of other effective biologic therapies.

Ex-U.S. markets represent another significant growth opportunity that AbbVie has just started to unlock. Ex-U.S. net sales grew 55% Y/Y to $387 million in Q2 and represented only 14% of global sales.

Skyrizi is just getting started in inflammatory bowel diseases, with more room for long-term growth for AbbVie through combination approaches

On the inflammatory bowel disease side, the approvals for Crohn’s disease and ulcerative colitis were in June 2022 and June 2024, respectively, and this is where I see a lot more potential in the late 2020s and early 2030s. I believe we are going to see significant improvements in clinical remission rates in these two indications in the following years, and that AbbVie will be one of the key beneficiaries. Skyrizi monotherapy achieves decent results, but remission rates are still far too low.

There are combination therapy approaches that managed to significantly improve remission rates of each of the monotherapy treatments. One example is from the VEGA trial of Johnson & Johnson’s anti-TNF drug Simponi (golimumab) and IL-23 antibody Tremfya (guselkumab) in patients with ulcerative colitis. The combination achieved a clinical remission rate of 47.9% at week 38, which was much higher than induction and maintenance treatment with Tremfya monotherapy (31%) and Simponi monotherapy (20.8%). Importantly, there were no additional safety penalties for combining the two drugs.

Given the shared mechanism of action with Tremfya, this trial was also a de-risking event for Skyrizi, and it can use its own anti-TNF drug Humira in future combination trials. However, an anti-TNF therapy such as golimumab or Humira may not be desirable due to its adverse event profile and the class black box warning for serious infections, lymphoma and other malignancies, and there are other potentially synergistic mechanisms that can improve clinical remission rates in inflammatory bowel diseases.

One such mechanism is a TL1A antibody. We have seen promising data from several companies that have led to three deals since last year. Merck (MRK) acquired Prometheus for $10.8 billion to get the leading TL1A antibody in the clinic PRA023, Roche (OTCQX:RHHBY) acquired Telavant for $7.1 billion to get U.S. and Japan rights for RVT-3101, and Sanofi (SNY) paid Teva (TEVA) $500 million upfront for a 50:50 profit/loss split on TEV-’574.

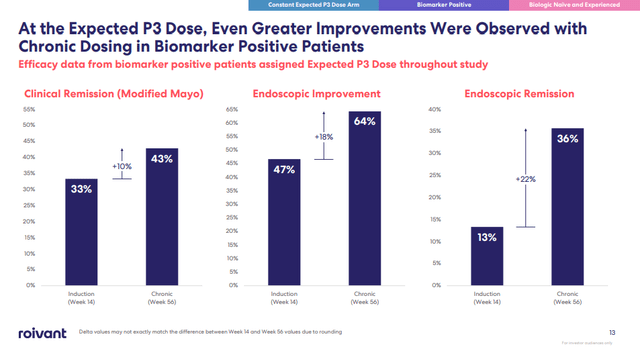

TL1A antibodies managed to drive clinical remission rates to the high 20s, and even up to 43% in the so-called biomarker-positive patients – this was achieved by RVT-3101, although Roivant (ROIV) and now Roche, did not reveal what this biomarker is, for competitive reasons.

Roivant Sciences investor presentation

AbbVie wasted no time and got its hands on a preclinical TL1A antibody by in-licensing FG-M701 from FutureGen Biopharmaceutical. AbbVie claims “potential best-in-class functional characteristics compared to first-generation TL1A antibodies, with the goal to drive greater efficacy and less frequent dosing as a therapy for IBD.” And it is getting that for $150 million upfront and near-term milestone payments, up to $1.56 billion in additional milestone payments, and it will pay FutureGen tiered royalties up to low-double digit on global net sales.

I believe this is a great move by AbbVie as it gets a very cheap way to participate in this emerging class of drugs, and it will do so with a next-generation candidate, although I think it is a stretch to call a preclinical asset a best-in-class, as they do not have access to data from many of the competing candidates in development.

The first step for FG-M701 will be to move into the clinic and to be tested in healthy volunteers and IBD patients, the next move will be to test it in combination with Skyrizi.

And this is only one of the several potential combinations – another important one will be with AbbVie’s internal α4β7 (alpha-4 beta-7) candidate, which shares the mechanism of action with Takeda’s (TAK) multibillion blockbuster Entyvio.

I expect the use of Skyrizi in combination with FG-M701, with AbbVie’s internal “Entyvio” and as a backbone of additional combination approaches, to unlock additional significant sales potential in IBD, by increasing the clinical remission rates, time on treatment, and by increasing the sales of other products like FG-M701 and AbbVie’s internal “Entyvio.”

Tying it all together

Making precise estimates well into the future is an ungrateful task, but based on what I see today, I expect Skyrizi’s peak sales to exceed $30 billion by the early to mid-2030s (in all indications), and that AbbVie’s other IBD products will be capable of generating another $10 billion globally by that time. I see this part of AbbVie’s product portfolio and pipeline as the most promising.

This represents approximately $30 billion in additional growth compared to this year’s sales of Skyrizi which are expected to reach approximately $11 billion. The current difference between the 2033 consensus and the 2024 consensus is $22.4 billion ($55.7 billion for 2024 and $78.1 billion for 2033), and I do expect the rest of the product portfolio to grow in the next 9 years as well, through internal pipeline maturation and expansion, and through business development (and even if Humira net sales go from $10 billion this year to zero). All this is to say that I see room for a lot more top and bottom-line growth than what can be seen in the Street consensus today, and expect AbbVie to continue to deliver long-term shareholder value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROIV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.