Summary:

- AbbVie is set to acquire ImmunoGen for $10.1 billion, gaining Elahere, a promising ovarian cancer treatment, and enhancing its oncology portfolio.

- ImmunoGen’s advanced ADC pipeline, including potential blockbusters, complements AbbVie’s existing programs and promising revenue growth.

- AbbVie’s solid financial position, with substantial cash reserves and assets, supports this strategic acquisition’s funding.

- Investors should consider a “Hold” on both ImmunoGen and AbbVie, balancing immediate financial gains against risks in AbbVie’s integration and R&D efficiency.

champpixs/iStock via Getty Images

Introduction

The recent announcement that ImmunoGen, Inc. (NASDAQ:IMGN) will be acquired by AbbVie Inc. (NYSE:ABBV) marks a notable shift in the pharmaceutical sector, particularly within the realm of ovarian cancer therapies. This article explores the depths of this significant transaction, highlighting how AbbVie’s strategic decision elevates its position in a fiercely competitive field. Emphasizing both the financial and strategic elements of this acquisition, the discussion provides critical perspectives for investors seeking to understand and navigate the complexities of biotechnology investments in a rapidly changing landscape.

Transforming Oncology: AbbVie’s ImmunoGen Buyout and Market Implications

AbbVie acquiring ImmunoGen, along with its flagship product Elahere, for a substantial $10.1 billion, signifies a strategic entry into the ovarian cancer market. Elahere, a first-in-class ADC approved for platinum-resistant ovarian cancer, positions AbbVie as a pivotal player in this commercial space. Given the alarming statistics of ovarian cancer being the leading cause of gynecological cancer-related deaths in the U.S. and Elahere’s impressive early success with annualized sales exceeding $400 million in its first full year, it holds significant potential as a multi-billion-dollar medicine. Moreover, Elahere’s ongoing expansion into earlier therapy lines and broader ovarian cancer segments could further enhance its market presence in this critical area of healthcare.

The ADC field is rapidly gaining attention, with many major pharmaceutical companies investing heavily in ADC programs. AbbVie’s acquisition aligns with this trend, indicating a strategic focus on innovative cancer therapies. The company’s history with ADCs has been mixed, with a notable failure in 2019 with Rova-T for small cell lung cancer. However, acquiring Elahere, already FDA-approved and showing promising results, marks a renewed and potentially more fruitful venture into the ADC space.

Beyond Elahere, ImmunoGen’s pipeline includes next-generation ADCs like IMGN-151 and pivekimab sunirine, targeting a rare blood cancer. These assets could further enhance AbbVie’s oncology portfolio and offer long-term revenue growth prospects. The follow-on pipeline complements AbbVie’s existing programs, potentially transforming treatments for multiple solid tumors and hematologic malignancies.

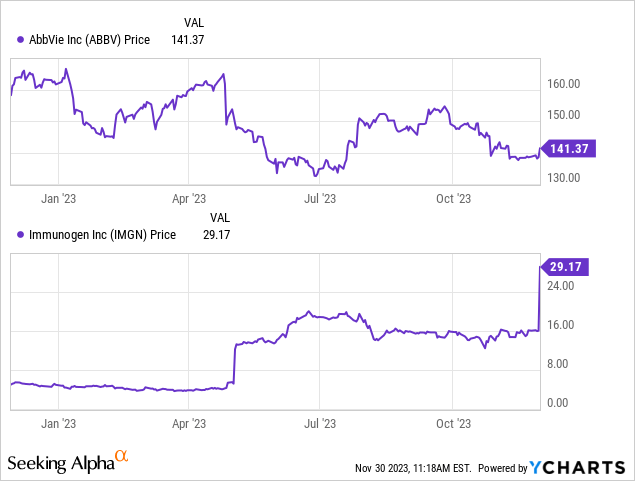

Financially, AbbVie’s offer at $31.26 per share represents a 94.6% premium over ImmunoGen’s last closing price, reflecting high value and expectations from this deal. ImmunoGen’s shares surged by 90% in premarket trading after the announcement.

This acquisition is crucial for AbbVie as it seeks to diversify and strengthen its oncology segment, especially as its top-selling drug Humira faces increasing competition.

AbbVie’s internal ADC pipeline, including drugs like Teliso-V and others, remains in early-stage development. The acquisition of ImmunoGen’s advanced ADCs could provide a much-needed boost to these efforts. The deal also comes at a time when AbbVie’s blockbuster blood cancer drug, Imbruvica, is facing potential pricing pressures from U.S. Medicare insurance plans starting in 2026.

For AbbVie, this acquisition represents not only a substantial expansion of its oncology portfolio but also a strategic move to strengthen its position in the competitive pharmaceutical market. For investors, the deal signals AbbVie’s commitment to innovative cancer treatments and its potential for long-term growth in the oncology sector. The financial premium paid for ImmunoGen underscores the high expectations and confidence AbbVie has in this acquisition, suggesting a positive outlook for future revenue streams and market presence.

AbbVie’s Robust Finances Support Strategic Oncology Expansion with ImmunoGen

AbbVie’s most recent financials, as of September 30, 2023, reveal a solid financial position that could support its acquisition of ImmunoGen. The company reported $13.287 billion in cash and equivalents, an increase from $9.201 billion at the end of 2022. This significant cash reserve is a key asset in financing the ImmunoGen deal.

Furthermore, AbbVie’s total assets stood at $136.221 billion, while its total equity was $12.129 billion. The company’s long-term debt was substantial at $55.631 billion, but this debt level, relative to its asset base and cash reserves, suggests that AbbVie has the capacity to manage the financial obligations of the ImmunoGen acquisition. The combination of available cash, the potential to raise more capital if necessary, and the strategic importance of the acquisition for AbbVie’s portfolio in oncology, suggests a financially sound decision.

Considering these financials, AbbVie seems well-positioned to fund the $10.1 billion acquisition. It may utilize a combination of existing cash reserves and potential borrowing, given its creditworthiness and the strategic nature of the acquisition. In sum, the acquisition’s long-term benefits, particularly in expanding AbbVie’s presence in the oncology market, align well with the company’s financial strategy and growth objectives.

ImmunoGen’s Value Unlocked by AbbVie’s Significant Buyout

For ImmunoGen investors, AbbVie’s acquisition is highly beneficial. The deal, valued at a significant premium, offers immediate financial gains, as reflected in the sharp increase in ImmunoGen’s share price after the announcement. In the long-term, this acquisition validates the potential of ImmunoGen’s technology and pipeline, particularly Elahere, in the competitive biotech space. The buyout by a major pharmaceutical player like AbbVie not only provides a lucrative exit for current shareholders but also acknowledges ImmunoGen’s successful strategic focus and development efforts over the past several years. This acquisition thus represents a significant win for ImmunoGen and its investors, both in terms of immediate financial return and the recognition of the company’s value and prospects in the oncology market.

My Analysis & Recommendation

In conclusion, AbbVie’s acquisition of ImmunoGen and its drug Elahere marks a pivotal moment in the pharmaceutical landscape, presenting a mix of advantages and potential pitfalls. This deal reinforces AbbVie’s oncology portfolio, particularly in ovarian cancer treatments, but also casts light, in my view, on inefficiencies in its R&D process. Creating an ADC like Elahere internally might have been a more cost-effective approach, to say the least, indicating this acquisition as a strategic response to previous R&D gaps.

For ImmunoGen investors, the acquisition brings immediate financial benefits due to AbbVie’s premium offer. However, with ImmunoGen’s presumed transition into AbbVie’s operations, its independence ceases. Investors should consider moving from a “Strong Buy” to a “Hold” position, recognizing the end of ImmunoGen’s autonomous business and the anticipated integration challenges with AbbVie.

While AbbVie remains a “Hold” for investors, balancing potential synergies from Elahere against the high investment cost and implied R&D shortcomings, the deal’s completion is not guaranteed. This uncertainty introduces risks, including potential regulatory hurdles or failure to meet acquisition terms, which could significantly impact investor returns. To mitigate these risks, investors should closely monitor the deal’s progress and maintain a diversified investment portfolio. Staying vigilant of market trends and AbbVie’s integration capabilities is crucial, along with a keen eye on the broader oncology market for alternative investment opportunities.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.