Summary:

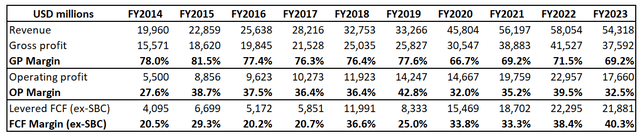

- AbbVie is a profitability superstar with a strong track record of success, generating almost 40% in free cash flow margin.

- The company has a diverse portfolio of products across several promising drug markets, including an intact position in the immunology drugs market.

- The stock offers an attractive valuation, a solid dividend yield, and is recommended as a “Strong Buy” for long-term investors.

vzphotos

Investment thesis

AbbVie (NYSE:ABBV) is a profitability superstar, generating almost 40% in free cash flow margin even when I deduct stock-based compensation. The company has a stellar revenue growth trajectory over the past decade, which was fueled mostly by strategic acquisitions. The approach is aggressive, but AbbVie’s strong track record of success increases my confidence in future growth. AbbVie has a diverse portfolio of products across several promising drug markets. The valuation looks very attractive, and the stock offers a solid 3.7% forward dividend yield, with consistent dividend hikes. All in all, I assign ABBV a “Strong Buy” rating for long-term investors.

Company information

According to the company’s latest 10-K report, AbbVie is a global research-based biopharmaceutical company with a comprehensive product portfolio that has leadership positions across immunology, oncology, aesthetics, neuroscience and eye care.

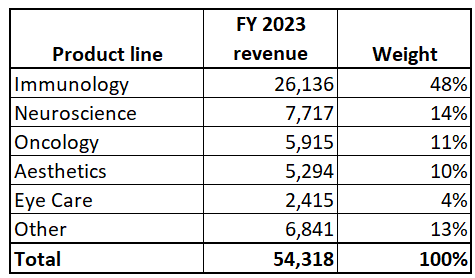

The company’s fiscal year ends on December 31, and it operates via a sole segment. Immunology product line represented almost half of the company’s total revenue in FY 2023.

Compiled by the author based on 10-K

Financials

Let me start with examining secular trends in AbbVie’s financial performance. Over the past decade, ABBV delivered an impressive 11.8% revenue CAGR and its free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] has almost doubled.

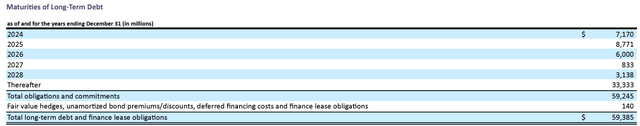

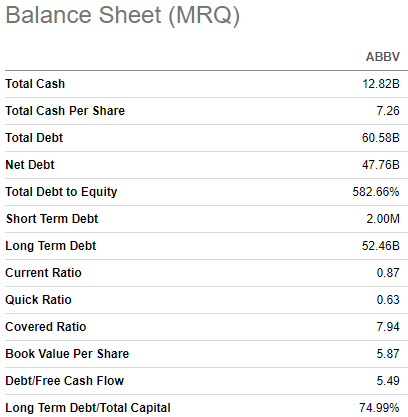

The company’s growth strategy over the last decade has been fueled by several large acquisitions, which were mostly financed by debt. For example, to finance the deal with Allergan, AbbVie sold $30 billion in bonds in 2019. The company’s aggressive growth through acquisitions’ strategy explains substantial leverage on the face of the balance sheet.

Seeking Alpha

I do not consider ABBV’s sky-high leverage ratio as a problem for several reasons. First, the company’s FCF margin has been consistently above 30% for several last years and almost 8 covered ratio looks comfortable to me. Second, ABBV has overall stellar profitability metrics, meaning that operations are efficient and financial discipline is prioritized by the management. Last but not least, the debt maturities table looks good, with more than half of the total debt maturing after 2028.

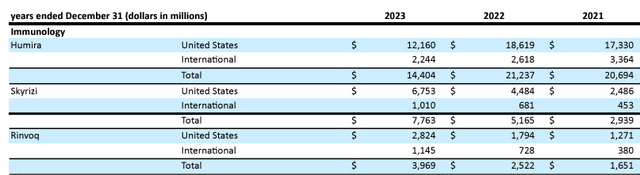

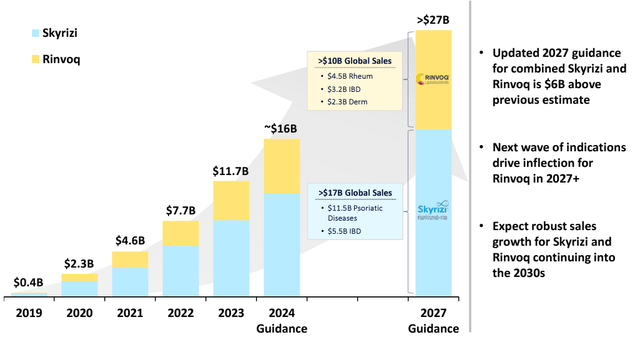

According to Fortune Business Insights, the immunology drugs market size was valued at $98.5 billion in 2023. This means that AbbVie holds more than a 25% market share in immunology drugs, which is a robust market positioning. What is crucial is that, according to the same source, the immunology market size is expected to grow with a 12% CAGR over the next decade. This looks like a solid tailwind for the company controlling a quarter of the whole immunology market. It is crucial to know that ABBV’s flagship product, Humira, has demonstrated multibillion declines in sales in 2023 due to the competition from biosimilars as its exclusivity expired. However, ABBV has new stellar products, Skyrizi and Rinvoq, which demonstrated above 50% YoY revenue growth in two consecutive years.

The management is confident in the sustainability of Skyrizi’s and Rinvoq’s success and expects the two products to generate a combined $27 billion revenue in FY2027. This is $6 billion above the management’s previous long-term guidance for these two products, which is a massive boost which underscores the bright prospects of ABBV in immunology. According to the 10-K report, both products’ U.S. patents expire in 2033, meaning that generics are not expected to enter the market legally within the next decade.

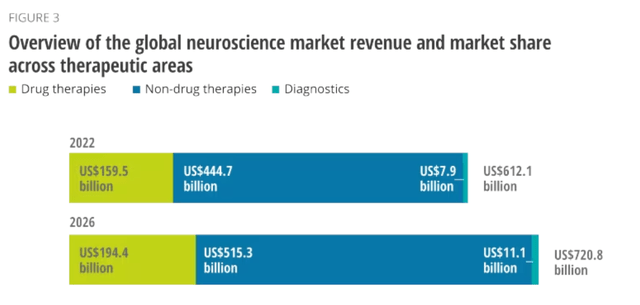

ABBV also has a solid footprint in neuroscience solutions. According to Deloitte, the global neuroscience drug market was worth almost $160 billion in 2022. This means that ABBV holds around 5% of the global neuroscience drugs market, which is solid. This segment of the pharmaceutical market is expected to grow at a much more modest 4.2% CAGR [according to the same report from Deloitte], but it is still above long-term inflation averages. That said, this product line is also expected to grow in real terms over the next several years.

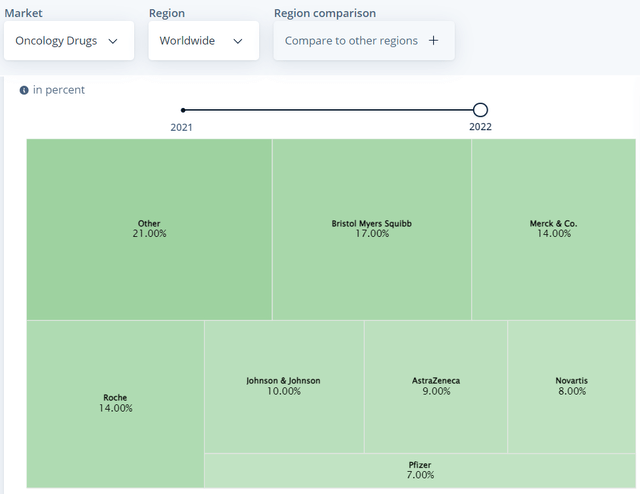

The company’s presence in Oncology is also notable with almost $6 billion revenue in FY2023, but ABBV is far behind its rivals in terms of the market share. According to Statista, the global oncology drugs market was worth around $188 billion in FY2023. This indicates a 3% market share for ABBV here, way behind industry leaders. However, the industry is expected to compound with almost a 14% CAGR for the next five years, and it appears that there is a solid room for all market players to enjoy industry tailwinds.

Another crucial product line for ABBV is aesthetics, which generates around 10% of the total revenue. Aesthetic medicine is another promising market, which is expected to compound with almost a 15% CAGR over the next several years. This projection does not look too optimistic given the increased penetration of social media, where beauty industry influencers like Kylie Jenner have hundreds of millions of subscribers across various platforms. With its flagship Botox product, AbbVie’s position in the aesthetics market is robust as well.

The product lines I have emphasized on [immunology, neuroscience, oncology, and aesthetics] represented 83% of the company’s total revenue in 2023. All of these industries are growing at a solid pace, and in three out of four [except oncology] AbbVie has solid market positions. Patents for its most emerging immunology products are not expiring soon. All these robust strategic signs make me very bullish about the company’s long-term prospects.

Valuation

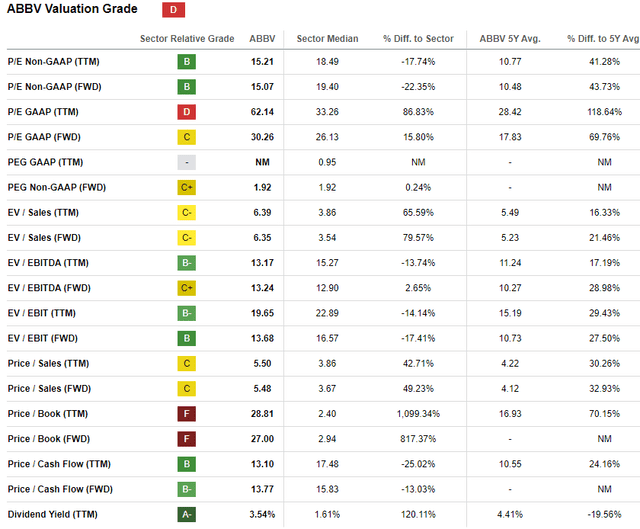

ABBV does not look cheap from the valuation ratios perspective. I usually say that for mega caps like ABBV [around $300 billion market cap] it is better to look at the comparison between the current valuation ratios and the last five years’ averages. But it is not the case for ABBV due to its revenue and profits spike in recent years after Allergan was acquired. Therefore, I would not rely on ratios much in the case of ABBV.

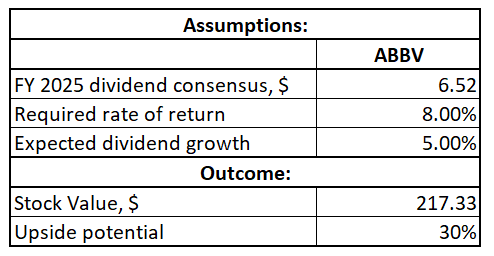

Due to ABBV’s strong dividend consistency, I proceed with the dividend discount model [DDM]. I use an 8% required rate of return, which aligns with the recommended range from valueinvesting.io. The base dividend is $6.52, which is an FY 2025 consensus estimate. I use my 5% dividend CAGR estimation because historical growth rates are inconsistent across various timeframes. A 5% growth rate looks like a golden middle between the last five years’ CAGR and three year forward estimates.

Author’s calculations

According to my DDM simulation, ABBV’s fair value is $217. This is 30% higher than the current share price, representing a compelling investment opportunity.

Risks to consider

While my DDM indicates $217 as ABBV’s fair share price and assumptions look sound, I have to warn readers that the stock never traded anywhere close to the $217 level. As shown below, ABBV is currently not very far from all-time highs, which were notably below $200. That said, before ABBV moves closer to my fair value estimations, the stock will have to break a crucial psychological $200 level, which might demonstrate solid resistance.

As we see from impressive trends in AbbVie’s profitability, the company’s aggressive approach of growth through acquisitions has proved itself successful. However, investors should keep in mind that past success is not a guarantee that potential new acquisitions will create value for shareholders. Investments in new companies might not bring expected synergetic effects, or payback periods might be longer. Apart from financial risks from acquisitions, there are also integration risks that should not be discounted.

Bottom line

To conclude, ABBV is a “Strong Buy”. The stock looks cheap from the DDM perspective, which appears to be unfair given its stellar and expanding profitability and bright prospects across its most important product lines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.