Summary:

- AbbVie is one of the most prominent biotechnology/healthcare stocks known for paying a good dividend.

- Besides the dividend, AbbVie didn’t generate any returns on a one-year basis and is still a bit away from its all-time high.

- Due to the fallout of Humira as AbbVie’s blockbuster product, analysts expect a steep downfall in earnings in 2023 and flat earnings in 2024.

- Even though AbbVie is undervalued compared to its historical averages, it’s still mispriced when looking at growth prospects and gives zero to little total return potential at current prices.

- In this article, I will look solely at AbbVie’s valuation compared to its past and not at the current business performance.

JHVEPhoto

Thesis

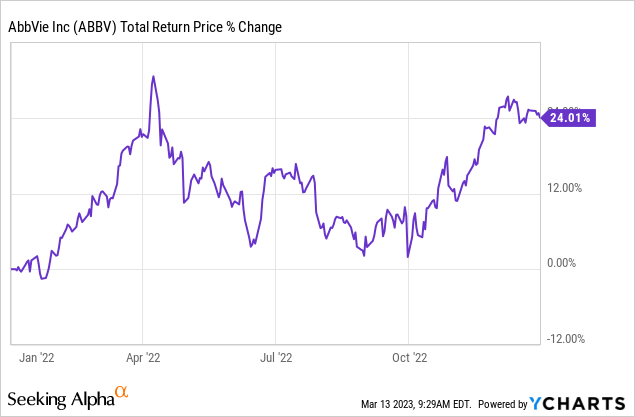

AbbVie (NYSE:ABBV) is a well-known and liked healthcare stock, and I own some shares, too. In the last year, the market feared the end of Humira as AbbVie’s blockbuster product would damage sales and earnings more than previously expected. Therefore, the stock price did a bit of a rollercoaster in 2022 but ended the year up 24% on a total return basis.

Much of this gain is probably due to healthcare being the “safe haven” in times when other sectors fail to perform and the market fears a recession.

Besides the overall market, especially the technology companies, did rather well, AbbVie has had a challenging start so far, being down 7% YTD and 12% from its most recent high on 01/06. But, AbbVie is still mispriced if considering that there is a decline in earnings in 2023 and flat earnings in 2024.

In this article, I won’t go into AbbVie’s product pipeline, balance sheet, or latest earnings report. I will solely focus on the valuation and total return potential. This is due to two things:

- Others have already done this. I recommend reading this article by Bradley Guichard.

- When the total return potential is too low, I mostly don’t bother looking much longer.

But now, let’s start with looking at AbbVie’s valuation and return potential.

Mispriced in comparison to previous growth prospects

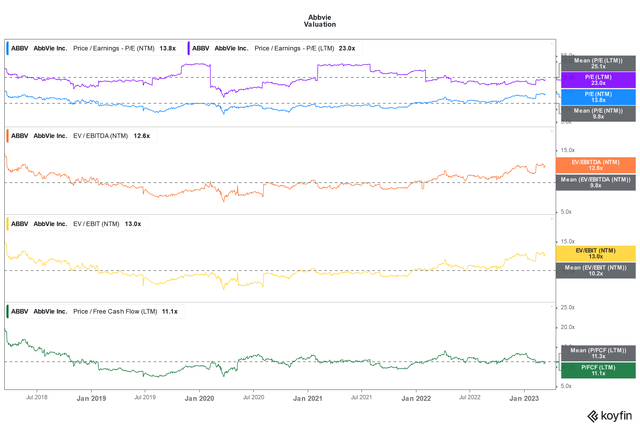

At the current valuation, AbbVie trades above its five- and ten-year averages:

AbbVie’s current valuation (koyfin.com)

Apart from the Price/Free Cash Flow metric, AbbVie trades above all the averages, here shown the five-year averages. This alone is fine, as we have to compare the valuation in combination with the (future) business performance. And that’s where I see the bigger problem:

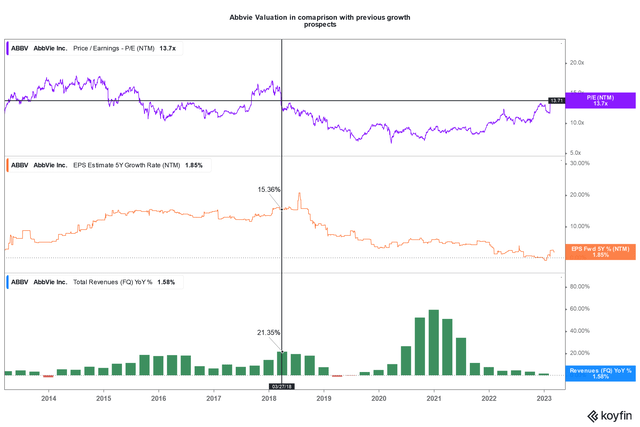

AbbVie’s valuation in comparison to its growth prospects (koyfin.com)

The last time AbbVie’s NTM P/E ratio traded at 13.7x was in March 2018. Back then, sales were growing at 21.35% YoY, while they grew just 1.6% YoY in December 2022. More important is the estimated earnings growth. In March 2018, analysts estimated the five-year EPS growth to be 15.4%. As of now, analysts expect the EPS growth to be 1.85% for the next five years. In other words, you’re paying the same price with just a fraction of the growth and growth estimates. That’s why I think AbbVie is mispriced when compared to its business performance.

Overall valuation

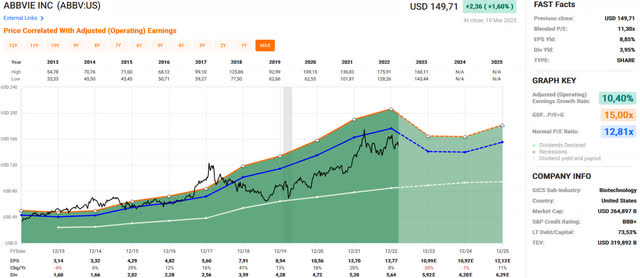

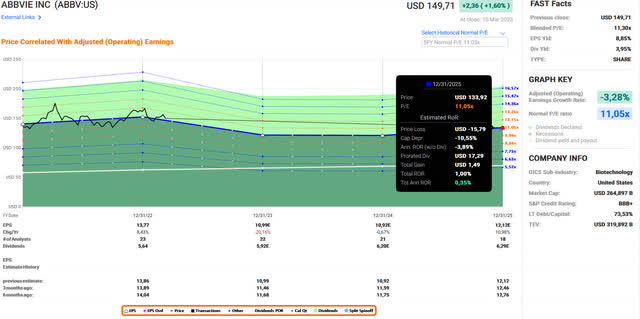

Looking at FastGraphs’ full history chart of AbbVie, we can see that the stock trades below its own historic adj. P/E average (blue line) and the fair value of 15x earnings FastGraphs suggests (orange line).

FastGraphs’ historical chart (fastgraphs.com)

As seen above, this only applies to the longer-term historical average. If we go down to the last five years, AbbVie trades slightly above the average. In any case, AbbVie’s valuation looks more or less fair, according to the charts. What’s bothering me with these FastGraphs charts is the total return potential we can easily analyze here. FastGraphs’ forecasting calculator shows us how the historic averages apply to the analyst’s estimates:

FastGraphs’ forecasting calculator (fastgraphs.com)

If AbbVie’s share price reverts to its five-year average, an investment at current prices will result in a loss in share price but a total return of 0.35% until the end of 2025 due to the dividend. That is, obviously, not attractive. If we assume AbbVie’s stock reverts to its ten-year average, the total return goes up to 5.2% until the end of 2025.

FastGraphs’ forecasting calculator (fastgraphs.com)

This is all based on the assumption that the analyst’s estimates are correct and don’t change in the future. To give myself a margin of safety, I calculated both returns for the case that analysts’ estimates will be raised by 20% or the actual results are 20% higher than the estimates. In this case, the total return goes up to 6.9% and 13.1% annually until the end of 2025. While 6.9% is still unattractive, 13.1% seems okay. But for this to happen, AbbVie needs to perform 20% better than expected, and the stock needs to revert to its ten-year average, which isn’t likely since AbbVie isn’t as well positioned as previously. The five-year seems more likely to be a fair valuation.

Conclusion

AbbVie is not a well-known healthcare company, belonging to the biggest on the market. They are known for delivering steady business performance and paying a generous and safe dividend of almost 4%. Unfortunately, the stock does not seem fairly priced, considering the differences in growth compared to previous times. Combined with falling and stagnating earnings, this gives us zero to little total return potential. To have an attractive total return, the stock would need to revert to its ten-year average P/E ratio, which is rather unlikely, and perform 20% better than expected, which is doubtful, too. You could use less risky alternatives like money market accounts, bonds, or CDs and get the same o even better returns. Therefore, AbbVie is not a “buy” for me. Instead, I rate it a “hold” because it is still a good dividend stock and could be an investment for people solely seeking income.

Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.