Summary:

- AbbVie reported mixed Q2 2024 results, adding to my concerns of its growth potential.

- Looking ahead, I see continued pressure for Humira sales and also increasing in-house R&D expenses.

- These issues will translate into both topline and EPS growth headwinds in the years to come.

- Such growth headwinds, when combined with its current elevated stock prices, point to heightened investment risks.

Robert Way/iStock Editorial via Getty Images

I last wrote on AbbVie stock (NYSE:ABBV) back in July 2024, a bit more than two months ago. In that article, I explained my thought process for exiting the position from our income account. The key consideration is that I think “the market has corrected its overreaction to the Humira patent cliff by now”.

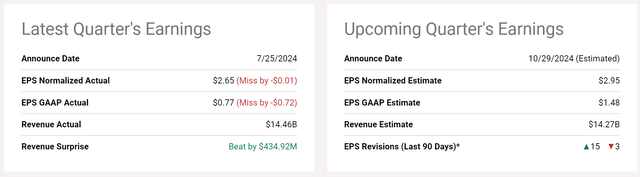

Since that writing, the company has released its 2024 Q2 earnings report (“ER”). Given the new financials and business fundamentals updated in the ER, I think it is a good idea to reexamine the stock. Overall, my view is that the company reported a mixed Q2. As seen in the next chart below, the company beats revenue consensus slightly (by $434M) but missed EPS consensus estimates both in terms of normalized EPS and GAAP EPS. Looking ahead, the company has provided updated guidance for the full year of FY 2024, targeting adjusted earnings of $10.71-$10.91 a share this year. At the midpoint of this guidance range, it implies a 3% decline versus the 2023 figure. Yet the stock prices rallied after the ER. The combination of these mixed results and the stock price appreciation have created an uninspiring return profile going forward, as elaborated next.

ABBV Stock: Humira headwinds in focus

As argued in our earlier article, Humira-related issues represent a key factor in my decision to exit. Results from the Q2 ER keep showing concerning signs surrounding this blockbuster franchise. On the positive side, momentum in its immunology assets continued. Notably, Skyrizi enjoyed sales growth of 45% year over year and Rinvoq grew even more by 56%. These performances helped to mitigate the decline in Humira sales (which plummeted by another 30% in the past quarter due to growing competitive pressures in domestic markets). To my knowledge, I can now count at least 10 close copies of the drug available in U.S. markets. As such, I consider further sales decline as a certainty in the next few years to come.

To combat the issue, I expect the company to keep investing aggressively in acquisitions (more on this later) and also in-house research & development (“R&D”). As you can see from the chart below, the company’s R&D expenses reached $1.98 billion in the past quarter, a sizable increase compared to the figure of $1.73 billion a year ago. These investments might bear fruit in the longer term. But in the near term, I expect such milestone expenses to weigh on the bottom line and pressure its profitability. As a result of the higher expenses, operating income stayed essentially flat ($4.99B vs. $4.94B) despite a mild growth in the top line.

ABBV stock: currently trading at full valuation

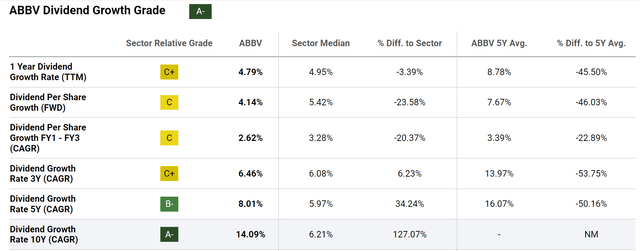

Given the combination of sales pressure from Humira and increasing expenses, I see limited EPS growth potential in the years ahead. As a quintessential dividend champion, I will rely on its dividend growth rate to gauge the growth rate of its true economic earnings. As seen in the next table below, ABBV’s dividend growth has been over 14% in the past 10 years but has slowed down to 8% in the past 5 years and only 6.4% in the past 3 years.

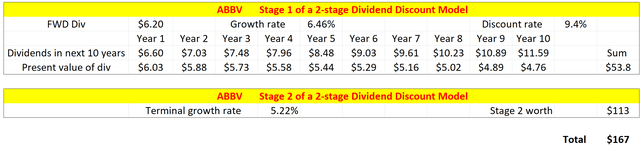

Also, considering its dividend champ status, it is very fitting to assess its valuation using a discounted dividend model (“DDM”). More specifically, here I will apply a two-stage DDM model to capture both near-term and long-term growth potential. Details of the mode are provided in my earlier article, and the key parameters are summarized below:

There are a total of 3 key parameters in the 2-stage DDM: the discount rate, the growth rate in stage 1, and the terminal growth rate. For the discount rate, I relied on the so-called WACC, the weighted average cost of the capital model. The discount rate for ABBV is about 9.4% on average in recent years following this model.

To be on the generous side, I will apply its dividend growth in the past 3 years (i.e., 6.46%) as the growth rate for the first stage, even though consensus estimates project a slower growth rate of 5.7% CAGR only for the next 10 years (see the screenshot below).

For its terminal growth rate, my approach is detailed in my other articles. Here I will just quote the end results below:

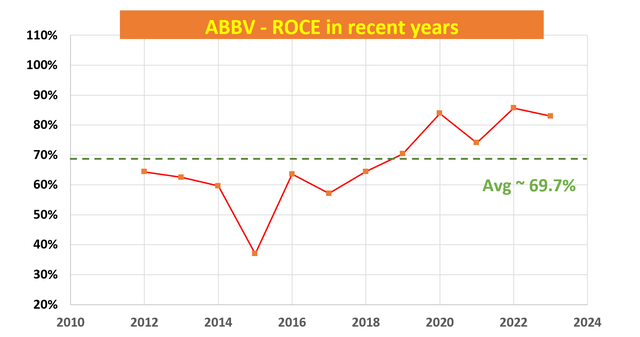

The method involves the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The ROCE for ABBV has been around 69.7% in recent years as seen in the chart below. I will assume an RR of about 7.5%, the average for large mature companies. With these inputs, ABBV’s terminal growth rate would be ~5.22% (69.7% ROCE x 7.5% RR = 5.22%).

With these above parameters, the last table at the end of this section shows the final results from the 2-stage DDM. Note that I used its FWD dividend of $6.2 per. As seen, these parameters lead to a fair valuation of $167, indicating substantial valuation risk compared to its current market price of $195 per share as of this writing.

Other risks and final thoughts

In terms of upside risks, drug development is a high-risk and high-payoff business. Some of the pipeline drugs could become blockbusters and accelerate ABBV’s EPS growth. As an example, the company has done a good job internally developing Skyrizi and Rinvoq. Each was quick to achieve blockbuster status, and they have been pivotal in offsetting Humira losses. Both are well poised to be the headliners of AbbVie’s product portfolio for years to come, in my view. In addition to internal development, ABBV has also been instrumental on the acquisition front. I won’t be surprised if management continues relying on bolt-on M&A to supplement its organic developments. As a recent example, earlier this year, ABBV closed a $10 billion deal for ImmunoGen, a company focused on oncology. Then more recently in August, ABBV finalized another deal of around ~$9 billion to acquire Cerevel Therapeutics. This acquisition strengthens its neuroscience pipeline.

All told, my overall conclusion is that downside risks outweigh the upside potential under the current conditions. The recent stock price rallies have also factored in all the positives already and leave little margin of safety for the negative scenarios. In particular, this article examined the revenues and EPS growth headwinds in the years to come. The combination of a tepid growth outlook and elevated stock prices suggests a substantial valuation risk according to a dividend discount model. A simple PEG ratio (P/E to growth ratio) suggests the same – probably an even more alarming – risk. With a projected EPS growth rate of 5.7% based on consensus estimates, the stock’s current 18x P/E implies a PEG ratio of over 3.1x, in contrast to the gold standard of 1x many growth-oriented investors seek.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.