Summary:

- AbbVie will report Q3 2024 results next week and I expect to see a beat-and-raise quarter.

- The outperformance should be driven by top growth products Skyrizi and Rinvoq, the strong performance of neuroscience and oncology segments and by the return to growth of the aesthetics segment.

- I also expect the company to increase the full-year revenue guidance by $300-500 million.

- Updates on the clinical timelines on recently acquired Cerevel assets are also something to keep an eye on.

- The level of Humira’s erosion represents the key downside risk to near-term growth expectations.

mohd izzuan

AbbVie (NYSE:ABBV) will report third quarter results next week and I expect to see a continuation of trends from the first half of the year with top and bottom-line beats and an improved full-year outlook, driven by the outperformance of key products Skyrizi and Rinvoq, the continued strong performance of the neuroscience segment and the expected return to growth of the aesthetics segment. Continued erosion of Humira is to be expected, and is only a matter of how fast the decline is, but so far, so good for AbbVie as it is managing the impact of biosimilars quite well.

A reinforcement for the product portfolio also came recently with the FDA approval of Vyalev, and the $8.7 billion acquisition of Cerevel finally closed and clears the way for potentially significant launches of emraclidine in schizophrenia and other indications in the second half of the decade.

Return to topline growth to solidify in the second half of the year

In my initiation article in April, I wrote how impressed I was with how AbbVie is managing the impact of the launches of biosimilar Humira – both the erosion of Humira itself and the replacements that were introduced – primarily Skyrizi (which I labeled as the next Humira in my August update) and Rinvoq, but also the business development transactions, and in particular, the acquisition of Cerevel that finally closed in early August.

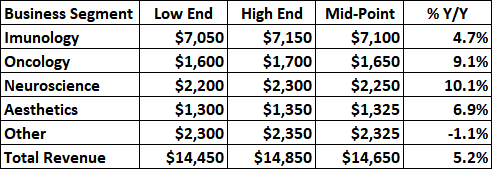

I expect AbbVie to report mid-single-digit revenue growth in the third quarter, driven by a recovering immunology segment, the strong contribution of oncology and neuroscience segments and a return to growth of the aesthetics segment. Below are my sales estimates for the third quarter for each business segment and for total revenue.

Author’s estimates

If the company reports revenues at the mid-point of my estimate range, this would be the highest Y/Y growth rate since the loss of exclusivity for Humira.

Immunology segment returns to growth despite Humira erosion

The immunology segment should grow nearly 5% Y/Y at the mid-point of my estimate range and it will achieve this despite more than a 30% Y/Y decline in Humira net sales – my estimate is $2.4 billion, a 32% Y/Y decrease.

Humira’s significant Y/Y decline will be offset by the strong growth of Skyrizi and Rinvoq.

I expect Skyrizi net sales to exceed $3 billion in the third quarter, and grow by at least 41-42%, and potentially 45%+ to reach or exceed $3.1 billion. This should be achieved through continued strong adoption in the older indications such as psoriasis and psoriatic arthritis, and by strong progress in new indications – ulcerative colitis and the recently approved Chron’s disease.

For Rinvoq, I expect net sales to grow between 45% and 50% over the same quarter in 2023 and exceed $1.6 billion, as AbbVie continues to see strong momentum across several indications, from rheumatology to atopic dermatitis and the shared indications with Skyrizi – ulcerative colitis and Chron’s disease.

It is possible, but I am not really expecting a significant bump in the sales growth of Rinvoq and Skyrizi from the recent approvals in Chron’s disease in May and ulcerative colitis in late June, respectively. A continuation of strong growth trends is my baseline assumption for the two products.

Addition of Elahere is driving the return to growth of the oncology portfolio

For the oncology segment, I am expecting a 9.1% Y/Y increase at the mid-point of the range, but I should note that the growth rate is artificially inflated by the addition of Elahere in February (from the acquisition of Immunogen).

Partner Johnson & Johnson (JNJ) already reported third quarter results, so, we know that Imbruvica is experiencing a continued decline in net sales due to increased competition in the chronic lymphocytic leukemia market.

Venclexta should continue to deliver 10-15% Y/Y growth.

And last but not least, we should see stronger sequential progress of Epkinly with potential growth acceleration after the recent FDA approval for the treatment of relapsed/refractory (or third-line+) follicular lymphoma and by the potential launches in ex-U.S. territories (pending approvals) in the following quarters. I wrote in greater detail about Epkinly in my most recent article on AbbVie’s partner Genmab (GMAB), and I believe the strong uptake in the initial indication (relapsed/refractory diffuse large B cell lymphoma) is a good indicator for the launch in follicular lymphoma.

Neuroscience remains the best-performing business segment

Continued, healthy, double-digit Y/Y growth of the neuroscience segment is my baseline assumption and it should be driven by the two migraine drugs Ubrelvy and Qulipta, and also by continued growth of Vraylar and the Botox therapeutic.

Vyalev (ABBV-951) was finally approved by the FDA last week after two rejections, and we should see in the following quarters whether it can live up to the company’s expectations of becoming a blockbuster product in the Parkinson’s disease market.

As mentioned, the acquisition of Cerevel closed in early August and I expect it to be a major growth driver for the neuroscience segment later this decade. What I would like to hear from AbbVie next week is whether there are changes to the trial readout timelines – Cerevel previously guided for topline data from phase 2 trials of emraclidine in schizophrenia patients in the second half of the year. I would also like to hear about any other plans AbbVie has with Cerevel’s pipeline candidates.

The competing product to Cerevel’s emraclidine, Bristol Myers Squibb’s (BMY) Cobenfy (xanomeline and trospium chloride, also known as KarXT) was approved in late September for the treatment of schizophrenia, and this launch will be worth watching for AbbVie investors as Cobenfy’s trajectory will be a good indicator of demand for this class of drugs with emraclidine expected to be the second entrant in a few years.

Can the aesthetics business return to growth?

The aesthetics business generated $2.64 billion in revenue in the first half of the year and AbbVie guided for $5.5 billion for 2024. This implies a decent sequential recovery in the second half of the year. I have modest expectations here and expect approximately 7% Y/Y growth to $1.325 billion at the mid-point of the estimate range, driven partially by the reversal of inventory de-stocking and the company holding up its market share. These modestly positive trends could be partially offset by continued headwinds in China.

Q3 revenue beat to drive an EPS beat and improved full-year guidance

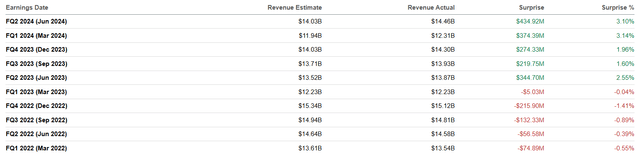

The Street consensus for Q3 is $14.27 billion and my estimate range of $14.45-14.85 billion implies a $180-580 billion topline beat, and it would extend the streak of quarterly topline beats to six.

Seeking Alpha

The revenue beat should flow to the bottom-line and result in a non-GAAP EPS beat, but I am not sure of the magnitude as it also depends on various expense lines, and the company did miss EPS two times in the last six quarters despite beating revenue estimates.

The GAAP EPS is expected to be under pressure this year due to the recognition of acquired IPR&D and milestone expenses that may be incurred from collaborations. In early October, AbbVie said updated its EPS guidance for the year and said that third quarter EPS will be negatively impacted by $2.88-2.92 per share.

I also expect the Q3 revenue beat to result in an increase in the full-year revenue guidance of $300 million to $500 million. The current full-year guidance is $55.5 billion and I believe AbbVie can exceed this guidance by as much as $1 billion if the trends from the first half of the year persist in the second half of the year.

Conclusion

AbbVie looks well-positioned to deliver strong third quarter results next week. I expect revenues to be in the $14.45-14.85 billion range and ahead of the $14.27 billion consensus and expect the company to increase its full-year revenue guidance by $300-500 million. The outperformance should be driven by the top growth products Skyrizi and Rinvoq, and by the strong performance of the neuroscience business, and a potential return to growth of the aesthetics business. The topline beat and increased full-year revenue guidance should also at least partially flow to the bottom line.

The largest unknown and downside risk is Humira. Based on management comments on Q1 and Q2 earnings calls, it is entirely possible that my estimate is too conservative, but it is an ongoing battle with biosimilar manufacturers and I would not be surprised (but would also not be worried) if the outlook for Humira deteriorates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.