Summary:

- AbbVie Inc. is showing signs of growth beyond the loss of exclusivity for Humira, with strong 2024 guidance.

- Sales of Skyrizi and Rinvoq are replacing lost Humira sales, with projected sales more than doubling through 2027.

- AbbVie’s acquisitions of ImmunoGen and Cerevel Therapeutics are expected to further boost sales, though add $18.7 billion to debt.

- The stock is relatively cheap, trading at 14x ’25 EPS targets.

Bloomberg/Bloomberg via Getty Images

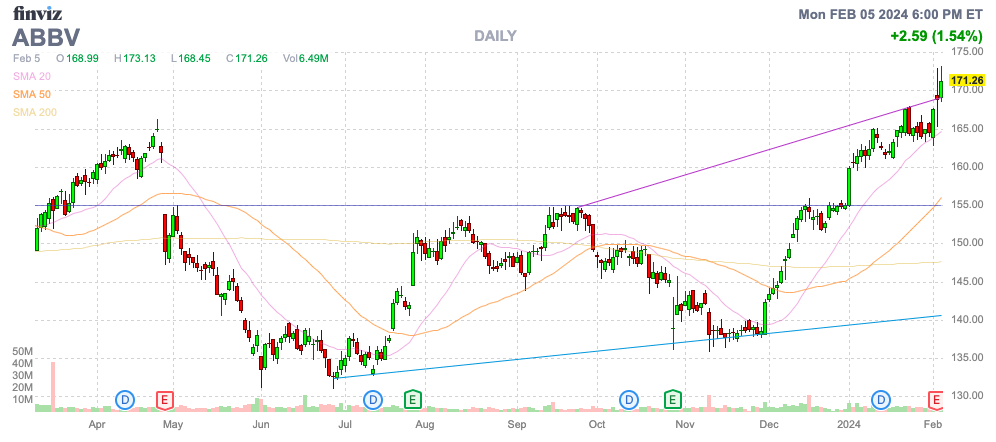

Even before a couple of major acquisitions close and impact results, AbbVie Inc. (NYSE:ABBV) is showing solid signs of growing beyond the Humira loss of exclusivity. The stock has already soared to yearly highs on the back of solid 2024 guidance. My investment thesis remains Bullish on the biopharma moving back towards growth mode this year.

Source: Finviz

Robust Outlook

Last Friday, AbbVie reported somewhat mixed results for Q4, with revenues beating estimates by $270 million, but the biopharma actually reported a 5% sales decline for the December quarter as follows:

The biopharma has faced a difficult period due to the loss of sales from Humira due to biosimilar competition, but AbbVie has a strong plan to reverse the sales trend. Most importantly, Humira sales are down to only $3.3 billion in Q4, a decline of 40.8% from last Q4.

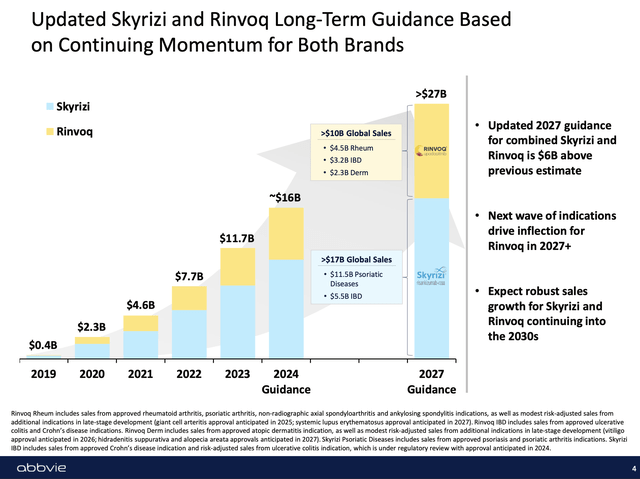

AbbVie has been able to quickly replace these lost drug sales with a big ramp-up in Skyrizi and Rinvoq. The drugs reached combined 2023 sales of $11.7 billion, and the company projects a big ramp to ~$16.0 billion in 2024 followed by an additional sales increase of another $11.0 billion through 2027.

Source: AbbVie Q4’23 presentation

In essence, the Skyrizi and Rinvoq sales boost through 2027 is set to top the remaining Humira sales base, and AbbVie shouldn’t see the franchise sales completely disappear. On the Q4 ’23 earnings call, COO Rob Michale was clear the updated guidance for Rinvoq doesn’t even forecast several additional potential label expansions in a few years as follows:

This forecast comprehends modest contributions from several new disease areas for Rinvoq, which we anticipate will be launching in the second half of the decade. These new indications have a collective peak sales potential of several billion dollars.

On top of that, the company raised the peak sales outlook for Ubrelvy and Qulipta to more than $3 billion, up from the prior target by over $1 billion. Naturally, the earnings call was very upbeat with the sales bump for already approved drugs, and the business shifted beyond the sales decline in Humira due to LOE.

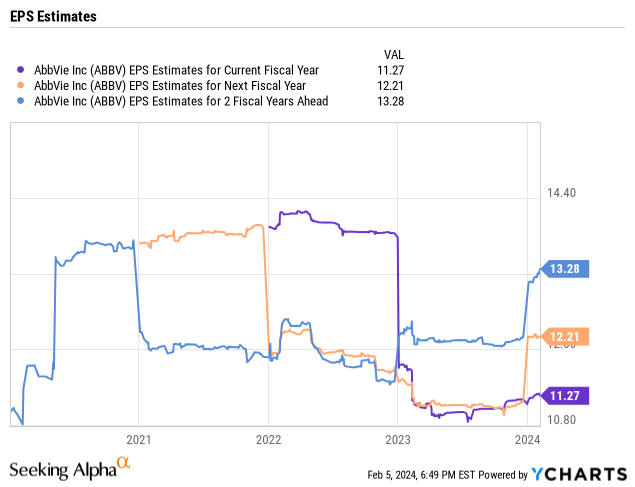

The biopharma is now forecasting sales to start growing at high-single digit rates in 2025 and lasting through at least 2029. The numbers are impressive considering AbbVie guided 2024 adjusted EPS to $11.37 to $11.57 when excluding $0.32 in dilutive impact from the ImmunoGen (IMGN) and Cerevel Therapeutics (CERE) acquisitions. Analyst were only forecasting a $11.29 EPS in comparison to the prior guidance from management at $11.00.

The acquisitions should add even further boosts to sales with ImmunoGen alone targeted at reaching $1+ billion in sales by 2026. AbbVie is really a nearly $55 billion sales company, so the acquisitions won’t provide initial material impacts.

Full Speed Ahead

Based on the boosted EPS guidance, consensus estimates for the next couple of years have been increased, and the investor community has far more confidence in the growth ahead. AbbVie is now forecasted to reach a 2025 EPS of $12.21 followed by another $1+ gain annually in the years ahead.

The stock has quickly jumped to over $170 and already trades at 14x 2025 EPS targets. The stock still offers a solid 3.7% dividend yield, while a similar P/E multiple on the 2026 EPS targets of $13.28 will place the stock at $185 to start 2025.

AbbVie can generate a nearly 10% annualized capital gain along with the solid dividend yield. The stock is about fairly valued here, providing capital gains mostly in line with the EPS growth in the years ahead.

The stock appears set for a breakout above the all-time highs reached in early 2022. The recent bullish sentiment on the stock and the positive indications on the top performing drugs could provide further multiple expansion in the year ahead, whether or not warranted.

AbbVie ended the prior quarter with over $50 billion in debt with a cash balance of $13 billion. The one major negative to the biopharma stock is the $37 billion in net debt and the required cash payments for the 2 deals. The company agreed to pay $8.7 billion in cash for Cerevel and another $10 billion for ImmunoGen for combined cash outlays ahead of $18.7 billion.

The company forecast 2024 free cash flows of $18 billion with plans to spend $7 billion on repaying debt maturities due this year. Clearly, AbbVie has the cash flows to pay the large dividend and repay debt, especially now that the company has confidence that profits will now grow going forward through 2029.

Takeaway

The key investor takeaway is that AbbVie Inc. shares are still cheap, though the stock has risen over 20% in the last few months. The large biopharma has finally changed the trajectory of the business and now looks poised to start moving beyond the LOE of Humira. Investors are likely to pay a premium for the stock going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.