Summary:

- AbbVie’s Q1 2023 global net revenues totaled $12.225 billion, marking a 9.7% decrease from the previous year due to biosimilar competition against Humira.

- Despite Humira’s decline, AbbVie sees growth in other therapeutics, especially Skyrizi, Rinvoq, and Venclexta, and plans more strategic acquisitions and diversification.

- AbbVie’s robust pipeline and profitability metrics make it attractive for long-term, income-focused investors, despite short-term uncertainties linked to Humira.

vzphotos

Introduction

AbbVie Inc. (NYSE:ABBV), a global pharmaceutical company, focuses on developing and selling diverse medical therapies. Its portfolio includes drugs for autoimmune diseases like Humira, Skyrizi for psoriasis and Crohn’s disease, Rinvoq for various forms of arthritis, Imbruvica for blood cancers, and Venclexta for hematological malignancies. They also offer aesthetic products, treatments for Parkinson’s disease, migraines, glaucoma, hepatitis C, irritable bowel syndrome, and hypothyroidism, among others. The company, headquartered in North Chicago, collaborates with various life science entities.

In light of the declining revenue of Humira due to the introduction of biosimilars, this article assesses the financial well-being of the company and explores its future prospects.

Q1 2023 Earnings

Let’s first look at the firm’s most recent earnings report: AbbVie’s Q1 global net revenues totaled $12.225 billion, marking a 9.7% decrease from the previous year. The immunology portfolio saw a 9% decline, with Humira revenues down 25.2%. However, Skyrizi and Rinvoq revenues increased by 44.7% and 47.5%, respectively. The hematologic oncology portfolio dropped by 14%, with Imbruvica revenues declining 25.2%, but Venclexta revenues increased by 13.7%. The neuroscience portfolio grew by 13.9%, with a notable 31.3% increase in Vraylar revenues. The aesthetics portfolio dipped by 5.4%, despite a 2.9% increase in Botox Cosmetic revenues. The company reported a gross margin ratio of 67.4%, an operating margin of 22.6%, and diluted EPS of $0.13 on a GAAP basis.

ABBV Stock Assessment

It’s time to assess AbbVie’s vital signs: Per Seeking Alpha data, AbbVie is currently valued with a forward P/E ratio of 12.26, a GAAP P/E ratio of 31.76 over the trailing twelve months (TTM), and an EV/EBITDA of 9.96. The company’s revenues have grown by 18.55% over the past three years, with a year-over-year growth rate of 0.03%. However, the EPS has declined by 39.01% YoY and 9.03% over the past three years. Levered free cash flow saw a YoY growth of 7.53%.

AbbVie’s gross profit margin stands at 70.96%, with an EBIT margin of 36.98% and a net income margin of 13.37%. The company also demonstrates strong profitability with an ROE of 51.27% and ROA of 9.44%.

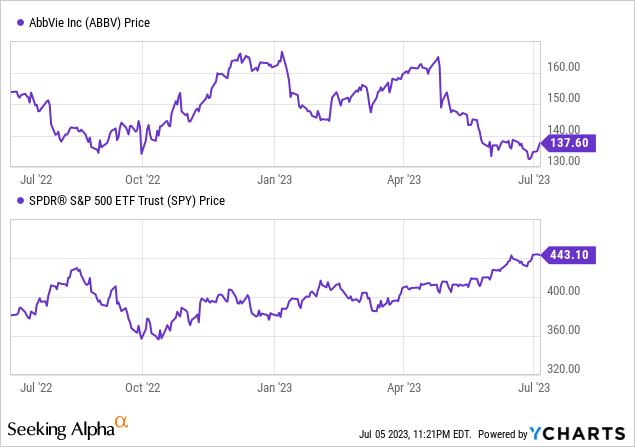

Over the past year, AbbVie’s stock performance has decreased by 12.22%, while the S&P 500 index has increased by 16.48%.

The company has a market cap of $238.20 billion, total debt of $62.46 billion, and cash holdings of $6.72 billion, leading to an enterprise value of $293.96 billion.

AbbVie’s forward dividend yield is 4.38%, with an annual payout of $5.92. The payout ratio is 44.16%, with a five-year CAGR of 14.53% and nine consecutive years of growth. The next ex-dividend date is July 13, 2023, with the payout due on August 15, 2023. The dividends are paid quarterly.

AbbVie’s Strong Therapeutic Portfolio Drives Financial Performance, Despite Biosimilar Competition

AbbVie’s management remains optimistic following their recent strong financial performance, which was largely driven by their robust therapeutic portfolio. Notably, the immunology sector, backed by Skyrizi and Rinvoq, reported revenues of approximately $5.6 billion. Skyrizi has not only shown exceptional growth in the U.S. psoriasis market but also rapid adoption in Crohn’s disease treatment, with plans for a new indication in ulcerative colitis next year. Rinvoq, with global sales of $686 million, also showcased impressive performance, particularly in rheumatology, and holds promising growth potential in gastroenterology. While Humira’s global sales decreased to $3.5 billion due to biosimilar competition, Venclexta partially offset the declining revenues in Hematologic Oncology. Furthermore, the Neuroscience sector, led by Vraylar, and the therapeutic treatments for migraines, such as BOTOX Therapeutic and oral CGRP therapies, showed robust performance. Despite some economic challenges in the U.S., the aesthetics portfolio thrived with $1.3 billion in global sales, backed by strong sales in China and Japan. Looking ahead, management foresees substantial growth, particularly in aesthetics, with an estimated total sales exceeding $9 billion by the decade’s end.

Humira’s Revenue Outlook: Navigating Biosimilar Challenges with Strategic Counterstrategies

AbbVie’s flagship drug Humira has played a pivotal role in the company’s financial success over the years. However, the rise of lower-cost biosimilar alternatives threatens to dent this lucrative revenue stream. This development necessitates a closer look at Humira’s potential revenue trajectory and AbbVie’s counterstrategies to mitigate potential losses.

As biosimilars continue to emerge, a gradual decrease in Humira’s revenue is anticipated in the coming years. Biosimilars’ availability in international markets has already instigated a marked decrease in Humira’s international sales, a trend set to continue when biosimilars gain footing in the U.S. market in 2023.

Nonetheless, AbbVie has proactively prepared for this inevitability. The company has significantly invested in the research, development, and marketing of new drugs, aiming to compensate for Humira’s projected revenue loss. For instance, the promising growth of new immunology drugs, Rinvoq and Skyrizi, illustrates this strategic plan. These drugs have demonstrated strong sales performance and are expected to drive significant revenue for the company.

Moreover, AbbVie’s strategy to bolster growth includes an increased focus on oncology. The promising results from drugs like Imbruvica and Venclexta in treating various cancers could help balance out declining Humira sales.

Another part of AbbVie’s growth strategy is acquiring smaller companies with exciting pipeline potential, as exemplified by the 2020 Allergan acquisition. This move broadened AbbVie’s portfolio into aesthetics, eye care, and neuroscience.

It’s also important to note that transitioning patients from a biologic to a biosimilar is not always an immediate or simple process. Many physicians and patients may opt to stay with Humira, especially if it has been effective for them, offering a level of buffer during this transition period.

My Analysis & Recommendation

In conclusion, AbbVie is a multi-faceted pharmaceutical company that’s navigating a dynamic and challenging landscape. While the downward trend in Humira revenues due to the emergence of biosimilars is a concern, the company’s proactive approach to building a robust portfolio of new drugs and the resilience of its other therapeutic segments paint a picture of considerable adaptability and potential resilience.

Investors with a long-term outlook may find AbbVie attractive, given the firm’s strategy to counteract declining Humira revenues with the promising growth of Rinvoq and Skyrizi in the immunology sector and a growing focus on oncology. Moreover, AbbVie’s acquisition strategy, as evidenced by the Allergan deal, may offer continued diversification, reducing dependency on a single drug.

Over the next 12 months, the company’s stock may experience volatility due to the uncertainties surrounding the impact of biosimilars on Humira’s sales, especially in the U.S. market. However, a few years down the line, the potential growth of the company’s other therapeutic areas, combined with an impressive pipeline, could contribute to a stronger performance.

AbbVie’s strong profitability metrics, combined with its attractive dividend yield, make it an appealing choice for income-focused investors. Despite short-term headwinds, the firm’s proactive approach to innovation and diversification may sustain profitability and cash flow, supporting continued dividend growth.

Considering the short-term uncertainties linked with Humira, it would be prudent for current investors to retain a ‘Hold’ position. On the other hand, AbbVie might provide a compelling ‘Buy’ opportunity for prospective investors interested in long-term growth and substantial dividend yield, especially during any major dips in the stock. This could be more likely if the market has an exaggerated response to the anticipated drop in Humira. According to Seeking Alpha estimates, AbbVie is expected to announce its second quarter earnings towards the end of July. It would not be a surprise to witness AbbVie’s stock price inching towards $100 within this year. However, it is essential for investors to keep an eye on the performance and acceptance rate of AbbVie’s emerging drugs, as well as the competitive landscape in the biosimilar arena. This vigilance will help confirm that the company’s growth strategy is hitting its objectives.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.