Summary:

- AbbVie is one of my biggest winners and a top 10 holding in my portfolio.

- The company’s increasing contributions from Skyrizi and Rinvoq pushed net revenue higher in Q2.

- AbbVie maintains its A- credit rating from S&P on a stable outlook.

- The current valuation is already pricing in most of the anticipated growth for the next couple of years.

- AbbVie is positioned for modest total returns through 2026.

A pharmacist assists a customer. gradyreese/iStock via Getty Images

The formula for successful long-term investing is pretty simple. Quality plus a reasonable or better valuation plus time equals vigorous total returns.

I’ve touched on what I mean by quality in past articles, but please allow me to reiterate:

- A track record of consistent earnings growth. If a company grows its profits just about every year, this is probably the best indicator that the business is well-run, and the business model is viable.

- The dividend payout ratio is sustainable for a company’s industry. Coupled with steadily rising profits, this can support growth in the payout each year.

- Solidly investment-grade corporate credit ratings. This provides a business with a low cost of capital to carefully execute bolt-on acquisitions to bolster growth. Depending on the industry, it can also briefly serve as a buffer for the dividend if needed.

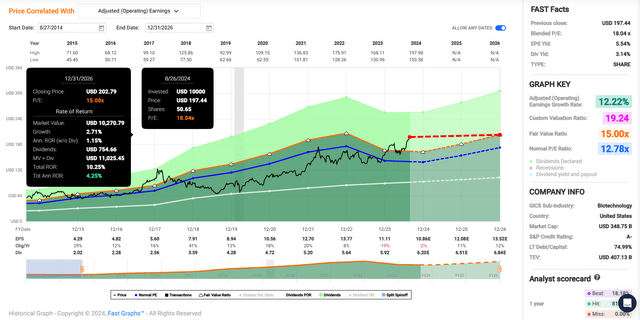

AbbVie (NYSE:ABBV) is a core holding in my portfolio that I believe handily meets these criteria. Since my first purchase in August 2018, I’m up 58% before dividends. My best tranche was purchased in April 2019, and I’m up 149% before dividends on that transaction. Unsurprisingly, the company accounts for 1.9% of my portfolio and is my ninth-biggest investment holding.

When I last covered ABBV with a hold rating in May, I appreciated the sizzling growth prospects of Skyrizi and Rinvoq. I also liked the company for its A-rated balance sheet. At the time, the valuation was the only factor that I didn’t find compelling.

Today, I’m going to be maintaining my hold rating. ABBV shared respectable second-quarter results on July 25th. Skyrizi and Rinvoq still have plenty of room to drive future growth. The dividend is secure and can keep growing. Even though I have raised my fair value estimate significantly, shares have rallied by much more.

Net Revenue Growth Is Accelerating

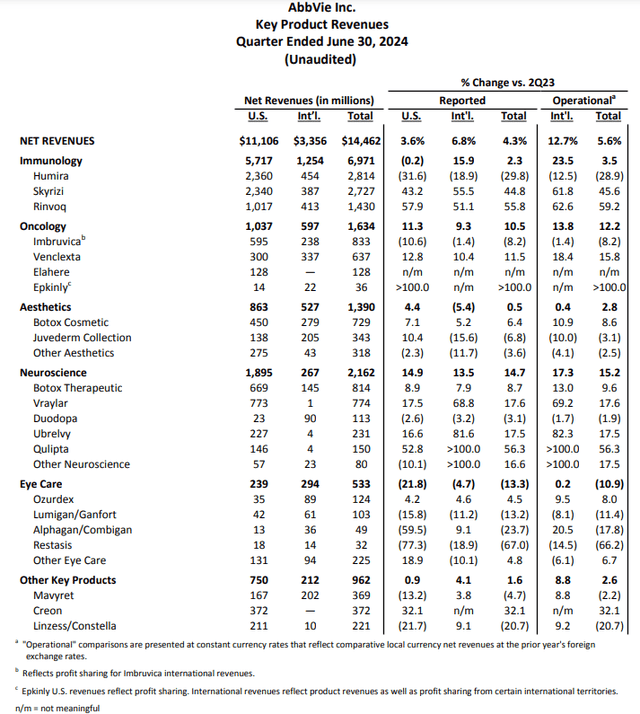

ABBV Q2 2024 Earnings Press Release

Last month, ABBV released what, I thought, were impressive second-quarter results. The company’s total net revenue rose by 4.3% over the year-ago period to $14.5 billion during the quarter. Put into context, this was $430 million better than Seeking Alpha’s analyst consensus for the quarter.

It gets even better, too. Adjusting for unfavorable foreign currency translation, ABBV’s operational or constant currency net revenue would have grown by 5.6% in the second quarter. This was also higher than the 1.6% operational growth rate logged in Q1.

Beginning with Humira, the company’s top-selling drug experienced a 29.8% year-over-year drop in net revenue to $2.8 billion during the second quarter. CEO Rob Michael shared an encouraging nugget in his opening remarks during the Q2 2024 Earnings Call:

Since the drug started facing biosimilar competition in the U.S., this marked the sixth straight quarter (in as many quarters) that it has either achieved or exceeded company guidance.

Skyrizi and Rinvoq haven’t just taken the proverbial torch from Humira in recent quarters. They ripped the torch away from the former top-selling drug in the world.

Skyrizi’s net revenue roared 44.8% higher over the year-ago period to $2.7 billion for the second quarter. According to COO Jeff Stewart, that was driven by the share of the U.S. psoriasis biologic market rising to 38% (versus over 35% in Q1). Ramping share in psoriatic arthritis to 15% in the U.S. also helped drive this growth.

Continued momentum in its psoriasis and Crohn’s disease indications bode well for the future. As does the U.S. Food and Drug Administration approval in June for ulcerative colitis.

Rinvoq performed exceptionally well in the second quarter as well. The drug’s net revenue soared by 55.8% year-over-year to $1.4 billion during the quarter. Growth in U.S. atopic dermatitis share to 10% and a leading in-place share for ulcerative colitis in the U.S. are what’s fueling this admirable topline growth.

Continued growth in these indications and the launch of five additional indications later this decade currently in late-stage development are growth catalysts for Rinvoq.

Elsewhere, ABBV’s Vraylar anti-psychotic posted $774 million in net revenue for the second quarter. This was a 17.6% growth rate over the year-ago period. Market share gains and market growth powered this topline growth.

ABBV’s ex-Humira products account for more than 80% of its total net revenue. As an idea of just how well these products are performing, the company expects that ex-Humira net revenue will beat initial guidance by more than $1 billion.

Moving to the bottom line, ABBV’s adjusted diluted EPS fell by 8.9% year-over-year to $2.65 in the second quarter. This was $0.01 below Seeking Alpha’s analyst consensus during the quarter.

A 480 basis point decline in the non-GAAP net profit margin to 32.8% offset the higher revenue base for the second quarter. This is what led adjusted diluted EPS to contract as net revenue increased in the quarter.

For the current year, the FAST Graphs analyst consensus is that adjusted diluted EPS will decrease by 2.3% to $10.86. But beyond this year, a return to adjusted diluted EPS growth is expected.

The FAST Graphs consensus is that adjusted diluted EPS will grow by 11.2% in 2025 to $12.08 in 2025. Another 11.9% growth in adjusted diluted EPS is anticipated for 2026.

ABBV’s drug pipeline also looks to put it in a great position beyond just the next couple of years. This is because 50+ of its programs are in mid to late-stage development. That means the company has plenty of new product launches and new indications in the works to keep net revenue and adjusted diluted EPS moving higher.

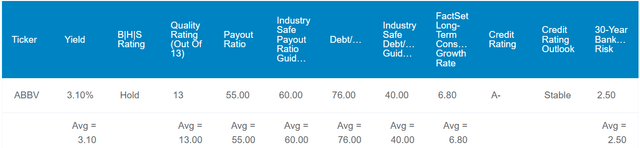

ABBV’s financial health is also decent. As of June 30, the company carried net debt of approximately $57.5 billion. Against the $18.1 billion in annualized EBITDA in the first half of 2024, this equates to a net debt-to-EBITDA ratio of 3.2. This is what supports an A- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to ABBV’s Q2 2024 Earnings Press Release and ABBV’s Q2 2024 10-Q Filing).

Fair Value Could Be $175 A Share

Shares of ABBV have rallied by 27% in the last three months, leaving the 7% gains of the S&P 500 Index (SP500) in the dust. Predictably, that has moved shares from a hold/borderline buy rating more firmly into hold territory.

ABBV’s current-year P/E ratio of 18 is meaningfully above its 10-year normal P/E ratio of 13.2. In the years ahead, I could see a multiple of 15 as fair value. That’s because, thanks to its immunology duo, ABBV’s net revenue base is less concentrated than it has been in the past. That reduced net revenue concentration and a return to the growth of prior years can justify such a multiple.

The calendar year 2024 will be 67% complete in just a few days. That leaves another 33% of 2024 and 67% of 2025 ahead in the next 12 months. This is how I’m weighing adjusted diluted EPS forecasts to get a 12-month forward adjusted diluted EPS input of $11.68.

Using my fair value estimate with this adjusted diluted EPS input, I compute a fair value of $175 a share. That suggests ABBV is trading at a 12% premium to fair value from the current $175 share price (as of August 27th, 2024). If ABBV matches the growth consensus and returns to fair value, it could produce 10% cumulative total returns by the end of 2026.

A Safe And Market-Beating Payout

The Dividend Kings’ Zen Research Terminal

ABBV’s 3.2% forward dividend yield clocks in at double the healthcare sector median forward yield of 1.4%. This is enough to warrant an A- grade from Seeking Alpha’s Quant System for forward dividend yield.

ABBV scores impressively in other categories, too. The company’s dividend compounded by 6.5% annually in the past three years. This is better than the sector median of 6% in that time. Overall, the Quant System awards ABBV an A grade for dividend growth.

Looking ahead, the company remains well-positioned to build on its dividend growth streak. ABBV’s dividend payout ratio is poised to come in between a mid-50% and a high 50% range. This is better than the 60% payout ratio that rating agencies desire from the industry. That is also during what is likely going to be ABBV’s trough year for adjusted diluted EPS for the foreseeable future.

This provides a comfortable buffer for the company to keep growing the payout in the years ahead. That’s why ABBV earns a B+ grade from the Quant System for dividend safety.

Risks To Consider

ABBV is a top-notch company, but it faces risks that are worth noting. Since there are no new risks outlined in its most recent 10-Q Filing, I’ll take a moment to rehash some key risks from prior articles.

ABBV has historically navigated patent expirations and biosimilar competition with ease. There is always the risk that this won’t continue indefinitely. As I highlighted in my previous article, the mounting success of Skyrizi and Rinvoq will make moving beyond the duo more challenging by the middle of the next decade.

The good news is that ABBV does have plenty of time to continue to lean into the immunology pair and plan for the future that comes after them. That can be done via acquisitions and organically via internal drug development.

Even so, Humira served as the latest reminder that ABBV’s adjusted diluted EPS will be volatile from time to time. So, I think it’s always a good idea to keep that in mind.

Another risk to ABBV is the litigious nature of the pharmaceutical industry. Whether that’s patient lawsuits or patent lawsuits from competitors, monitoring any legal cases against the company in the future is advisable. Losing any major lawsuits could have the potential to materially alter ABBV’s fundamentals.

One last risk to think about is the possibility that significant industry legislation could be enacted in major markets. If this happened, ABBV’s profit margins could be harmed.

Summary: Holding Onto AbbVie

In an otherwise unpredictable industry, I believe ABBV stands out as a best-of-breed player. As dependent as the company was on Humira just a couple of years ago, it remains set to get back on track in fairly short order. ABBV’s financial positioning is also solid, and leverage should fall firmly below 3 as early as next year.

My only reservation remains the valuation. As it stands, the market is pricing in most of ABBV’s growth through 2026. The company could keep outperforming expectations and perform better than anticipated. The current valuation doesn’t leave any margin of safety in my opinion, though. In the meantime, that’s why I’ll continue to hold until the multiple retreats to the mid-teens or lower.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.