Summary:

- AbbVie is one of the largest global Pharmaceuticals, with a market cap of >$265bn.

- The company’s lead asset – all-time best selling immunology drug Humira – finally loses patent protection this year and sales will enter a period of terminal decline.

- Investors needn’t panic however – Humira’s replacements are expected by AbbVie’s CEO to generate even higher revenues per annum.

- In this post I model AbbVie product sales to 2030 – including pipeline assets – and use discounted cash flow analysis to calculate a present day share price target.

- I believe AbbVie is likely 15 – 20% undervalued at current price. Although investing in AbbVie isn’t riskless, it is advisable based on what we know about the company.

Win McNamee/Getty Images News

Investment Overview

Ever since its split from Abbott Laboratories (ABT) in 2012 AbbVie (NYSE:ABBV) has delivered strong returns for investors – its stock price having risen overall from $30, to $149 per share at the time of writing – trading down slightly from its all-time high of >$160 achieved in early December last year.

As well as the stock price gains AbbVie has always paid a handsome dividend – which has increased by 270% since the Pharma’s inception, currently paying $1.48 per quarter, for a current yield of 4% – the highest in the large Pharmaceutical sector.

AbbVie’s success – as its shareholders will doubtless be aware – stems from the runaway success of its immunology drug Humira, which is indicated for a range of autoimmune conditions, including Rheumatoid Arthritis, Psoriatic Arthritis, Psoriasis, Crohn’s Disease, Ulcerative Colitis, Hidradenitis Suppurativa and Ankylosing spondylitis.

Sales of the drug reached $19.9bn in 2018 and were $19.2bn, $19.8bn and $20.6bn in 2019, 2020, and 2021 respectively. In 2022, Humira revenues will likely reach $21bn, which will see the drug overtake cholesterol-lowering Lipitor as the best-selling drug of all-time.

AbbVie is led by CEO and Chairman Rick Gonzalez – likely the only Pharma CEO who lacks a college degree – who has successfully defended Humira from generic drug competition by adopting a controversial strategy of continually applying for new patents related to minor changes in manufacturing methods or administration, often referred to as a “patent thicket”.

Without the additional patents – >130 in total – Humira would have lost its market exclusivity in 2016, but having eventually lost protection in Europe, which has resulted in a sales decline from $6.3bn in 2018, to ~$2.7bn in 2022, Humira will finally face generic competition in the US from the beginning of this year.

Any company is likely to struggle if sales of its best-selling asset begin to decline by ~20% per annum, which is traditionally the rate at which patent expired drugs’ sales slip, but when the drug in question accounts for >35% of a company’s sales, as Humira does, the situation becomes even more serious.

Fortunately for AbbVie shareholders Gonzalez and his management team have had many more years than expected to prepare for Humira’s Loss of Exclusivity (“LOE”), and it has never been the Pharma’s ambition to build its business around a single, all-conquering but time-limited drug.

The AbbVie of today has 5 thriving divisions – Immunology, Oncology, Neuroscience, Aesthetics, and Eye Care – with the latter 3 divisions acquired from Allergan as part of AbbVie’s $63bn takeover of that company.

In 2022, the company will most likely boast 12 “blockbuster” (>$1bn per annum) selling assets, driving ~$48bn of revenues between them, with Humira being the only drug that faces a near term patent expiry, whilst AbbVie is promising at least 6 or 7 major new product launches by 2026.

Although the company has admitted that 2023 earnings will likely be down in 2022 – guidance for last year is for earnings per share (“EPS’) of $13.84 – $13.88 on an adjusted diluted basis, versus $12.7 in 2021 – Gonzalez and his team were making some bold promises to investors at this year’s JP Morgan Healthcare conference. The CEO, speaking at a fireside chat during the conference, commented:

we remain well-positioned to absorb the impact from the Humira LOE and quickly return to strong growth starting in 2025. We continue to anticipate a clearer path to strong sales growth in 2025 with high-single-digit compounded annual growth rate to the end of this decade.

Investors do not seem to be taking the bait, however, as AbbVie’s share price has slipped by >7% across the past month, and >5% across the past 5 days.

Armed with management’s detailed guidance and commentary on sales performance of key assets and new product launches, however, I have completed sales projections for AbbVie to 2030, which I will share in this post, highlighting areas of strength and potential weaknesses.

I’ll also share some a forward income statement and discounted cash flow analysis that suggests the present value of AbbVie shares ought to trade as high as $176, implying that shares are presently discounted by as much as 18% to their true worth.

AbbVie’s post-Humira LOE plans are not riskless, and its targets are ambitious, but nevertheless I see no harm in picking up shares in the Pharma at the current price, accepting a generous 4% dividend, and likely benefitting from share repurchases and a steadily growing share price until 2030.

Below, I will outline how I see AbbVie putting the Humira LOE firmly behind it, and driving the high single digit percentage annual growth management has promised.

AbbVie To 2030 – Overcoming Humira LOE – Immunology Division

Let’s begin our analysis with the immunology division.

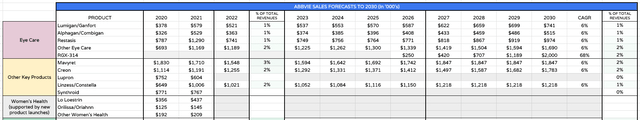

AbbVie projected sales – immunology (my forecasts and assumptions)

As we can see the immunology division consists of only 3 assets yet by my calculation, will likely account for 50% of AbbVie’s revenues in 2022 (to calculate 2022 sales revenues by product, since we do not yet have final figures, I have used 9m 2022 figures and assumed Q4 revenues will be the average of the previous 3 quarters).

After 2022 Humira’s row is shaded yellow to signify patent expiry. My calculation is that Humira revenues in 2023 will be 80% of the 2022 figure, or $16.7bn. AbbVie CEO Gonzalez told the audience at the JPM Healthcare conference that:

We now have a little over 90% access for next year for Humira at parity. What that means is, essentially it will be on formulary with biosimilars, but there won’t be any difference between the biosimilar and Humira from a co-pay standpoint or any kind of a step editing.

The majority of the biosimilar (more sophisticated versions of generic drugs) imitations of Humira that will contest for market share with the original will launch around the middle of 2023, including versions developed by Pfizer (PFE), Boehringer Ingelheim, Organon (OGN), Biocon, Coherus Biosciences (CHRS) and Sandoz, whilst Amgen’s (AMGN) Amjevita is permitted to launch in January.

The important point here is that physicians will not necessarily be under any pressure to switch patients from Humira to a biosimilar, given, as Gonzalez puts it:

there won’t be any difference between the biosimilar and Humira from a co-pay standpoint or any kind of a step editing.

AbbVie will have to drop its price point to compete with the generics however, plus there is the 10% of the market it is not covered for, so an overall 20% decline in revenues in 2023 seems accurate. In my model I have then reduced revenues by 20% between 2024 – 2026, and then by 10% per annum between 2027 – 2030.

To summarize, Humira may be going off-patent, but is more than capable of delivering double-digit billion revenues for another 3-4 years, and even in 2030, it could be amongst the top 20 best-selling drugs worldwide.

Nevertheless, AbbVie is clearly under huge pressure to protect its dominance in the immunology markets, and the signs are it has been able to do just that thanks to the launches of 2 new drugs – Skyrizi and Rinvoq.

Naturally, if there is a more effective and safe drug than Humira available for the same indication, then physicians are likely to prescribe it over Humira, or a Humira biosimilar. Skyrizi – which inhibits the activities of IL-23 – a naturally occurring cytokine that is involved in inflammatory and immune responses – and Rinvoq – a member of the janus kinase inhibitor drug class – fit this profile.

approvals of Humira, Skyrizi, Rinvoq (AbbVie JPM Healthcare conference presentation)

As we can see above one of either Skyrizi or Rinvoq has now been approved for all of the same indications as Humira is, except for Hidradenitis Suppurativa, although Rinvoq is undergoing a Phase study in this indication.

The development of these 2 drugs has been very quick by drug development standards, and to date both have performed exceptionally well. Their combined revenues are expected to reach $7.5bn in 2022, and Gonzalez told the audience at JPM that:

Skyrizi and Rinvoq are now on pace to deliver more than $17.5 billion in combined sales, risk adjusted sales in 2025, well above our previous expectations. We now expect global sales for Skyrizi to reach more than $10 billion in 2025, an increase of $2.5 billion versus our previous guidance, reflecting higher performance across basically all of the indications.

As we look beyond 2025, we expect combined sales for Skyrizi and Rinvoq to exceed the peak revenues achieved by Humira, which was more than $21 billion. We expect that to happen in 2027 with continued significant growth anticipated in the following years.

In other words, no Humira, no problem! Skyrizi and Rinvoq will together achieve a higher peak sales figure than even Humira could manage, even while Humira is still making a substantial top line contribution, still accounting for as much of 7% of AbbVie’s total sales in 2030.

Skyrizi has shown superiority to Humira in fields such as plaque psoriasis by a statistically significant amount, with a comparable safety profile, whilst Rinvoq has shown superiority in e.g. psoriatic arthritis at a lower dose, again with a comparable safety profile, and has also won approval in a field where Humira has not, namely Atopic Dermatitis.

It should be noted that the strength of the competition AbbVie faces from other Pharma’s desperate to claim a larger share of the immunology markets after Humira’s LOE is fierce – Eli Lilly’s (LLY) Olumiant, Pfizer’s (PFE) Zeljanz, Amgen’s Otezla, Bristol Myers Squibb’s (BMY) Zeposia, Johnson & Johnson’s (JNJ) Tremfya, Novartis’ (NVS) Cosentyx and Regeneron (REGN) / Sanofi’s (SNY) Dupixent to name a few.

It’s hard to argue against Skyrizi and Rinvoq’s performance to date, however, and with the total addressable market across all immunology indications likely well in excess of $100bn, I feel fairly comfortable that AbbVie can grow this division’s revenues even as the world’s biggest ever selling drug exits stage left.

Oncology – Beefing Up A Failing Hematology Division, Entering Solid Tumor Markets

AbbVie probably does not want to be recognized as simply an immunology giant however, it wants to be substantially more diversified and like all major Pharma’s it has a strong long-term focus on oncology.

AbbVie Oncology Division Forward Revenue Projections (my table and assumtpions)

One of the few pain points AbbVie experienced during a year of portfolio wide growth in 2022 was the decline in the revenue contribution from Imbruvica, approved to treat various types of lymphoma. Management initially blamed slow take-up post pandemic for the drug’s declining sales, but Gonzalez also told JPM Conference attendees that “new competitive entrants has significantly lowered our sales expectations for Imbruvica”.

As a result I have dropped Imbruvica revenues to just over $3.5bn in 2022 and modelled for a CAGR growth of just 1.5% between then and 2030. That certainly won’t derail the oncology division however. Venclexta – a “first-in-class BCL-2 inhibitor for multiple hematological malignancies”, according to Gonzalez, is forecast for strong growth, whilst Gonzalez has name checked 3 new drugs he expects to be approved by 2026.

The first is Epcoritamab, a CD3xCD20 bispecific for B-cell malignancies, including DLBCL and follicular lymphoma, which AbbVie expects will be approved this year. Analysts have tipped the drug to achieve peak sales of $2.75bn, and although the emergence of CAR-T therapies and some concerns around safety – notably cases of cytokine release syndrome (“CRS’) – persist, this revenue figure is achievable in my view.

The next two approvals – for Navitoclax in Myelofibrosis and Teliso V in non squamous non-small cell lung cancer (“NSCLC”) – are anticipated by management in 2024.

Myelofibrosis has proved to be a tricky indication for drug developers and there are no wholly satisfactory solutions on the market at present, therefore if approved I would expect Navitoclax – a drug that AbbVie has been working on for some time – to generate a couple of billion dollars in peak sales.

Teliso V is an antibody drug conjugate and a c-Met inhibitor. Other approved ADC’s targeting the c-Met protein, a validated target in NSCLC, include Novartis Tabrecta, which has been pegged for peak sales of ~$1.5bn, which seems a realistic target for Teliso given how large the lung cancer market is – the largest of all oncology markets.

With AbbVie seemingly very confident of approvals for all 3 of these drugs, and Gonzalez suggesting they could form the basis of a “$6 billion kind of franchise” I have modelled for such an outcome by 2030. But AbbVie is also keen to explore solid tumors, and I am therefore adding an additional $1.5bn of revenues from that source by 2030. This figure could eventually end up substantially larger – according to Gonzalez:

We’ve begun to see some very exciting data from several solid tumor programs, including our anti-GARP antibody ABBV-151, and our PTK7 ADC, ABBV-647. We expect proof-of-concept data from roughly a dozen additional early stage oncology opportunities over the next couple of years.

To summarize, although AbbVie does not have the same clout in oncology as it does in immunology – as evidenced perhaps by the declining sales of Imbruvica – it is clearly an area of focus for management. Drug development has not traditionally been one of AbbVie’s strengths – it has not had to be – but we ought to see the positive results of heavy investment into the oncology pipeline over the next 5-7 years, and by 2030, I believe this division could account for >17% of AbbVie’s total revenues.

As per management’s guidance, I am modelling for $5.7bn of revenues in 2023, with growth beginning to accelerate substantially from 2025 / 26 onwards.

Aesthetics and Neuroscience – Reaping the Benefits Of Allergan Acquisition

AbbVie made the bold decision to take on a heavy debt load and bid for Allergan, with the deal being completed in 2020. Allergan was a troubled company in many ways, but there is no doubting the strength of its products and pipeline. According to CEO Gonzalez:

Over the long-term, aesthetics continues to be an extremely attractive underpenetrated market with significant growth potential. And we remain confident in our ability to achieve total sales of more than $9 billion by 2029.

AbbVie Aesthetics / Neurology revenues forecasts to 2030 (my table and assumptions)

As such I have modelled similar, although I have included an additional revenue stream from new products which I expect to be minor in nature but ultimately contributing an additional $1.5bn to the top line. The risks associated with aesthetics are that the industry can be severely buffeted by economic headwinds, as these products are more consumer focused and are often considered an unnecessary expenditure in times of hardship.

Neuroscience is one of AbbVie’s most intriguing divisions and perhaps the hardest to model. Management are very optimistic on Vraylar, with Gonzalez describing it as “now the only antipsychotic that is a dopamine and serotonin partial agonist approved for the treatment of the most common forms of depression, Bipolar 1 and MDD” and targeting >$5bn peak sales. Migraine therapy Ubrelvy is a future blockbuster, Gonzalez believes, as is Qulipta, in the same indication.

Duodopa is approved for Parkinson’s Disease but Gonzalez believes that the subcutaneous non-surgical delivery system of candidate ABBV951 can “significantly expand the patient population currently addressed by Duopa”, and sees the drug as yet another future blockbuster. ABBV-916 is targeting Alzheimer’s and it is an anti-amyloid antibody, with a similar mechanism of action (“MoA”) to recently approved Leqembi, developed by Biogen (BIIB) / Eisai, and likely soon-to-be approved Donanemab, developed by Eli Lilly.

Both Leqembi and Donanemab are potential $5bn – $10bn selling assets, but both drugs still have safety questions to answer and not certain to be made eligible for reimbursement. ABBV-916 is therefore a real opportunity for AbbVie to develop a more effective and safer drug in the same class and claim a sizeable share of a 6m patient market. I have speculatively assigned peak sales of $2bn, although it should be noted that success here is far from guaranteed, although if AbbVie did succeed with ABBV916 sales could be 2 or 3x higher than my forecast.

Eye Care, Other Products – & A Disappearing Women’s Health Division

Eye Care, Other products Division Projected Revenues to 2030 (my table and assumptions )

Finally, eye-care – another division inherited from Allergan – has been performing well for AbbVie although I am not expecting particularly strong growth from the current product portfolio. What intrigues here is the possibility of RGX-314, an anti-VEGF gene therapy that Gonzalez believes “has the potential to be a one-time treatment for wet AMD, diabetic retinopathy and other chronic retinal conditions”.

Gene therapies have been a long time coming, having first been popularized in the early noughties. There are still very few approved therapies, although that could change with Crispr Therapeutics (CRSP) / Vertex (VRTX) Sickle Cell Disease therapy leading the charge in 2023. The obvious advantages of a “one and done” permanent cure make them potentially very lucrative therapies.

The eye-disease markets are very large – Regeneron’s Eylea is a >$7bn per annum selling drug and AMD markets are >$20bn in size. Bringing RGX314 would be a coup for AbbVie although I am forecasting for only $2bn in peak revenues in 2030 as a hedge against the risk that this candidate does not make it to market on safety grounds.

Other products such as Mavyret and Creon appear to have many more years of blockbuster sales ahead of them, although it is interesting to note that AbbVie no longer reports revenues from its Women’s Health division, and scarcely mentions it. Perhaps this is an example of how ruthless management can be when encountering falling sales, and a warning that not all company divisions are guaranteed to thrive.

Modelling Income Statements & DCF / EBITDA Multiple Analysis

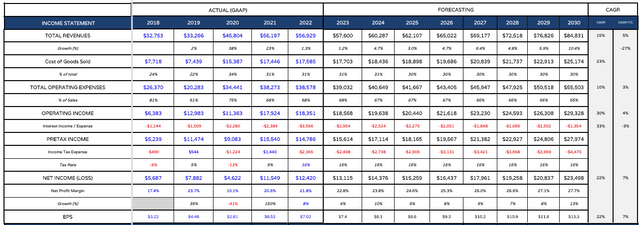

AbbVie income statement forecast (My table and assumptions)

First we can take a quick look at what a forward income statement for AbbVie might look like to 2030. I have plugged my revenue expectations into this table knowing that they closely match AbbVie management’s own expectations based on what they have said in public.

My EPS figure increases slightly between 2022 and 2023, whilst AbbVie has suggested it will be down slightly before beginning to accelerate towards the end of the decade, as revenues correspondingly begin to climb sharply once the worst of the Humira LOE is over.

I am modelling for AbbVie to grow revenues at a compound annual growth rate of ~5% between now and 2030 with growth accelerating in the latter half of the decade. That is substantially higher than the 12% CAGR achieved between 2018 – 2022, although that period includes the additional revenues from Allergan. AbbVie does not have the funds to pursue any large M&A deals, but it does not need to either, given the strength of its pipeline and products.

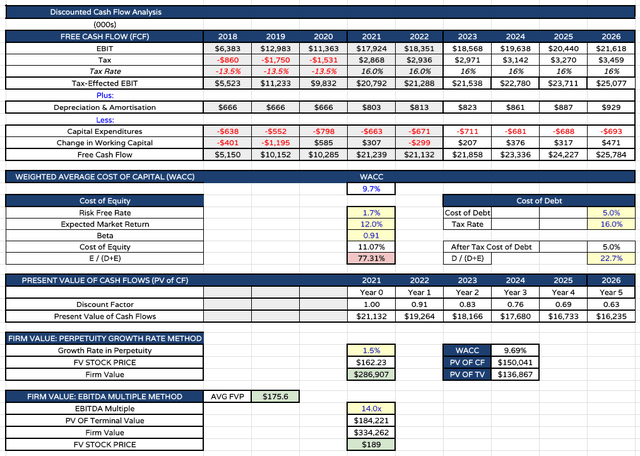

target price for AbbVie stock based on DCF / EBITDA multiple analysis (my table and assumptions)

Finally I can present a target price for AbbVie stock in 2023 using DCF / EBITDA analysis. I am using a weighted average cost of capital of ~10%, which is broadly consistent with the figure I use when modelling for the other 7 members of what I term the “Big 8” US Pharmas – Johnson & Johnson, Eli Lilly, Pfizer, Merck & Co (MRK), Bristol Myers Squibb, Amgen, and Gilead Sciences (GILD) – which helps prove the accuracy of the calculation.

With AbbVie’s revenues accelerating past $80bn in 2030 (by my calculation), and cash flow generated in that year being >$25bn, after applying discount factors for each year I reach a price target of $176 – the average of DCF – $162 per share – and EBITDA – $189 per share – calculations.

Some Risks To Consider

The Large Pharma sector performed remarkably well in 2022, with the “Big 8” delivering an average ~15% gain whilst the S&P 500 index fell in value, and the biotech sector was in turmoil. Not only do these companies pay handsome dividends, they typically grow revenues every year and generate wide profit margins which leads to share price upside.

That makes companies like AbbVie generally very attractive to investors although it should be noted that AbbVie carries a very high level of debt which stood at >$60bn as of Q322 – more or less the amount the company paid to acquire Allergan.

AbbVie says it will pay down debt of $4bn in 2023, which will “bring cumulative debt pay down ~$34bn”, but the company is heavily reliant on maintaining an investment grade rating. Currently, the company has a “stable” rating, but that must be maintained or investors will perceive the company as unsafe to invest in and that will drag the share price down rapidly.

Pharmaceuticals are often valued based on a philosophy of “jam tomorrow” as opposed to jam today i.e. on the strength of its future rather than present portfolio. There is an element of risk to that as clinical trial failures are common, even for a giant like AbbVie, and even CEO Gonzalez may be forced to backtrack on some of his blockbuster sales projections. As with debt, if approval and revenue targets aren’t met, it can quickly result in a loss of faith in the company.

Drug pricing is another issue – there is bipartisan, and international pressure on US Pharmas to reduce drug pricing, particularly outside of the US. Gonzalez has vigorously defended AbbVie against accusations of price manipulation, but the company is renowned for pushing drug prices up annually and should its powerful lobbies become less powerful in the face of external pressure, once again, the sector will start to look unattractive for investors.

Conclusion – Humira’s LOE Is Not Going To Derail This Company’s Strong Progress – I Predict Steady Share Price Growth to 2030

I will conclude this analysis by stating that, based on all available information, market headwinds and tailwinds, competitors, and opportunities via its products and pipeline, I still consider AbbVie to be a strong investment opportunity.

The company may not generate as much excitement as some of the other members of the “Big 8” – most notably Eli Lilly and its weight loss franchise, but the path to revenue growth, expanding margins and a growing share price is clear.

An investment in AbbVie is not without risk, but my contention is that this Pharma is in good hands – CEO Gonzalez has made few mistakes during his near-decade in charge – and will emerge from the Humira LOE a stronger and more diverse company.

Disclosure: I/we have a beneficial long position in the shares of BMY, GILD, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.