Summary:

- AbbVie has a yield of 3.7% and consistent dividend growth, making it a great investment for a wide range of investors.

- Despite concerns about the loss of its Humira patent, AbbVie remains in a fantastic position and is upgrading guidance in key segments.

- The company’s strong financial results and future growth potential indicate elevated annual returns for shareholders.

cagkansayin

Introduction

It’s time to talk about one of my favorite dividend investments. A company that has both an elevated yield of 3.7% and consistent dividend growth, making it a great investment for a very wide range of investors.

That company is AbbVie (NYSE:ABBV), a stock I covered on November 29 in an article titled 4.5%-Yielding AbbVie Is One Of My Favorite Value Plays For 2024.”

Here’s a part of the takeaway I used back then:

Despite the prevailing underperformance of value stocks since 2006, I anticipate a shift in the market dynamics, particularly for healthcare stocks.

Amid the challenges posed by patent loss, AbbVie stands out as a compelling value play with a 4.5% yield. The company’s strong performance, evidenced by robust earnings and a 4.7% dividend increase, reflects its resilience and future growth potential.

As the title of this article shows, AbbVie’s yield has come down substantially.

This is the result of a fantastic performance.

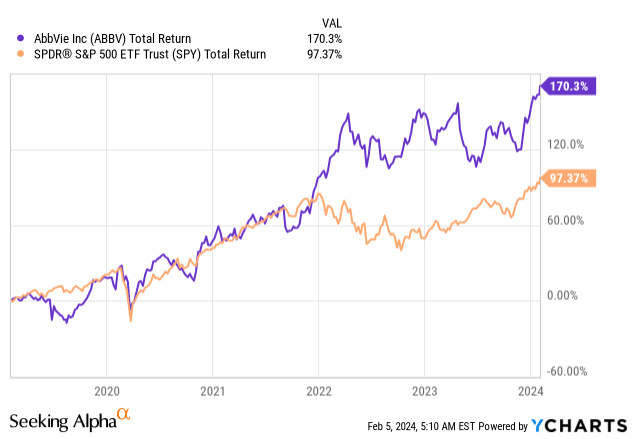

Since November 29, the stock has returned 23%, beating the 9% return of the S&P 500 by a substantial margin.

Now, it’s time to update my thesis. After all, AbbVie is still doubted by many investors due to the loss of its Humira patent and general uncertainty in the industry regarding elevated rates and competition.

As the just-released earnings reveal, the company remains in a fantastic position. It is dealing very well with the Humira patent loss, is upgrading guidance in key segments, and is very upbeat about its future growth potential.

Even better, despite its strong performance, I believe that AbbVie remains in a great spot to maintain elevated annual returns for its shareholders.

So, let’s dive into the details as we have a lot to discuss!

Fantastic News For Shareholders

As the chart above shows, the former Abbott Laboratories (ABT) spin-off has beaten the S&P 500 by a wide margin over the past few years.

Despite the Humira patent loss and a general emphasis on tech and growth stocks in recent years, investors have flocked to the ABBV ticker.

This is no surprise, as it stands for consistent growth and reliability.

Notably, the growth platform, excluding Humira, achieved over 8% full-year sales growth and demonstrated accelerated growth of more than 15% in the fourth quarter.

This performance was attributed to the strength of the diversified growth platform, which effectively absorbed the patent loss impact of Humira.

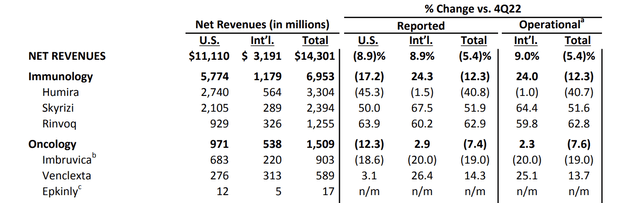

In general, AbbVie’s immunology segment showed a strong performance, surpassing expectations with total revenues exceeding $6.9 billion.

Key contributors included Skyrizi and Rinvoq, which achieved total sales of approximately $2.4 billion and more than $1.2 billion, respectively.

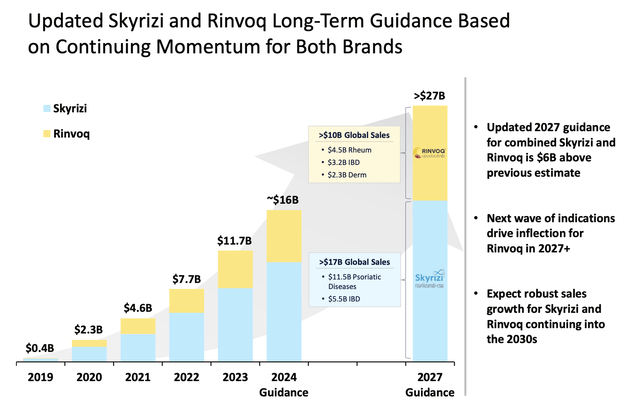

The combined revenue for Skyrizi and Rinvoq in the full year exceeded $11.7 billion, marking an impressive YoY increase of $4 billion.

Moreover, the company showed substantial market share gains in inflammatory bowel disease (“IBD”), with a strong presence in Crohn’s disease, and plans to launch Skyrizi for ulcerative colitis, which paves the road for future growth.

In the oncology segment, AbbVie reported total revenues of $1.5 billion, with notable contributions from Imbruvica and Venclexta.

According to the company, the introduction of novel ADC therapies, Elahere for ovarian cancer and Teliso-V for lung cancer, indicated its commitment to expanding its market presence and growth potential in a very promising and important market.

Adding to that, neuroscience emerged as the second-largest therapeutic area, with full-year revenues exceeding $7.7 billion.

In this area, Vraylar demonstrated robust growth, while the oral CGRP portfolio for migraine contributed approximately $348 million in combined sales, reflecting a growth rate of approximately 40%.

Aesthetics also played a significant role, with global sales of approximately $1.4 billion, marking an operational increase of 6.9%. Strong performance in the U.S. facial toxin market, particularly with Botox Cosmetic, and the successful launches of Volux and SkinVive in the dermal filler category contributed to this growth.

Thanks to these very positive developments, the company reported strong financial results, with adjusted earnings per share of $2.79, exceeding the guidance midpoint by $0.05.

Total net revenues for Q4 reached $14.3 billion, reflecting 15.3% growth from the ex-Humira growth platform.

All of this bodes well for shareholders, as it also comes with a strong outlook.

Future Growth & Shareholder Returns

One of the most important things in the company’s drug manufacturing/biotech industry is innovation. It’s also why I own Danaher (DHR), a company providing equipment for research.

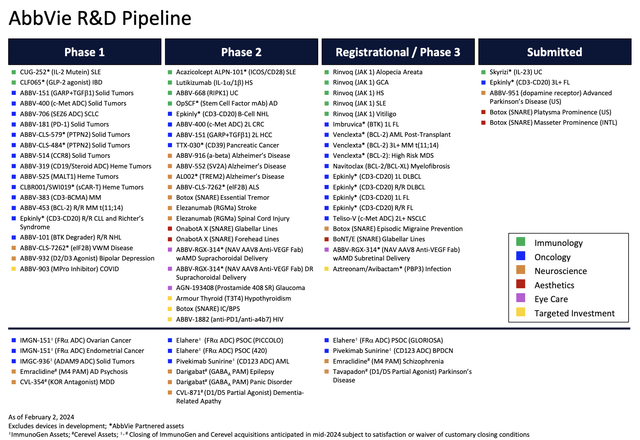

During its 4Q23 earnings call, the company made clear that it increased adjusted R&D expenses by nearly $600 million in 2023.

These investments were directed toward promising pipeline programs.

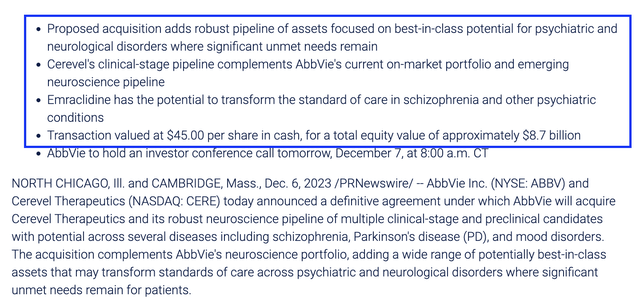

Furthermore, the acquisitions of companies with portfolios in solid tumors and neuroscience were also emphasized as strategic moves to strengthen AbbVie’s foothold in these areas.

The proposed acquisition of ImmunoGen and their portfolio of ADCs, accelerating our entry into the solid tumor space and strengthening our oncology pipeline. As well as the proposed acquisition of Cerevel, a unique opportunity to augment our presence in neuroscience with a pipeline of differentiated assets. – ABBV 4Q23 Earnings Call

The company also outlined three key priorities for the near term.

- First, there is a clear focus on driving the performance of the growth platform, excluding Humira. The emphasis is on key brands contributing to double-digit sales growth in 2024 to continue the promising performance of 2023.

- Second, AbbVie is prioritizing investments in its pipeline, which is a no-brainer, as it’s the core of future growth.

We anticipate updates this year from several important R&D programs, including approvals for Skyrizi in UC, 951 in the U.S. and potentially accelerated approval for Epkinly in third line plus follicular lymphoma. We also anticipate regulatory submissions for BonTE, our novel short-acting toxin and potentially Teliso-V in advanced non-squamous non-small cell lung cancer. – ABBV 4Q23 Earnings Call

- Finally, the company is concentrating on the closure and integration of the aforementioned strategic acquisitions, viewing these opportunities as substantial sources of revenue growth well into the next decade.

The company also reaffirmed its long-term sales outlook with a strong conviction. This included an expectation of returning to robust revenue growth in 2025 and sustaining a high single-digit compound annual growth rate through the end of the decade.

Notably, products like Skyrizi and Rinvoq are expected to remain blockbusters, with a collective sales estimate exceeding $27 billion by 2027. These two products generated less than a billion in sales in 2019.

This isn’t just good news for future earnings growth but also shareholder distributions.

During its earnings call, the company mentioned its strong cash balance of $12.8 billion at the end of December and its free cash flow target of approximately $18 billion in 2024.

Analysts are even more upbeat, expecting north of $19 billion in FCF. This translates to 6.3% of its roughly $300 billion market cap.

As the company has a 1.6x 2024E net leverage ratio and a stellar credit rating of A-, it is in a good spot to further engage in M&A when needed and grow its dividend.

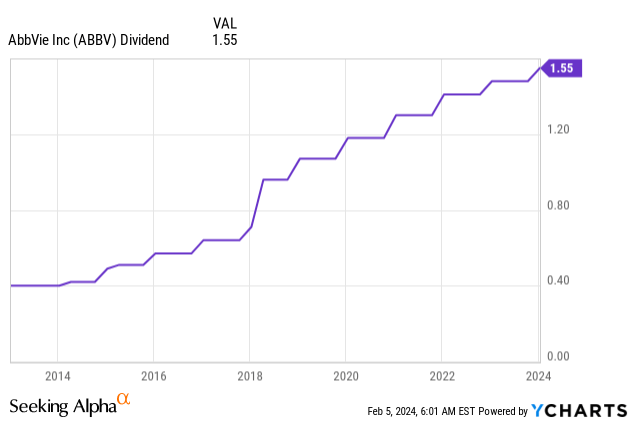

During its earnings call, the company highlighted its capital allocation priorities, including the significant increase in dividends, which have grown by more than 285% since inception.

On October 27, the company hiked its dividend by 4.7% to $1.55 per share per quarter, indicating a 3.7% yield. The five-year dividend CAGR is 8.7%.

As its free cash flow numbers indicate, it is a well-protected dividend with a 2024E cash payout ratio of 58%.

Going back to ABBV’s capital allocation priorities, debt repayment remains a focus, with plans to pay down approximately $7 billion in maturities in the current year.

Valuation

Despite its recent surge, I believe there is a good case to be made that ABBV is still an attractive investment.

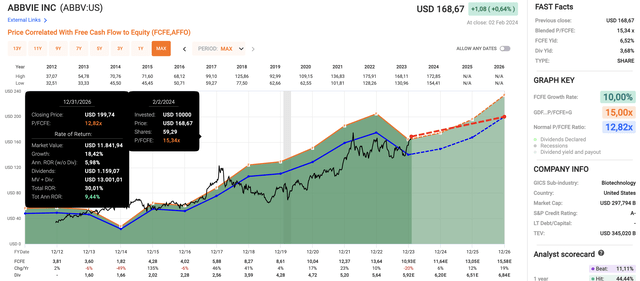

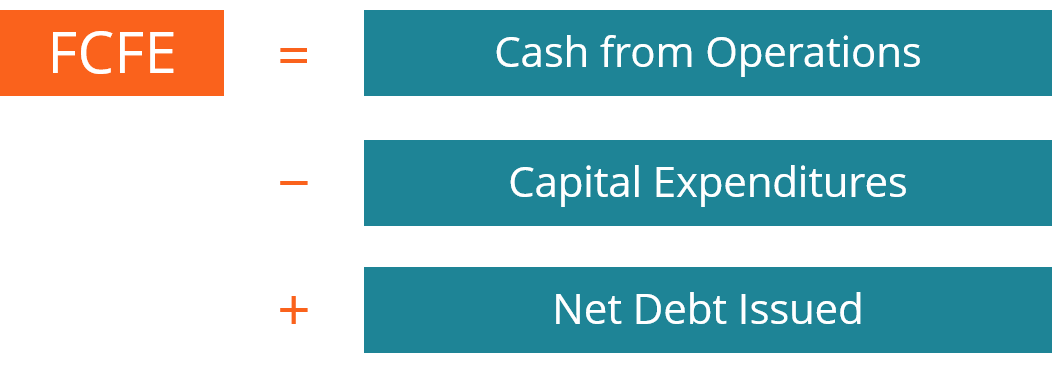

In this case, I’m using the company’s price/FCFE ratio. FCFE is free cash flow to equity.

Free cash flow to equity (“FCFE”) is the amount of cash a business generates that is available to be potentially distributed to shareholders. It is calculated as Cash from Operations less Capital Expenditures plus net debt issued. – Corporate Finance Institute

Corporate Finance Institute

Using the data in the chart below:

- ABBV is currently trading at a blended P/FCFE ratio of 15.3x.

- Its long-term normalized P/FCFE ratio is 12.8x. That’s the blue line in the chart below.

- This year, FCFE is expected to grow by 6%, followed by 12% growth in 2025 and 19% growth in 2026.

- A 12.8x multiple, including its dividend and expected FCFE growth, paves the way for 9-10% annual returns through 2026.

- Since 2012, ABBV has returned 17.3% per year.

All things considered, ABBV continues to deliver exactly what I expected when I started investing in this giant.

- It is handling the Humira patent loss very effectively.

- Its pipeline remains very strong.

- New M&A fits the company well and paves the road for consistent long-term growth.

- The company continues to maintain a very healthy balance sheet.

- Strong free cash flow generation allows for consistent dividend growth.

Needless to say, I remain a buyer of any potential weakness, as I believe that the biggest risks (regulatory and pipeline/innovation) remain subdued at this point. The same goes for elevated interest rate risks, thanks to its stellar balance sheet.

Takeaway

AbbVie stands resilient amid challenges, outperforming with a 23% return since my November 29 article.

Despite Humira patent loss concerns, Q4 earnings reveal a robust performance.

Key segments like immunology, oncology, and neuroscience show substantial growth, with Skyrizi and Rinvoq contributing significantly.

Meanwhile, strategic acquisitions and strong R&D investments emphasize future potential.

With a solid financial outlook, ABBV affirms long-term sales growth and aims for a 2024 free cash flow target of $18 billion.

All things considered, ABBV’s consistent dividend growth, strong balance sheet, and promising valuation make it an attractive investment for a wide range of investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.