Summary:

- AbbVie’s growth prospects remain strong despite the impending decline in revenue from Humira, thanks to promising alternatives Skyrizi, Rinvoq, and the recently FDA-approved Linzess.

- The company’s robust R&D investments, diverse product lineup, and consistent presence in a burgeoning pharmaceutical manufacturing industry position it well for long-term growth.

- Despite regulatory risks, AbbVie’s impressive ROIC over the past decade and exceptional dividend yield reflect its financial strength.

- Considering AbbVie’s resilience in the face of short-term biosimilar competition and long-term growth potential, I rate the company as a “Buy”.

vzphotos

Thesis

Standing as a leader in the global biopharmaceutical industry, AbbVie (NYSE:ABBV) demonstrates consistent growth in the pharmaceutical manufacturing industry. This is evident in its expanding product portfolio and strategic R&D investments. AbbVie’s strong market presence further underscores its robust growth trajectory. The company foresees a dip in revenue from Humira, its flagship drug. However, they’ve skillfully rolled out alternative drugs such as Skyrizi, Rinvoq, and the recently FDA-approved Linzess, reinforcing their revenue stream. Impressively, AbbVie has a median ROIC of 14.5% over the past decade, supported by a hefty dividend yield. This is a testament to its financial strength. Potential risks loom, stemming from a rigorous regulatory environment and possible litigation. Yet, AbbVie remains poised for a promising future. Its market position, diverse product assortment, and strategic investments all align for this future. Even with short-term stagnation due to biosimilar competition, ABBV stock presents a compelling opportunity for long-term investors.

Introduction

Born out of its separation from Abbott Laboratories in 2013, AbbVie is a research-based biopharmaceutical company. They harness their unique innovative approach, expertise, and committed team to significantly enhance treatments. Their primary therapeutic focus areas are immunology, oncology, virology, and neuroscience.

Industry Analysis

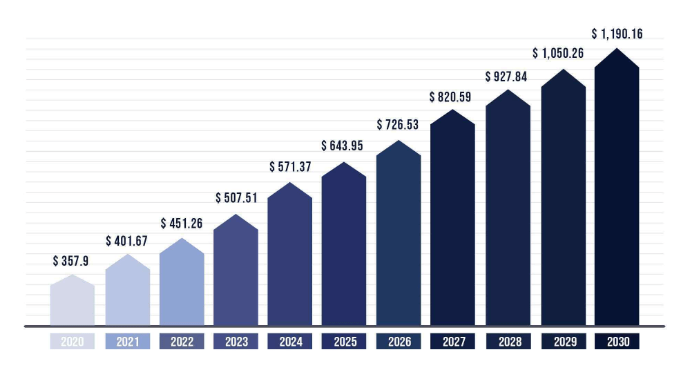

AbbVie is a part of the pharmaceutical manufacturing industry which is projected to reach around $1,190.16 billion by 2030, growing at a significant CAGR of 12.8%.

projected growth (Precedence Research)

Various factors fuel this industry’s growth. The rise of chronic diseases, an aging population, escalating per capita healthcare expenditure, and favorable reimbursement scenarios in emerging regions all contribute. Equipped with a robust product portfolio and a strong market presence, AbbVie stands well-prepared to capitalize on these industry trends.

Entrance of Humira Biosimilars Is Not a Worry

Humira, AbbVie’s flagship drug, has been a vital revenue contributor. In 2022 alone, it generated global net revenues of $21.2 billion. The drug’s exclusivity expires in 2023, which paves the way for biosimilar competition in the U.S. market. As a result, there are expectations of a flood of eight to ten adalimumab biosimilars in 2023 alone. This could potentially eat into Humira’s sales and lead to a drop in demand, since these biosimilars are projected to be more affordable. Despite this, AbbVie’s 2023 Q1 earnings show strong performance. The company even upgraded its annual profit forecast, citing stable demand for Humira. This should be a positive sign for investors, signaling Humira’s continued strength as a key revenue driver.

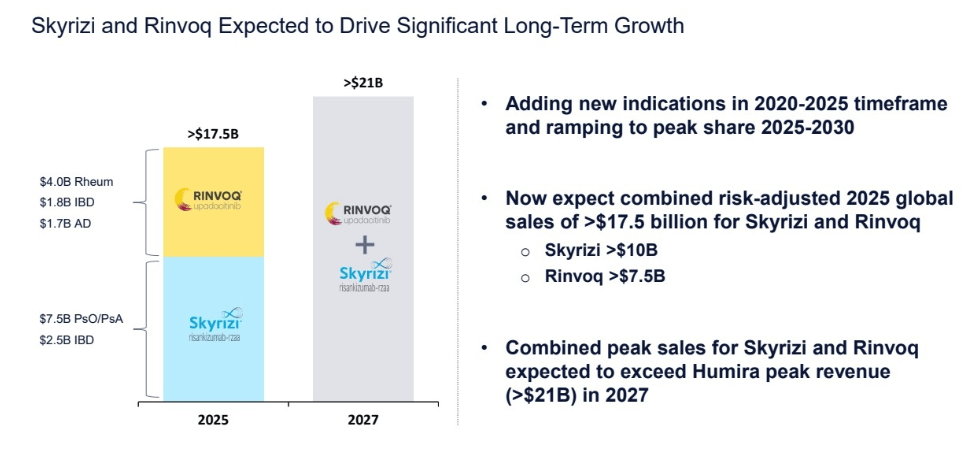

Despite Humira sales potentially dipping due to biosimilar competition, AbbVie believes that its sales will stabilize by the end of 2024. Moreover, they have launched exclusive drugs, Skyrizi and Rinvoq, that address similar conditions to Humira. These two drugs had a combined revenue surpassing $7 billion in 2022, marking over a 60% increase from 2021. The future is bright with anticipated combined revenue expected to soar to more than $21 billion by 2027, which would be an average YoY increase of over 24%.

JP Morgan Healthcare Conference

Expanding Product Portfolio

AbbVie’s recent FDA approval for Linzess (linaclotide) marks a significant milestone. This drug, treating irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC) in adults, helps propel AbbVie’s expansion in the gastrointestinal therapeutic arena.

Being the only guanylate cyclase-C (GC-C) agonist approved by the FDA, Linzess addresses numerous IBS-C and CIC symptoms. This novel treatment option opens a significant market for AbbVie, considering the high prevalence of these conditions. With an estimated 13 million IBS-C and 35 million CIC sufferers in the U.S., AbbVie has the potential to seize a substantial market share, which could significantly boost its revenue growth.

The addition of Linzess also strengthens AbbVie’s already robust gastrointestinal portfolio, including Humira and Skyrizi. The diversified lineup allows the company to serve a broad spectrum of gastrointestinal conditions, thereby boosting its competitiveness in this therapeutic domain.

AbbVie has also committed to strategic investments in research and development (R&D), a critical element for its future growth. With a focus on diverse therapeutic areas such as immunology, oncology, neuroscience, and eye care, AbbVie’s R&D could potentially foster new breakthrough therapies. This could catalyze the company’s growth in the upcoming years, considering its robust pipeline.

JP Morgan Healthcare Conference

Financial Overview

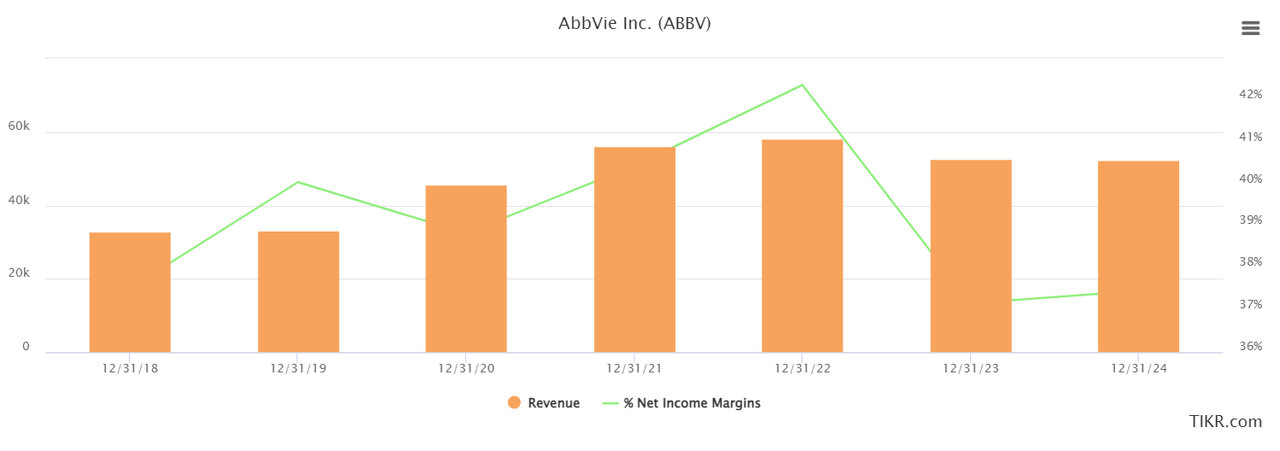

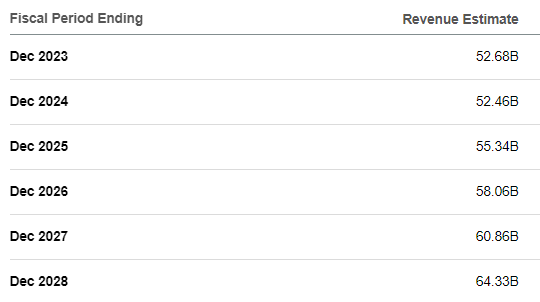

Now let’s dive into the numbers. AbbVie’s market cap of over $244 billion highlights its position as a well-established company and not one of those small market-cap biopharmaceutical companies that experience high volatility. Over the last 5 years, its revenue has grown consistently at a CAGR of over 15%. However, the concerning part to most investors is that revenue over the next couple of years is expected to be stagnant, due to the entrance of biosimilars.

This should not be concerning since management expects a stabilization by 2024 before a massive boom over the next 5 years. As such, smart long-term investors understanding the true growth potential should capitalize on any fear in the market should the stock sell-off in the future.

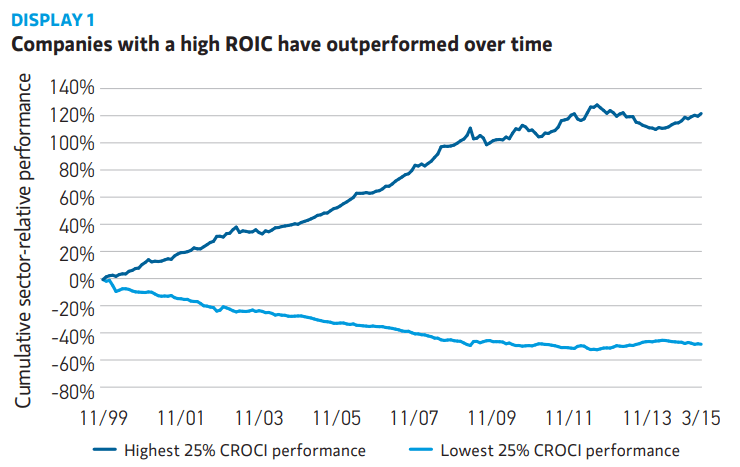

Seeking Alpha

Another great aspect is AbbVie’s remarkable 10-year median Return on Invested Capital (ROIC) of 14.5%. This figure underscores AbbVie’s efficiency in its expansion efforts, as it demonstrates the company’s ability to generate substantial returns on the capital it physically invests. Furthermore, a higher ROIC is often indicative of a company with greater return potential for shareholders, as firms with high ROICs tend to significantly outperform the broader market. This is largely due to their ability to generate elevated levels of free cash flow, which is ultimately the determining metric for intrinsic value.

Morgan Stanley

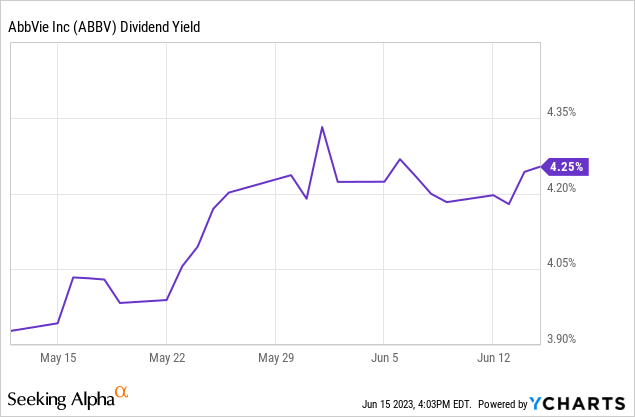

One of the greatest parts about AbbVie is that it is a dividend king, which is a company that has consistently raised its dividend over the last 50 years or more. With an outstanding yield of over 4%, investors will be receiving returns even during this down period (Or as I see it, “load up period”) over the next two years and can be confident that this high dividend is sustainable and only likely to increase going forward.

YCharts

Valuation and Target Price

Analyzing some valuation ratios, AbbVie seems to be in line with its peers. For example, its EV/Sales of 5.28 is in line with the sector median of 4.21. However, its forward P/E of 23.94 is 13.51% below the sector median of 27.68 potentially making it an attractive investment when considering future earnings growth.

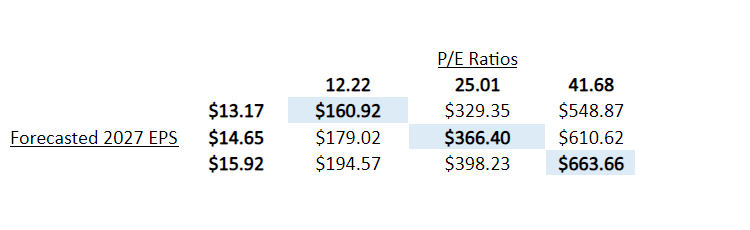

I like to think in the mid to long term. As such, I estimated a five-year target price for AbbVie by examining analysts’ projections for the company’s earnings per share in 2023 and 2024. By analyzing the low, average, and high estimates, I established conservative, base, and optimistic scenarios by growing each EPS forecast at rates of 5.5%, 7.5%, and 9% respectively per annum until 2027. Moving on, to estimate the price-to-earnings (P/E) multiple at which AbbVie might trade in 2027, I used a value of 12.22 for the conservative scenario, since this was the lowest value from the last 5 years. Meanwhile, I utilized its five-year average of 25.01 as the base case. For the optimistic scenario, I chose the highest P/E AbbVie has traded at over the last 5 years of 41.68. Thus, it is very likely that its P/E in 2027 will fall in between this range.

By combining the base case projected EPS and the projected P/E ratio, I arrived at a 5-year target price of around $360 for AbbVie. This calculation yields an average return of over 21%, which widely outperforms the S&P 500’s average yearly return of approximately 10%.

Author’s Material

Risks

Investments come with their share of risks and AbbVie is no exception. The evolving regulatory environment is one such risk. Pharmaceutical companies, like AbbVie, operate under stringent regulations enforced by the FDA and other global regulatory bodies. If companies don’t comply, regulatory changes could lead to hefty penalties. This of course would harm AbbVie’s profitability and revenues.

Another risk to consider is the possibility of lawsuits. Lawsuits that are related to product liability are quite common in the pharmaceutical industry, and AbbVie itself has dealt with lawsuits over its drug AndroGel in the past, resulting in over $150 million in punitive damages.

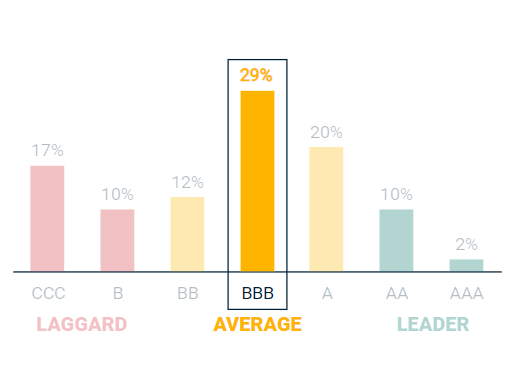

ESG

With an MSCI ESG rating of BBB, AbbVie’s ESG is average among companies in its industry.

MSCI

It is a leader in areas of human capital development and access to health care. However, they are considered a laggard in a couple of key areas, including corporate behavior and product safety and quality. Additionally, AbbVie is considered to be aligned with the UN Sustainable Development Goals of gender equality, clean water and sanitation, affordable and clean energy, and responsible consumption and production.

Conclusion

AbbVie’s reputation as a prominent global biopharmaceutical entity is cemented by its inventive product portfolio, strategic R&D investments, and robust market presence. It is working and navigating through the expected revenue dip from Humira with the introduction of potential alternatives and by expanding into new therapeutic sectors. While regulatory and litigation risks exist, AbbVie’s impressive financials, strong dividend yield, and strategic long-term growth approach make it a compelling investment. This hold true even considering short-term market volatility due to the entrance of biosimilars. Given the current and future prospects, investors seeking a resilient, innovative pharmaceutical player should consider AbbVie a “Buy”.

Analyst Recommendation: Vayun Chugh

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.