Summary:

- AbbVie’s stock has risen to an all-time high, raising the question of whether it’s still a good buy, especially as the market multiples look elevated from a historical perspective.

- Progress on its treatments, particularly for Inflammatory Bowel Disease, is encouraging. This is key, as the market for the disease is growing with its rising incidence impacted by lifestyle factors.

- The company’s revenue turnaround after the patent expiration for Humira also continues, though the profits could be better.

- Still, from a medium to long term perspective, AbbVie has positive prospects.

valiantsin suprunovich/iStock via Getty Images

Here’s something inescapable about AbbVie (NYSE:ABBV). With a ~20% rise since early July, it’s now trading at all-time highs. This is a far cry from where it was when I last checked in June, with a 3% price correction in the quarter to the article. Even at that time, though, it was apparent that the stock was due for an upward move, resulting in a Buy rating. In fact, I had pointed to five distinct reasons that made it attractive.

One of these reasons was its attractive market multiples. But partly because of its recent fast price rise and partly because of an update in its earnings outlook, the case for it isn’t as strong on the price-to-earnings (P/E) ratio front. Here, I assess how it’s doing on other factors like developments in treatments and financials to assess if there’s still a buy case for AbbVie.

Long Term Price Chart (Source: Seeking Alpha)

Continued momentum on IBD treatments

In the past quarter, developments in the company’s inflammatory bowel disease [IBD] treatments are notable. This is key, as IBD, which can show up as Crohn’s disease or Ulcerative Colitis, is a growing market, influenced by environmental and lifestyle factors.

IBD in numbers

It’s estimated that the disease impacted 10 million people globally in 2022. These numbers are on the rise too. Between 2006 and 2016, patients with IBD grew by 33% in the UK alone. While it has historically been associated with high-income countries, it’s now on the rise in Asia as well.

The market for its treatments is expected to grow at a compounded annual growth rate [CAGR] of 5.7% between 2023 and 2030, with the market size estimated at $39.2 billion by the end of the forecast period.

Passing the baton from Humira

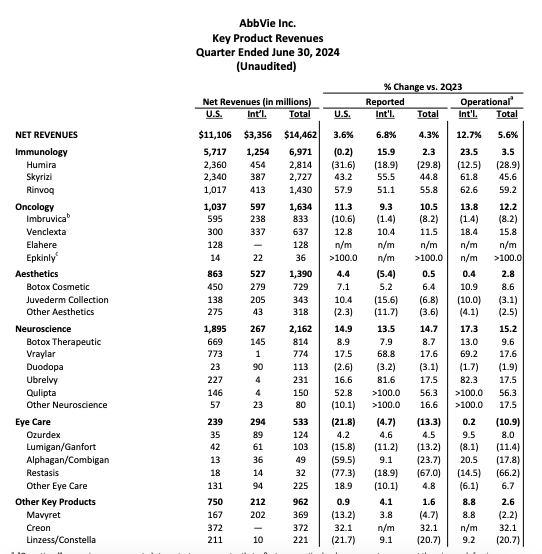

AbbVie’s biggest treatment Humira, which brought in 19.5% of the revenues in the second quarter (Q2 2024), among other diseases, treats the IBD conditions of Crohn’s disease and Ulcerative Colitis. However, after a patent expiration, revenues from Humira have been contracting. In fact, its impact was big enough to shrink the company’s overall revenues in 2023.

However, AbbVie has multiple answers to this challenge. Not only are its other IBD treatments growing fast, it’s also collaborating with other companies and making acquisitions focused on the segment. Here’s how.

- Skyrizi and Rinvoq grow fast

Skyrizi, its biggest treatment after Humira, which contributed ~19% of Q2 2024 revenues, is already seeing strong growth. It grew by 44.8% year-on-year (YoY) in reported terms during the quarter and 45.6% in operational terms, where operational terms represent constant currency revenues.

So far, the treatment was approved for Crohn’s disease, and others like Plaque Psoriasis and Psoriatic Arthritis. Recently, however, it has also been approved for treating moderate to severe Ulcerative Colitis by the US Food and Drug Administration. The company also says that the European Medicines Agency has also adopted a positive opinion on its use as treatment for Ulcerative Colitis.

Like Skyrizi, the company’s third-biggest treatment, Rinvoq also treats IBD, among other conditions. Its growth is even bigger, at 55.8% YoY in Q2 2024, though its 10% revenue contribution during the quarter is smaller.

- Licensing IBD treatments

The company’s hardly stopping at existing treatments, though. In mid-June, it entered into a license agreement with Beijing based FutureGen Biopharmaceutical to develop a next-generation antibody that treats IBD. The goal of the treatment is to “drive greater efficacy and less frequent dosing as a therapy for IBD”. AbbVie has made an upfront payment for the drug to FutureGen of $150 million to manufacture and commercialise it.

- Inorganic growth

Finally, it has made recent acquisitions that target IBD. When I last wrote, it had just acquired Landos Biopharma, a clinical stage company that focuses on autoimmune diseases. Its asset NX-13 has seen promising results for treatment of Ulcerative Colitis as well.

Now, AbbVie has also acquired Celsius Therapeutics for $250 million in cash, which also has a focus on IBD. Like Landos Biopharma, it too is at the clinical stage. AbbVie calls Celsius’ investigational asset CEL383 “a potential first-in-class anti-TREM1 antibody”, where TREM1 is the main gene leading to IBD.

Source: AbbVie

Revenue turnaround…

These developments could potentially add to the growth momentum that AbbVie has acquired recently. Even as Humira’s drag on revenue growth waned, until Q1 2024, the number was just 0.7% YoY.

It’s, however, much better as of Q2 2024, at 4.3% YoY in reported terms. For perspective, this is the fastest growth in eight quarters. The growth is even better at 5.6% YoY in operational terms, which is revenues in constant currency.

Further, revenues ex-Humira have actually risen by a significantly higher 18.1% YoY in the quarter. Besides Skyrizi and Rinvoq, the Neuroscience segment remained a standout one, with 14.7% YoY growth.

… but profits feel the acquisition drag

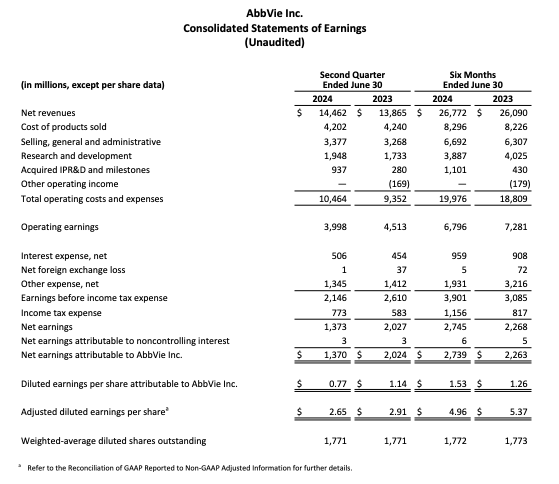

However, the profits don’t look as good, with operating income declining by 11% YoY in Q2 2024, compared to a 1% YoY growth in Q1 2024. When I had last checked, the operating income was important, as both the reported and adjusted earnings per share [EPS] figures were skewed by expenses on account of its acquisitions.

But the impact has become more visible on operating income as well now. If it weren’t for these expenses, it would have seen a YoY increase in operating income instead. Additionally, a downtrend was observed in EPS for the latest quarter, with a 32.5% decline in GAAP EPS and 8.9% contraction in adjusted diluted EPS.

Source: AbbVie

EPS outlook and market multiples

For the full year 2024, AbbVie expects its adjusted diluted EPS at between $10.61-$10.81, which compares with its projection of $11.13-$11.33 as of Q1 2024. The difference arises due to a drag of $0.6 from acquired IPR&D and milestone expenses, as opposed to the $0.08 factored in during Q1 2024. To be fair, if the impact of these expenses was removed, at the midpoint, the latest EPS forecast would still be $0.10 higher compared with the previous one.

However, for the purpose of this discussion, the actual outlook needs to be considered. Assuming that the EPS comes in at the midpoint, the forward non-GAAP P/E ratio is at 18.3x. This is higher than the 15.3x, the last I checked, and far higher than its five-year average of 11x.

What next?

The stock’s forward P/E along with its highest-ever price levels do call for caution when considering investing for the short term. With AbbVie’s current acquisition drive, there could even be further changes to the EPS outlook in the next quarters.

At these P/E levels, it’s trading only below Eli Lilly (LLY) and Novo Nordisk (NVO) among the biggest five pharmaceutical stocks by market capitalisation. But then they have a real growth driver in their portfolio with diabetes management and weight loss treatments, so they are in their own league. Compared to Merck (MRK) and Johnson & Johnson (JNJ), AbbVie is still trading at higher multiples.

Even investors who want to buy it for the medium-to-long-term, there could be a better opportunity coming if the stock corrects. But for those who don’t want to time the markets, AbbVie still looks good. It’s forward P/E declines to a more comfortable 16.2x in 2025, which isn’t that far away now. And it’s steady dividend with a +3% yield is an added attraction.

Further, its focus and growth in IBD treatments are encouraging. If it didn’t have these positive prospects, I’d be more hesitant. But it still looks good to me from a longer-term perspective, especially with a double-digit revenue increase ex-Humira in Q2, 2024. I’m maintaining my buy on AbbVie.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABBV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—