Summary:

- AbbVie’s upcoming Q123 earnings – scheduled for release this Thursday – will be the first since mega-blockbuster Humira lost patent protection.

- As such they will be watched extremely closely – although AbbVie tends to outperform analysts’ expectations and Humira had only 1 direct generic competitor last quarter.

- As such these earnings could provide a surprise to the upside, although longer term I am not sure AbbVie’s share price can grow much beyond current highs.

- AbbVie is a strong Pharma with good stewardship and a host of other blockbuster assets besides Humira and I have few concerns about the long term share price performance.

- A generous dividend yielding >3.5% at time of writing makes ABBV stock a pretty good buy and hold Pharma – even if there will be short to medium term volatility as Humira’s post LOE performance is closely monitored.

Michael Vi

Investment Overview

AbbVie (NYSE:ABBV) is one of the world’s largest Pharmaceutical companies, and a popular choice for investors looking for longer-term “buy and hold” opportunities within this outperforming sector.

Spun out of Abbott Laboratories in 2012, AbbVie’s growth has been nothing short of phenomenal – thanks primarily to one phenomenal drug, Humira – the autoimmune therapy that is a neutralizer of tumor necrosis factor (“TNF”)-alpha, which plays a key role in inflammation. The drug has helped AbbVie’s share price gain >330% since its spin-out, and its revenues grow from $19bn in 2013, to $58bn last year.

The stunning sales growth of Humira – the drug is approved to treat inflammatory conditions across a range of multi-billion dollar markets including Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”) – has seen it become the world’s best selling drug, driving $21.24bn of revenues in FY22, but now it is no longer patent protected and management expects revenues from the drug to fall ~37% in 2023.

Humira accounted for 37% of AbbVie’s total revenues in 2022, but that figure will decline along with the drug’s sales in 2023 – the extent of the decline will likely be the key focus of AbbVie’s Q1’23 earnings, which are due to be released this Thursday, 27th April.

AbbVie is far from a single product company, however, and management has a long-term plan in place to offset the decline in Humira sales with new product launches.

AbbVie Q1’23 Earnings Preview – Key Metrics

Announcing 2023 guidance during its Q4’22 earnings call with analysts, AbbVie’s Vice Chairman and President had this to say:

Turning to our financial outlook for 2023. Our full year adjusted earnings per share guidance is between $10.70 and $11.10. This earnings per share guidance does not include an estimate for acquired IPR&D expense that may be incurred throughout the year. We expect net revenues of approximately $52 billion.

FY23 revenues of $52bn represents a year-on-year decline of >10%, whilst the forecast for adjusted EPS of $10.7 – $11.10 represents a decline of 21% from last year’s $13.77 per share.

Whilst that may be a disappointment for investors, the forward price to earnings ratio for AbbVie still stands at a very respectable 15x – below average for the Big Pharma sector – and the forward price to sales ratio at ~5.5x, again, a good if not exceptional score.

In other words, AbbVie shareholders should not be panicking ahead of Q1’23 earnings, even if this is the year that Humira finally faces generic competition in all of its markets in the US. Let’s take a look at what analysts are predicting EPS wise in 2023 for AbbVie’s quarterly earnings.

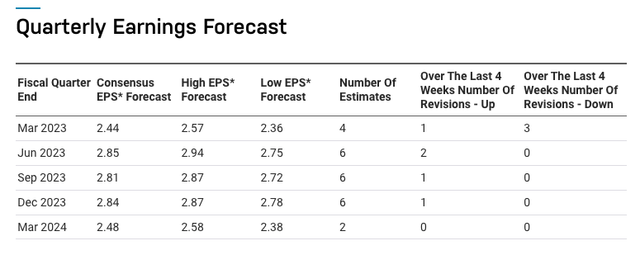

Quarterly earnings forecast (nasdaq.com)

AbbVie has a nice habit of beating analysts’ earnings estimates, outperforming them four times out of four last year, and there are several reasons for believing the Pharma will do so again when Q1’23 results are announced Thursday – although it should be noted that we are talking adjusted EPS here – AbbVie’s GAAP EPS reported for 2022 was $6.63 – EPS being $2.53 in Q122, $0.52 in Q222, $2.22 in Q322, and $1.38 in Q422.

First of all, in Q1’23 Humira faced only a single biosimilar – a more sophisticated form of generic drug – competitor in Amgen’s (AMGN) Amjevita, meaning sales of the drug are likely to have declined significantly less year-on-year than they will do later in the year, when there will likely be as many as 8 Humira biosimilars on the market.

On an adjusted basis AbbVie’s EPS in Q122 was $3.6, so analysts are forecasting a drop off of >30% year-on-year, although according to Zacks, the consensus forecast for revenues is for $12.1bn, compared to $13.54bn in Q1’22, implying a drop off of ~10.6%.

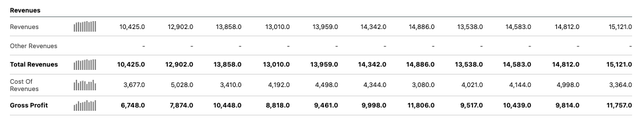

AbbVie revenues by quarter (Seeking Alpha)

As we can see above, traditionally, AbbVie earns the least amount of its annual revenues in Q1, followed by Q2, then Q3, and the largest figure is usually earned in Q4. This year, however, that trend could be reversed thanks to Humira, which is likely to have its best quarter in Q1, with revenues falling more steeply across the next 3 quarters.

As such, I would not be too surprised to see AbbVie beat estimates in Q1’23, which may give its share price – currently trading at $162, close to its all-time peak of $175, a temporary boost.

More Than Just Humira – What Else To Look Out For When AbbVie Announces Q1’23 Earnings

Why do I believe any Q1’23 earnings related share price boost will be temporary?

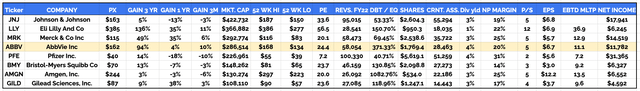

Investors appear to taken the Humira loss of exclusivity (“LOE”) very well, given AbbVie’s share price is +13% across the past 6 months. In fact, of the major US Pharma’s – whom I tend to refer to as the Big 8 – Johnson & Johnson (JNJ), Eli Lilly (LLY), Merck (MRK), AbbVie, Pfizer (PFE), Bristol Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD), AbbVie’s 3-year and 3-months share price performance is second only to Eli Lilly.

Big 8 US Pharmas metrics compared (data collected from TradingView, Google Finance)

It is interesting to note, for example, that despite posting >$100bn of revenues in FY22, Pfizer’s market cap and share price has been falling – how can that be?

The explanation is that Pharmas tend to be valued more on what is coming next that what has happened before. Pfizer made ~$100bn from its COVID vaccine Comirnaty and antiviral Paxlovid, but the market views these revenues as temporary and likely to decline rapidly in 2023, so Pfizer’s valuation has been falling.

Eli Lilly, on the other hand, has recently launched its Tirzepatide drug into the diabetes market as Mounjaro, and is likely to secure approval for the candidate in weight loss also. Since the markets believe the drug could make >$20bn per annum sales in both markets, Lilly’s valuation is rising on the promise of future revenues.

AbbVie could be suffering the same fate as Pfizer given its best-selling asset is facing falling revenues – management has guided for a 37% decline in Humira revenues in 2023, to ~$13.7bn – but AbbVie has moved quickly to offset the revenue declines with new product launches – most notably in Humira’s current markets.

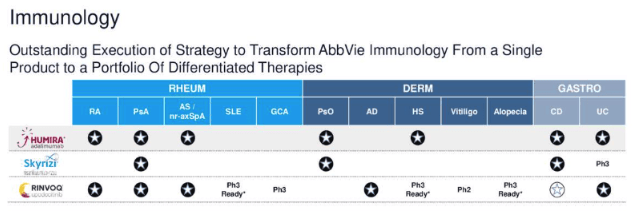

Skyrizi, Rinvoq and Humira approvals (AbbVie presentation)

As we can see above, the 2 drugs AbbVie has developed to replace Humira – Skyrizi – which inhibits the activities of IL-23, a naturally occurring cytokine that is involved in inflammatory and immune responses – and Rinvoq – a member of the janus kinase inhibitor drug class – have secured approvals in most of the markets where Humira has been dominant for so long, and look set to eventually be approved in all of Humira’s markets.

Management is guiding for Skyrizi to drive $7.4bn of revenues in 2022, and for Rinvoq to drive $3.7bn – up 43% and 47%, or $2.2bn and $1.2bn respectively year-on-year – which helps to offset the 37%, or $7.5bn projected decline in Humira revenues. Eventually, AbbVie CEO Rick Gonzalez has told analysts, it is expected that Skyrizi and Rinvoq will drive >$25bn revenues per annum between them – a higher figure then even Humira could achieve.

The quarterly performance of these 2 drugs is therefore critically important to AbbVie’s plans to grow its business even as its best-selling drug exits stage left, and will be a feature of the upcoming earnings.

Auto-immune markets are highly lucrative but also fiercely competitive – every major Pharma is developing for indications such as Psoriasis, Atopic Dermatitis, Rheumatoid Arthritis etc – so AbbVie needs to prove that Skyrizi and Rinvoq can dominate like Humira used to.

Above and beyond its immunology division, however, AbbVie has 5 more major divisions that drove the remaining 50% of revenues the Immunology division did not in 2022, and there are high hopes for every division long term, even if 2023 performance in some divisions will be affected by the economic downturn.

Within Oncology, for example, whilst lead drug Imbruvica targeting hematological cancers is experiencing declining revenues owing to increased competition, another blood cancer drug, Venclexta, is expected to drive $2.2bn of revenues in 2023 – up 10% year-on-year.

The Aesthetics division performance is expected to be flat to declining year-on-year, owing to an unstable post-COVID environment, with revenues forecast to decline from $5.3bn in 2022, to $5.2bn in 2023, although management has high hopes that this division – led by the globally recognized brand Botox – can significantly outperform long term – signs that this is happening earlier than expected could provide a boost to Q1’23 earnings performance.

Neuroscience is forecast for double digit growth in 2023 – from $6.5bn in 2022 to ~$7.2bn this year – led once again by Botox – this time as a migraine therapy – and recently launched Vraylar. The Eye care division is expected to underperform, driving ~$2.2bn of revenues in 2023, whilst revenues of “Other Key Products” will be flat to declining.

Looking Further Ahead – ABBV’s Pipeline, Long Term Performance and Target Share Price

Humira will doubtless dominate discussion around Humira’s first set of earnings post-LOE, and as suggested above, I suspect an earnings beat may occur on Thursday as the drug’s sales will only be impacted by a single competitor in Q1’23.

One of the great things about AbbVie however is that management has put together very clear plans about how it will overcome Humira’s LOE, whilst continuing to drive long-term growth, and shareholders / investors can pretty much tick off the achievements and milestones, whether it be a new product approval or a revenue target.

CEO Rick Gonzalez told analysts on the Q4’22 earnings call that:

we don’t anticipate that 2024 earnings will be lower than the $10.70 for 2023 adjusted earnings per share guidance which we are issuing today.

Gonzalez also told the audience at the JPM Healthcare Conference in January that:

we remain well-positioned to absorb the impact from the Humira LOE and quickly return to strong growth starting in 2025. We continue to anticipate a clearer path to strong sales growth in 2025 with high-single-digit compounded annual growth rate to the end of this decade.

AbbVie’s bullish guidance is likely what is keeping the share price buoyant – that and the fact that there is a thriving pipeline – Gonzalez told analysts in Q4’22 that 80 programs are ongoing at various stage of development – and very few patent expiries other than Humira are occurring this decade.

As much as Q1’23 earnings will be an important and historic one for AbbVie – its first reporting post Humira LOE – in another way, because the Pharma’s growth plans are so transparent and measurable – it will not necessarily matter is Humira revenues fall by 10, 20, 30, or >50% year-on-year given the long term growth will be driven elsewhere.

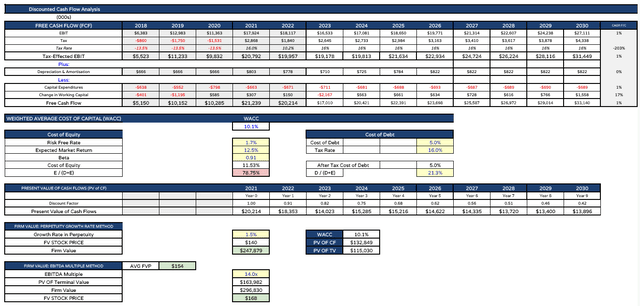

In my last note on AbbVie published prior to Q4’22 earnings, I mapped out sales projections for the Pharma to 2030, and using discounted cash flow analysis, established a target share price of $176.

Having updated my models to factor in management’s 2023 guidance and been a little more conservative with some measures – increasing the weighted average cost of capital from 9.7% to >10%, for example, my share price target has become significantly more conservative, as I discuss below.

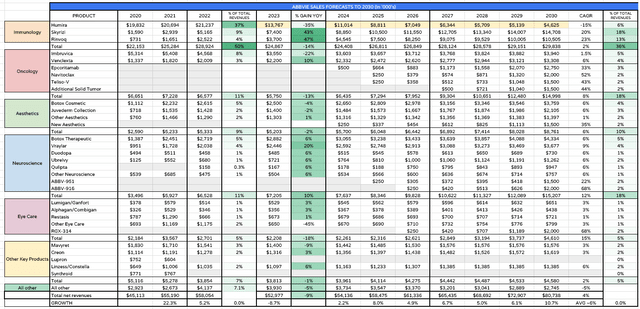

AbbVie product sales forecasts (my table and assumptions)

Following management’s 2022 guidance my long-term sales forecasts shown above have become a little more conservative – note I have included some new product approvals within Oncology, Aesthetics, Neuroscience and Eye Care based on company updates – although these figures should be considered as rough guidance only, the general revenues trend reflects management’s promise for recovery in 2024 and steady higher single digit growth after that until the end of the decade.

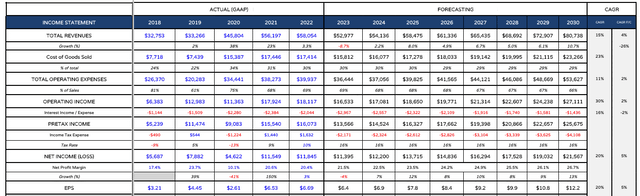

The projected income statement now looks as follows, with my expectation for 2030 revenues having declined by ~$5bn, to just over $80bn.

AbbVie income statement forecast (my table and assumptions)

And, finally, my updated discounted cash flow gives me a lower price target of just $154, based on the average of standards DCF analysis, and EBITDA multiple analysis.

AbbVie DCF analysis (my table and assumptions)

Conclusion – Q1’23 Earnings Will Be (Temporarily) Seismic But Whatever Happens AbbVie Is A Solid Pharma To Back Long Term

My share price target for AbbVie may have fallen 13%, from $176, to $154, which suggests that AbbVie stock may be ~5% overvalued at this time, but as mentioned these tables are speculative – nobody can predict the future with complete accuracy – and reflect the fact that AbbVie does face many tough tests in 2023 and for the next few years.

Although I am not necessarily concerned about AbbVie’s share price falling significantly – as discussed, I would expect slight outperformance against analyst’s estimates in Q1’23 and perhaps a small short-term share price spike – there is no denying that prevailing economic conditions and the Humira LOE uniquely challenges AbbVie, and there may be many uncertain sets of quarterly earnings before we really know if management’s careful planning is paying off.

That uncertainty may weigh slightly on the share price and create additional volatility, which is why I would expect some decisive movement on Thursday, which will likely be very closely related to perceptions around Humira performance.

Thankfully, AbbVie pays an excellent dividend – currently $5.92 per annum – which has been raised every year for many years, and which provides a good deal more certainty that short term share price fluctuations.

As such, even if I am not expecting stellar growth from AbbVie’s share price this year, and would not be surprised to see a downward trend even if there is a short term spike on better than expected Humira performance in Q1’23, I’d be pretty confident that AbbVie stock remains a strong buy and hold, and there is every chance management can outperform my own long-term expectations over the next few years and earnings seasons.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, GILD, BMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.