Summary:

- AbbVie Inc.’s Q1 2024 earnings will be announced next Friday, with Wall Street projecting revenues of $11.94bn and EPS of $2.28 on a normalized basis.

- ABBV share price has grown by over 110% in the past 5 years, but only 4% in the past 12 months, after a slight recent dip.

- AbbVie’s best-selling drug, Humira, lost its patent protection in Europe in 2020 and in the U.S. in 2023, leading to a decline in revenues in 2023.

- Nevertheless, the company appears strong in most areas, with its two new immunology assets and detailed forecasts suggesting Q124 earnings may exceed expectations.

- Longer-term, AbbVie can use next week’s earnings as a springboard for the post Humira era – and a steady period of share price growth.

Galeanu Mihai

Investment Overview – AbbVie In The Post Humira Era

AbbVie Inc. (NYSE:ABBV), the Chicago, Illinois based Pharma giant, will announce its Q1 2024 earnings pre-market next Friday, 26th. Analysts are forecasting earnings per share (“EPS”) on a normalized basis of $2.28, and on a GAAP basis, $0.68, on projected revenues of $11.94bn.

Since being spun out of Abbott Laboratories (ABT) in 2012, AbbVie has delivered excellent value for shareholders, its stock having gained by ~350%. Across the past 5 years, AbbVie’s share price has grown by >110%, although over the past 12 months, it has grown by just 4%.

Having reached an all-time high value of $182 per share at the beginning of this month, AbbVie’s share price has retreated, trading at $165 at the time of writing, although this may be due to the fact the company paid its most recent dividend on April 12th. AbbVie continues to pay a handsome dividend which was raised to $1.55 per quarter in January this year, and yields 3.8% at the time of writing – above average for the “Big Pharma” industry.

Besides its strong dividend, AbbVie is probably best known for marketing and selling what, for a long period during the past and present decade, was the world’s best-selling drug – Humira. Humira, indicated for a range of autoimmune conditions, including Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Psoriasis (“PsO”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”), lost its patent protection in Europe in 2020, and in the U.S. in 2023.

In 2020, 2021, and 2022, the drug earned respectively $19.8bn, $20.7bn, and $21.2bn of revenues, but in 2023, that figure fell to $14.4bn, as at least eight generic versions of the drug launched last year, from Amgen Inc.’s (AMGN) Amjevita, to Samsung Bioepis’ Hadlima, Sandoz’ Hyrimoz, Celltrion’s Yuflyma, and so on.

Patent expirations of key drugs is arguably the toughest challenge a Big Pharma has to face, and AbbVie has handled Humira’s loss of exclusivity (“LOE”) with aplomb, launching two new autoimmune drugs, Skyrizi and Rinvoq, which it expects to earn $17bn and $10bn respectively by 2027, in the indications of psoriasis, psoriatic arthritis, and inflammatory bowel disease (“IBD”), and rheumatoid arthritis, IBD, and atopic dermatitis respectively.

With that said, these numbers must still be achieved, in highly competitive markets, while AbbVie must support its immunology division with strong performances from its other divisions – oncology, which accounted for ~11% of the company’s total revenues in 2023, Aesthetics, which accounted for 10%, neuroscience, 14%, eye care, 4%, and other key products, 7%.

As well as financial headwinds, i.e., rising inflation, high interest rates, currency fluctuations, cost of debt etc., AbbVie faces other issues. Government pressure on drug pricing is one – one time >$5bn selling hematological cancer drug is one of the first drugs whose pricing will be determined at least in part by the centers for Medicaid and Medicare Services (“CMS”).

Another is succession planning – AbbVie’s long-term CEO, Rick Gonzalez, who has played an instrumental role in the company’s success, and AbbVie’s somewhat controversial “patent thicket” extension of Humira’s market exclusivity, keeping generics at bay for a decade after Humira’s initial patent protections expired – is set to retire in June.

Other issues, such as counterfeit Botox products – AbbVie acquired Botox developer Allergan is a ~$66bn deal in 2020 – and a troublesome set of earnings in Q1 2023 – will be preying on the company as it prepares to update the market and analysts for the first time in 2024.

Nevertheless, AbbVie has been one of the best-performing Big Pharma companies to be invested in long-term. Unlike in Q1 ’23, when the company delivered a downbeat set of earnings, I am expecting a positive update next week – in this article, I’ll highlight some areas of interest for investors to focus on, and offer some thoughts about where I see AbbVie’s valuation headed in 2024, and beyond.

Let’s begin by taking a look at 2023 performance as a whole.

AbbVie 2023 Earnings Overview – Impact Of Humira LOE

Across 2023, AbbVie delivered revenues of $54.32bn, down 6.4% year-on-year, and largely due to the Humira LOE. Despite Skyrizi revenues growing by 50% year-on-year, to $7.8bn, and Rinvoq revenues by 57%, to $3.97bn, AbbVie’s immunology division revenues fell by 10% year-on-year, to $26.14bn.

Thanks to imbruvica’s falling revenues, to $3.6bn, AbbVie’s oncology division also saw revenues decline by 10%. However, the neuroscience division outperformed, with revenues up 18% to $5.9bn. Aesthetic division revenue growth was flat, with the division earning $5.3bn in 2023.

AbbVie posted EPS of $2.72 on a GAAP basis in 2023, down 59%, and adjusted EPS of $11.11, down 19% year-on-year. For 2024, the company guided for EPS of $11.05 – $11.25. On the Q4 2023 earnings call with analysts, AbbVie’s Executive Vice President and Chief Financial Officer, Scott Reents went into detail around revenue expectations.

Reents told analysts that:

We expect total net revenues of approximately $54.2 billion, reflecting a return to modest operational growth. At current rates, we expect foreign-exchange to have a 0.5% unfavorable impact on full year sales growth.

He went on to discuss company expectations for “global immunology sales of $25.6 billion” with Humira making a $9.6bn contribution, Skyrizi $10.5bn, and Rinvoq $5.5bn. Within oncology, revenues of $5.7bn, and within aesthetics, revenues also of $5.7bn, with neuroscience contributing $8.9bn, and eye care, $2.2bn. Regarding the P&L, Reents commented:

Moving to the P&L for 2024, we are forecasting full-year adjusted gross margin of 84% of sales. Adjusted R&D investment of 14% of sales, adjusted SG&A expense of 23.5% of sales, and adjusted operating margin ratio of roughly 46.5% of sales.

In Q1 2024, management expects revenues of $11.9bn, an adjusted gross operating margin of 44.5% of sales, and a non-GAAP tax rate of 14.8%, resulting in adjusted earnings per share of $2.3 – $2.34 – slightly above Wall Street’s expectations.

Finally, regarding capital allocation, Reents told analysts:

Our cash balance at the end of December was $12.8 billion. And we expect to generate free cash flow of approximately $18 billion in 2024, which includes roughly $1.9 billion in Skyrizi royalty payments. The strong free cash flow will fully support a strong growing dividend, which we have increased by more than 285% since inception, continued debt repayment, where we expect to pay down the approximately $7 billion of maturities this year, and also provides capacity for continued business development to further augment our portfolio.

AbbVie reported total current assets of $33bn at the end of 2023, versus current liabilities of $37.84bn, and total assets of $134.7bn, versus total liabilities of $124bn, with $52.4bn of long-term debt.

While there is no question AbbVie carries a lot of debt on its balance sheet, the company is in no danger of losing its investment grade credit rating – as per its 2023 annual report/10-K submission:

In 2023, Moody’s Investors Service upgraded AbbVie’s senior unsecured long-term credit rating to A3 with a stable outlook from Baa1 with a positive outlook and affirmed AbbVie’s Prime-2 short-term credit rating. In addition, Standard and Poor’s Global ratings upgraded AbbVie’s long-term issuer credit rating to A- with a stable outlook from BBB+ with a positive outlook.

Key Updates To Look Out For In Q1 ’24 Earnings – Can Skyrizi And Rinvoq Surprise To The Upside This Year?

The fact that AbbVie was able to grow its share price in 2023 – the year in which its mega-blockbuster drug – responsible for nearly 40% of its total revenues in 2022 – saw revenues decline by almost $7bn, speaks to the faith the market has in AbbVie management’s good stewardship.

The company is certainly not shy about sharing very specific, product-by-product, division-by-division guidance, which has helped it manage the market’s expectations as it morphs into a more diversified company – although the risk of its ongoing reliance on dominating highly competitive autoimmune markets must be acknowledged.

Of course, if AbbVie misses its own targets, the market may begin to worry, hence Q1 2024 earnings should be straightforward to interpret. As the company’s new President and Chief Executive Officer (“CEO”) cautioned during a fireside chat at the Barclays Annual Healthcare Conference:

I think hopefully, we don’t have a repeat of what happened last year with some mismodeling, misunderstanding of the first quarter dynamic. We saw the rest of the year played out as we had guided, we actually beat those estimates. But this year, I think first quarter, hopefully, we’ve given enough clarity to the Street that we don’t have a repeat of that in the first quarter.

AbbVie’s share price fell from ~$162, to a low of ~$135 – a drop of ~17% – after the company reported Q1 earnings last year, after Skyrizi and Rinvoq sales fell short of the market’s expectations, and given the expectations placed upon these two drugs, and their competition – Johnson & Johnson’s (JNJ) Stelara, Novartis AG (NVS) Cosentyx, Amgen Inc.’s (AMGN) Otezla, and Eli Lilly’s Taltz, in Skyrizi’s case (and others besides), and Lilly’s Olumiant, and Pfizer Inc.’s (PFE) Xeljanz in Rinvoq’s case, for example – AbbVie will want to avoid missing Wall Street’s expectations for the second year in a row.

In general, however, Skyrizi has emerged victorious in numerous head-to-head studies against its closest competitors for market share, whilst Rinvoq appears to have shaken off safety concerns around the JAK inhibitor class of drugs, and bested arguably its main rival, Dupixent, in head-to-head studies.

As such, I don’t see these two drugs – AbbVie’s most important – letting the company down when Q1 2024 earnings are announced next week, plus there are multiple other highlights to look out for.

Pipeline Progress – M&A Success In Oncology/Neuroscience Sets ABBV Up For Long-Term Success

Last year, AbbVie spent reasonably heavily on M&A, its two major acquisitions being the $8.7bn acquisition of neuroscience specialist Cerevel Therapeutics, and the $10.1bn acquisition of Immunogen, whose antibody drug conjugate (“ADC”) portfolio of dual-acting cancer drugs includes Elahere, approved to treat platinum-resistant ovarian cancer (“PROC”).

ADCs are arguably the hottest property in cancer treatment at present – last year, Pfizer spent $43bn acquiring Seagen and its portfolio of three approved ADCs, while Merck invested $5.5bn in a partnership with Daiichi Sankyo to develop ADC’s – the deal could rise to >$20bn in value depending on progress.

Both the Cerevel and Immunogen acquisitions are complementary to AbbVie’s existing business – the company has its own ADC, Teliso-V, in development, while its neuroscience portfolio includes Vraylar, indicated for Major Depressive Disorder and expected to reach $5bn in annual revenues, and migraine therapies Ubrelvy and Qulipta, expected to drive >$3bn revenues combined (according to expectations shared in a recent AbbVie pipeline presentation).

AbbVie has said that it expects its oncology division to return to growth in 2026, buoyed by Venclexta, its imbruvica replacement, and newly approved Epkinly – a bispecific CD20-directed CD3 T-cell engager for use in the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), which analysts have speculated could drive >$1.5bn in peak revenues. Navitoclax, which inhibits Bcl-XL, will share Phase 3 data this year, and further ADC pipeline updates may be provided on the Q1 2024 earnings call. Elahere revenue data ought to be intriguing – the drug is expected to earn revenues in the multi-billions, long term.

Otherwise, AbbVie’s oncology assets are mostly immature, but promising, while the Cerevel deal mainly focuses upon tavapadon, a Parkinson’s Disease drug that posted positive late-stage data this week, and will read out Phase 3 data this year. If approved, the drug will support AbbVie’s duodopa as part of a likely “blockbuster” (>$1bn revenues per annum) PD franchise.

Concluding Thoughts – Q1 ’24 Earnings Can Be Springboard To Launch Of Post Humira Era

To summarize much of the above, I am not expecting AbbVie to make the same “mistake” it did last year and deliver a set of earnings that surprises, and ultimately disappoints the market.

In fact, I’d expect the company to meet its own forecasts, and if it does that, it will exceed Wall Street’s expectations, and that may well result in a reversal of the recent downwards share price trend.

Doubtless, there will be a heavy focus on Humira – which may surprise to the upside, given reports suggest generics are finding it harder than expected to take market share away from the old stager.

Skyrizi and Rinvoq revenues will be closely scrutinized, as will progress towards winning approval in new indications, such as in Ulcerative Colitis for Skyrizi, and Rinvoq in giant cell arteritis (“GCA”), and again, there are reasons to believe updates provided by management will be broadly positive.

Management has provided revenue guidance for all of its divisions, which I have shared above, so there ought not be too many surprises here, and I am expecting management to share some longer-term forecasts, such as for a return to revenue growth in 2025, and by 2026, for AbbVie’s revenues to be back above the 2022 revenue high watermark of $58bn.

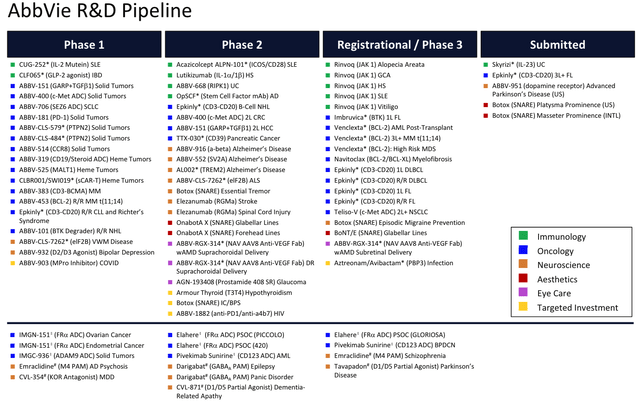

I am not expecting AbbVie to spring a surprise M&A announcement, as its existing debt does not necessarily support further M&A. The company is not renowned for its pipeline development expertise, although, as we can see below, there is plenty of activity on the R&D front to support long-term revenue growth.

AbbVie pipeline (Investor Presentation)

My own forecasts – which I will share in a future post – support AbbVie being on track to achieving >$80bn of revenues by the end of the decade, buoyed by a >$30bn revenue immunology division, and a >$15bn neuroscience division, and a >$10bn oncology division. If that scenario were to materialize, my discounted cash flow analysis supports a share price target of >$200.

Naturally, there are many obstacles in the way of that target, but it is based on forecasts that are broadly in line with AbbVie management’s internal expectations.

Frankly, as an AbbVie shareholder, I would settle for a positive Q1 2024 earnings report next week, with no unpleasant surprises that could lead to downside (although no scenario can ever truly be ruled out), which sets the tone for a year of solid growth in 2024, and all being well, an end of year share price that comes close to challenging my target of $200.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.