Summary:

- AbbVie’s Q1 earnings beat estimates, with a smaller decline in Humira sales than expected.

- The company’s next-generation drugs, Rinvoq and Skyrizi, are offsetting the decline in Humira sales.

- AbbVie’s profitability will be weaker than in previous years, and its valuation is relatively high compared to peers.

vzphotos

Article Thesis

AbbVie Inc. (NYSE:ABBV) reported its first quarter earnings results Friday morning. The company’s results beat estimates on both lines as the Humira sales decline was less pronounced than feared. Execution is very solid, but the valuation is not as low as it used to be, which is why I would not buy shares at current prices.

Past Coverage

I have covered AbbVie several times here on Seeking Alpha, moving between “Buy” and “Hold” ratings, depending on factors such as valuation and the current dividend yield. I gave the company a “Buy” rating last summer when shares were irrationally cheap, which has worked out well, as shares generated a return of 27% since then. Earlier this year, I downgraded AbbVie to a “Hold” on the back of a rising valuation. Since then, the company has slightly trailed the broad market’s return with a 6% gain vs. a 7% gain for the S&P 500. In today’s article, we will focus on the company’s Q1 results and what they mean for investors.

What Happened?

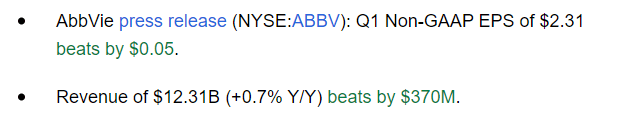

AbbVie reported its Q1 earnings results on Friday morning before the market opened. The headline results can be seen in the following screencap:

AbbVie results (Seeking Alpha)

We see that AbbVie Inc. was able to outperform analyst expectations for both its top line and its bottom line, which naturally was a positive surprise. While a 0.7% revenue increase isn’t very compelling in general, especially when we consider that inflation is still running way ahead of the Fed’s target range, the result was much better than what was expected.

After all, the loss of the Humira patent protection is a major headwind for the company’s sales generation. Thus, analysts were predicting that revenues would decline by a couple of percentage points compared to the previous year’s quarter. The company was able to manage a small revenue increase, however, which is a strong feat considering the patent expiration headwinds. Not too surprisingly, higher-than-expected revenues went hand in hand with higher-than-expected profits. Analysts tend to underestimate AbbVie, with the company now having beaten profit estimates in 18 out of the last 20 quarters.

AbbVie: Underlying Performance Is Solid

As noted earlier, the loss of Humira’s patent protection in the US last year was a headwind for the company. The drug lost its patent protection in Europe earlier, but that was less of a hit for the company as revenue generation in the US is higher compared to Europe.

But while a range of competitors has come to the market with their respective biosimilars, AbbVie has managed to hold a better-than-expected market share in its home market. Seeking Alpha reported earlier this month that AbbVie had retained a market share of close to 100%, although this was only possible due to some pricing concessions. We see this in the earnings report (source: earnings release):

Global Humira net revenues of $2.270 billion decreased 35.9 percent on a reported basis, or 35.2 percent on an operational basis. U.S. Humira net revenues were $1.771 billion, a decrease of 39.9 percent. Internationally, Humira’s net revenues were $499 million, a decrease of 15.8 percent on a reported basis, or 11.6 percent on an operational basis.

While Humira still generates very strong sales, with an annual pace of around $7 billion in the US alone, the number was down by almost 40% compared to the previous year’s period. With AbbVie’s market share remaining high, the logical explanation for the revenue decline is that the company lowered its prices to remain the major supplier in its home market. In the non-US business, where patent expiration has been lapped, the ongoing decline rate was significantly smaller, but the business nevertheless keeps shrinking to some degree.

The good news is that AbbVie’s next-generation products have been able to offset the headwinds from the Humira patent loss on a company-wide sales basis. Rinvoq and Skyrizi, which mostly target the same conditions that can be treated with Humira, have continued to grow at an attractive pace during the most recent quarter:

– Global Rinvoq sales were up by a hefty 59% year over year, rising to $1.1 billion, now with more than $4 billion in annual revenues.

– Global Skyrizi sales rose by a strong 48% compared to the previous year’s quarter, climbing to $2.01 billion, now with a $8 billion annual sales pace.

Combined, these two next-generation immunology drugs are generating more than $12 billion in annual sales while growing at an annual pace of around 50%. If this were a single drug instead of two relatively comparable ones, the combination would be an absolute mega-blockbuster for AbbVie – Rinvoq and Skyrizi combined are now generating substantially higher revenues than Humira.

When we consider that the growth rate of Rinvoq and Skyrizi is higher than the decline rate of Humira and that Rinvoq and Skyrizi are generating larger overall sales, it seems quite possible that the overall immunology portfolio will generate positive growth going forward despite the headwinds from the Humira patent loss. That being said, it’s possible that the Humira sales decline will be more severe in the upcoming quarters due to the fact that CVS Health Corporation (CVS) is now favoring the biosimilars from AbbVie’s competitors – we will see how that impacts AbbVie’s results when the company announces its second-quarter earnings around three months from now.

When it comes to profits, AbbVie beat estimates, but results were down vs. the previous year’s quarter nevertheless. Adjusted earnings per share were down by a little more than 6%, which isn’t disastrous, but not great. This includes the impact of milestone expenses and similar items, but even if we back those out, earnings per share would be down slightly compared to Q1 of 2023. The fact that AbbVie lowered its prices for Humira in order to maintain market share seems to have hurt the company’s margins to some extent. Selling, general, and administrative expenses also were up year-over-year, rising by 10%. Increased efforts to maintain Humira’s market share in the face of growing competition likely play a role in higher selling expenses.

Looking beyond the first quarter, we see that AbbVie has increased its guidance for the current year. The company is now forecasting earnings per share of ~$11.23, which is up vs. the previous earnings per share guidance midpoint of $11.07. The new guidance midpoint is higher than the analyst consensus estimate, which was rewarded by a share price increase in pre-market trading. The better-than-expected Humira performance in the United States helps explain why AbbVie believes it will be more profitable than previously thought.

On the other hand, investors should not disregard the fact that the updated guidance still implies that profitability will be significantly weaker than during the peak years 2021 and 2022 when AbbVie was earning well above $12 per share.

Is AbbVie A Good Investment?

AbbVie is a quality company, I believe. The biotech player owns some strong assets, such as its immunology drugs Skyrizi and Rinvoq, but also other franchises such as Botox, its cancer portfolio, etc.

But right now, the company is facing headwinds from the Humira patent loss, which is why 2024 will not be a strong year for the company. While revenues and profits are not falling off a cliff, AbbVie will not be a high growth company for the foreseeable future.

Today, shares are trading for 15x net profits. While that is not a high valuation in absolute terms or relative to how the broad market is valued, a 15x earnings multiple for a biotech/pharma company is also far from low. Profits declined during the first quarter, which suggests that AbbVie should not be trading at a high valuation.

With peers such as Pfizer Inc. (PFE) or Roche Holding AG (OTCQX:RHHBY) trading at just 11x to 12x net profits, AbbVie looks somewhat pricey on a relative basis.

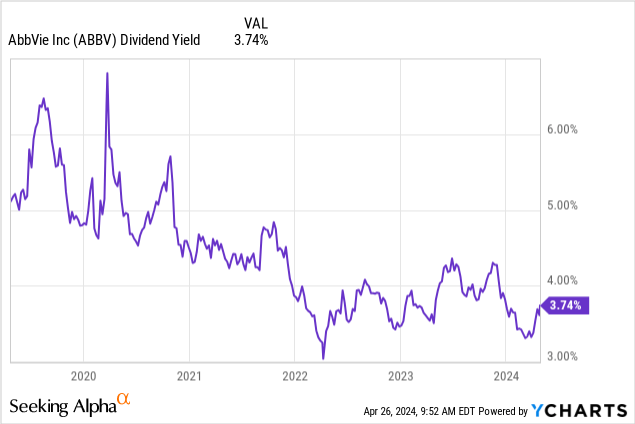

For many investors, AbbVie is a dividend growth investment primarily thanks to its compelling dividend growth track record. In the following chart, we see that the company’s dividend yield is currently rather low, relative to the five-year range:

A 3.7% dividend yield is far from bad in absolute terms, but the above chart suggests that right now may not be a great time to buy additional shares. Shares have pulled back from the 52-week high of around $180, but I believe that it’s not unlikely that a better buying opportunity will materialize. Waiting for another 10%-15% pullback (such a pullback is not guaranteed, of course) would allow for a starting yield of 4.2% to 4.4%, which would be more attractive. The valuation would also be less demanding in that case. When we consider that AbbVie traded at as low as $131 over the last year, the current share price of more than $160 is not overly compelling. I thus consider AbbVie a “Hold”/”Neutral” right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!