Summary:

- AbbVie Inc. will announce its Q2 2024 earnings next Thursday, 25th July.

- The company has a new CEO, with insider Rob Michael taking the reins after long-term CEO Rick Gonzalez’s retirement.

- Wall Street watches Humira’s revenue post patent expiry in the US closely, and sold stock after Q1 showed a >30% YOY decline.

- Expectations for Q2 include revenue of $14 billion, and adjusted earnings of $3.05 — $3.09 — slightly ahead of analysts estimates.

- With AbbVie’s long-term Humira replacements delivering strong growth and winning head-to-head battles against rivals, I am hopeful attention will switch focus from Humira in Q2, and market reaction to be positive.

tifonimages/iStock via Getty Images

Investment Overview

AbbVie Inc. (NYSE:ABBV), the North Chicago, Illinois-based Pharma giant formed via a spin out of Abbott Laboratories’ (ABT) pharmaceuticals division in 2012, will announce its Q2 2024 earnings next Thursday, 25th July.

It’s a new era for the company in more ways than one. Firstly, it will be the first time AbbVie’s long-term CEO Rick Gonzalez will not be presiding over the earnings call with analysts. The CEO officially retired from his position on July 1st, replaced by company insider Rob Michael, formerly Chief Operating Officer.

Here is what the outgoing CEO had to say about his time at the company on the Q1 2024 earnings call:

Looking back, AbbVie has evolved tremendously as an independent company and our performance has truly been exceptional. Since our inception, we’ve grown our revenue from $18 billion to $55 billion. Our market capitalization has increased substantially from $54 billion to roughly $300 billion today.

We have achieved a total shareholder return of more than 675%, which is top-tier relative to our peers. And importantly, we’ve substantially increased our investments in R&D to discover and develop new medicines that have the potential to improve the lives of patients.

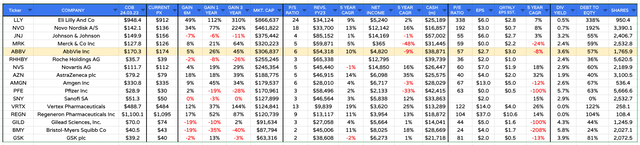

AbbVie shareholders will doubtless agree that Pharma’s performance has been exceptional to date, and as we can see below, by most metrics, the company makes for a strong investment proposition.

AbbVie compared to selected global pharmas (my table using data from TradingView, Google Finance)

Today, AbbVie is the fifth-largest global Pharma by market cap and the fifth-largest by revenues generated in 2023. It has a double-digit 5-year compound top-line annual growth rate, has current assets of ~$39bn, a satisfactory debt-to-equity ratio, and a generous dividend that yields 3.6%, being $1.55 per quarter presently.

On the more negative side of the ledger, the company’s net income – on a GAAP basis – fell from $11.8bn in 2022, to $4.9bn in 2023. The company’s revenues also fell, from $58bn to $54.3bn, which most people familiar with AbbVie will know is down to the patent expiry in the US of its mega-blockbuster autoimmune drug Humira.

Humira is the second reason why AbbVie can be said to be in a new era – the post-Humira loss of exclusivity (“LOE”) era.

CEO Gonzalez and AbbVie management had managed to extend Humira’s patents for more than five years longer than expected. In 2020, 2021, and 2022, the drug, which is indicated for a range of conditions including Rheumatoid Arthritis and Psoriasis, earned revenues of $19.8bn, $20.7bn, and $21.2bn, respectively.

In 2023, however, following the expiry of its US patents, and the entry of at least eight new generic versions of the drug into the marketplace, with price points as much as 85% lower than the original drug, Humira revenues fell. They were down by 32% year-on-year, to $14.4bn.

Fortunately for shareholders, AbbVie had years to prepare for this eventuality. It has launched two drugs, Skyrizi and Rinvoq, that are well on the way to securing approvals in all of Humira’s markets. As for the past several quarters, Humira, Skyrizi, and Rinvoq will likely dominate the agenda when Q2 earnings are presented and analyzed.

In this post, I’ll take a closer look at what to expect from the upcoming earnings next week. We will cover what I expect will be major topics of discussion, performance expectations, and what impact I believe earnings and business updates will have on the share price.

Q1 2024 In Review – Expectations For Q2

In Q1 2024, worldwide net revenues were $12.31bn, up 0.7% on a reported basis, with the immunology division – consisting of Humira, Skyrizi, and Rinvoq – contributing $5.4bn, down 3.9% year-on-year, oncology contributing $1.54bn, up 9%, neuroscience $2bn, up 16%, and aesthetics $1.25bn, down 4%.

GAAP gross margin was 66.7%, or 82.9% on an adjusted basis, with SG&A expenses representing 27% of net revenues, and R&D representing 16% of revenues. Operating margin was 23%, or 42% on an adjusted basis, and earnings per share (“EPS”) came to $0.77 on a GAAP basis, or $2.31 on an adjusted basis.

The company also raised its full-year 2024 outlook as follows:

AbbVie is raising its adjusted diluted EPS guidance for the full year 2024 from $10.97 – $11.17 to $11.13 – $11.33, which includes an unfavorable impact of $0.08 per share related to acquired IPR&D and milestones expense incurred during the first quarter 2024.

In terms of Q2 2024, AbbVie’s Chief Financial Officer (“CFO”) Scott Reents had this to say on the Q1 2024 earning call with analysts:

Turning to the second quarter, we anticipate net revenues of approximately $14 billion, which includes U.S. Humira erosion of approximately 32%, reflecting a step-up in volume erosion and with the recent CVS formulary change, partially offset by a one-time price benefit also associated with that change.

At current rates, we expect foreign exchange to have a 1.3% unfavorable impact on sales growth. We are forecasting an adjusted operating margin ratio of approximately 49.5% of sales, and we are also modeling a non-GAAP tax rate of 16.4%. We expect adjusted earnings per share between $3.05 and $3.09. This guidance does not include acquired IP R&D expenses that may be incurred in the quarter.

Analysing Immunology – Progress Of Rinvoq & Skyrizi

AbbVie had long promised a “trough” year in 2023 as the full force of the Humira LOE was felt. However, astonishingly, management’s long-term guidance has Skyrizi revenues reaching >$17bn in 2027, and Rinvoq revenues reaching >$10bn, making the duo a better joint prospect than Humira was at its absolute peak.

Despite this, however, the market still watches Humira revenues like a hawk, and when they fell >30% year-on-year in Q1 2024, to “just” $2.27bn, AbbVie’s stock dipped by ~5%, falling to a value of ~$159, despite a beat on earnings, and raised 2024 revenue guidance.

If AbbVie management has done their market research and math correctly, then we can make the case that fears around Humira’s rapidly declining revenues are overblown. With each passing quarter, attention will shift from Humira’s falling revenues to the impressive performance of Skyrizi and Rinvoq.

Management is forecasting $10.7bn of Skyrizi revenues in 2014, and $5.6bn of Rinvoq sales, reflecting >50% growth per annum. If these figures are reinforced by Q2 numbers, I would expect Wall Street to pay less attention to Humira’s numbers, which are expected to fall by >30% year-over-year once again. The Street instead will switch its focus to the strong outperformance of the new drugs.

Management appears to have supreme confidence in its two new immunology drugs and has made a policy out of conducting head-to-head clinical studies against rival drugs – i.e., Johnson & Johnson’s (JNJ) Stelara, or Sanofi’s Dupixent, both double-digit billion selling products. These studies have pointed to the superiority of Skyrizi and Rinvoq.

During a fireside chat at The Goldman Sachs Group, Inc.’s (GS) recent healthcare conference, Jeffrey Stewart, AbbVie’s Chief Commercial Officer, told the audience:

So we’ve done something that’s really unprecedented and we’ve highlighted before, where we’ve had 10 head-to-head trials against almost all mechanisms across the indications there. So it’s quite clear to the stakeholders, how good and how transformative Skyrizi and Rinvoq, for example, are.

In summary, if Q2 204 earnings are to be another referendum on the future of AbbVie’s immunology division, as I suspect it will be, then I predict a much more positive response to results than after Q1 earnings.

Other Areas To Consider – M&A, Aesthetics, Eyecare

During Q1, AbbVie completed the acquisition of Immunogen for ~$11bn. Immunogen is an antibody-drug conjugate (“ADC”) specialist – a drug class that is expected to make a massive impact on the way cancer is treated for decades to come. Immunogen has already secured approval for Elahere, in ovarian cancer, and AbbVie is forecasting $450m in revenues in 2024. The drug received its full FDA approval during Q1 and could become a multi-billion-selling asset, so any recent updates will be worth noting.

AbbVie also acquired Landos Biopharma last quarter, for $138m plus milestones of up to $75m, gaining access to NX-13, a “first-in-class, oral NLRX1 agonist”, which it hopes it may use in combo with Skyrizi / Rinvoq, to bolster the immunology division. More clarity on how this may be achieved may be provided on the earnings call.

Meanwhile, AbbVie’s proposed acquisition of the central nervous system drug developer Cerevel is potentially under threat, as the Federal Trade Commission (“FTC”) investigates whether it may be anti-competitive. This is based on Cerevel’s Emraclidine being a therapy that would potentially compete against AbbVie’s near $3bn per annum selling Vraylar, and Parkinson’s Disease candidates that would complement AbbVie’s $500m per annum selling Duodopa, a gold standard PD therapy. Management will likely provide a detailed update on this issue – I’d still expect the deal to go through.

Aesthetics is the only area of AbbVie’s business (besides immunology, which will soon return to growth) that does not appear to be showing growth. While Botox and Juvederm, acquired as part of AbbVie’s $63bn Allergan acquisition in 2020, are clear market leaders, threats are posed by the likes of Evolus, Inc.’s (EOLS) Jeuveau, and Revance Therapeutics, Inc.’s (RVNC) Daxxify.

Management has a target for $9bn of aesthetics revenues by 2029. They were $5.3bn in 2023. Therefore, I would expect to hear some positive updates – if Q2 is another down quarter, there will be rumblings of discontent among analysts. However, I’d consider that unlikely, as AbbVie is truly the 800-pound gorilla in this market.

I’d also be on the lookout for fresh updates around a new, short-acting toxin, which management believes can open a new and lucrative market, and keep Botox ahead of the competition.

Oncology is a division that AbbVie wants to diversify, now that sales of imbruvica, once a >$5bn per annum selling drug, are falling in the face of government pricing controls and fresh competition.

Epkinly, a blood cancer therapy, has secured fresh approval in follicular lymphoma in Q2. It is pegged for >$3bn in peak annual sales, while the likes of ADC candidate and Teliso V and Venclexta, a long-term imbruvica replacement, are progressing through Phase 3 studies, which could be a topic for discussion.

Ultimately, management has pledged that the oncology division will “return to growth” by 2026, however, my suspicion is that AbbVie wants to go further and turn oncology into a double-digit billion revenue per annum division.

Finally, eye care may be a small division, contributing ~$2.5bn revenues per annum, and $538m in Q1 2024, but the pipeline asset ABBV-RGX-314 is an exciting one-time subretinal treatment that targets the VEGF protein. It is indicated to treat wet advanced macular degeneration, making it a potential challenger to Regeneron’s >$8bn per annum selling Eylea. An update on clinical progress would be welcome.

Concluding Thoughts – If AbbVie Sticks To Its Script, I Expect A Positive, Share Price Accretive, Q2 Earnings

While AbbVie’s CEO may be moving on, Gonzalez will likely remain a key figure at the company in his new role as Executive Chairman. With the new CEO being an AbbVie insider, there is no reason to expect AbbVie to make radical changes to its long-term strategic plans.

Those plans, as I have discussed in this note, involve returning to growth within its immunology division, with Skyrizi and Rinvoq more than offsetting any losses from Humira. This could be a >$30bn revenue division by the end of the decade if these two drugs can establish themselves as “best-in-class.” Management is pulling out all the stops to make sure that happens, with head-to-head studies and fiercely competitive marketing.

Meanwhile, oncology and aesthetics are expected to be more or less >$10bn per annum businesses by the end of the decade, and neuroscience also, providing the Cerevel deal gets over the line. Finally, Eye Care is a potential wild card, with an exciting gene therapy in prospect.

In Q2, the headline figures – analysts are expecting normalized EPS of $2.76, and GAAP EPS of $1.56, on revenues of $14.01bn – will be key, as will the latest Humira numbers. However, unlike in Q1, the former may be considered more important than the latter this time, leading to a share price spike if outperformance is achieved.

AbbVie is generally open and transparent with investors about where it sees its growth coming from. Therefore, the new approvals and pipeline updates from the past quarter will help identify any potential issues with longer-term guidance, and also in that context, updates around the Cerevel deal will be noteworthy.

All things considered, my expectation is for AbbVie to meet or exceed expectations in Q2. It will potentially upgrade expectations for the full year. I expect them to continue to make the case for revenues to begin growing again in 2024 after a “trough” year in 2023, and for a high single digit, industry exceeding CAGR between 2025 and 2030, as it has regularly promised.

If that happens, my calculations show that AbbVie can be a>$80bn revenue company by 2030, and my discounted cash flow analysis shows a price target of ~$225. That won’t be achieved in 2024, and certainly not post-Q2 earnings. However, a positive update will help maintain the current upward momentum – AbbVie stock is up by 13% since the end of May – and perhaps guide the share price past the $180 mark.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.