Summary:

- AbbVie’s recent Q2 earnings release was robust, validating my initial bullish thesis, which has aged well as the stock has outperformed the broader market since mid-April.

- The Q2 earnings release strengthened my bullish stance due to the robust performance across all business lines, solid operating leverage, and immense momentum in AbbVie’s flagship products.

- According to my valuation analysis, ABBV stock is still around 35% undervalued.

FilippoBacci

Investment thesis

My initial bullish thesis about AbbVie (NYSE:ABBV) aged well, as the stock is notably outperforming the broader U.S. market since mid-April.

Today, I want to update my thesis, which is especially crucial in light of the fresh Q2 earnings release. ABBV delivered a robust quarter with revenue growing across all business lines and its major young stellar products demonstrating the immense growth momentum. Revenue growth was accompanied by the expanding operating leverage, which is a big bullish sign for investors, indicating the management’s ability to drive growth efficiently. Secular trends also look favorably as all niches where ABBV has a strong footprint are poised to deliver solid long-term growth rates. The valuation is still very attractive as well, according to the updated valuation model. All in all, I reiterate my “Strong Buy” rating for ABBV.

Financial analysis and Q2 earnings review

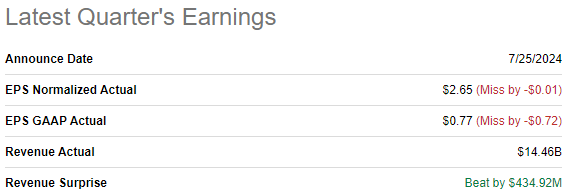

ABBV released its latest quarterly earnings recently, on July 25. There was a solid Q2 revenue beat. On the other hand, EPS figures were below consensus estimates. Nevertheless, investors absorbed Q2 earnings with optimism, as the stock rallied by more than 5% during two days after the release. The reason for optimism is likely explained by the full-year EPS guidance upgrade by $0.10, from $10.61 – $10.81 to $10.71 – $10.91.

Seeking Alpha

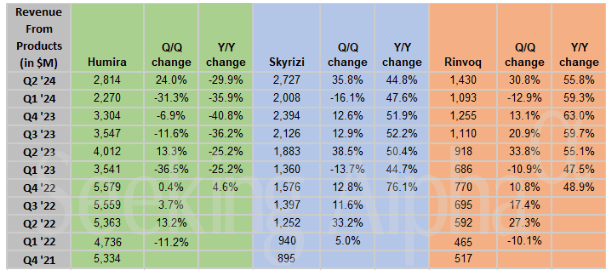

Revenue grew by 4.3% YoY, while the operating margin expanded from 34.4% to 35.1%. Expanding operating leverage is another positive sign, indicating the management’s ability to drive revenue growth efficiently. Massive revenue decline in Humira is not a surprise as the product lost its exclusivity due to patent expiration.

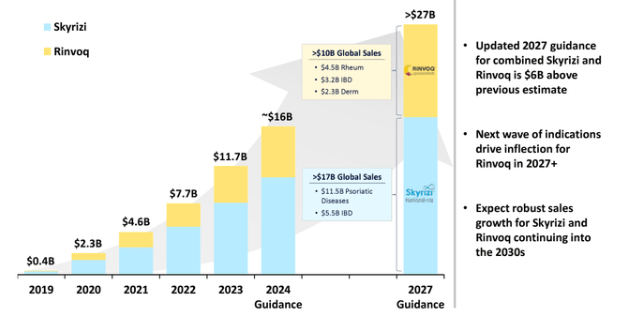

Stellar products losing their exclusivity over time is not something unique in the industry, and a pharmaceutical company’s fundamental strength significantly depends on the ability to consistently release new best-sellers. From this perspective, I want to underline that revenue growth momentum for younger products like Skyrizi and Rinvoq is still immense. The fact that the company’s relatively new stellar products are thriving is a bullish indicator.

Seeking Alpha

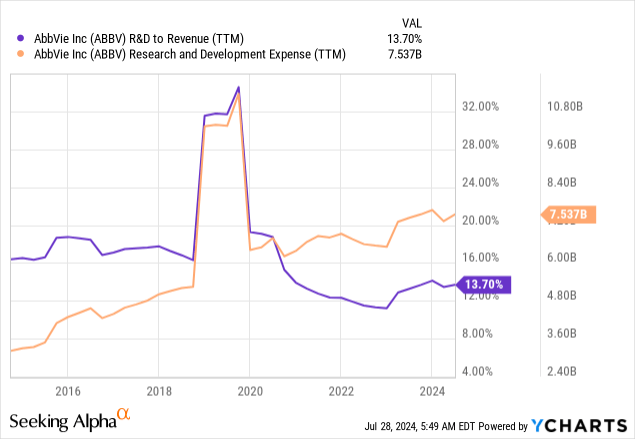

Another bullish sign is that ABBV delivered revenue growth across all business lines: Immunology, Oncology, Neuroscience, and Aesthetics. It is crucial because growth across all segments highly likely means that the company’s business mix is robust and resilient. Moreover, the ability to deliver growth across various business lines suggests that the company is able to roll out compelling products across various domains. That said, the company is quite efficient in converting its substantial R&D budget into financial success.

Apart from the R&D efficiency, ABBV is also very active in fueling growth via acquisitions. During the earnings call, the management announced that this year’s deals are expected to expand the company’s pipeline. For example, the recent acquisition of Celsius Therapeutics, will help in further expanding the company’s footprint in immunology as it will bring a Phase 2 ready anti-TREM1 antibody for IBD and a license agreement with FutureGen to develop a next-generation anti-TL1A antibody for IBD.

To summarize, I think that the recent Q2 earnings release is quite bullish, and the company once again proved its commitment to financial excellence and delivering value for shareholders. I am still very bullish from the secular perspective as well. The long-term growth outlook for niches where ABBV operates is quite optimistic.

The company’s core business is immunology medicine, and this industry is expected to compound with a 12.1% CAGR by 2032. This is crucial as ABBV is a massive player in the niche. According to Fortune Business Insights, the immunology drugs market size was valued at $98.5 billion in 2023. According to the company’s latest 10-K report, AbbVie’s immunology business generated $26.1 billion in FY 2023. This means that AbbVie holds more than a 25% market share in immunology drugs, which is means that it boasts a formidable strategic positioning in this thriving industry. Therefore, I am not surprised that the management is very optimistic about the long-term growth potential of Skyrizi and Rinvoq. According to the 10-K report, both products’ U.S. patents expire in 2033, meaning that generics are not expected to enter the market legally within the next decade.

AbbVie

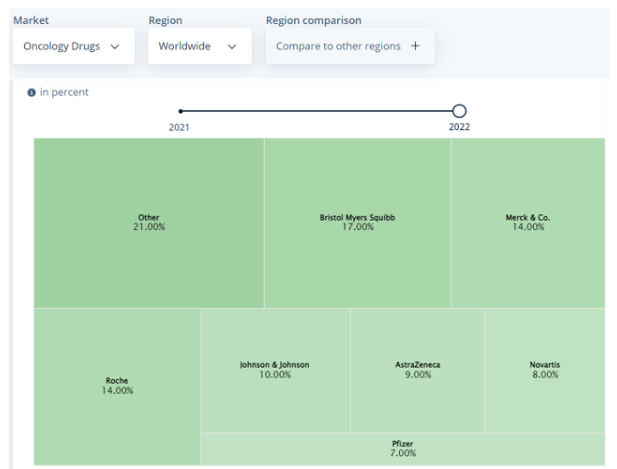

The oncology drugs market is projected to deliver an 11.3% CAGR by 2032. Despite the fact that ABBV is not among the top players in the global oncology market, I think that its success across various business lines indicates the management’s strong flexibility in different niches, which can help in driving oncology revenue growth at least in line with the industry’s growth pace.

Statista.com

Moreover, ABBV also has a notable footprint in the aesthetic medicine market, and this one is also expected to show double-digit CAGR by 2033. This projection does not look too optimistic given the increased penetration of social media, where beauty industry influencers like Kylie Jenner have hundreds of millions of subscribers across various platforms. With its flagship Botox product, AbbVie’s position in the aesthetics market is robust as well.

Global neuroscience drugs market is projected to observe a 4.2% CAGR over the long term. The growth rate in neuroscience looks modest, but it is still higher than historical inflation rates, and the gap between growth and inflation will also likely contribute to the shareholders’ value.

Valuation update

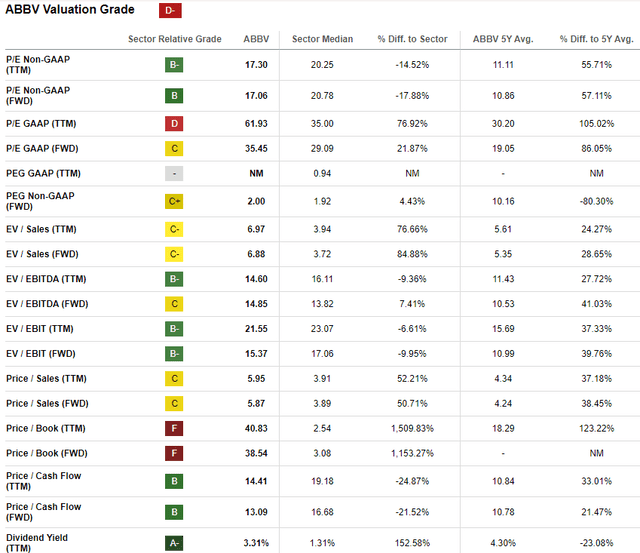

ABBV might seem expensive from the valuation ratios perspective since it has a low “D-” valuation grade from Seeking Alpha Quant. I usually say that for mega caps like ABBV [around $330 billion market cap] it is better to look at the comparison between the current valuation ratios and the last five years’ averages. However, it is not the case for ABBV due to its revenue and profits spike in recent years after Allergan was acquired. Therefore, I would not rely on ratios much in the case of ABBV.

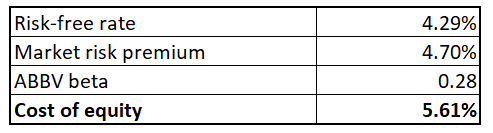

Due to ABBV’s strong dividend consistency, I proceed with the dividend discount model [DDM]. I think that an 8% required rate of return I used last time was too high considering ABBV’s low beta, and this time I want to calculate the cost of equity by myself based on the CAPM approach.

Author’s calculations

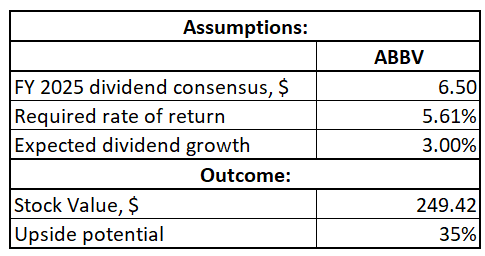

Based on the above calculations, ABBV’s cost of equity is 5.61%. The base-year dividend is $6.50, which is an FY 2025 consensus estimate. The perpetual growth rate is 3%, approximately in line with the current inflation levels. All the above assumptions look fairly conservative for a DDM analysis, in my opinion.

Author’s calculations

According to my DDM simulation, ABBV’s fair value is $249. This is 35% higher than the current share price, representing a compelling investment opportunity.

Risks update

AbbVie’s massive market share in immunology does not mean that the company does not face competition in this niche. According to IQVIA, the immunology market is becoming more crowded with alternative therapy options to treat autoimmune diseases.

As a biopharmaceutical company, ABBV faces substantial risks of its flagship products losing exclusivity. As I mentioned above, one of the company’s all-time bestsellers, Humira faces substantial pressure from generics and biosimilars. While Skyrizi and Rinvoq appear to be successfully replacing revenue decreases from Humira, constant future success is not guaranteed.

While my DDM indicates $249 as ABBV’s fair share price and assumptions look sound, I have to warn readers that the stock never traded anywhere close to the $249 level. As shown below, ABBV is currently not very far from all-time highs, which is still notably below $200. That said, before ABBV moves closer to my fair value estimations, the stock will have to break a crucial psychological $200 level, which might demonstrate solid resistance.

As we see from impressive trends in AbbVie’s profitability, the company’s aggressive approach of growth through acquisitions has proved itself successful. However, investors should keep in mind that past success is not a guarantee that potential new acquisitions will create value for shareholders. Investments in new companies might not bring expected synergetic effects, or payback periods might be longer. Apart from financial risks from acquisitions, there are also integration risks that should not be discounted.

Bottom line

To conclude, ABBV is still a “Strong Buy”. Strong Q2 earnings is not surprising for me as the company is fundamentally strong and operates across very promising industries. The valuation is still extremely attractive, even despite a solid recent outperformance compared to the broader market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.