Summary:

- The total returns of AbbVie’s shares have tripled that of the S&P 500 since I last covered it in November.

- The big pharma company’s fourth-quarter financial results were mixed.

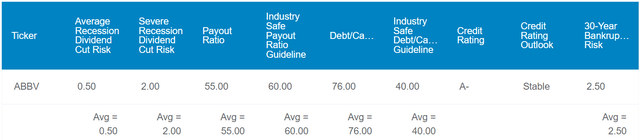

- AbbVie possesses an A- credit rating from S&P on a stable outlook.

- Shares could be 9% overvalued at the current share price.

- I am awaiting a pullback to $155 and below before adding more to my position in AbbVie.

A pharmacist and a customer speak to each other. SDI Productions/E+ via Getty Images

Over near-term to medium-term time frames, financial markets often swing too far in either the direction of greed or fear. That is, share price movements can be exaggerated beyond what is justified by fundamentals.

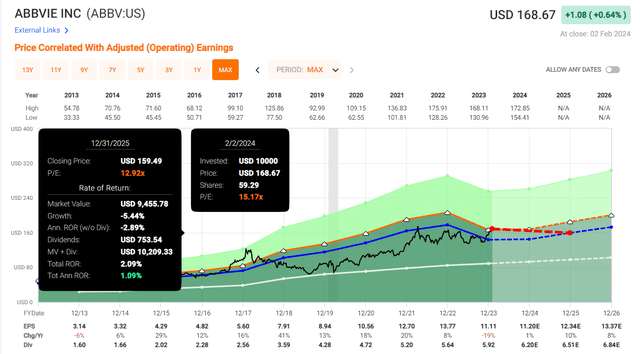

One example of the outsized returns that market sentiment can produce in a short time is AbbVie (NYSE:ABBV). Since I last covered and rated it a buy in November, it has gone on to produce 26% total returns. That’s almost three times the 9% total return that the S&P 500 (SP500) has delivered over that time.

I am sold on AbbVie’s underlying business, with the big pharma company comprising 2.2% of my 99 stock portfolio’s value. This makes it the fourth biggest holding in my portfolio. However, I am downgrading AbbVie from a buy to a hold now. As I will discuss, I think the fundamentals are still sound. But until the valuation becomes more attractive, I have no plans on adding to my position in the days and weeks ahead.

Dividend Kings Zen Research Terminal

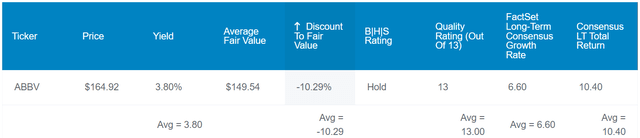

AbbVie’s 3.6% dividend yield remains more than double the 1.4% yield of the S&P 500. What’s more, the company should have ample room to grow its payout further in the years ahead.

That’s because AbbVie’s 55% EPS payout ratio is below the 60% that rating agencies prefer from the pharmaceutical industry. This is why I think that the dividend can grow in line with earnings from here on out. AbbVie’s 76% debt-to-capital ratio is almost twice as high as the 40% that rating agencies like to see from the industry.

However, as I will discuss, AbbVie’s financial health is better than this metric alone would suggest. Thus, the company’s debt is rated A- on a stable outlook from S&P. This implies that AbbVie’s probability of going to zero in the next 30 years is 2.5% per the Dividend Kings Zen Research Terminal screenshot shown above and rating agencies such as S&P.

As a result of these fundamentals, Dividend Kings projects that the chance of the company cutting its dividend in the next average recession is 0.5%. A severe recession would lift this risk further to a still moderated 2%.

Dividend Kings Zen Research Terminal

It’s not hard to imagine that with such an intense rally in such short order, I believe AbbVie is at least somewhat overvalued here. Based on its dividend yield and P/E ratio since spinning off from Abbott Laboratories (ABT) in 2013, shares could be worth $150 each.

My fair value estimate is a bit higher but still close to the $150 range. My inputs into the dividend discount model are as follows: A $6.20 annualized dividend per share, a 10% discount rate, and a 6.25% annual dividend growth rate. Together, these inputs give me a fair value of $165 a share.

When I average out these two fair values, I get a $157 fair value. This suggests shares are priced at a 9% premium versus the $172 share price (as of February 5, 2024). If AbbVie reverts to such a valuation and grows as anticipated, here are the total returns that it could deliver over the coming 10 years:

- 3.6% yield + 6.6% FactSet Research annual growth consensus – a 0.9% annual valuation multiple contraction = 9.3% annual total return potential or a 143% 10-year cumulative total return versus the 9.8% annual total return potential of the S&P or a 155% 10-year cumulative total return

Still Due For A Rebound In Operating Fundamentals

AbbVie Q4 2023 Earnings Press Release

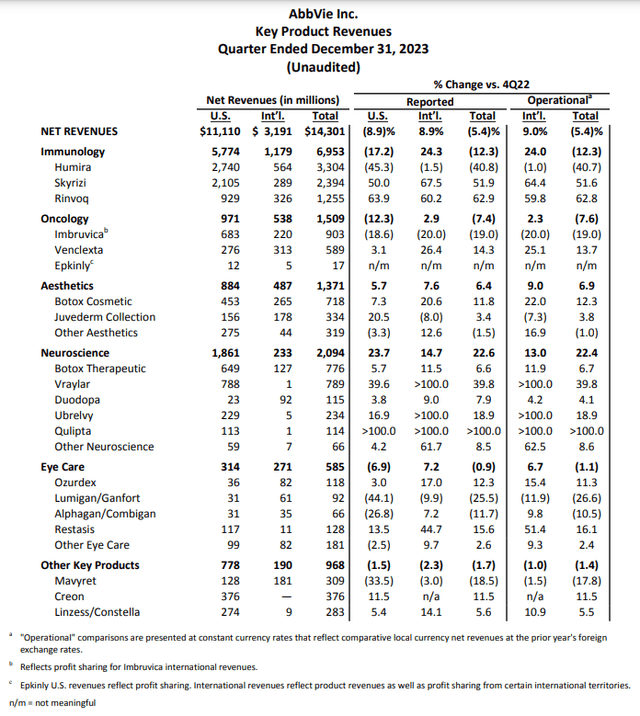

Despite its challenges, from my perspective, AbbVie had a decent fourth quarter that ended Dec. 31. The company’s net revenue fell by 5.4% year-over-year to $14.3 billion during the quarter. However, it’s worth noting that this came in $270 million ahead of the analyst consensus.

As has been the case for a while now, the two therapy areas that have been key to AbbVie were immunology and neuroscience. In the former, net revenue declined by 12.3% year-over-year to $7 billion for the fourth quarter. This decline was entirely due to a 45.3% drop in Humira’s U.S. net revenue to $2.7 billion over the year-ago period as it faced competition from biosimilars. There was plenty of good news in the quarter, though.

Immunology drugs Skyrizi and Rinvoq each posted 50%+ year-over-year growth in net revenue during the fourth quarter. The two drugs grew to a combined net revenue of $3.6 billion, which was greater than Humira’s $3.3 billion in total net revenue. The majority of the net revenue plunge in U.S. Humira revenue looks to have been absorbed. That is how the two immunology blockbusters should be able to counter further net revenue decreases in Humira with double-digit growth rates of their own. Thanks to the continued strength from Skyrizi and Rinvoq, AbbVie anticipates that the two will combine for over $27 billion in net revenue in 2027.

Moving to the neuroscience therapy area, net revenue climbed by 22.4% over the year-ago period to $2.1 billion for the fourth quarter. That was driven by 39.8% year-over-year net revenue growth from the anti-psychotic Vraylar to $789 million.

AbbVie’s adjusted diluted EPS declined by 22.5% year-over-year to $2.79 in the fourth quarter. This missed the analyst consensus by $0.01 per Seeking Alpha. The company’s diminished net revenue base and a 780 basis point contraction in non-GAAP net margin to 34.7% were to blame for this sharp fall in adjusted diluted EPS.

As I alluded to above, it should only be up from here for AbbVie. Analysts are projecting that after falling 19% in 2023, adjusted diluted EPS will grow by 1% in 2024, 10% in 2025, and almost fully recover with 8% growth expected in 2026 per FAST Graphs. In my opinion, these estimates are similar to how I view the company currently. It’s perfectly rational to expect high- single-digit to low- double-digit annual earnings growth in the second half of this decade. That’s because, as the impact of diminishing U.S. Humira sales fades throughout 2024, growth from AbbVie’s other two immunology drugs could return it to mid- single-digit annual sales growth. For more perspective, the company has Rinvoq in phase 3 clinical trials for multi-billion-dollar markets. These include lupus (a potentially $3 billion market by 2025) and alopecia areata (a market with $13.7 billion potential by 2030). Per his remarks during the Q4 2023 earnings call, Chief Commercial Officer Jeff Stewart also anticipates that the company will launch Skyrizi for ulcerative colitis later this year. That is a market that could be worth almost $11 billion by 2030.

Coupled with modest share buybacks and margin expansion, that is how analysts and myself arrive at such an earnings growth forecast.

AbbVie’s interest coverage ratio in 2023 was 7.6 (unless otherwise noted, all details in this subhead were sourced from AbbVie’s Q4 2023 Earnings Press Release). Given that 2023 should be the bottom for the company, this is a decent interest coverage ratio that should only strengthen in the years ahead.

The Dividend Is Adequately Covered

Since 2019, AbbVie’s quarterly dividend per share has cumulatively compounded by 44.9% to the current rate of $1.55. Dividend growth in the next five years probably won’t be as much, but it should still be solid.

That is because the $6.20 in dividends per share that are slated to be paid in 2024 are covered by adjusted diluted EPS. Against the $11.20 adjusted diluted EPS consensus for 2024, this would be a 55.4% payout ratio.

Risks To Consider

AbbVie is a high-quality business, but some risks warrant contemplation.

As it currently stands, the company appears to be well on its way to moving on from Humira. Nonetheless, the same risks remain. If/when Skyrizi and Rinvoq go on to surpass the commercial success of Humira, the same patent expirations will eventually await those drugs. Unless the company’s current group of drugs in clinical trials can get approved by regulators and achieve enough success commercially, its fundamentals could be pressured. Even if AbbVie can overcome these eventual obstacles as I believe it can, it would likely not be without its bumps in the road (e.g., a few years of diminished net revenue and earnings).

Another risk to AbbVie is that it is the target of product liability claims and lawsuits. If materially significant lawsuits were to arise, this could weigh on the company’s growth as well.

Summary: I’m Waiting For Weakness Before Adding

AbbVie is a business that I appreciate in just about every aspect. The management team led by Chairman and CEO, Rick Gonzalez, is arguably second to none. The market-beating dividend is sustainable and positioned to grow further. The company’s financial strength is acceptable, with an A- credit rating. The forward growth potential appears to be fine.

AbbVie’s valuation is the only thing that I don’t like about it at this moment. That is why I am waiting for the stock to fall back to around $155 a share before upgrading it back to a buy, which I believe would be a fair entry point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.