Summary:

- AbbVie Inc.’s Q4 revenue beat expectations, a positive sign considering the expiration of Humira exclusivity in 2023.

- Skyrizi and Rinvoq contributed $3.7 billion to Q4 revenue, showing strong growth that prompted the company to guide up its 2027 sales projections by $6 billion.

- AbbVie’s stock is technically strong and has room for further upside before becoming overbought.

Bloomberg/Bloomberg via Getty Images

AbbVie Inc. (NYSE:ABBV) recently reported its Q4 results as Seeking Alpha has covered here. The stock went up less than 1% after the earnings but is up nearly 9% YTD. 2023 was expected to be a challenging year for the company given the Humira patent expiration. How did AbbVie perform in Q4 and 2023 in general? Let’s find out below.

Before that, my most recent coverage on AbbVie was ahead of the company’s Q3 when I rated the stock a “Buy”, primarily backed by its valuation and well-covered dividend yield. Since then, the stock has gone up nearly 16% compared to the market’s 14% run. Let us now get into the details.

The Good

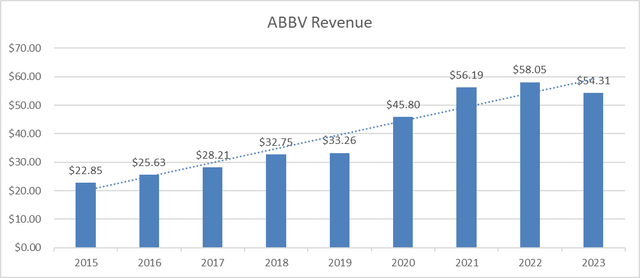

- Q4’s revenue of $3.304 billion beat expectations by about 2%, which marks the third consecutive quarter that AbbVie has beaten estimates. This is a significant positive for the company given that Humira exclusivity expired in 2023 and several biosimilars are already available in the market. While there have been a couple of years (including 2023) where revenue fell YoY, it has gone up nearly 150% since 2015.

ABBV Revenue (Author, data from Seekingalpha.com)

- In my Q3 preview, I had written that AbbVie expected to bring in $21 billion by 2027 from its new wonder drugs, Skyrizi and Rinvoq. This number was upgraded to $27 billion during Q4’s earnings call. In addition, Skyrizi and Rinvoq added $3.7 billion to Q4 revenue while showing a 32% QoQ growth.

- Revenue from Botox cosmetics segment rose 12% YoY to come in at $718 million. The company is excited about the long-term potential, stating the below on its Q4 call:

“We do see it as a long-term tailwind any time people are getting more engaged in their appearance“

The global Botox market is already $4.3 billion strong and is expected to grow at 10%/yr till 2035. As a side note, I had a chuckle reading the “any time people are getting more engaged in their appearance” line as I believe a vast majority of us are guilty of vanity, which is great news for AbbVie.

- While this is not directly related to Q4, AbbVie announced a dividend increase after my previous coverage. The new annual dividend of $6.20/share gives AbbVie a dividend yield of 3.70%, which is down a bit from the 4% at the time of my previous writing but that is largely due to the stock’s 15% run up in price.

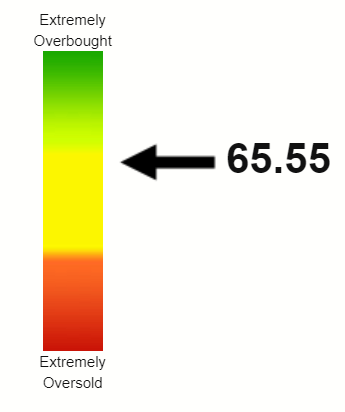

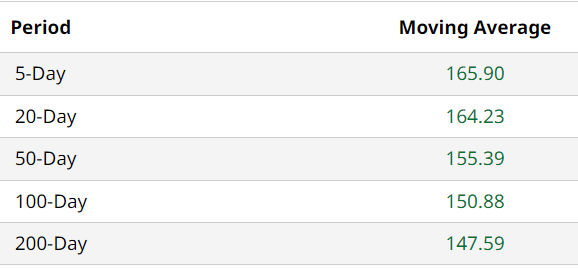

- Finally, AbbVie stock is in a much stronger place technically now than it was during my last review. ABBV’s Relative Strength Index [RSI] was in the 30s and heading towards the oversold zone back then and is now in my personal sweet-spot of 60s. At 65, the stock is both showing accumulation and has enough room to the upside before getting overbought technically. In addition, the stock is trading above all the commonly used moving averages.

ABBV RSI (stockrsi.com) ABBV Moving Avgs (barchart.com)

The Bad and The Ugly

- Full-year global immunology portfolio revenue went down 10% YoY, primarily due to the Humira situation. While Skyrizi and Rinvoq are getting stronger by the quarter, I expect 2024 to be another down year in terms of overall revenue YoY.

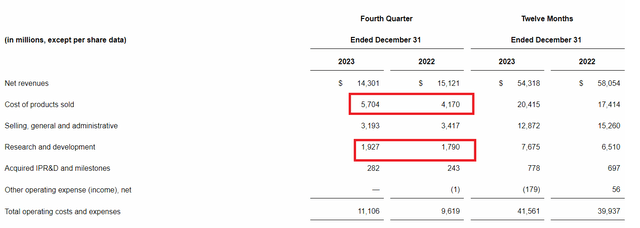

- It is understandable that R&D expenses went up nearly 8% in the year of Humira patent expiration but even Q4 Revenue went down 5.4% YoY, cost of products sold went up nearly 37% at the same time. For the FY, cost of products sold went up 17%, clearly conveying that this was not just a quarterly occurrence. In another worrying sign, selling and general admin expenses have gone up nearly 50%, from $6.7 billion in 2019 to $13.1 billion in 2023.

ABBV Rev and Cost (investors.abbvie.com)

- The company anticipates headwinds in China to continue into 2024, just as it experienced in Q3 and Q4 2023. It remains to be seen if the company can meet its expectations from this market where it plans to launch nearly 30 drugs in the next five to six years.

Conclusion

AbbVie reported a decent Q4 in my opinion, despite the expected YoY decline in revenue. The stock’s run since my October review has increased its forward multiple from 13 then to 15 now. While that sounds cheap on paper, bear in mind that the company is expected to slow down over the next five years with growth rate declining.

The stock is now almost at its median price target, although I expect the price target to be revised upside as analysts digest the Q4 numbers, especially the $6 billion upward revision in 2027 projections for Skyrizi and Rinvoq. I am retaining my “Buy” rating on the stock, backed by its still-reasonable forward multiple, the recently-increased dividend, and the less than expected impact from the Humira cliff.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.