Summary:

- AbbVie investors have good reason to be concerned about the company’s future return potential.

- Sales are expected to fall markedly this year due to the patent expiration of Humira in domestic markets.

- And judging by its dividend yields (3.94% currently), the stock’s valuation is no longer cheap.

- However, priced at ~11.4x of its FY1 pretax earnings, it still provides an asymmetric return/risk potential according to Buffett’s 10xEBT rule (earnings before taxes).

- And the business is well-prepared for the patent expiration.

vzphotos

The Investment Thesis

If you have been bullish on AbbVie (NYSE:ABBV), you have good reason to reconsider your thesis given the development in the past few months. The impacts of Humira patent expiration are as bad as everyone feared. With the first generic version of the drug being made available earlier this year, this flagship franchise saw a large sales decline. In the recent Q2 earnings release, ABBV reported a 25% decline in Humira sales globally and a 26% decline in the U.S. market. In the meantime, the stock’s valuation is no longer as cheap as 2~3 years before. As seen in the chart below, judging by its dividend yields, the stock’s current yield of 3.94% is below its historical average of 4.41% by a good amount.

Against this backdrop, the thesis of this article is to argue for a “Buy” rating on the stock. For its Humira issue, I will argue that the business is well-prepared for it already. The company has been investing heavily in replacement drugs for years, and these efforts have resulted in two promising new drugs: Rinvoq and Skyrizi. And I will detail their implications later. For valuation, I will analyze it from an alternative approach, following the so-called Buffett’s rule of 10xEBT. And as you will see, according to this timeless wisdom, the stock still offers a very attractive valuation and sizable return potential.

Buffett’s 10x Pretax Rule

For those new to Buffett’s 10xEBT rule, our blog article provides a detailed tutorial. Here I will only provide a very brief recap for ease of reference.

The grandmaster paid ~10x pretax earnings (referred to as “EBT,” Earning Before Taxes, in the remainder of this article) for many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express, Wells Fargo, Walmart, Burlington Northern, and the more recent Apple. This is hardly a coincidence because:

- The best equity investments should be bond-like. When we speak of bond yield, that yield is pretax. So, a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. Any growth will be a bonus.

- A second reason why the rule makes good sense is that after-tax earnings do not reflect business fundamentals. Taxes can change due to factors that have no relevance to business fundamentals, and there are plenty of ways for a company to optimize its tax obligations.

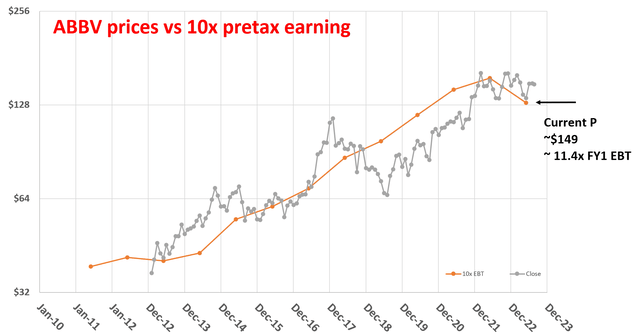

Now, specific to ABBV, the stock is currently trading around a price of $149 as of this writing. Consensus forecasts an FY1 EPS of $11.05. The company’s effective tax rates have been on average 15% in recent years. Assuming this same tax rate, its FY1 EBT would be about $13.0 per share. As such, under its current price, it’s trading at about 11.4x of its FY1 EBT as seen in the chart below.

It’s a bit higher than 10x, and therefore, not the most ideal fit for Buffett’s 10xEBT rule. However, from the chart, you can see whenever the price is near or below 10x EBT, it has generally been a good time to buy. And the stock did trade at multiples substantially above 10xEBT for extended periods. Thus, I’m not too concerned if the entry price is only slightly above 10xEBT. And furthermore, I see good growth potential ahead as to be elaborated on next.

Author Based on Seeking Alpha Data

Warnings

But before I start on the growth aspect, a strong warning is in order. The 10xEBT rule does not mean that everything selling close to or below 10x is a good investment. As detailed in our blog article, the 10xEBT rule helps us avoid valuation risks after survival risk has been eliminated. And the unsaid assumption for my thesis is of course that ABBV has no existential risk, which is a good assumption in my view.

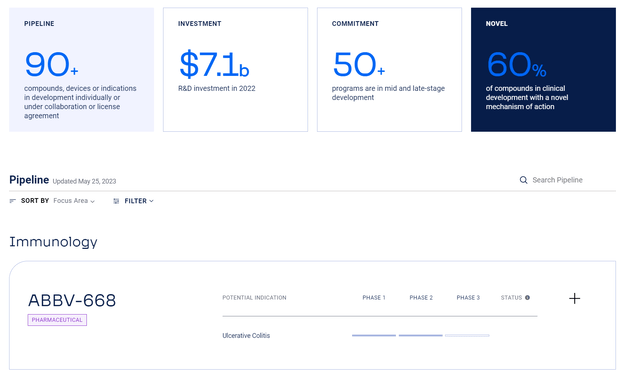

If any of us are concerned about extension risk (at least in the near term) for ABBV, then I think it’s again because of the Humira issue. As mentioned earlier, my view is that ABBV is well-prepared for the patent expiration and has a strong lineup of both replacement drugs and pipeline drugs. As seen in the chart below, its pipeline includes more than 90 compounds, devices, or indications in development individually or under collaboration or license agreement.

As aforementioned, Rinvoq and Skyrizi have been gaining strong momentum since their release. Management expects them to bolster the immunology portfolio in the wake of Humira’s losses. And they expect these two new drugs to combine for more than $20 billion in sales by 2027. I certainly share management’s optimism given the positive results so far and the continued approval for their application to a wider range of conditions. Besides its strong immunology portfolio, the company’s pipeline also includes promising candidates in other key areas such as neurosciences (e.g., drugs targeting Alzheimer’s Disease) and also oncology (e.g., drugs targeting lung cancer).

ABBV’s Growth Prospects

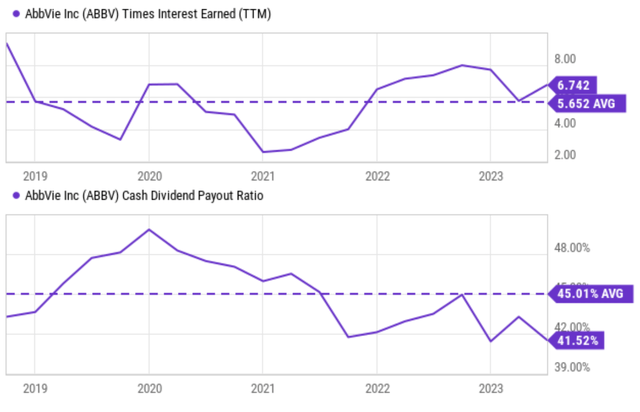

ABBV certainly has the financial strength to continue investing in these new drugs. As seen in the chart below, the company’s financial strength is close to a peak level in multi-years as measured by the interest coverage ratio (top panel) and so is its capital allocation flexibility as measured by the dividend payout ratio (bottom panel). Hence, I would be happy with its 11.4x EBT valuation even if it stops growing with its financial strength and staying power. An 11.4xEBT already translates into a pretax return of ~9%.

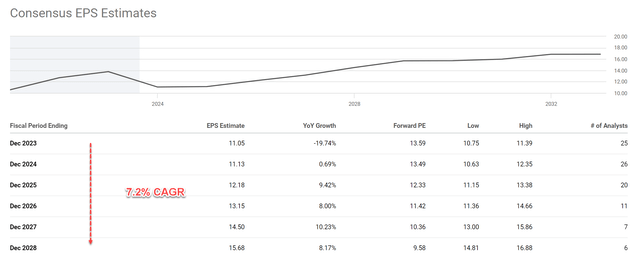

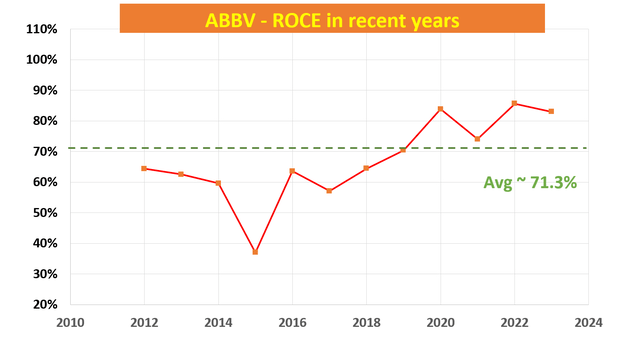

Yet, the stock offers plenty of growth potential. As seen from the chart below, consensus estimates forecast an EPS growth of 7.2% in the next five years. And I totally agree with such a forecast based on its pipeline as analyzed above and also its current profitability and growth investment. As seen in the second chart below, ABBV has enjoyed a robust and expanding return on capital employed (“ROCE”) in recent years. To wit, its ROCE has been on average 71.3% in the past 10 years. And its current level is substantially above the historical average. Long-term earnings growth is governed by the product or ROCE and reinvestment rate. My estimate of its reinvestment rate is around 10% in recent years, thus leading to ~7.1% of organic growth, consistent with consensus estimates.

Author and Seeking Alpha Data Author Based on Seeking Alpha Data

Risks and Final Thoughts

Investment in ABBV entails some risks too. To start, as with any drug development, the trial results and approval are generically uncertain. An immediate uncertainty involves ABBV’s acquisition of IPR&D and the milestones expenses. The acquisition could both impact ABBV’s future earnings and also new drug developments. Its Q2 earnings report already anticipates an unfavorable impact of $0.23 per share on its EPS due to this acquisition. And the earnings release acknowledged that impacts further out cannot be reliably forecasted at this point. The acquisition also could delay the progress of its pipeline drugs in several ways. The acquired IPR&D may be associated with products that are still in development and not yet proven to be successful. And the acquisition can take more resources, both monetary and management time, than expected.

All told, I see an overall favorable return/risk ratio under current conditions. In terms of business fundamentals, I see the company well-prepared for the Humira patent cliff and also poised for sustained growth. In terms of valuation, the stock is still trading at an attractive level according to Buffett’s 10xEBT rule. Priced at 11.4x FY1 EBT, it offers almost 9% pretax yield. Combined with growth, the stock offers a double-digit total return potential per annum.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.