Summary:

- AbbVie’s stock price fell by about 7% last week after the company revised its full-year and Q1 guidance downward.

- There are indeed a few near-term challenges, including Humira sales decline, acquisition synergies, and milestones expenses.

- However, looking beyond these immediate challenges, I see an excellent business for sale at a very reasonable price.

- In essence, I see it as an opportunity to invest in an equity bond around 10x EBT that is very likely to grow its earnings at ~8%annual rate.

vzphotos

Why did ABBV price fall sharply last week?

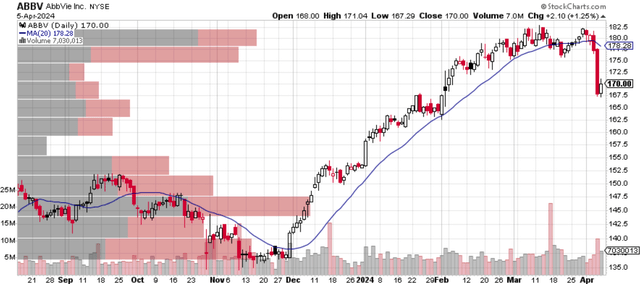

AbbVie (NYSE:ABBV) suffered some of the worst declines last week. As you can see from the chart below, the stock just touched a near-record all-time high of around $182.5 earlier last week. Then the sell-off started last Thursday after the company revised its full-year and Q1 guidance. All told, the stock suffered a sizable correction of about ~7% in the past week.

The market has good reasons for such a response – at least for the near term because the company revised its EPS outlook downward. As detailed in the following news update:

ABBV said its full-year and Q1 2024 guidance for adjusted diluted earnings will now stand at $10.97–$11.17 and $2.18–$2.22 per share, respectively, after accounting for acquired in-process R&D and milestones expenses.

To better contextualize things, back in February 2024, ABBV just reaffirmed its full-year EPS guidance (adjusted and fully diluted) in a range of $11.05–$11.25 for 2024. As such, the revision reflected an ~2% downward adjustment.

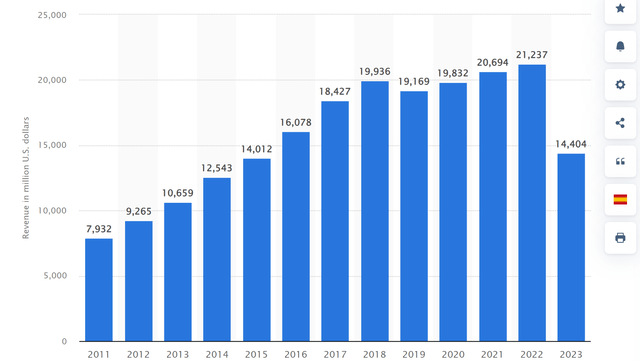

In addition to the acquired in-process R&D and milestones expenses, ABBV is also facing a few other headwinds in the immediate term. The top one in my view is, the degree of the Humira sales decline. The market has of course prepared for the patent expiration on Humira. And the softened demand over the past few years due to exclusivity loss is not a surprise. The chart below shows AbbVie’s revenue from its top product Humira from 2011 to 2023. As you can clearly see, from 2011 to 2022, AbbVie’s revenue from Humira enjoyed a robust upward trend. This one immunology drug has generated hundreds of billions in sales over the last two decades and is the main driver that helped to establish AbbVie as a powerhouse in the large pharma space it is now. However, the trend dramatically reverses in 2023. Revenue dips from more than $21B in 2022 to only about $14.4B.

But I am afraid that the worst is not over yet. Competition started entering the U.S. market in force during 2023, and I anticipate the disruption to be at its worst in the next 1-2 years. The extent of the impact on Humira sales is very uncertain and creates an overhang on investors’ minds (including my own) rightfully so.

Buffett’s 10x Pretax Rule

However, for those of us who have a longer investment timeframe (say ~5 years) and can manage to look beyond the next 1-2 years, I see ABBV as a good fit to Buffett’s 10xEBT rule – i.e., a good example of an equity bond. For those new to the 10x EBT rule, our blog article provides more details and the gist is highlighted below:

The grandmaster paid ~10x pretax earnings (referred to as “EBT”, Earning Before Taxes, in the remainder of this article) for many of his largest and best deals. The list is a really long one, ranging from Coca-Cola, American Express, Wells Fargo, Walmart, Burlington Northern, and the more recent Apple. This is hardly a coincidence because:

- The best equity investments should be bond-like. When we speak of bond yield, that yield is pretax. So, a 10x EBT would provide a 10% pretax earnings yield, directly comparable to a 10% yield bond. Any growth will be a bonus.

- A second reason why the rule makes good sense is that after-tax earnings do not reflect business fundamentals. Taxes can change due to factors that have no relevance to business fundamentals, and there are plenty of ways for a company to optimize its tax obligations.

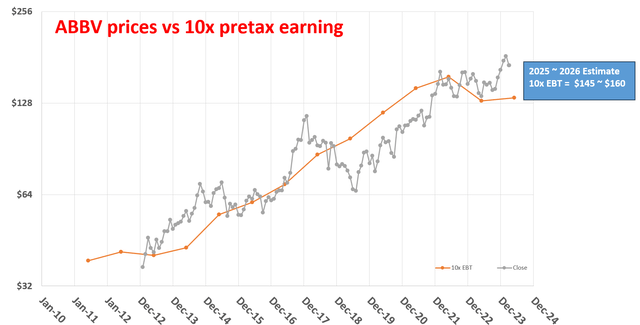

Specific to ABBV, the chart below compares its historical prices against 10x of its EBT. As seen, as a stalwart in the healthcare space, its prices have never strayed too far from the 10x EBT line.

Source: author based on Seeking Alpha data

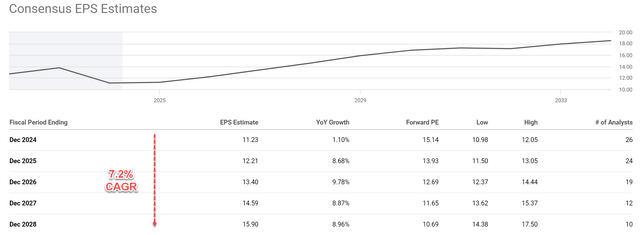

For 2024, due to the EPS pressure mentioned above, its current price of $170 is higher than its 10x EBT as seen. However, consensus expects the growth to resume in 2025 and the growth would bring the valuation to be about 10x EBT again. To wit, consensus forecasts a 2025 EPS of $12.2 and a 2026 EPS of $13.4. My projection for its effective tax rates is around 16% (consistent with its own outlook). At a 16% tax rate, its EBT for 2025 and 2026 FY then is estimated to be ~$14.5 and $16.5 per share, respectively, quite close to the current market price of $170.

Other risks and final thoughts

Moreover, my estimate for its growth in the next ~5 or so is a bit more optimistic than the consensus estimate. As seen in the chart above, consensus estimates imply a growth rate of 7.2% CAGR for the next 5 years. ABBV has been maintaining an average ROCE (return on capital employed) of around 80% in recent years. Considering its R&D, CAPEX, and also acquisition, my estimate of its reinvestment rate is at least 10%. Thus, I expect a real growth rate of around 8%, and the notional growth rate would be higher once an inflation escalator is added. There are plenty of growth catalysts afoot in my view. For example, the Rinvoq and Botox franchises have been very successful, and I expect the momentum to continue. Speaking of acquisitions, I also consider the recent acquisitions of ImmunoGen and Cerevel to be highly synergistic and expect meaningful contributions in the next few years to come.

In terms of downward risks, ABBV faces all the risks common to its fellow drug manufacturers such as clinical trial failures, regulatory changes, etc. While at the same time, there are also some challenges more specific to ABBV. As aforementioned, competition from generics and biosimilars is more pronounced to ABBV given the Humira patent cliff. In the meantime, its Rinvoq and Botox are not large enough to completely replace Humira. As such, I see a larger pipeline concentration risk at ABBV compared to other pharmaceutical stocks. ABBV’s future growth heavily depends on the success of drugs currently in the pipeline. If these drugs fail clinical trials or underperform in the market, ABBV might struggle to maintain its current growth trajectory.

All told, AbbVie certainly faces some headwinds, but my view is that these headwinds are largely all near-term. My thesis is that the company presents a compelling long-term investment opportunity. It’s a good case that fits Buffett’s 10x EBT rule. In essence, I see it as an opportunity to invest in an equity bond around 10x EBT that is very likely to grow its earnings at ~8% annual rate.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.