Summary:

- A proven track record of putting shareholders first is part of the litmus test that I use before buying stocks.

- AbbVie’s recent 4.7% dividend hike builds on an impressive dividend growth streak that it inherited from its former parent company, Abbott Labs.

- The pharmaceutical titan held up well in the third quarter, posting a double beat.

- AbbVie appears to be trading at a 9% discount to fair value.

- The ultra SWAN looks positioned to outperform the S&P 500 by a wide margin through the coming 10 years.

U.S. banknotes in the background. alfexe/iStock via Getty Images

As a dividend growth investor, I don’t put my hard-earned money into just any old business that pays a dividend. What has become more true with each passing year is that my investments need to earn and maintain my trust.

How can that be accomplished? A stable growth outlook, a sustainable dividend, and a financially sound balance sheet are three important factors in my analysis of a dividend payer. But as much as my investment decisions are guided by fundamentals, another consideration is a company’s attitude toward rewarding shareholders and creating value for them.

Besides strong fundamentals, I tend to emphasize investing in companies with lengthy dividend growth streaks. This is because the safest dividend is most often the one that has just been raised. Sure, you’ll occasionally be shocked by a situation like what happened with W.P. Carey (WPC). However, that is the exception to the rule.

AbbVie (NYSE:ABBV) just upped its quarterly dividend per share to be paid in February by 4.7% to $1.55, which was $0.01 more than I was expecting. Since being spun off from Abbott Laboratories (ABT) in 2013, the former has also boosted its dividend each year.

AbbVie makes up 1.8% of my individual stock portfolio weighting and is my sixth-largest position by portfolio value. For the first time in about six weeks, let’s revisit the company’s fundamentals and valuation to understand why I am upgrading it to a buy as of now.

Even in this environment where the 10-year U.S. treasury is yielding 4.3%, AbbVie is competitive with a 4.5% dividend yield. Investors can be confident that this dividend is also rather safe for a few reasons.

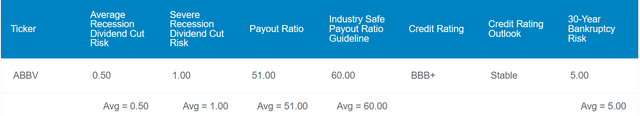

First, AbbVie’s 51% EPS payout ratio is below the 60% that rating agencies consider to be safe for the pharmaceutical industry per Dividend Kings. That is even with the ongoing challenge that the company is tackling in shifting away from its top-selling drug, Humira.

Secondly, AbbVie maintains a BBB+ credit rating from S&P on a stable outlook. That implies the risk of going bankrupt in the next 30 years is just 5% according to Dividend Kings.

Finally, I will elaborate on AbbVie’s amazing free cash flow generation in the dividend section of this article. For these reasons, Dividend Kings estimates that the risk of a dividend cut in the next average recession stands at merely 0.5% and 1% in the next severe recession.

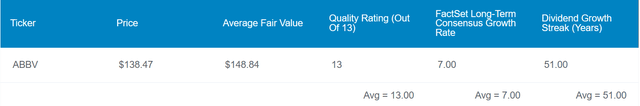

Thanks to a 6% pullback in AbbVie’s share price since my last article and its dividend raise, the stock has shifted from modestly overvalued to modestly discounted versus its current $139 share price (as of November 29, 2023).

Using historical dividend yield and P/E ratio, Dividend Kings values shares of AbbVie at $149. This jives with my $155 fair value estimate, which I arrived at using the following inputs for the dividend discount model: A $6.20 annualized dividend per share, a 10% discount rate, and a 6% annual dividend growth rate (I believe dividend growth will again accelerate as AbbVie turns the corner).

If the ultra SWAN meets growth expectations and returns to an average fair value of $152, here are the returns AbbVie could generate for the next 10 years:

- 4.5% yield + 7% annual FactSet Research growth consensus + 0.9% annual valuation multiple expansion = 12.4% annual total return potential or a cumulative 10-year 222% total return against the 9% annual total return potential of the S&P 500 (SP500) or a cumulative 10-year 137% total return

AbbVie Is Executing Well

AbbVie Q3 2023 Earnings Press Release

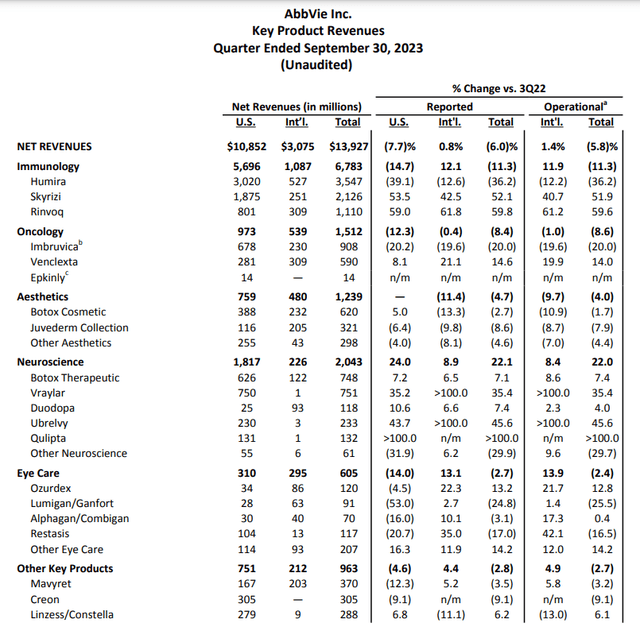

Over the years, AbbVie has proven itself to be a relatively steady performer within its industry. The third quarter of 2023 was no different for the company. AbbVie’s $13.9 billion in net revenue was down 5.9% over the year-ago period. However, this came in $220 million ahead of the analyst revenue consensus.

Despite a 36.2% year-over-year decline in net revenue to $3.5 billion, Humira will remain a key part of the business in terms of cash flow over the next few years. AbbVie again demonstrated that its future is comprised of several drugs growing like weeds. This is what led the company’s non-Humira net revenue to grow by over 12% during the third quarter, according to President and COO Rob Michael’s opening remarks in the recent earnings call.

As I noted in my previous article, best-in-class immunology medicines Skyrizi and Rinvoq are leading the way. Due to expanding market share and additional indications, both of these drugs grew net revenue at 50%+ rates in the third quarter. Per Chief Commercial Officer Jeff Stewart, the two drugs are on pace to top $11.6 billion in combined sales in 2023. In addition to ongoing momentum, the ulcerative colitis indication for Skyrizi is expected to be approved in the U.S. and Europe in 2024. For these reasons, AbbVie thinks the peak net revenue of these two medicines will top Humira’s peak net revenue by 2027. From there, the net revenue of the duo could continue growing at healthy rates.

The company’s adjusted diluted EPS of $2.95 was down 19.4% over the year-ago period, though this topped the analyst consensus by $0.08. A lower net revenue base and a contraction in non-GAAP net margin were responsible for the downtick in adjusted diluted EPS.

AbbVie’s interest coverage ratio of 5.9 isn’t the most robust in its industry. However, it’s worth noting that this isn’t an apples-to-apples comparison as the company is going through a patent cliff that peers aren’t right now but will eventually. For the circumstances, this interest coverage ratio suggests that the company is fine financially. In the coming 24- to 36 months, I expect AbbVie to stabilize to a more ideal interest coverage ratio in the high- single-digits.

AbbVie Is A Free Cash Flow Monster

AbbVie’s dividend appears to be safe from an adjusted diluted EPS perspective. More importantly, the company also knows how to produce loads of free cash flow to pay its dividends and repurchase shares.

AbbVie generated $17.5 billion in free cash flow through the first nine months of 2023. Compared to the $40 billion in net revenue during that time, this is a blistering 43.8% free cash flow margin. Against the $7.9 billion in dividend paid and $2 billion in share repurchases (pages 7 and 3 of 47 of AbbVie 10-Q filing), AbbVie has ample free cash flow to keep growing the dividend and lowering its share count.

Risks To Consider

AbbVie is undoubtedly a blue-chip dividend stock, but it isn’t perfect.

The company has a deep pipeline and several seemingly promising products in its portfolio. However, I would reiterate the risk that competition against these products could be greater than currently anticipated. If this proves to be true, it could weigh on AbbVie’s growth prospects.

Patent expirations are also a part of the pharmaceutical industry. Although I am confident in the company’s ability to manage these bumps in the road, AbbVie and the industry itself may not be right for everybody.

Like other businesses, the company is also dependent on IT infrastructure to keep its operations running efficiently. If these systems were to experience a failure, AbbVie’s operations could be impacted.

Summary: An Undervalued, High-Quality Dividend Growth Stock

AbbVie is a world-class business that I am glad to have in my portfolio. If I weren’t working on building my emergency fund up for another six- to eight weeks, I would consider adding to my position a bit here.

That is because AbbVie is trading under my $152 average fair value estimate per my inputs into the DDM and Dividend Kings’ $149 fair value. This valuation level builds in an adequate margin of safety in my opinion to meet my 10% annual total return requirements if the company comes up short of the analyst growth consensus.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.