Summary:

- AbbVie Inc.’s share price has been slipping as its globally best-selling drug Humira has lost its U.S. patent protection.

- At least 8 biosimilar versions of the drug will be launched by rival companies this year – Humira sales will likely decline by ~30% year-on-year, and ~25% thereafter.

- Slightly underwhelming Q1 2023 earnings have also affected ABBV stock’s valuation – but shareholders should not panic.

- Management is doing a strong job of coping with one of the biggest challenges in Pharma – replacing an asset worth >$20bn in annual sales.

- Management has promised a return to growth within 3 years thanks to new drugs Skyrizi and Rinvoq and other burgeoning divisions, plus the dividend yields >4%. AbbVie remains a magnet for investor money.

FG Trade/E+ via Getty Images

Investment Overview – Why Humira’s Patent Expiry Is So Significant For AbbVie

Since AbbVie Inc. (NYSE:ABBV) was spun out of Abbott Laboratories (ABT) in 2012, in order to split the Pharmaceutical / drug development business from the Nutritionals, Diagnostics and Medical Devices divisions, and allow the market to value it independently. Its share price has delivered gains of ~300% – significantly outperforming the 200% gain posted by the S&P 500 (SP500) over the same period.

AbbVie has gone from strength to strength and is now the U.S.’ 4th largest Pharmaceutical by market cap valuation – at $241.5bn, AbbVie is now worth substantially more than its parent company Abbott’s $181bn.

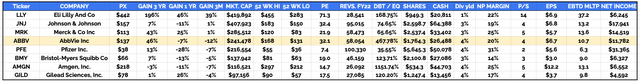

With that said, across the past 5 years AbbVie shares have gained ~40%, whilst the S&P has increased in value by >55%, but across the past 12 months its share price has decreased in value by 7%. Across the past 3 months, AbbVie’s share price is down by 12% – making it the worst performing amongst U.S. based, >$100bn market cap “Big Pharma” companies.

“Big 8” US Pharmaceutical companies compared (TradingView, Google Finance)

The past 12 months has been a difficult period for the Big Pharma sector – as we can see in the table above, 6 of 8 companies have seen their share prices fall. Sector wide headwinds include the introduction of the Inflation Reduction Act, which prevents Pharma’s raising drug prices by more than the rate of inflation, and an ongoing battle to demystify and change the way drugs are priced, to make them more affordable for patients.

In AbbVie’s case, however, the company has been facing an even greater, company specific threat. It’s all-time best-selling drug Humira, indicated for a range of autoimmune conditions, and largely responsible for AbbVie’s becoming a Top 5 U.S. Pharma by size, revenues, and profits, lost its patent protection in the U.S. this year.

Implications of a drug losing patent exclusivity

When a drug’s patents expire it means that other companies can market and sell “generic” or “biosimilar” drugs that are near identical to the original drug, i.e., these companies can copy AbbVie’s formula for manufacturing Humira without fear of being prosecuted for patent infringement.

New drugs are typically awarded a 10-year period of “exclusivity” in the marketplace, meaning only the company that developed the drug can market and sell a version of it. This is the company’s reward for discovering a valuable new drug, and helps to cover the Research & Development costs that went into developing it.

The underlying idea is to stimulate the development of new and better drugs – if there were no period of exclusivity, then companies would not be incentivized to invest in R&D, because other companies could simply copy their work and bring competing products to market in a matter of months.

Some argue that the system is open to abuse – for example AbbVie has long been accused of creating a “patent thicket” around Humira, continually registering new patents for minor changes to manufacturing methods, for example, in order to extend the period of patent exclusivity.

According to research, the average cost of developing a new drug – from preclinical candidate to approved and branded therapy available via prescription – is ~$2bn. That seems like a big number, and helps explain why drug developers deserve to be rewarded for investing such large sums – especially when the failure rate can be as high as 90%. According to Deloitte, the return on investment from new drugs fell to as little as 1.2% last year – the lowest in 13 years.

Humira Breaks The Mold By Becoming a “Mega-Blockbuster”

Every now and then, however, an all-conquering drug like Humira is discovered, and the revenues earned from these “mega-blockbuster” make the return on investment almost unfathomably large. Between 2018 – 2022, for example, Humira earned revenues of $19.9bn, $19.2bn, $19.8bn, $20.7bn, and $21.2bn – nearly $100bn over a 5-year period.

Clearly, AbbVie has been handsomely rewarded for developing Humira – a tumor necrosis factor (“TNF”) inhibitor that rapidly established itself as a best-in-class therapy and won approvals in multiple indications including Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Ankylosing spondylitis (“AS”), Psoriasis (“PsO”), Hidradenitis suppurativa (“HS”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”).

It is hardly surprising that AbbVie was desperate to prolong its patent protection for Humira, given the drug accounted for e.g. 43%, 37%, and 36% of the company’s entire revenues between 2020 – 2022 – but having extended patents that were originally scheduled to expire in 2016 for many more years, after their expiration in Europe in 2018, 2023 is the year they have finally expired in the U.S.

The Humira Generic / Biosimilar Invasion

Naturally, many generic drug developers and biosimilar specialists have been impatiently awaiting the patent expiry date in the U.S., so that they can launch their generic and biosimilar drugs and claim a share of a >$20bn annual market.

In 2023, Amgen’s (AMGN) Amjevita – a Humira biosimilar – was able to launch in February, followed by Organon’s (OGN) Hadlima, in July, then Cyltexo, developed by Boehringer Ingelheim, and Coherus’ Biosciences’ (CHRS) Yusimry, and Viatris’ (VTRS) Hulio, also July, and then Novartis’ (NVS) Hyrimoz, in September, and Pfizer’s (PFE) Abrilada, in November.

These companies hoping to challenge Humira are not small, speculative biotechs with limited marketing experiences and resources, but a selection of the world’s largest pharmaceutical companies – in short, the game is truly up for Humira and the drug’s sales will begin to fall billions per annum – although there are some extenuating circumstances.

For example, patients who have certain types of medical insurance do not have to pay much for Humira – as little as $5 per month reportedly, and may therefore have no desire to switch from a medicine they know and trust. Likewise, physicians may not initially have access to, trust, or even be aware of the new biosimilar drugs, and may find it simpler, and better for patients, to keep prescribing Humira.

History tells us however that drugs losing their patent protection see their sales decline at a rate of ~25% per annum or more, and this is confirmed both by the sales performance of Humira in Q123. Revenues generated by the drug last quarter were $3.54bn – down exactly 25% year-on-year. Declines in Europe after patents expired in 2018 have been a little less steep, although this has more to do with AbbVie’s hiking the price of the drug than successfully protecting the drug’s market share.

AbbVie’s Response To The Humira ‘Loss Of Exclusivity” Crisis? – Buy A Business, Discover Better Drugs!

When an all-time best-selling drug worth >$20bn per annum in revenues and generating >35% of all revenues is threatened with a patent expiry, it’s hardly surprising that shareholders start to feel the heat, and begin to ask what management is doing to maintain a path to growth in the face of such a significant loss?

Under long-time CEO Rock Gonzalez, AbbVie has certainly not shied away from the impending loss of exclusivity (“LOE”) – quite the opposite, in fact. Back in May 2020 AbbVie completed the purchase of rival Pharma and aesthetics giant Allergan, in a deal worth ~$193 per share, or ~$63bn.

That gave the company access to Allergan’s aesthetics business, including the globally recognized brand Botox and blockbuster (>$1bn per annum) selling Juvederm, as well as highly promising neuroscience and Eye Care divisions – in total, the deal added ~$15bn per annum to AbbVie’s top line.

Granted, AbbVie took on a mountain of debt to complete the deal, selling $30bn of bonds, but the company was able to benefit from cheap borrowing rates and maintains an investment-grade credit rating. According to the company’s 2022 10K submission (annual report):

In 2022, Moody’s Investors Service upgraded AbbVie’s senior unsecured long-term credit rating to Baa1 from Baa2, affirmed its Prime-2 short-term credit rating and revised its outlook to positive from stable. In addition, Standard and Poor’s Global Ratings revised its outlook to positive from stable and affirmed its long-term issuer credit rating of BBB+.

AbbVie’s debt remains onerous, with $63bn of long term debt, including the current portion of $4bn, and $28.4bn of interest on that debt to be paid long-term on that debt, as well as $16.4bn of contingent consideration liabilities. Since the Allergan acquisition, however, AbbVie has generated net income of $11.5bn in 2021, and $11.8bn in 2022 – a margin of >20% – meaning there is plenty of cash to cover debt repayments, whilst AbbVie also pays a generous dividend of $1.48 per quarter, which yields >4.3% annually at current share price (~$10bn was spent on dividend payments in 2022) whilst also buying back 8m shares last year, at a cost of $1.1bn.

The Emergence of Skyrizi and Rinvoq

With ~$15bn of additional revenues realized via the Allergan deal, AbbVie’s revenues leaped from $33.3bn in 2019, to $45.8bn in 2020, and they have kept growing, reaching $58bn in 2022, whilst the dependence on sales of Humira has been reduced.

Nevertheless, AbbVie had to find a way to protect its leading position within the dermatology / autoimmune disease markets, and in this respect the company appears to have been very successful, thanks to the development of 2 new drugs – the IL-23 inhibitor Skyrizi, and the janus kinase (“JAK”) inhibitor Rinvoq.

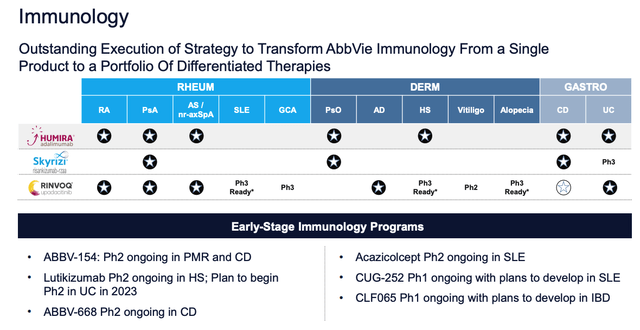

The emergence of Skyrizi and Rinvoq (AbbVie JPM Healthcare Conference presentation)

As we can see from the slide above, taken from an AbbVie presentation at the JP Morgan Healthcare conference, Skyrizi and Rinvoq are designed to address the same conditions that Humira did, only with a superior safety and efficacy profile.

Last month, Rinvoq successfully won approval to treat Crohn’s Disease, whilst in March, Skyrizi met the primary and all secondary endpoints in a Phase 3 trial for adults with ulcerative colitis, as ~20%, ~37%, and ~25% of participants in a 650-patient study achieved clinical remission, endoscopic improvement, and histologic-endoscopic mucosal improvement. That likely makes an approval in this double-digit billion market a formality.

Although AbbVie shares dipped after Q123 earnings were released, as Skyrizi and Rinvoq fell short of the market’s sky-high expectations, the 2 drugs revenues were nevertheless $1.36bn (Skyrizi) and $686m (Rinvoq) respectively, representing gains of 45% and 48% year-on-year. It is hard to be critical of such performance, in my view, given how intensely competitive these markets are, an as I wrote in a pre-earnings review of AbbVie back in April:

Management is guiding for Skyrizi to drive $7.4bn of revenues in 2022, and for Rinvoq to drive $3.7bn – up 43% and 47%, or $2.2bn and $1.2bn respectively year-on-year – which helps to offset the 37%, or $7.5bn projected decline in Humira revenues.

Eventually, AbbVie CEO Rick Gonzalez has told analysts, it is expected that Skyrizi and Rinvoq will drive >$25bn revenues per annum between them – a higher figure then even Humira could achieve.

The absolute best way to deal with an impending patent expiry is to develop a new drug that is superior to the previous one, and with less frequent dosing and better safety and efficacy readouts to date AbbVie seems to have hit the jackpot with these 2 drugs.

Looking Ahead – Can AbbVie Truly Drive Growth As Its All-Best Seller Exits Stage Left?

If Q1 2023 earnings were slightly disappointing – with AbbVie’s revenues of $12.3bn down 10% year-on-year, with Humira sales down 25% to $3.5bn, Skyrizi and Rinvoq not quite meeting the market’s expectations, and sales of oncology blockbuster falling 25%, to $878m, and aesthetics revenues falling slightly to $1.3bn, whilst gross margin and operating margins fell to ~67% and ~23%, down from 70% and 35% in the prior year period – there is no reason for investors to panic, in my view.

AbbVie also announced on its earnings call for Q123 that it was raising guidance for 2023, now anticipating $52.4bn of revenues for the year – up $400m – and adjusted earnings per share to $10.72 – $11.12. That more positive news may have been overlooked in the rush to make an early judgement on how Humira sales in the US were impacted by the LOE.

The reality is that Humira’s sales figures are likely to have a disproportionately large say on how analysts and the market interpret AbbVie’s performance going forward, even though management has already implemented plans to recapture lost Humira revenues via other elements of the business i.e. aesthetics and the twin assets Skyrizi and Rinvoq.

In order to gauge whether AbbVie is under or over-valued at the present time, I use forward revenue by product forecasts, based on management’s guidance and market size, strength of competition etc, and then plug these forecasts into a forward income statement and finally use discounted cash flow analysis to establish a fair market price for AbbVie’s shares.

I have shared these forecasts several times before in posts for Seeking Alpha, and although they are ballpark estimates only, I have found them to be a useful guide. Having adjusted them post Q123 earnings, I share the results below, starting with product forecasts.

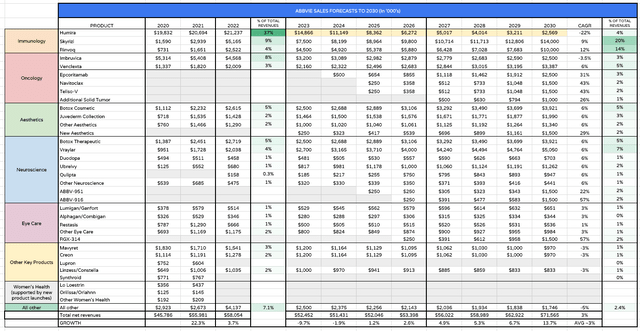

AbbVie product sales forecasts (my table and assumptions)

Since my last note, I have adjusted several revenue forecasts downwards, starting with Humira, whose sales I have forecast to fall by 30% in 2023, by 25% between 2024 – 2026, then by 20% per annum. By the end of the decade Humira’s contribution is forecast in my table to be just $2.5bn. I suspect that may be a little too low, but I am also upholding CEO Gonzalez’ prediction that Skyrizi / Rinvoq revenues will grow >$24bn.

Within the oncology division I forecast Imbruvica sales to keep falling as the drug AbbVie acquired for $21bn via its buyout of Pharmacyclics in 2015 loses out to competitive threats. Nevertheless, I expect to see several new drugs approved in this division, and management provided updates on each on the Q123 earnings call.

Teliso-V, an antibody drug conjugate will read out Phase 2 data in non-squamous non-small cell lung cancer later this year, which could support an accelerated approval, whilst Epcoritamab may well win approval this year in relapsed or refractory large B-Cell lymphoma. Navitoclax also has a key data readout this year in myelofibrosis and could secure an approval next year. I see as much as $6.5bn in new revenue streams from the oncology division by 2030.

Management has expressed confidence that the aesthetics division will drive >$9bn of revenues by 2030, whilst the neuroscience division is expected to go from strength to strength, based on the strong performances of migraine therapies Vraylar and Ubrelvy, and the continued strength of Botox (as a migraine therapy in this instance.

Meanwhile, ABBV-951, indicated for motor fluctuations in patients with advanced Parkinson’s disease, was rejected for approval in the U.S. by the FDA, who requested additional information, although management remains positive this drug can still be approved next year. ABBV-916, in Alzheimer’s, is an interesting opportunity in a rapidly evolving AD treatment market whose value could exceed >$50bn per annum one day.

I am also expecting the eye disease division to more or less double in size by 2030 – this is another vast market opportunity for the right therapies – but I am massaging down revenues from established drugs such as Creon and Hep C therapy Mavyret.

AbbVie forward income statement (my table and assumptions)

As we can see above, as CEO Gonzalez has predicted, I have AbbVie’s revenues falling in 2023 and 2024, before returning to growth in 2025 and then increasing in each year subsequently. I am using GAAP as opposed to adjusted EPS, which grows to >$10 per share by 2030, while net profit margins increase from 21%, to 26%.

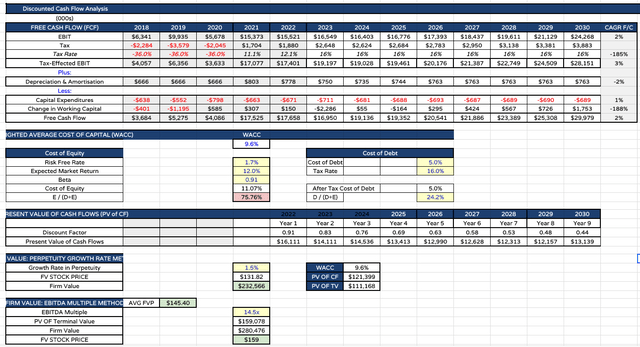

AbbVie price target using DCF analysis (my table and assumptions)

Finally I present some discounted cash flow analysis and EBITDA multiple analysis using a weighted average cost of capital of ~10%, which is the standard rate I use for all Big Pharma DCF analysis.

In my last note, the calculation showed a price target of $154, but after making adjustments based on learnings from Q123, my adjusted target is lower, at $145 per share.

Given AbbVie Inc.’s current share price of $137.5, my price target does not offer much in the way of upside, but I would stop a long way short of suggesting that that makes AbbVie stock a poor investment opportunity.

Obviously, AbbVie is transitioning through a period which I have previously described as the toughest challenge in Pharma – coping with the patent expiration of the world’s best-selling drug.

To my mind, management has done an excellent job preparing for this event, and although there are substantial challenges to be overcome – most notably hitting guidance of ~$24bn in Skyrizi / Rinvoq sales and bringing through the necessary pipeline assets to ensure that the company returns to growth in less than 3 years – AbbVie remains a magnet for investors’ money, in my view.

I may have been a little too circumspect with some product sales forecasts, and failed to include several pipeline assets which could bring in additional revenues between today and the end of the decade, and raise the target share price, but even so, with a dividend yielding >4.3%, a share buyback program in place, and much less dependence on sales of Humira, AbbVie’s is future-proofed for shareholders, in my view.

As AbbVie Inc. says goodbye to an all-time best-selling drug, the likes of Eli Lilly and Company (LLY) and Novo Nordisk A/S (NVO) may be the most attractive Pharma’s on the market at present, thanks to the >$50bn per annum the market believes they can extract from their GL1P agonist weight loss / obesity drugs tirzepatide and semaglutide, but as Lilly’s market cap valuation recently surpassed Johnson & Johnson’s (JNJ) to become the most valuable global Pharma, it is now valued at 14x sales and a price to earnings ratio of 71.

If that is a little too risky for your liking, AbbVie Inc. has a much higher yielding dividend, and the market is a little preoccupied with Humira’s performance when AbbVie itself has already moved on to potentially bigger and better things.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.