Summary:

- AbbVie Inc. has lowered its adjusted EPS guidance range for Q2 and FY23 due to certain IPR&D and milestone expenses, disappointing investors further.

- ABBV has fallen significantly to levels last seen in early 2022, suggesting investors likely reflected substantial headwinds relating to Humira’s patent expiration.

- AbbVie could face near-term growth challenges as it navigates the competitive landscape facing its highly successful earnings driver.

- However, ABBV is no longer significantly overvalued, offering investors a fantastic opportunity to buy more on the recent dips.

JHVEPhoto

AbbVie Inc. (NYSE:ABBV) updated investors recently to expect a markedly lower adjusted EPS guidance range for Q2 and FY23 due to certain IPR&D and milestone expenses.

It was a disappointing development, as the revised adjusted EPS guidance range of $10.57-$10.97 is well below its previous outlook of $10.72 – $11.12, which was upgraded at its Q1 earnings release. Notably, the new range is also lower than its pre-Q1 outlook of $10.62 – $11.02, indicating a marked impact on its earnings.

As such, I find it surprising that management didn’t identify these issues earlier. Also, I’m keen to find out whether management expects a more significant impact from the Humira Biosimilars, even though the company remains confident of its current Immunology portfolio.

Management updated in a recent June conference that it isn’t unduly concerned with the near-term impact as it navigates the competitive landscape facing Humira post-patent expiration. Management telegraphed its confidence that “the current portfolio and pipeline are sufficient to deliver on the existing growth expectations.” As such, the company’s focus remains on leveraging its capabilities and the potential of Skyrizi and Rinvoq.

In addition, AbbVie’s well-managed balance sheet with net debt/forward EBITDA of 1.84x should keep the company well-poised to undertake pivotal business development activities to spur growth, if necessary.

Despite that, the execution risks emanating from the emergence of Humira Biosimilars have likely resulted in the significant downward de-rating in ABBV, as it re-tested levels last seen in early 2022.

I believe the de-rating is justified as the company navigates the impact of pricing headwinds in the near term. AbbVie’s economic moat is anchored on the success of Humira and is still expected to be a “key determinant of the company’s earnings performance over the next three years.”

As such, the market needs to reflect pricing risks, even as AbbVie expects these headwinds to abate after 2023. Accordingly, it should alleviate AbbVie’s ability to manage market share dynamics while driving volume after experiencing the expected pricing headwinds this year.

Notwithstanding, investors should continue to expect flux this year as AbbVie looks to provide more “insights into the marketplace and dynamics for 2023” at its upcoming Q2 earnings release on July 27. However, with AbbVie’s pre-earnings guidance that lowered its full-year outlook, it seems like management has attempted to manage investors’ expectations to be less optimistic heading into Q2 earnings.

With that in mind, analysts’ estimates are expected to be revised downward to reflect the updated range. Analysts have penned in a 0.5% decline in sales for FY24 after this year’s 9.2% downtick. However, with adjusted EPS expected to be revised downward, AbbVie could struggle to generate meaningful earnings growth through the end of next year before potentially bottoming out.

As such, investors who decide to add ABBV at the current levels need to have high conviction of its ability to recover with its current portfolio while being optimistic that Humira could navigate the pricing/volume dynamics better next year.

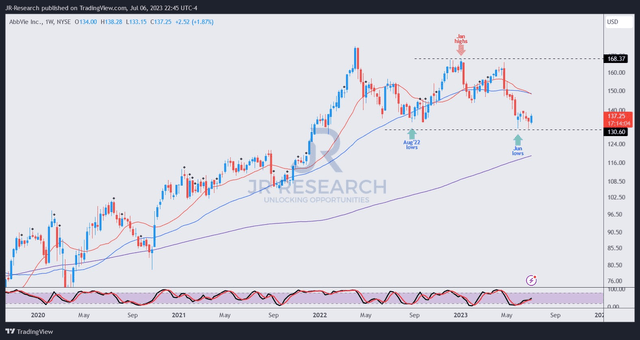

ABBV price chart (weekly) (TradingView)

ABBV last traded at a forward EBITDA multiple of 11.5x, above its 10Y average of 10.5x. However, it’s broadly in line with its biopharma peers’ median of 12.4x (according to S&P Cap IQ data). Seeking Alpha Quant’s valuation grade of a “D+” corroborates that there isn’t a valuation dislocation for investors to consider adding aggressively.

ABBV’s price action suggests that its June bottom remains robust, forming a bear trap or false downside breakdown, as ABBV remains at levels well below its 2023 highs.

ABBV’s consolidation must be closely watched, but I expect its June lows to hold. However, as ABBV is not undervalued, the market could decide to de-rate it down further to reflect higher execution risks due to Humira’s challenges. That remains to be seen and must be observed closely.

If we do get there, a steeper pullback sending ABBV down to the $100 to $115 region could open up a potentially aggressive buying opportunity. For now, I still see an opportunity for investors to add exposure, anticipating its June lows to remain validated.

Rating: Buy

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!