Summary:

- AbbVie Inc. has demonstrated its ability to overcome headwinds from Humira’s loss of exclusivity.

- AbbVie’s Skyrizi and Rinvoq blockbusters have shown remarkable revenue growth, and AbbVie has lifted its long-term outlook.

- Its recent acquisitions and strong guidance have reduced execution risks.

- The market is justified in reflecting higher optimism about improved revenue visibility and prospects, moving past Humira’s headwinds.

- AbbVie investors looking to chase further upside must be wary about chasing its recent excitement, which I assessed as way too fast.

JHVEPhoto

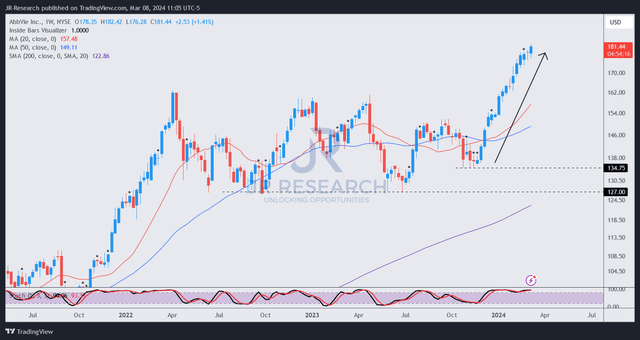

I’ve underestimated biopharma company AbbVie Inc.’s (NYSE:ABBV) ability to overcome the near- and medium-term headwinds from Humira’s LOE. I assessed that the risk/reward of ABBV was well-balanced in my previous update in late November 2023. However, that Hold/Neutral thesis has proved to be too cautious. I had anticipated selling pressure to intensify, potentially leading to a drop to the $130 support level before bottoming out.

However, the market has spoken. ABBV buyers returned with conviction, helping the stock stage a resilient bottom close to the $130 zone in November. AbbVie’s fourth-quarter earnings release in February 2024 likely justified the market’s optimism, as AbbVie demonstrated its ability to forge ahead with its ex-Humira growth portfolio.

Accordingly, AbbVie posted an 8% revenue growth for FY23 for its ex-Humira portfolio. In Q4, AbbVie posted a 15% growth. As a result, I assessed that AbbVie has corroborated its long-term outlook as investors look past the headwinds from Humira’s LOE. Management underscored that AbbVie’s “diversified growth platform successfully absorbed” the “largest loss of exclusivity event in the industry.”

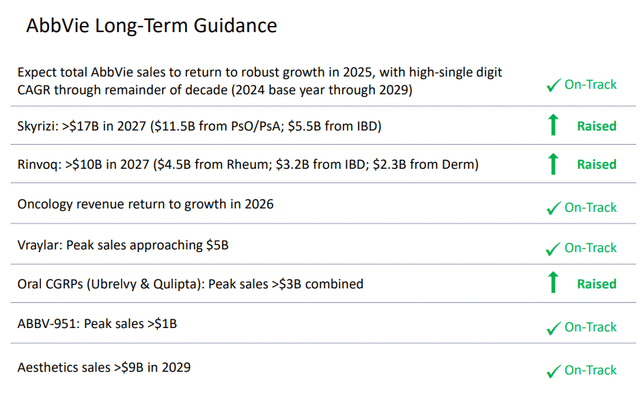

AbbVie delivered remarkable metrics in Skyrizi and Rinvoq, notching revenue growth of 52% and 63% in FY23, respectively. Furthermore, AbbVie also lifted its long-term outlook for both the blockbusters, potentially reaching a high of $27B in combined annualized sales by 2027, up $6B from AbbVie’s previous guidance. As a result, it’s expected to blow past Humira’s peak sales of $21B notched in 2022, showcasing AbbVie’s capability to manage Humira’s LOE competently.

AbbVie long-term guidance (AbbVie filings)

Furthermore, management assured investors of AbbVie’s upgraded long-term guidance. Its recent acquisitions of ImmunoGen and Cerevel have also contributed to the company’s revenue trajectory, reducing execution risks. Management highlighted that its long-term outlook has contemplated its recent acquisition. Accordingly, AbbVie telegraphed a midpoint adjusted EPS of $11.15 for FY24. Analysts’ estimates suggest AbbVie’s outlook could be conservative, as they penciled in an adjusted EPS forecast of $11.21.

Furthermore, AbbVie maintained its long-term revenue guidance of achieving a high single-digit revenue CAGR through 2029. AbbVie hasn’t materially upgraded its long-term outlook. However, I believe the market has reduced its assessment of AbbVie’s execution risks, given its solid performance and strong guidance of its ex-Humira portfolio. As a result, I assessed it was justified for the market to re-rate ABBV’s earnings multiples, considering the higher revenue visibility attributed to its growth portfolio.

ABBV is valued at a forward adjusted EBITDA multiple of 14x, well above its 10Y average of 10.6x. In other words, the market has rapidly reflected its optimism over its long-term potential, repricing it higher. In my previous update, I should have been more optimistic about AbbVie’s ability to overcome Humira’s LOE risks. Despite that, I won’t suddenly go FOMO and start chasing ABBV’s surging momentum. ABBV should remain a core play for healthcare investors in a diversified portfolio. However, investors must be cautious about chasing its recent surge, as ABBV looks increasingly pricey.

ABBV price chart (weekly, medium-term, dividend adjusted) (TradingView)

Income investors could point to ABBV’s relatively attractive forward dividend yield of 3.4%. However, ABBV’s 5Y total return CAGR of 23.8% should inform investors that ABBV is primarily a capital appreciation play. There’s little doubt that AbbVie is a high-quality and fundamentally strong healthcare stock with a best-in-class “A+” profitability grade. Also, with ABBV recovering its long-term uptrend as it surged to a new high, I didn’t glean red flags suggesting investors should consider cutting their exposure.

In other words, investors who missed adding on AbbVie Inc.’s significant dips should consider assessing its subsequent pullback while waiting patiently for another opportunity to add to their positions.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!