Summary:

- AbbVie is a pharmaceutical giant that is building out its portfolio to look nothing like it did a decade ago, and that is great for investors.

- In 2023, ABBV’s #1 selling drug Humira lost its US patent protection which will be a short-term drag on the company.

- The company prioritizes returning money to shareholders.

vzphotos

AbbVie (NYSE:ABBV) is a name that has been in my portfolio for a number of years and it has grown into one of my favorite positions as well.

I have long labeled ABBV as “The Investor’s Trifecta” and here is why:

- They offer growth potential

- They offer a high(er) dividend yield

- They offer robust dividend growth

In today’s piece I will touch on all three of these areas.

Growth Potential

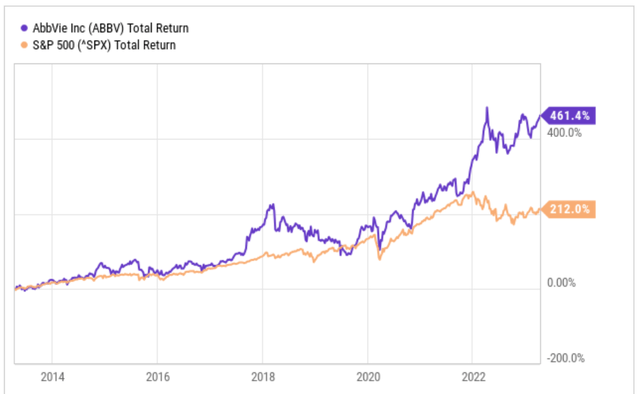

AbbVie has been a machine since becoming its own public company a little more than a decade ago when they were spun off from Abbott Labs (ABT). Over the course of the past decade, ABBV has seen a total return of 461% compared to the S&P 500’s total return of 212% over that same period.

Far too often investors look at dividend stocks and get too fixated on the dividend yield as the primary return, but dividend stocks are a total return investment.

Share price appreciation + Dividend Income = Total Return

Here is a look at the company’s financial results over the past 12 months:

- Revenues: $58.1 billion (3.3% growth)

- Operating Income: $18.1 billion (1.1% growth)

- Operating Margin 31.2%

- Adjusted EPS: $13.79 (13.8%)

Revenues and operating income have slowed due in large part to patent loss in the international market for their number one selling drug Humira. Early on, Humira accounted for roughly 70% of company sales, but today Humira accounts for 36.5% of company sales.

There are two reasons for the drop. First, the patent protection overseas expired a few years back and with the US patent expiring in 2023, Humira sales are expected to continue to drop moving forward. However, the other thing that has lowered the company’s exposure to Humira has been the growth in some of the company’s other products.

Those products include Rinvoq and Skyrizi. During the 12-months ended December 31, 2022, Skyrizi generated revenues of $5.2 billion and Rinvoq generated revenues of $2.5 billion. This was an increase of 75.7% for Skyrizi and 52.8% for Rinvoq, year over year. Management believes these two drugs have the ability to be blockbusters, and they expect the combination of both to surpass peak Humira sales, which is very encouraging for investors.

No longer is AbbVie a one trick pony. They are spread much wider now, especially after they acquired Allergan a few years back which also brought online a whole new set of products, including botox.

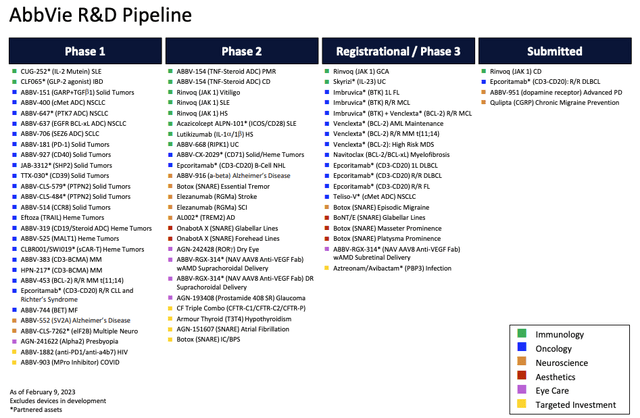

Although 2023 and 2024 is expected to be a period of transition for the company, the growth engine is currently being refueled with new blockbuster drugs and a loaded pipeline.

Here is a look at just how big that pipeline is currently and where certain drugs stand in terms of regulatory approval phase.

Not Only A Solid Dividend But A Growing Dividend

AbbVie was a spin off from Abbott Labs, which is also a company that has taken great pride in returning money to shareholders. So much so that the company is a Dividend King for having increased their dividend payout for 50+ consecutive years.

AbbVie on the other hand has increased their dividend EVERY year that they have been a public company on their own.

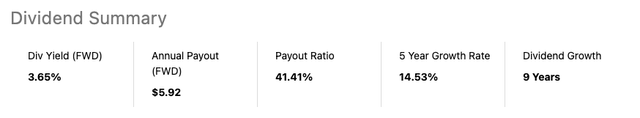

ABBV currently pays a dividend of $5.92 per share which equates to a dividend yield of 3.7%. Being that I have held the stock for a number of years, I prefer to buy the stock when the yield is at or above 4%.

More often than not, when a stock yields a dividend near 4%, you often do not see much in terms of dividend growth. You certainly do not see double digit dividend growth, but this is what makes ABBV special. Over the past five years, the company has increased the dividend an average of 15% per year, which is fantastic. However, the past two years those hikes have slowed as we neared the end of Humira’s patent protection.

The dividend is plenty covered with a low payout ratio of 41% and a free cash flow payout ratio of 43%. During 2022, AbbVie generated FCF of $24.2 billion, which was a 10.3% increase over the prior year.

In my opinion, ABBV will continue hiking its dividend as the years go on, but the growth rate is bound to be low for the next two years until Skyrizi and Rinvoq start nearing their true potential.

Investor Takeaway

AbbVie is a very well-run company, but they are in a period of transition as they are no longer protected by the excellence of Humira. This year is the first year in which generics can be sold, and we have already seen one come to market with another nine going through the approval stages.

This will have a material impact on the business in the near-term, but AbbVie has been working towards this for a while. They have built a strong pipeline, which Skyrizi and Rinvoq have come out of. In addition, the acquired Allergan to help speed up the diversification of their portfolio.

The potential for Skyrizi and Rinvoq is evident and investors should be excited about their potential, but there are risks to the business.

The first risk being that the potential of those two drugs does not live up to the hype management has placed on them. Other risks include failures within their pipeline, something we have seen with ABBV in the past with the acquisition of Rova-T, which never gained regulatory approval. Lastly, there is political risk as government officials are looking to drive down the price of prescription drugs here in the US.

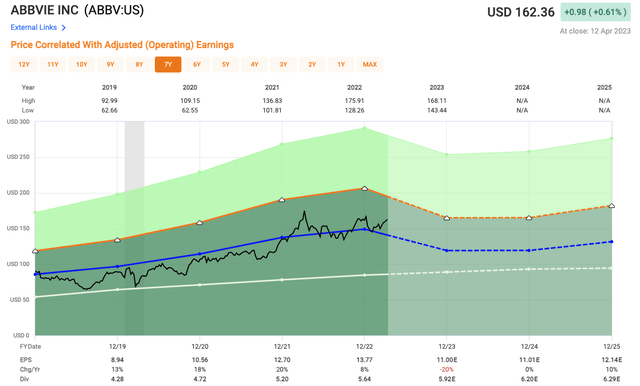

On the year, shares of ABBV are flat after a solid year in 2022 which saw the stock rise 20%, easily outpacing the S&P 500 which finished well in the red.

Analysts are looking for adjusted EPS of $11 which equates to a 2023 P/E of 14.7x. This is well above the company’s five-year average multiple of 10.8x.

AbbVie is already a top position in my portfolio, thus given the valuation and current transition away from Humira dominating the headlines, I am looking to take a wait and hold view to see how the company navigates this period and the pending recession on the way.

I currently rate shares of ABBV as a HOLD.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.