Summary:

- AbbVie will report its Q1 results soon.

- Earnings will most likely be down, but the forward guidance will be important.

- Shares have become more pricey, locking in some gains might make sense.

JHVEPhoto

Article Thesis

AbbVie (NYSE:ABBV) is a quality biotech name that will have a relatively weak 2023. At the same time, its stock tends to be volatile and experiences regular ups and downs. Over the last two months, shares ran up substantially, and AbbVie is now somewhat pricey again — it could be a good idea to lock in some gains, as AbbVie’s shares might decline again in the not-too-distant future. In this article, we’ll also look at AbbVie’s upcoming earnings report later this month.

Upcoming Earnings Results

AbbVie will report its first quarter earnings results later this month, on April 27. The company will, if Wall Street estimates are correct, report a substantial profit decline relative to the first quarter of the previous year. While that is not great, it may not be disastrous, either, as the profit compression that is expected for the current year will hopefully be temporary.

AbbVie is a biotech company that owns assets in different therapeutic areas, including immunology, oncology, neurology, and so on. But still, its exposure in some areas is larger than in others, and AbbVie used to be highly exposed to the performance of its core drug Humira. Humira, which can be used to treat a wide range of immunology indications, went off-patent in the United States during the first quarter of the current year. Being the world’s best-selling drug in the past, there were naturally many biotech companies that positioned themselves to capture some market share once the patent expiry allowed for that. Biosimilars by a range of companies have come to the market already, while others will introduce their products later this year. This means that sales for Humira have likely declined substantially during the first quarter, and further sales declines can be expected for the remainder of the year and beyond.

Of course, sales will not fall to zero, as some doctors and patients will continue to prefer Humira over (cheaper) biosimilars. Some patients and doctors will prefer to do so as Humira is well-known and since patients that tolerate it may fear that they will not react similarly to a biosimilar. Others may prefer to continue to use Humira due to the fact their insurance companies provide coverage, and so on. Humira will thus continue to generate sizeable revenues for AbbVie, but not at the levels we have seen in the past.

That is why sales are expected to fall from $13.3 billion during last year’s first quarter to $12.2 billion during this year’s Q1, which makes for a 10% revenue decline. Due to the fact that Humira generated above-average margins for AbbVie in the past, relative to the rest of its product portfolio, and since revenue declines usually go hand in hand with margin pressure due to operating leverage working against the company, profits will fall considerably more than revenues. Analysts are currently expecting that AbbVie will report earnings per share of $2.49 for the quarter, which would be down 21% year over year.

That will, according to Wall Street, make Q1 the worst quarter of the current year, as profits are forecasted to be higher in Q2-Q4. That can be explained by the fact that growth from AbbVie’s non-Humira assets, such as its oncology drugs and its next-generation immunology drugs Skyrizi and Rinvoq, will soften the blow as time passes. In fact, AbbVie’s management and Wall Street analysts agree that these mitigating factors will eventually allow AbbVie to generate positive sales growth again, although that will not happen in the very near term.

When it comes to the upcoming earnings report, investors should consider that there is a good chance that AbbVie will outperform expectations. The company has beaten earnings per share estimates in 10 out of the last 10 quarters, thus Wall Street analysts have a history of underestimating AbbVie’s profitability. That being said, even an earnings beat of a couple of cents (on a per-share basis), in line with the beats seen over the last couple of quarters, would still result in a meaningful year-over-year decline when it comes to AbbVie’s profits, so lower profits are (almost) set in stone.

Of course, other items from the upcoming earnings report are not known yet. This includes management’s guidance for the current year, which will be important for setting the tone and market expectations when it comes to the company’s operating performance during the remainder of the year. In the past, AbbVie has oftentimes increased its guidance throughout the year, as management generally followed an approach of underpromising initially and delivering guidance increases/guidance beats over time — which is preferable to overpromising and underdelivering, of course. But since the uncertainties this year are at an above-average level due to the Humira patent expiration, we do not know whether this positive track record will continue. While I do not see it as especially likely, it is possible that AbbVie’s management reduces guidance for the current year during the upcoming earnings call, e.g., if the impact from Humira biosimilar competition is stronger than initially thought. One could thus call the upcoming quarterly earnings call more important than the average call in the past, when things were more certain and when no major surprises were expected.

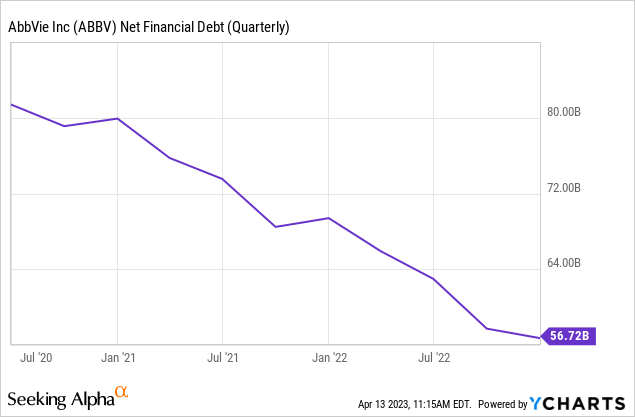

AbbVie might also come up with news when it comes to capital allocation. On one hand, the company has paid down a significant portion of the debt it has taken on to finance the Allergan takeover a couple of years ago, which has improved its flexibility when it comes to capital allocation in the future. While another large takeover is not very likely in the near term, I believe, AbbVie might be able to pursue acquisitions more eagerly than when its debt levels were much higher:

As of the end of the most recent quarter, AbbVie had a $57 billion net debt position. That was down from more than $80 billion in 2020, making for a hefty net debt reduction of more than $20 billion.

In general, that’s good for investors, as it could allow for more M&A deals in the future, while higher shareholder returns via dividends and buybacks are also possible when a company’s balance sheet is stronger.

On the other hand, this year’s expected earnings decline could make management more conservative when it comes to capital allocation, and the company might decide against substantial spending. A small dividend growth rate in the near term could be the result, as AbbVie might prioritize further debt reduction due to the expected earnings decline this year, and since the rising rates environment makes debt more costly for all companies.

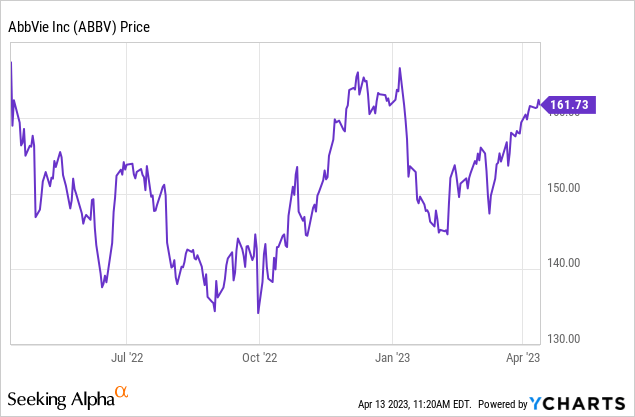

Shares Have Rallied

Over the last couple of years, AbbVie’s shares have seen ups and downs repeatedly. Those were mostly not driven by underlying results, such as AbbVie’s earnings or sales performance. Instead, it seems like ups and downs were primarily driven by fears about the Humira patent expiry (the date was known for a couple of years already), and by the easing of said fears. Over the last year, AbbVie’s share price moved like this:

Right now, shares are trading relatively close to 52-week and all-time highs, as ABBV stock has rallied considerably over the last two months or so. At the same time, AbbVie has become somewhat pricy, as it trades for 15x net profits right now, while the company oftentimes traded at lower earnings multiples over the last couple of years.

I believe that this means that right now is not a great time to enter or expand a position. In fact, locking in some gains could be a good idea, as it would not be too surprising if AbbVie’s shares move down again in the next couple of months. We have seen this move repeatedly in the past. Early this year, we recommended AbbVie as a buy as its shares had fallen considerably. But since shares have rallied by 13% since then, they are now less attractive. Owning a core position and trading an additional position, dependent on AbbVie’s current share price, seems like a good idea.

Takeaway

AbbVie is a quality company, but the upcoming earnings results won’t be strong. This year’s earnings will fall, and there is the risk of a negative surprise when it comes to management’s forward guidance.

At the same time, AbbVie’s shares have rallied substantially, which is why locking in some gains could be a solid idea.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!