Summary:

- AbbVie has had some big shoes to fill indeed, due to the loss of exclusivity for Humira, after 20 years of monopoly and $200B in revenues.

- With nearly ten more biosimilars expected to enter the market in 2023, it is unsurprising that its stock prices have been similarly impacted.

- PFE has had a similar story, with the deceleration of demand for Comirnaty vaccine and Paxlovid therapy from 2023 onwards, worsened by the patent cliff from 2025 onwards.

- Then again, income investors who are not looking to cash in their holdings may just keep calm and continue holding on since ABBV remains a dividend aristocrat.

- Thanks to its expanding pipeline, intensified annualized R&D efforts at $9.16B (+28.6% QoQ/ +54.7%YoY), and 2027 top-line replacement from SKYRIZI and RINVOQ, this correction is only temporary.

alexsl

The Pharmaceutical Investment Thesis Always Comes With These Inherent Risks

AbbVie Inc. (NYSE:ABBV) has had some big shoes to fill indeed, due to the loss of exclusivity for Humira, after 20 years of monopoly and $200B in revenues. With nearly ten more biosimilars expected to enter the market in 2023, it is unsurprising that its stock price has been similarly impacted.

In the first quarter alone, the pharmaceutical company reported a drastic decline for Humira global revenues at $3.54B (-36.7% QoQ/-24.6% YoY).

Since the therapy commands $21.23B (+22.5% YoY) in sales in FY2022, comprising 36.5% (+5.7 points YoY) of the total top-line, it is unsurprising that ABBV has had to lower its FY2023 adj EPS guidance to $10.77 (-21.7% YoY) at the midpoint, compared to the previous guidance of $10.92 (-20.6% YoY) at the midpoint.

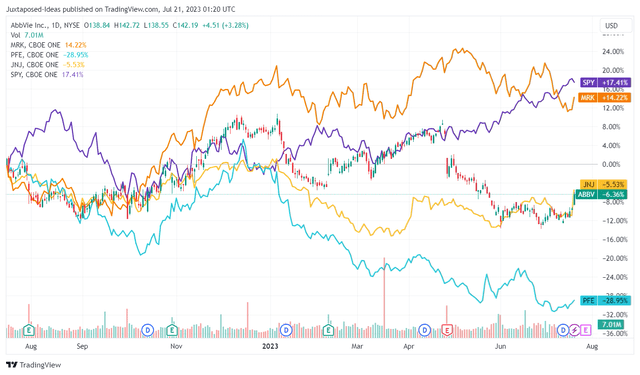

ABBV, PFE, MRK, & JNJ 1Y Stock Price

Trading View

Pfizer (PFE) has had a similar story, with the deceleration of demand for Comirnaty vaccine and Paxlovid therapy from 2023 onwards, worsened by the patent cliff from 2025 onwards.

With the pharmaceutical company expected to record an immense top-line impact of -$32B from the COVID-19 pipeline in FY2023 and another -$22B from the loss of exclusivity by the end of the decade, it is unsurprising that the PFE stock price has plunged by -39% from its peak in December 2021, nearing its 2019 averages.

We expect a similar cadence for Merck (MRK) as well, once Keytruda nears its patent expiry in the US by 2028 and in the EU by 2031, since the therapy contributes an annualized sales of $23.17B (+20.6% YoY), comprising 39.9% (+9.1 YoY) of its top-line by the latest quarter.

Therefore, while the MRK stock may have outperformed its peers, such as ABBV, PFE, and Johnson & Johnson (JNJ) over the past year, anyone interested to invest in any pharmaceutical stocks must be highly aware of these risks.

Patent expiries may only be extended for so long, with cliffs likely to bring forth painful moderations in the top and bottom lines. This is worsened by the low percentage of clinical trials that actually makes it to regulatory approval, with PFE reporting only a 9% success based on the FY2020 data.

Then again, income investors who are not looking to cash in their holdings may just keep calm and continue holding on, since ABBV remains a more than decent dividend aristocrat, with market analysts projecting a FY2024 payout of $6.14 per share and FY2025 of $6.36 per share, implying a CAGR of +3.56%.

In addition, the ABBV management has further iterated that its two leading Immunology therapies, SKYRIZI and RINVOQ, will be able to replace Humira’s peak revenues of $21B by 2027, expanding at a CAGR of +22.8%, from the FY2022 total of $7.68B.

This is impressive indeed, compared to the previous projection of $15B by FY2025, suggesting tremendous growth and ramp up in their applicable/ new indications.

With these two therapies’ patent expected to only expire by 2033 in the US, we suppose ABBV’s prospects remain more than excellent, with its top and bottom line expected to normalize by FY2027, if not FY2026.

This suggests that the moderation in its top/ bottom lines and stock prices are only temporal, especially due to its growing pipeline of over 90 compounds/ devices/ indications by May 2023 and intensified annualized R&D efforts at $9.16B (+28.6% QoQ/+54.7% YoY) in the latest quarter.

So, Is ABBV Stock A Buy, Sell, or Hold?

Interestingly, ABBV stock is still trading rather optimistically at an EV/NTM Revenue of 5.81x and NTM P/E of 12.93x, against its 1Y mean of 5.84x and 12.24x, respectively, despite the lowered FY2023 guidance. This cadence suggests the market analysts’ confidence on Humira being a cash cow for a little longer.

Based on its NTM P/E and the market analysts’ FY2025 adj EPS projection of $12.13, we are looking at a long-term price target of $156.84.

However, we believe a temporal downward rerating to ABBV’s 3Y pre-pandemic mean of 5.06x/11.44x is highly possible, suggesting a lower price target of $138.76, with all the upside already baked in at current levels.

Depending on its FQ2’23 results, we may see further volatility as well, if the management further lowers its forward guidance, against the market analysts’ optimistic projection thus far.

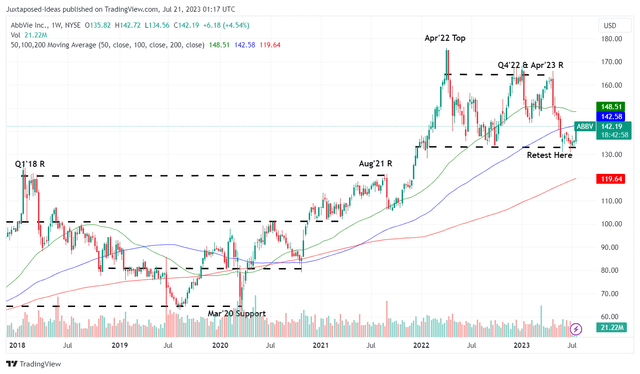

ABBV 5Y Stock Price

Trading View

With ABBV also retesting its critical support at the $135s, we believe anyone who chooses to add here may face volatility in the near term. Combined with our less optimistic price target, we prefer to cautiously rate the stock as a Hold (Neutral) here.

Interested investors may be well advised to wait for $120s for an expanded forward dividend yield of 5.11%, compared to its 4Y average of 4.48% and sector median of 1.44%. Long-term investors may consider dollar cost averaging at those levels for an improved margin of safety as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.