Summary:

- AbbVie dropped almost 8% after its most recent earnings release, which was triggered by lower-than-expected guidance and a sales decline caused by the Humira patent loss.

- The good news is that the company is seeing strong growth in its non-Humira core business, with accelerating growth expectations in the years ahead.

- The juicy dividend of roughly 4% is backed by high and rising free cash flow, a healthy balance sheet, rebounding growth, and a strong pipeline of new products.

- I significantly added to my ABBV position, making it a top 3 investment in my dividend growth portfolio.

vzphotos

Introduction

AbbVie (NYSE:ABBV) was one of the first stocks I put in my dividend growth portfolio in 2020. However, I have never written an ABBV-focused article. Until today, that is. What better way to start more frequent coverage than its post-earnings stock price correction? Not only did this provide tremendous food for thought, but it also allowed me to boost my position, making ABBV a top-three position in my portfolio.

While patent-related fears are always present, I believe that the market has overreacted. The company delivered good results, especially considering that the Humira sales implosion was expected.

The good news is that the company raised its guidance as its core portfolio continues to benefit from tremendous strength. In this article, I will dive into that and explain why I believe that ABBV offers tremendous shareholder value for many years to come.

So, let’s get to it!

Another Sell-Off

Like most of its healthcare peers, AbbVie enjoys anti-cyclical demand. The ABBV share price is mainly driven by headlines regarding its pipeline, existing products, and regulation issues.

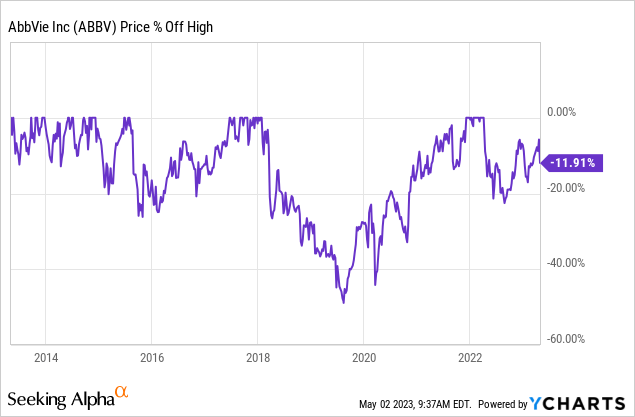

While ABBV is not a volatile stock, it tends to be subject to sell-offs of 10% on a somewhat regular basis. This is why I have never bought ABBV at its all-time high, as it has a habit of allowing investors to buy corrections.

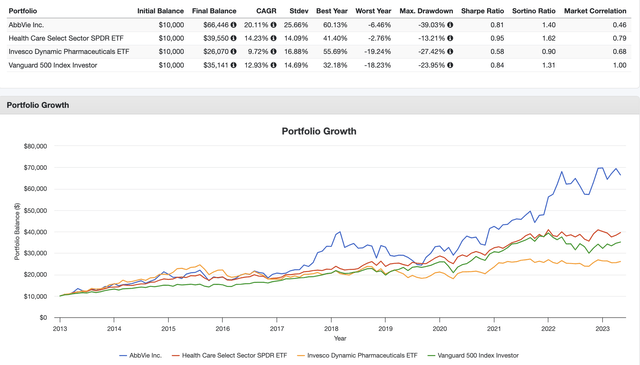

Since its spin-off from Abbott Laboratories (ABT), the company has returned 20.1% per year. While I do not expect that kind of performance to last, we’re not dealing with a very volatile stock, as the standard deviation is 26%. That is obviously higher than the market’s standard deviation, yet far from high for a single stock.

The most recent sell-off was roughly 8% after the company announced its 1Q23 earnings.

So, what caused the sell-off, and why did I use it to add more shares?

1Q Earnings – A Breakdown

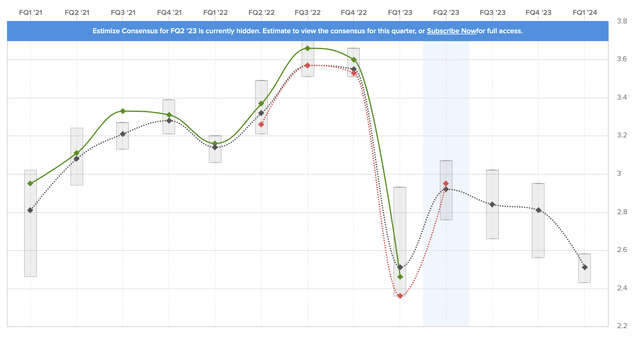

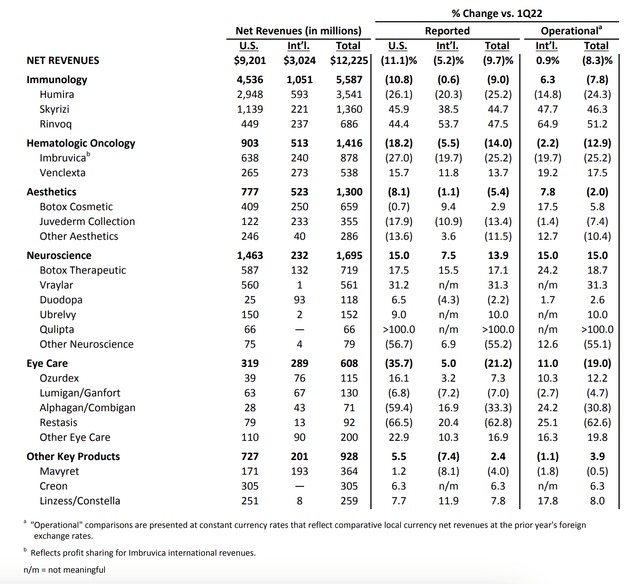

Looking at the bare numbers, 1Q23 was one of the worst quarters in its history. The company reported $12.2 billion in revenue, which was 9.7% below the prior-year quarter result yet in line with estimates. This led to an EPS decline to $2.46, which was slightly below estimates but above company guidance. As the overview below shows, the expectations range was very wide, as analysts had a hard time estimating how bad the Humira sales decline could be.

While its stock price didn’t reflect it, the company was quite satisfied with its results. Not only did these results beat the company’s guidance, but these numbers were supported by strong growth in core products.

Skyrizi and Rinvoq, two of the company’s top products, showed strong momentum across all approved indications. They are expected to contribute more than $11 billion in combined sales this year, consistent with full-year expectations. The company is also performing exceptionally well in neuroscience, with Vraylar sales accelerating following MDD approval and migraine delivering strong growth.

As the overview above shows, immunology alone did roughly $5.6 billion in revenue. That isn’t groundbreaking news, as it has been the company’s crown jewel for a long time. What is interesting is that Skyrizi achieved nearly $1.4 billion in global sales, reflecting a growth rate of over 46% despite retail inventory de-stocking.

According to AbbVie, Skyrizi has demonstrated high efficacy in treating psoriasis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis.

The drug has differentiated attributes across the categories that physicians and patients deem most important, including rapid onset of action after the first dose, high durability of response, and quarterly dosing for maintenance therapy. In-play share of new and switching patients is nearly 50% in the US, and Skyrizi has achieved in-play psoriatic disease leadership in more than 25 countries.

The other star, Rinvoq, delivered global sales of $686 million, reflecting operational growth of more than 50% despite similar retail inventory de-stocking.

AbbVie makes the case that Rinvoq has set a high bar for efficacy in both ulcerative colitis and Crohn’s disease, as it demonstrates strong rates of remission and endoscopic improvement. Hence, AbbVie believes that the drug has a high potential for growth in gastroenterology, with accelerating adoption among gastroenterologists. The drug is the only JAK approved to treat both IBD conditions in the EU.

Global Humira sales were down $3.5 billion, which translates to a 24.3% decline. This is the result of new biosimilar products entering the market, one of the biggest risks facing drug manufacturers.

Furthermore:

- Hematologic Oncology generated total revenues of $1.4 billion, with continued pressure on Imbruvica partially offset by robust double-digit growth with Venclexta.

- Imbruvica’s global revenues were $878 million, down 25.2% due to increasing competition and the cumulative impact of a suppressed market.

- Venclexta’s global sales were $538 million, up 17.5% on an operational basis, with strong momentum across both AML and CLL.

- AbbVie’s Neuroscience segment generated approximately $1.7 billion in revenue, up 15% on an operational basis. Sales of Vraylar were up 31.3% on an operational basis, above expectations. AbbVie sees an opportunity for accelerated growth across all approved indications, and the company raised its full-year guidance for Vraylar accordingly.

According to the company (emphasis added):

[…] we are one quarter into the U.S. biosimilar event for Humira, and are managing the erosion well. Most importantly, our growth platform is demonstrating strong performance, exceeding our expectations. We are executing well across all aspects of our business, and see numerous opportunities for our diverse portfolio to drive long-term growth.

So, what about the outlook?

ABBV Raised Its Guidance

AbbVie has raised its full-year adjusted earnings per share guidance to the $10.72 – $11.12 range. The guidance, which excludes an estimate for acquired IPR&D expense that may be incurred beyond the first quarter, reflects anticipated net revenues of about $52.4 billion, an increase of $400 million.

The guidance includes updated assumptions that Vraylar sales will be about $2.7 billion, reflecting strong prescription growth following the MDD approval.

For aesthetics, global revenue is expected to be about $5.3 billion, reflecting a better-than-expected recovery in China and stable economic trends in the US. While this is a bit of a risk, I do not see significant weakness in the segment that aesthetics (botox) caters to.

Please note that analysts were looking for $11.14 in expected full-year EPS. The company’s guidance slightly missed that mark, which was one of the reasons why its stock price fell.

In Q2, AbbVie anticipates net revenues of about $13.5 billion, including US Humira erosion of 27%.

AbbVie also said it saw very strong performance across all approved indications in the first quarter, with the partial offset of retail inventory de-stocking, which impacted Skyrizi and Rinvoq sales in the high single digits. Overall US demand was up just over 60% for Rinvoq and Skyrizi, with five new indications for Rinvoq and two for Skyrizi. AbbVie also expects to see data from its ALS program in late 2024 or early 2025.

Valuation & Dividend

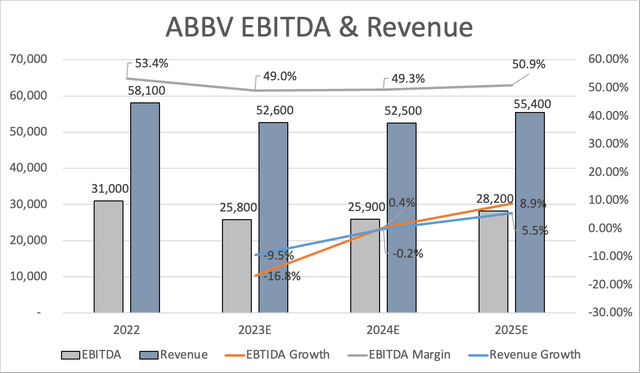

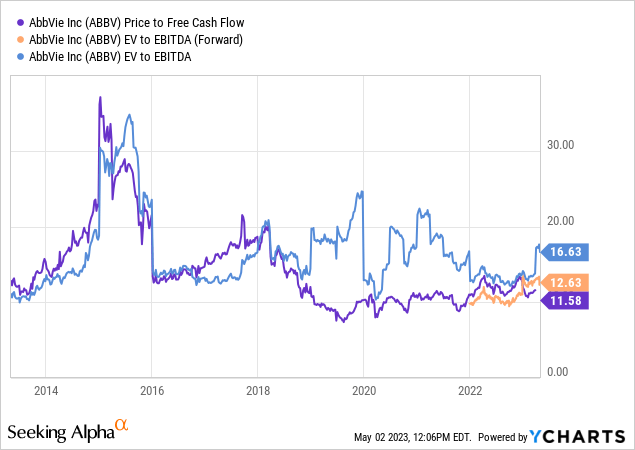

One of the many reasons I’m not worried is that nothing that is currently happening is unexpected. Sure, analysts expected slightly better guidance. However, that doesn’t change the bigger picture. While the company is not expected to recover from slower Humira sales until at least 2026, it is quickly recovering from the expected 10% total sales decline this year. EBITDA is expected to bottom this year, with 0.4% growth in 2024 and roughly 9% growth in 2025.

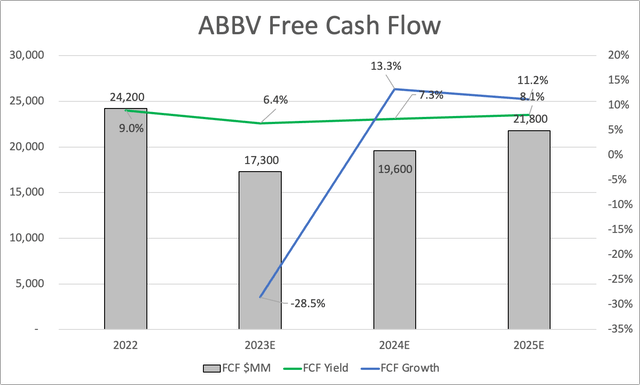

The same goes for free cash flow. This year, it’s expected to take a huge hit of 29%, followed by a steep recovery to $21.8 billion in 2025.

While that would still be below 2022 levels, investors have taken this into account. Last year, the company was trading close to 11x free cash flow, which would be ridiculously low if it weren’t for the obvious Humira news.

The company is currently trading at less than 14x 2024E free cash flow. This implies a free cash flow yield of 7.3%. The company is also attractively trading on an EV/EBITDA basis.

While I wouldn’t make the case that ABBV is significantly undervalued, I like the risk/reward at these levels.

I believe that ABBV is trading roughly 15% below its fair value. I also believe that if it weren’t for new banking troubles, the stock would be much higher already.

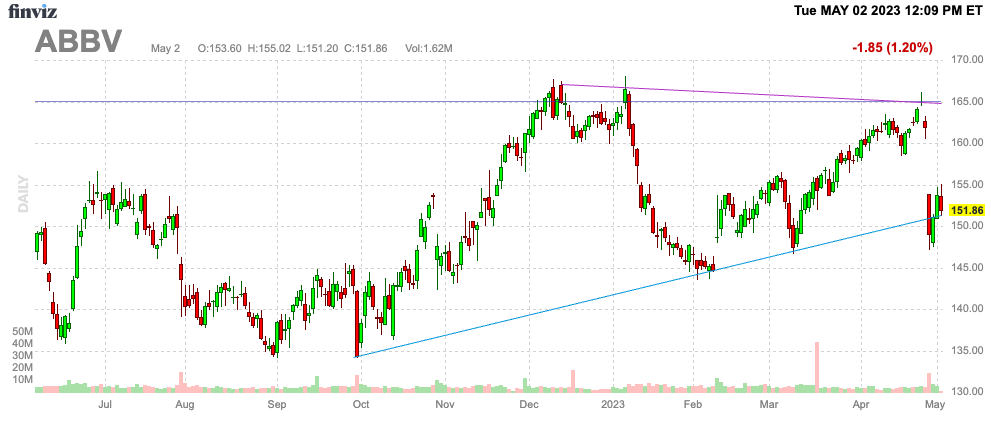

FINVIZ

Furthermore, the company has a juicy dividend yield, which is why I initially bought the stock.

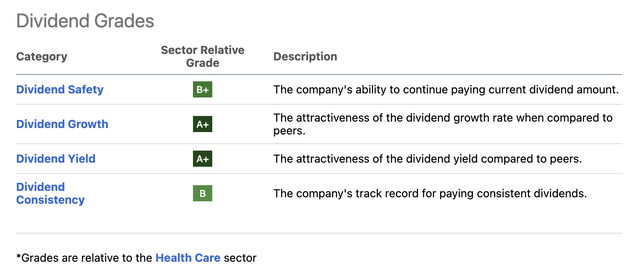

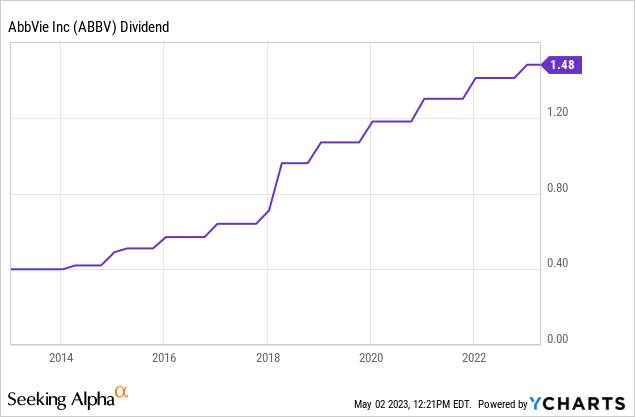

Looking at the Seeking Alpha dividend scorecard below, we see that ABBV shows fantastic scores across the board.

Here are some facts:

- The company currently yields 3.9%, which makes it a high-yield investment.

- It has hiked its dividend for nine consecutive years.

- The average annual dividend growth over the past five years was 14.5%.

- The company has a payout ratio of 44%.

- Even incorporating the Humira sales decline, the company has a 53% cash payout ratio using 2024 estimates.

Furthermore, the company has a net debt ratio of 1.8x EBITDA, which is based on 2023 numbers. It enjoys a BBB+ credit rating.

Takeaway

ABBV’s shares dropped by nearly 8% following the release of its earnings report, which showed a significant decrease in sales and guidance that fell short of analyst expectations. However, there is some positive news as the company’s core business remains strong, leading to a substantial increase in my position.

The core business surpassed the company’s guidance, particularly in Immunology (excluding Humira), which experienced robust growth despite inventory de-stocking. This success allowed the company to raise its guidance. Given its robust pipeline and favorable market trends, ABBV is likely to experience a sales growth bottom in 2023, followed by a series of strong years that could potentially restore sales to 2022 levels by 2026.

With a dividend yield of almost 4%, backed by a healthy balance sheet and high free cash flow expected to outperform revenue growth in the future, the company is currently attractively valued. While the Humira patent loss is a challenge for ABBV, it is performing well in other areas and is well-positioned to increase shareholder distributions.

I believe that the market’s fears are exaggerated and that ABBV is a great investment at its current price level.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.