Summary:

- AbbVie’s management increased the financial guidance for its 2023 adjusted diluted EPS from $10.86–$11.06 to $11.19–$11.23.

- In addition, the company, led by Richard Gonzalez, increased its quarterly cash dividend by 4.7% to $1.55.

- Combined sales of Skyrizi (risankizumab) and Rinvoq (upadacitinib) were $3.24 billion in Q3 2023, an increase of 55% year-over-year.

- AbbVie’s published financial results for the third quarter of 2023 were a key reason for increasing our price level at which the risk/reward profile would be attractive from $124 per share to $133-$134.5 per share.

- We continue our analytics coverage of AbbVie stock with a “hold” rating for the next 12 months.

Kemal Yildirim

AbbVie (NYSE:ABBV) is one of the largest companies in the global pharmaceutical market. The company is headquartered in North Chicago.

Thesis

Since writing our last article, the company’s share price has continued a downward movement, in line with our expectations. However, AbbVie’s published financial results for the third quarter of 2023 were a key reason for increasing our price level at which the risk/reward profile would be attractive from $124 per share to $133-$134.5 per share.

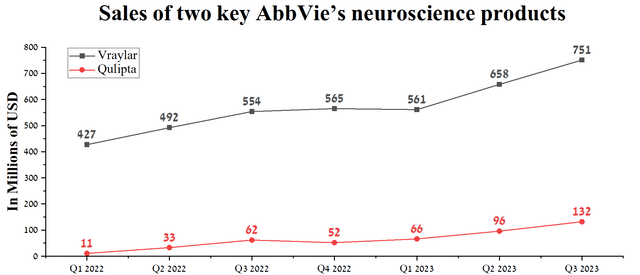

Firstly, the company’s management increased the financial guidance for its 2023 adjusted diluted EPS from $10.86–$11.06 to $11.19–$11.23. We believe this was due to stronger sales of the company’s two key neuroscience products. The first of these is Qulipta (atogepant), which is a medicine approved by regulatory authorities for the prevention of episodic and chronic migraines. Thanks to its mechanism of action of blocking the action of CGRP receptors and its oral route of administration, sales of Qulipta were $132 million in the third quarter of 2023, an increase of 112.9% year-over-year.

Author’s elaboration, based on quarterly securities reports

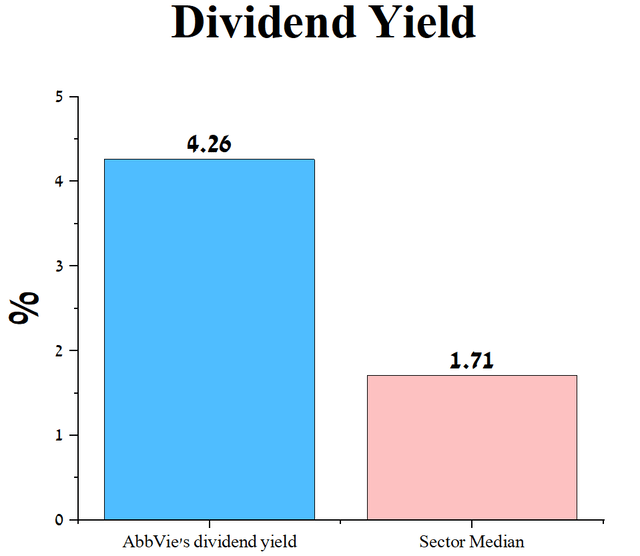

In addition, the company, led by Richard Gonzalez, increased its quarterly cash dividend by 4.7% to $1.55. Since the completion of AbbVie’s spin-off from Abbott in 2013, the company has maintained a policy of increasing dividend payments year after year, allowing it to remain a member of the prestigious S&P 500 Dividend Aristocrats index. Moreover, AbbVie’s dividend yield exceeds 4%, which is significantly higher than its main competitors in the healthcare sector, and this is one of the crucial investment theses that makes it an attractive asset for long-term investors.

Author’s elaboration, based on Seeking Alpha

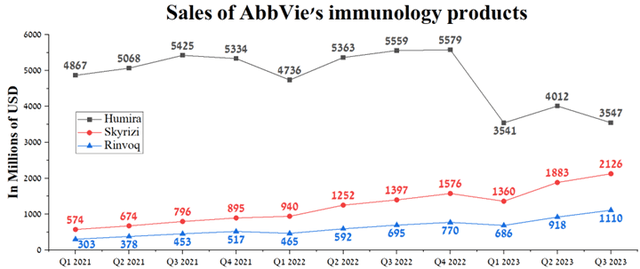

However, the key risk that threatens AbbVie’s revenue growth rate is its immunology segment, and because of this, we continue our analytics coverage of the company with a “hold” rating. Combined sales of Skyrizi (risankizumab) and Rinvoq (upadacitinib) were $3.24 billion in Q3 2023, an increase of 55% year-over-year.

Author’s elaboration, based on quarterly securities reports

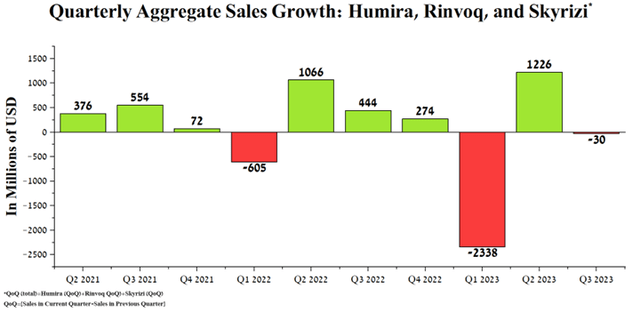

However, if you look at the pace of sales of the company’s immunology products from a different angle, the situation is quite dismal. So, the quarterly increase in sales of the company’s two essential products cannot offset the damage from the launch of an increasing number of Humira biosimilars from the beginning of 2023.

Author’s elaboration, based on quarterly securities reports

AbbVie’s Q3 2023 financial results and outlook for the 2H 2023

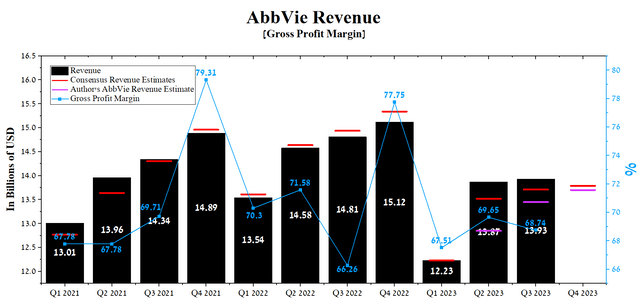

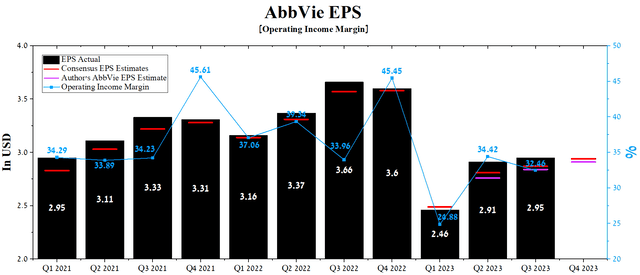

The third quarter of 2023 showed results that positively surprised us, as AbbVie’s revenue and EPS increased relative to the previous quarter. Moreover, the company’s EPS beat analysts’ consensus EPS estimates in nine of the last ten quarters, indicating that management’s business strategies continue to be effective even as competition in the global immunology and neuroscience market increases. In addition, sales of most of AbbVie’s drugs continue to grow yearly.

Author’s elaboration, based on quarterly securities reports

AbbVie is expected to publish its financial report for the fourth quarter of 2023 on February 9, 2024. According to Seeking Alpha, AbbVie’s revenue for the quarter is expected to be in the range of $13.6 billion to $14.03 billion, down 10.1% from the prior year and up 0.6% from analysts’ expectations for the previous quarter.

Meanwhile, according to our model, AbbVie’s total revenue will be within this range and reach $13.7 billion. A slight decrease in the company’s revenue compared to the previous quarter will be associated with a decline in sales of Humira, Imbruvica, and Botox and also the continuing trend of strengthening of the US dollar relative to other foreign currencies.

Author’s elaboration, based on Seeking Alpha

In light of stronger growth in AbbVie’s drugs targeting neurological diseases in recent months, we expect its operating income margin to reach 31.5% in 2023. Simultaneously, this financial indicator could increase to 32.1% by 2024, mainly due to an increase in prices for the company’s products, optimization of labor costs, expansion of indications for the use of its medicines, and reduction in the cost of raw materials necessary for their production.

According to Seeking Alpha, AbbVie’s fourth-quarter EPS is expected to be $2.88-$3.07, up 2.4% from the third-quarter 2023 consensus estimate. Furthermore, according to our model, AbbVie’s EPS will be slightly lower than the median of this range and will reach $2.91, which is 18.7% less than the previous year.

Meanwhile, the company’s Non-GAAP P/E [TTM] is 11.66x, 28.67% lower than the sector average. On the other hand, AbbVie’s Non-GAAP P/E [FWD] is 12.51x, which is 24.12% higher than the average over the past five years.

Author’s elaboration, based on Seeking Alpha

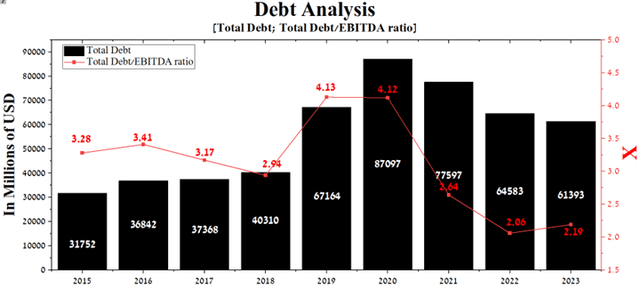

In addition to raising the financial guidance for its 2023 adjusted diluted EPS, the company pleased its investors with a reduction in total debt. At the end of the third quarter of 2023, AbbVie’s total debt was about $61.39 billion, down $3.19 billion from the end of 2022. However, due to the decline in sales of products in the immunology segment, which has a direct impact on AbbVie’s EBITDA, its total debt/EBITDA ratio increased slightly from 2.06x to 2.19x.

Author’s elaboration, based on Seeking Alpha

Conclusion

AbbVie is one of the largest companies in the global pharmaceutical market, which published its financial report for the third quarter of 2023 on October 27, 2023.

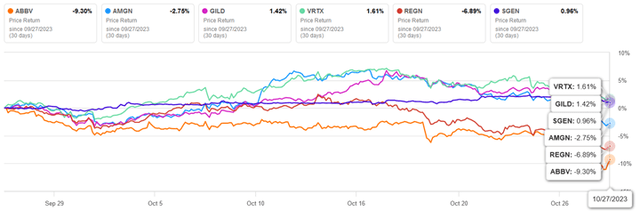

Even despite AbbVie’s growing gross margin and revenue quarterly, financial market participants continue to be skeptical about the company’s prospects due to increased competition from Humira’s biosimilars, which also contributed to a decline in its share price by more than 9% over the past month.

Author’s elaboration, based on Seeking Alpha

Despite rising geopolitical tensions around the world and President Biden’s Inflation Reduction Act, we believe growing demand for Skyrizi, Rinvoq, Venclexta, Vraylar, and Ubrelvy will be crucial medicines that will help improve the company’s financial position in 2024.

We continue our analytics coverage of AbbVie with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.