Summary:

- AbbVie’s turnaround is in full force, driven by solid performances from Skyrizi and Rinvoq, and robust ex-Humira growth prospects.

- AbbVie’s improved outlook has allayed the market’s fears, suggesting the worst of Humira’s headwinds are likely behind us.

- ABBV’s growth profile suggests that further re-rating could be challenging unless management presents a much better outlook.

- While AbbVie aims to expand into new growth vectors outside immunology, the developments are still early.

- I explain why it’s time for investors to step back, as ABBV is no longer priced at a bargain.

Daniel Boczarski/Getty Images Entertainment

AbbVie: Turnaround In Full Force

AbbVie Inc. (NYSE:ABBV) investors who bet on its successful turnaround and held on to their positions stoutly have been well-rewarded. The stock broke into a new high in July 2024, as the momentum continued through August. As a result, there’s no doubt that the market has looked past the challenges with Humira biosimilars, as they focus on the biotech company’s ex-Humira growth portfolio. In addition, Skyrizi and Rinvoq have outperformed expectations, underpinning AbbVie’s market leadership in immunology, which is fundamental to its bullish proposition.

Accordingly, Skyrizi and Rinvoq posted $4.1B in combined revenue in Q2, representing a 50% operational growth rate. In addition, additional indications for ulcerative colitis and growth prospects in its immunology pipeline should undergird its market leadership. As a result, I assess that AbbVie has demonstrated its remarkable ability to generate new growth vectors for its crucial immunology portfolio, helping to alleviate the market’s worries about Humira erosion risks.

In my previous bullish article on AbbVie, I upgraded the stock after assessing robust buying sentiments, bolstered by its attractive dividend yield. AbbVie’s fundamentally strong business was battered by a combination of execution and interest rate headwinds as investors reassessed the robustness of its ex-Humira growth portfolio. As the Fed is primed to lower interest rates from September 2024, income investors have likely returned to high-quality biotech players like ABBV, lifting it to a new high.

AbbVie raised its FY2024 adjusted EPS guidance to between $10.71 and $10.91. It has also anticipated some challenges from the Medicare Part D redesign (3% growth headwind), but they are not expected to be significant. In addition, the recent updates to the US government’s drug price negotiations are also not expected to impact AbbVie’s near- and medium-term growth profile significantly. While its aesthetics business is undergoing near-term growth challenges, its long-term prospects remain attractive.

AbbVie’s Immunology Portfolio Continues To Drive Growth

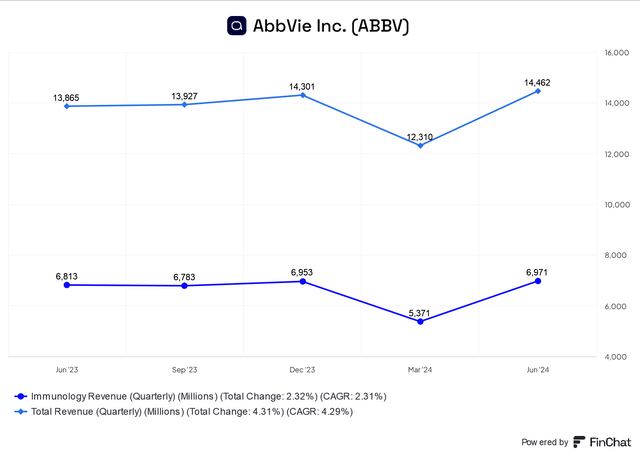

AbbVie’s Immunology revenue (FinChat)

I assess that the market will likely remain focused on the developments underpinning the recovery of its immunology assets. As seen above, the segment accounted for almost 50% of its Q2 revenue base. Given the solid performance of Skyrizi and Rinvoq in Q2, it has likely afforded more confidence for the market to anticipate a growth inflection. As a reminder, the company expects to be on track to surpass its combined Skyrizi and Rinvoq revenue guidance of more than $27B by 2027. Therefore, I assess that investors must continue scrutinizing the performance of its revived immunology portfolio moving ahead.

There are reasons to be optimistic about AbbVie’s growth prospects in its crucial revenue growth driver. It aims to develop “novel therapies for IBD” and is investing in “promising technologies and innovative mechanisms” that can bolster the efficacy of its current immunology portfolio. In addition, ABBV is making headways in combination therapies to expand the indications for its current portfolio assets. Hence, I have assessed that ABBV is not resting on its laurels as it looks to invest more aggressively to extend its market leadership in immunology.

Moreover, the recent Cerevel Therapeutics acquisition has expanded its exposure to neuroscience, bolstering its capabilities in schizophrenia, Parkinson’s disease, and major depression. Hence, it should help diversify the company’s reliance on its immunology portfolio with these neuroscience assets, buttressing its commercial execution.

AbbVie’s Growth Concerns Are Still Valid

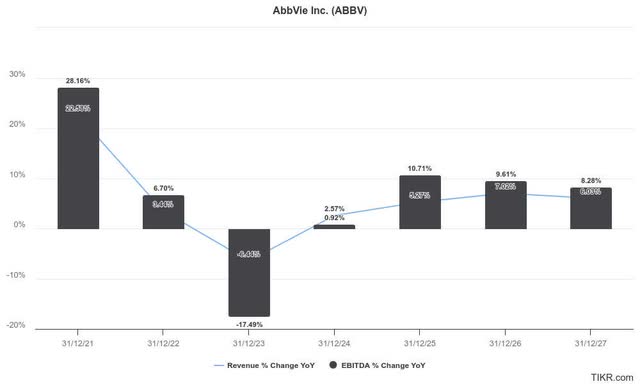

AbbVie estimates (TIKR)

Consequently, the market is likely confident that ABBV’s revenue growth hit a nadir in 2023. Therefore, it should provide more credibility to maintain its adjusted EBITDA growth profile through 2027. In addition, management assured investors that the biosimilar impact on Humira is assessed to be less significant from 2025 as it laps the challenges of its 2023 comps. Hence, I assess that the market has expressed its confidence that the worst of AbbVie’s Humira headwinds are likely behind us, focusing on its next-gen product growth engine.

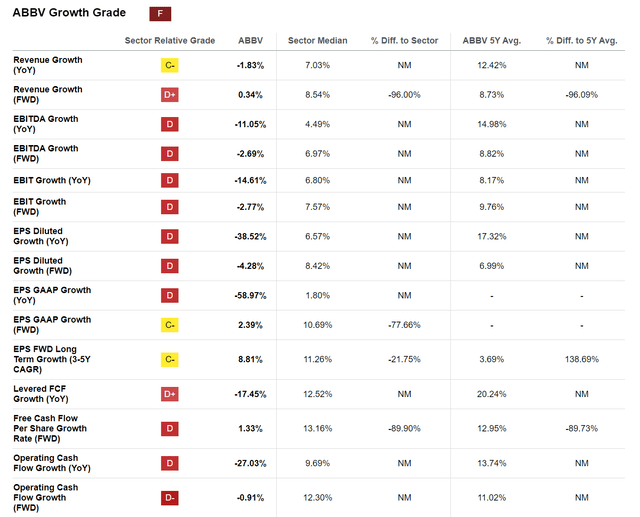

ABBV Quant Grades (Seeking Alpha)

Notwithstanding my optimism, there are valid concerns about whether the market would re-rate ABBV further against its healthcare sector peers and its long-term average.

Accordingly, ABBV’s “F” growth grade is a cause for concern, suggesting most of its forward growth metrics are expected to underperform its sector peers. Therefore, its risk/reward upside could be limited if the company faces growth challenges in its ex-Humira portfolio.

Accordingly, ABBV’s forward adjusted EPS multiple of 18.1x is more than 15% below its sector median. However, it’s nearly 65% above its 5Y average, suggesting the market has significantly re-rated ABBV. ABBV’s less attractive growth profile suggests that further re-rating could be challenging unless the company offers a better-than-anticipated forward outlook. However, given the headwinds attributed to its Humira biosimilars, I assess that management will continue to be conservative in its outlook to account for potential execution risks.

Risks To ABBV’s Buy Thesis

I assess that ABBV’s recent surge is justified, as the market was assessed to be too pessimistic. Hence, its recent outperformance has not surprised me. The stock’s below sector valuation suggests it’s still relatively undervalued, notwithstanding its recent recovery.

Its ability to diversify from its Humira blockbuster is pivotal to ABBV’s potential to be re-rated. Wall Street estimates on its forward growth prospects suggest a relative undervaluation to its sector median is apt. Hence, the risk/reward on ABBV seems relatively well-balanced at the current levels. Unless AbbVie can telegraph a more robust upgrade to its medium-term outlook, investors might find continued outperformance challenging.

In addition, Eli Lilly (LLY) aims to expand into new indications for its blockbuster GLP-1 portfolio. The other therapeutic areas include use cases involving psoriasis and inflammatory bowel disease, venturing into AbbVie’s treasured immunology assets. LLY’s decision to broaden the TAM for its GLP-1 blockbuster is telling, as it looks to capture a slice of the massive $117B immunology market by 2028. Investors are urged to monitor these developments, although they are not expected to hamper ABBV’s near-term outlook and execution capabilities.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!