Summary:

- Since its spin-off from Abbott Labs, AbbVie has delivered outstanding performance, surpassing both its parent company and the S&P 500, thanks to the success of Humira.

- In 2022, AbbVie became the second-largest pharmaceutical company, but despite diversifying into other areas, the impact of Humira’s patent cliff in 2023 is affecting its growth.

- Despite declining Humira sales, AbbVie remains resilient, focusing on new therapies, M&A, and R&D for sustained growth.

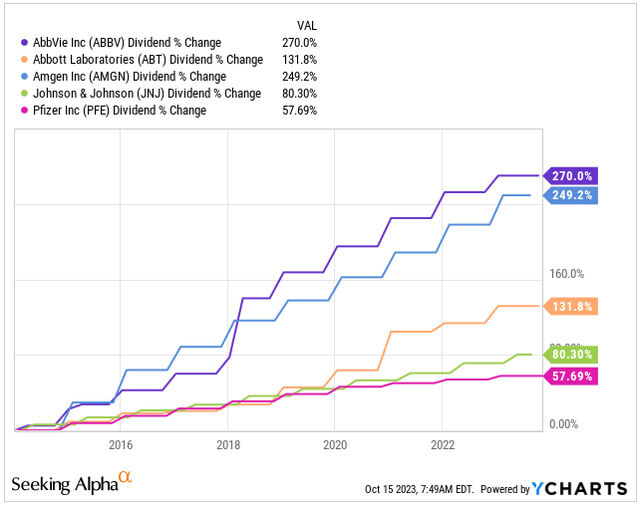

- AbbVie currently offers a 4% dividend yield and has achieved an impressive 270% dividend growth rate since 2014, while maintaining a payout ratio below 50%.

- Despite the promising future, the stock is trading at elevated valuations compared to its historical standards. I advise caution, suggesting an accumulation target in the range of $115 to $125.

vzphotos

Investment Thesis

As a dividend growth investor in my early 30s, I naturally prioritize the growth of my passive income rather than relying heavily on high dividend-yielding picks. Unlike those who depend on passive income for day-to-day expenses, my focus is on watching my income grow and reinvesting it.

If you find yourself in a similar situation, where you don’t need to rely on passive income immediately and prefer to watch it grow and reinvest, consider this perspective: choosing a company with an 8% dividend yield that grows its dividend at a rate of 2% annually will result in a yield on cost of roughly 11.9% after 20 years.

However, opting for a company like AbbVie (NYSE:ABBV), which currently yields 4% and consistently grows its dividend at around 10% annually, can lead to a yield on cost of 26.9% after 20 years.

Of course, it’s important to acknowledge that if the company doesn’t sustain its growth, the rate may slow down over time.

The concept is clear: focusing on growth rather than immediate yield can significantly enhance your returns in the long run.

Your choice ultimately depends on your time horizon and investment objectives. For me, I prioritize quality and outlook over chasing yield. AbbVie stands out due to its superior quality and promising future, making it one of the highest yielders in my portfolio.

AbbVie was established as an independent pharmaceutical company following its spin-off from Abbott Laboratories (ABT) in 2013. This strategic move allowed AbbVie to concentrate on R&D and commercialization of advanced therapies, setting itself apart from Abbott’s diversified medical products business.

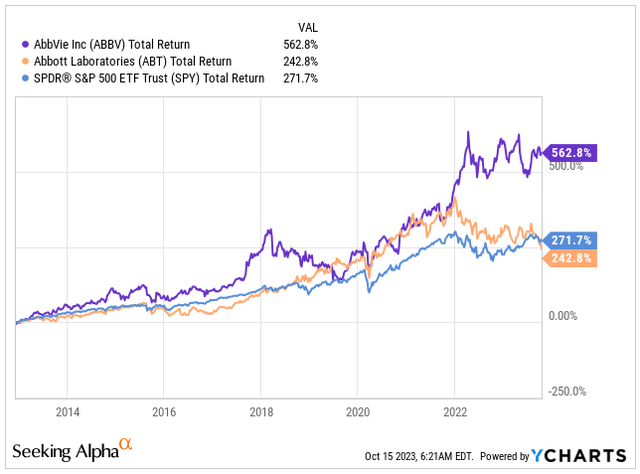

The spin-off has proven to be a highly strategic and well-executed move by management. AbbVie has delivered superior returns not only compared to the S&P 500 Index (SPY) but also in comparison to its parent company, Abbott Labs. This success underscores the exceptional ability of both companies in creating shareholder value.

Total Return (Seeking Alpha)

Naturally, AbbVie is not without its drawbacks; the main threat is the patent cliff of its flagship drug, Humira, which occurred in the US in 2016 when the first biosimilar version of Humira was approved by the FDA.

However, due to a series of legal agreements and settlements, biosimilars did not enter the US market until January 2023. This event marked a significant challenge for AbbVie, as the entry of biosimilars meant increased competition and revenue loss for Humira.

Despite this challenge, AbbVie’s management is executing well, and the company is strategically investing in different areas while maintaining a strong pipeline of drugs.

Let me show you why I appreciate AbbVie.

Humira’s Patent Cliff has Taken its Toll, but AbbVie was Prepared

AbbVie has emerged as the second-largest pharmaceutical company globally since its spin-off, based on the revenue generated by the end of 2022.

While Pfizer (PFE) leads the industry with revenue surpassing $100 billion, AbbVie’s achievement of securing the second position is remarkable.

This accomplishment gains further significance when considering the longevity of pharmaceutical giants like Johnson & Johnson (JNJ) and Merck (MRK), both of which have been in existence for over a century.

Top Pharma Companies (Proclinical)

Naturally, the question arises: how did AbbVie manage to evolve into such a pharmaceutical juggernaut, given its relatively short history?

Let me explain. The catalyst behind most of AbbVie’s success is Humira, which has become the most lucrative franchise in pharmaceutical history, generating a staggering $114 billion in revenue for AbbVie since 2016.

In that year, Humira faced a significant challenge – its key patent, protecting this best-selling anti-inflammatory medication used to treat conditions like arthritis, was expiring at the year’s end.

Regulators had approved a rival version of the drug, with more copycats in close pursuit. The market anticipated a drop in the medication’s $50,000-a-year list price due to increased competition.

However, the unexpected occurred. Through strategic, yet legal, exploitation of the US patent system, AbbVie managed to block competitors from entering the market. Consequently, the drug’s price continued to rise over the next six years, transforming it into an extraordinary success story for AbbVie.

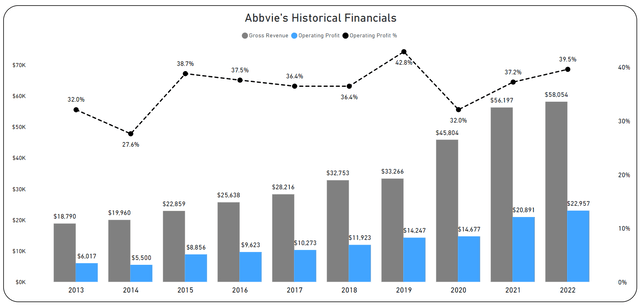

Leveraging this triumph, AbbVie remarkably grew its revenue from $19 billion in 2013 to over $58 billion by the end of 2022, representing an annualized growth rate of 20.9%.

What’s even more impressive is its Operating Income, which exhibited exceptional growth at a rate of 28.2% over the same period, reaching $23 billion by the end of 2022. This showcases the company’s improved efficiency as the margins have been very resilient and stable.

Historical Financials (Author’s Graph (Data SA))

However, as we are aware, AbbVie’s patent expired at the beginning of the year, and the inevitable decline has kicked off.

The generic version of the drug, Amjevita by Amgen (AMGN), which regulators approved more than six years ago, has entered the US market. Additionally, as many as nine more competitors for Humira are slated to enter the market in 2023, including pharmaceutical giants like Pfizer.

As of Q2 2023, AbbVie is already experiencing the effects of the patent cliff. Its net revenue has fallen by 4.2% to $13.86 billion, and Humira’s sales have plummeted by a staggering 24.8% compared to the previous year.

While Humira’s patent cliff is certainly cause for concern, AbbVie has had years to prepare for this eventuality, and in my opinion, they have done a commendable job.

One of the strategies to counter the patent cliff was the acquisition of Allergan, a deal successfully concluded in mid-2020, worth $63 billion.

This acquisition aimed to create a larger, stronger, and more diversified global biopharmaceutical company. Now, more than two years later, the new AbbVie is a fully integrated, more diverse company, and the strategic benefits of the acquisition have never been clearer.

Together, they have developed a more robust and diversified portfolio and expanded their R&D efforts into new therapeutic areas to foster business growth.

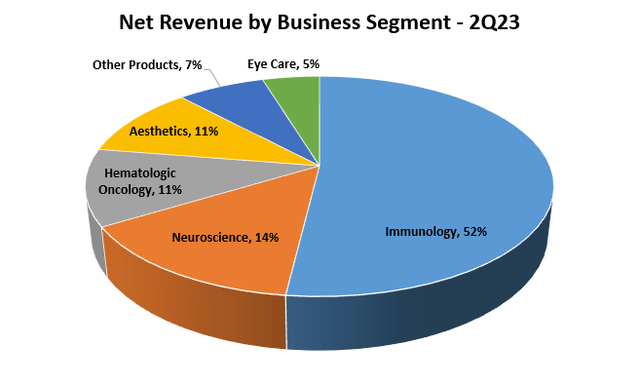

In 2014, Humira accounted for 63% of AbbVie’s net revenue. However, today, it has decreased significantly, making up only 29% of the total revenue.

Although Immunology remains the largest segment for the company, contributing to 52% of the net revenue, AbbVie’s current portfolio is significantly more diversified than before.

Moreover, it is anticipated that the importance of the Immunology segment will decline over the next decade, highlighting the company’s strategic shift towards greater diversification.

Net Revenue by Business Segment (Author’s Graph (Data ABBV IR))

Within the Immunology segment, AbbVie is currently focused on marketing drugs like Skyrizi and Rinvoq, both of which are experiencing sales growth rates of over 50%.

In the Hematologic Oncology segment, Venclexta stands out with a sales growth rate of 15%.

Meanwhile, in the Neuroscience segment, which currently contributes 14% to the overall sales, several promising therapies are emerging. Botox Therapeutic is growing at 11.3%, and Vraylar is experiencing substantial growth at 33.9% as of Q2 2023.

Beyond its existing pharmaceuticals and therapies, AbbVie is highly active in R&D. In 2022 alone, the company has invested $7.1 billion, approximately 12.2% of its Gross Revenue, into R&D.

Remarkably, more than 55% of the programs in its pipeline are in mid and late-stage development, showcasing AbbVie’s commitment to innovation and future growth, which should kick-in in the next few years.

AbbVie’s Pipeline (ABBV IR)

While I anticipated the 2023 adjusted diluted EPS to be at the upper end of AbbVie’s guidance, around $11.10 EPS, I do not foresee any significant increase in 2024.

The current portfolio requires some time to stabilize and counterbalance the negative impact of Humira. I expect EPS to resume growth in the mid to high single digits beyond 2024.

4% Yield, 270% DGR Since 2014

In the last five years, AbbVie has delivered great rate of return to its shareholders, achieving a return of 63.15% excluding dividends. However, this success has impacted its current dividend yield.

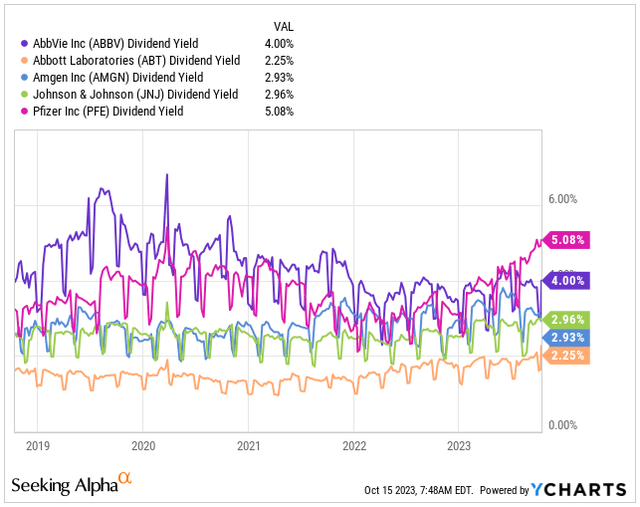

Although still offering an attractive 4% yield, appealing to both dividend growth investors and income investors, this figure is lower than the company’s 5-year average of 4.48%.

Nevertheless, currently only Pfizer offers a higher yield among the largest pharmaceutical companies. All other peers are yielding below 3%.

Dividend Yield (Seeking Alpha)

While the yield is certainly enticing, AbbVie’s true strength lies in its dividend growth rate. Thanks to the remarkable success of Humira, AbbVie has generated substantial FCF, leading to an impressive dividend growth rate of 270% since 2014.

This rate significantly surpasses that of its peers. Remarkably, AbbVie has achieved this while maintaining a safe payout ratio of less than 50%.

From my perspective, AbbVie is likely to continue growing the dividend at a rate ranging from 8% to 12% over the next decade. However, it’s important to note that we shouldn’t anticipate the same growth rates as in the previous decade.

DGR (Seeking Alpha)

The one concern that bothers me is AbbVie’s limited activity in share buybacks. In fact, the company has increased its share count by 11%, as part of the Allergan acquisition was partially financed with AbbVie’s stock.

In my opinion, reducing the share count could significantly contribute to the strategy of mitigating the impact of the patent cliff and boosting its EPS.

20% Stretched Valuation

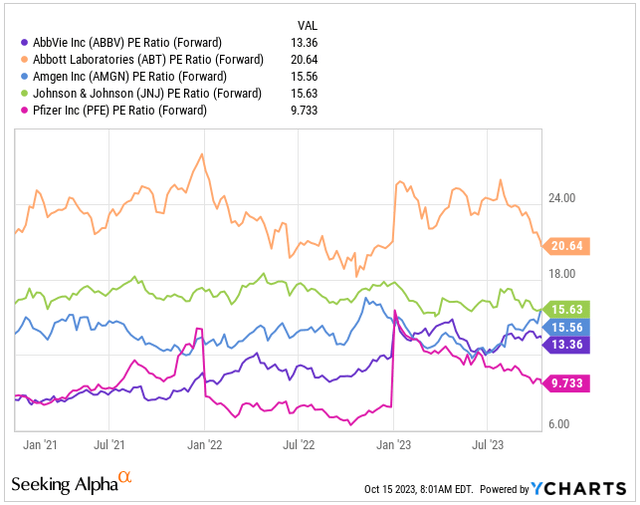

The current concern lies in the valuation. Due to AbbVie’s strong performance over the past couple of years, its valuation has stretched beyond my comfort level.

Although AbbVie compares favorably with its peers, which are trading at even higher Forward PE ratios, AbbVie is presently trading at 13.36 times its FY24 earnings. This figure is actually 30% higher than its 5-year average of 10.06x.

Forward PE (Seeking Alpha)

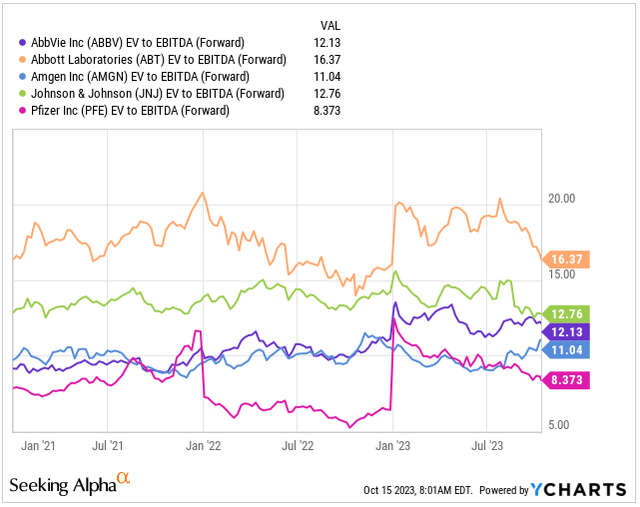

The Forward EV/EBITDA further supports this observation; AbbVie is currently trading at 12.13 times, which is 12% higher than its 5-year average of 10x.

Forward EV/EBITDA (Seeking Alpha)

Considering that significant EPS expansion is not anticipated in 2024 and beyond with only high single-digit growth, the Forward PE ratio is expected to remain elevated at 12.27x by FY26 as well.

Given the overvaluation of approximately 20%, I would advise readers against initiating positions at these levels. Entering at this point may result in negative capital appreciation for the foreseeable future, with the only profit coming from the 4% dividend yield.

In this scenario, it might be wiser to explore opportunities in money markets, such as CDs yielding 5%, and wait for a more favorable entry point into this high-quality, well-managed business.

Conclusion

AbbVie stands out as the epitome of delivering shareholder returns.

The success of Humira and the financial acumen of the company have propelled extraordinary growth and returns since its spin-off from Abbott Labs in 2013.

In just a decade, AbbVie has become the second-largest pharmaceutical company globally.

As anticipated, the impact of Humira’s patent cliff has started to reflect in the 2023 results, leading to a decline in sales. However, AbbVie has strategically positioned itself not only to navigate the patent cliff but also to grow and diversify through M&A and R&D initiatives.

While significant EPS growth is not expected in 2024 due to the need to stabilize the product portfolio and counter the decline in Humira’s sales, a reasonable rate of return of around 8-12% annually can be anticipated thereafter.

However, it’s worth noting that the company has experienced exceptional stock price appreciation in the last five years, leading to a somewhat stretched valuation today.

Given the current levels, I would advise exercising caution. It might be prudent to enjoy the 5% yield from CDs before considering initiating a position in AbbVie.

In case the stock price falls closer to the $115-$125 range, I recommend seizing the opportunity and investing in this well-managed pharmaceutical business with remarkably stable margins.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.