Summary:

- The US FDA has already approved two directly interchangeable biosimilars to ABBV’s Humira, namely Boehringer Ingelheim’s Cyltezo and PFE’s ABRILADA.

- The impact on ABBV’s sales may be great, since its competitors have priced their biosimilars at notable discounts, with the third interchangeable biosimilar likely to be approved sooner rather than later.

- Even so, the stock has maintained much of its gains since December 2021, since the Humira patent expiry was well known for years and pessimism was largely priced in.

- Then again, we believe that its financial and stock performance may stagnate at current levels until the management unlocks a new top and bottom line driver.

- For now, our long-term price target of $161.12 further implies ABBV’s underwhelming growth investment thesis for the foreseeable future.

Oleh_Slobodeniuk/E+ via Getty Images

What Is ABBV’s Investing Story After Humira’s Patent Expiry?

We previously covered AbbVie Inc. (NYSE:NYSE:ABBV) in July 2023, discussing its uncertain prospects due to Humira’s loss of exclusivity, after 20 years of monopoly and $200B in revenues.

We had believed that there might be further headwinds to its top-line growth, with nearly ten more biosimilars expected to enter the market in 2023.

For now, it appears that our fears may materialize after all, with the US FDA already approving two directly interchangeable biosimilars to ABBV’s Humira, namely Boehringer Ingelheim’s Cyltezo and Pfizer’s (PFE) ABRILADA.

For context, pharmacists may substitute US FDA-approved interchangeable biosimilars in place of Humira, without the advice of a healthcare professional.

The impact on ABBV’s sales may be great indeed, since Boehringer Ingelheim’s wholesale acquisition cost implies an -81% discount to Humira, with the brand name, Cyltezo, priced at a -5% discount.

PFE’s ABRILADA will also be available at two different price points, at -60% and -5% discount to Humira’s list price, respectively.

The third interchangeable biosimilar from Alvotech (ALVO) and Teva Pharmaceutical Industries Ltd. (TEVA) may also be approved within the year, potentially implying more pain to ABBV’s topline from Q3’23 onwards.

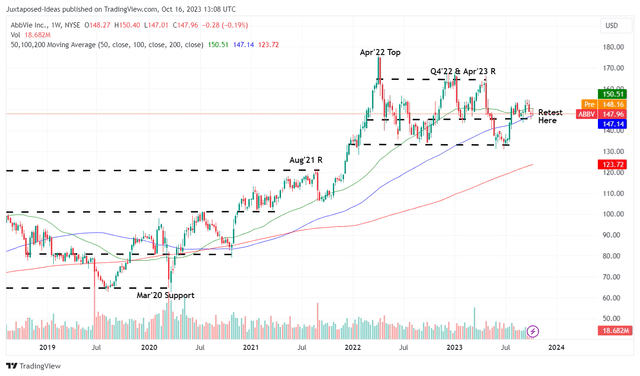

ABBV 5Y Stock Price

Despite so, ABBV has been able to maintain much of its 2022 gains, with the stock also trading sideways since December 2021. Perhaps this is attributed to the stock’s baked-in pessimism, with the Humira patent expiry already widely known for many years.

While the biotech company is expected to generate an underwhelming top and bottom line CAGR of -1.3% and -4.3% through FY2025, compared to its normalized levels of +14.7% and +19.1% between FY2016 and FY2022, respectively, we are not overly concerned yet.

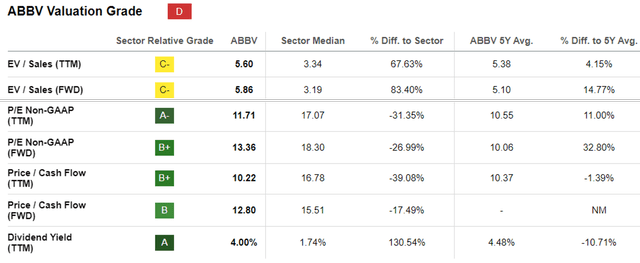

ABBV Valuations

This is because the same pessimism has already been observed in the ABBV stock’s impacted FWD P/E valuation of 13.36x, compared to its historical P/E mean of 16.50x and the sector median of 18.30x, implying that the worst has already been priced in.

The discount observed in its valuations has also been seen in multiple biotech/ pharmaceutical stocks, including Pfizer and Bristol-Myers Squibb Company (BMY).

While both companies have aggressively embarked on similar M&A paths to counter the ongoing patent cliffs, it is apparent that their prospects have been moderated as well, as demonstrated by their impacted P/E valuations of 9.73x and 7.66x, respectively.

Interested investors may read more about the two stocks in our previous articles linked above.

For now, it is unsurprising that ABBV has embarked on the same path, with the company acquiring three companies over the past three years, namely Allergan for $63B in June 2019, DJS Antibodies Ltd for $255M in October 2022, and Mitokinin for $110M in October 2023, amongst others.

While these deals have been made in an attempt to dilute Humira’s top-line contribution to ABBV’s overall revenues from 57.6% in 2019 at $19.16B, to 36.5% in FY2022 at $21.23B, and to 28.9% in FQ2’23 at $16.04B, it remains to be seen how these aggressive acquisitions pan out.

For now, we believe that ABBV’s prospects are largely tied to Skyrizi and Rinvoq, with the two therapies boasting high growth annualized sales trend at $7.52B (+38.2% QoQ/ +50.4% YoY) and $3.67B (+33.8% QoQ/ +55% YoY) in the latest quarter, respectively.

Both therapies have also increasingly expanded their uses across different indications, potentially well-balancing Humira’s patent expiration over the next few years, or based on the management’s projections, by 2027.

This is on top of the management’s aggressive FY2023 R&D projected spend of $6.8B (-4.2% YoY), with over “50 plus programs in mid and late-stage development.”

Nonetheless, we believe that as with most biotech/ pharmaceutical companies, investors must be aware that the success of ABBV’s pipeline and aggressive M&A activities remains to be seen.

This is especially true since the industry’s actual success rate from clinical trials to the eventual approval is only ~8%, implying that a pipeline remains a pipeline until efficacy has been proven and FDA authorization has been obtained.

ABBV’s prospects from Parkinson’s disease are uncertain as well, with Mitokinin’s candidate only in the early stages of development, with the eventual commercialization unlikely to occur over the next few years.

If any, Parkinson’s disease therapy is only expected to generate an overall TAM of $10.4B by 2031, unlikely to outperform Humira’s top-line contribution.

Unfortunately, we believe that ABBV’s financial and stock performance may stagnate at current levels until the management unlocks a new top and bottom line driver.

So, Is ABBV Stock A Buy, Sell, or Hold?

In the meantime, we believe that long-term ABBV shareholders may have to contend with minimal growth until a breakthrough occurs.

Then again, existing investors may continue to subscribe to their ongoing DRIP program, due to the more than decent forward dividend yield of 4% compared to the sector median of 1.54%, with it only slightly moderated from its 5Y average yields of 4.68%.

Its income investment thesis appears to have been decent as well, with a 3Y dividend growth rate of +7.84% compared to the sector median of +5.90%, though naturally lagging compared to its historical levels of +16.41%.

This theory has also been validated by the ABBV management’s updated FY2023 adj EPS guidance from the previous $10.90 – $11.10 to the current $10.86 – $11.06.

Investors may want to note that the -$0.04 headwind is “attributed to additional expense for acquired in-process research and development, or IPR&D, and milestones.”

The preliminary message seems to be crystal clear for now, with the headwinds from the Humira biosimilars remaining well within control and the biotech’s foothold still robust for at least two more quarters.

Based on ABBV’s revised FY2023 adj EPS guidance of $10.96 (-20.4% YoY) at the midpoint and its FWD P/E valuations of 13.36x, the stock appears to be trading near its fair value of $146.42 as well.

On the other hand, based on the consensus FY2025 adj EPS estimates of $12.06, there appears to be a minimal upside potential of +8.8% to our long-term price target of $161.12, further validating its underwhelming growth investment thesis for the foreseeable future.

As a result of the reduced margin of safety at current levels, we prefer to cautiously rate the ABBV stock as a Hold (Neutral) here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.