Summary:

- Despite losing patent protection for Humira in 2016, ABBV was able to maintain the drug’s market share by engaging in extensive patent litigation and agreements delaying biosimilar rollouts.

- These agreements are expiring all at once this year, leading to an expected rapid decline in Humira sales (which represents a significant portion of revenue).

- Although ABBV rolled out new products in anticipation of Humira’s sales decline, none of these drugs has the scale or growth enough to fully compensate for the expected revenue decline.

vzphotos

Investment Thesis

AbbVie (NYSE:ABBV) focuses on discovering, developing, and marketing branded therapeutics protected by intellectual property rights, allowing it to command higher prices and margins. However, once the exclusivity expires (usually after 15-20 years), other companies can produce and sell generic versions of the drug, which typically sell at a lower price than the branded product. The nature of its business requires continued investment in R&D to develop new products to replace those that lose patent protection or become obsolete. Management of the portfolio life cycle is critical to compensate for high capital costs and lessen the inherited sales volatility. This is especially true for ABBV, whose 9-year (and counting) consecutive dividend growth policy has attracted an income-oriented shareholder base.

Founded in 2013 as a spin-off of Abbott Laboratories (ABT), ABBV is best known for its flagship drug Humira, which is used to treat various autoimmune diseases, including rheumatoid arthritis, psoriasis, and Crohn’s disease. Humira has been the world’s best-selling drug for several years, generating nearly 40% of the biotech giant’s revenue.

Management “succeeded” in maintaining the market share of Humira despite losing patent protection in 2016, utilizing what many might describe as ethically-questionable strategies that attracted public scrutiny, including reformulating the drug and engaging in extensive patent litigation to prevent biosimilars (generics) from entering the market, including lawsuits and injunctions against companies seeking to launch biosimilar versions of Humira, exhausting its competitors before striking deals that delay the rollout of these biosimilars in the US, its most lucrative geographical market, in exchange of a compromise that entails allowing these companies to market the drug in Europe and other parts of the world.

As we discuss in the following paragraphs, all this is coming to an abrupt crash this year, adding pressure to a stock facing technical resistance as it trades at all-time highs, not to mention an aggressive regulatory environment that relentlessly seeks to lower national spending on drugs.

Agreements Expiring All at Once

Amgen (AMGN) developed a biosimilar version of ABBV’s blockbuster drug Humira, called Amgevita. In 2018, Amgevita was approved by the FDA for treating several autoimmune diseases, including rheumatoid arthritis and psoriasis. However, Amgen and ABBV agreed to delay the rollout of Amgevita in the US until January 31, 2023. In exchange, ABBV granted Amgen a non-exclusive license to market and sell Amgevita in Europe and other counties, a compromise that spares both companies’ costly litigation.

As one of the world’s largest pharmaceutical companies, AMGN has the resources and marketing capabilities to pose a significant threat to ABBV’s sales starting Q1 2023. But things get worse. Mylan, now part of Viatris (VTRS), Samsung Bioepis (part of Samsung Biologics), and Boehringer Ingelheim signed similar (but separate) agreements that delayed the rollout of their respective biosimilars until June-July 2023 of this year, in return of marketing rights in Europe. As the exclusivity period ends, these three companies will also be free to market their FDA-approved drugs (called Hulio, Imraldi, and Cyltezo, respectively) starting this summer.

In 2018, ABBV also struck a deal with Sandoz, a subsidy of Novartis (NVS), to delay the commercialization of Humira biosimilar called Hyrimoz until September 30, 2023, giving the final blow for ABBV before year-end.

The Magnitude of the Decline

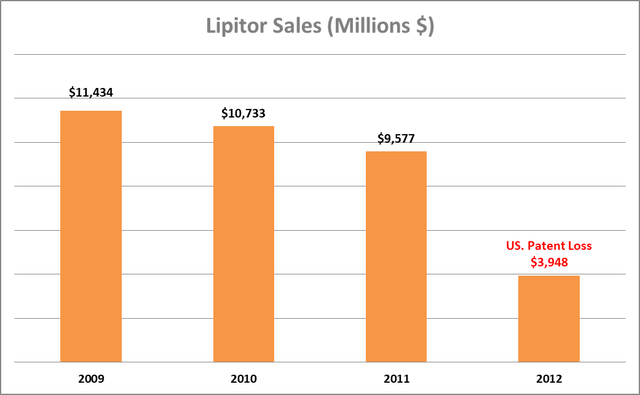

Lipitor (atorvastatin), a cholesterol-lowering drug, was once the best-selling drug in the world, similar to Humira, with annual sales of over $12 billion, providing an excellent case study to estimate Humira’s revenue dynamics in the next 6 – 12 months. Pfizer (PFE) lost Lipitor’s US patent in November 2011. Although generics weren’t available until mid-2012, the impact on Pfizer’s revenue was significant, showing a rapid decline in sales as cheaper generic versions of the drug became available.

Author’s estimates based on PFE filings

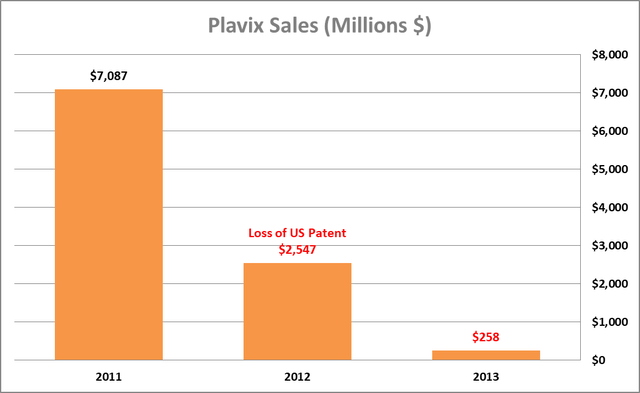

Plavix (clopidogrel), a blood-thinning drug used to prevent heart attacks and strokes, is yet another example of a drug with commercial success comparable to Humira, and once has been the best-selling drug worldwide, with annual sales at its peak standing at $9.7 billion. Plavix was developed by Bristol-Myers Squibb (BMY) but lost its US exclusivity patent in 2012, leading to a dramatic decline in sales, as shown below.

Author’s estimates based on BMY filings

Based on the performance of other best-selling drugs subsequent to the loss of patent exclusivity in the US, Humira sales will likely decline significantly in the next few quarters.

Ice-Cube Business Model

The business model of branded drug biotech companies can be compared to an ice-cube machine producing cubes with a limited lifespan, eventually melting out and becoming obsolete. Similarly, branded biotech products have a limited lifespan due to the expiration of IP and the loss of exclusivity, which allows generic competitors to enter the market and erode the revenue and profits of the original manufacturers. This comparison highlights the importance of innovation, continuously creating and adding more ice cubes, to stay ahead of the revenue cycle. This has a crucial impact on valuation. For a less capital-intensive company, retained earnings (beyond those distributed as dividends) are used for growth initiatives such as M&A and operational expansion. In the case of ABBV, a significant portion of retained earnings are channeled to maintain revenue instead of generating growth.

In the past few years, ABBV rolled out several new products to enhance its revenue in anticipation of revenue decline from Humira, the most important of which are Skyrizi (risankizumab), Rinvoq (upadacitinib), with annual sales in 2022 of $5,165 million, $2,522 million respectively, representing 8%, 4% total sales respectively. However, neither of these drugs alone nor collectively have the scale and growth enough to compensate for the expected decline in Humira sales, especially when taking into consideration other blockbuster drugs in ABBV’s portfolio that are becoming obsolete, such as Imbruvica (Ibrutinib), with $4,568 million FY 2022 sales, down $840 million (16%) from FY 2021 levels.

ABBV gained FDA approval for Skyrizi and Rinvoq, which collectively target all the indications covered by Humira. Although the three drugs have different mechanisms of action, to my knowledge, they are interchangeable to a great extent, and while one can argue that the US consumer’s taste towards branded new healthcare products provides some moat, incorporating this level of granularity in sales estimates should be read in the context of a tighter regulatory environment that explicitly and aggressively encourages the use of generics whenever possible, tilting any outcome of insurance coverage decisions in favor of Humira’s biosimilars. In fact, I wouldn’t be surprised if sales of Skyrizi and Rinvoq decline in the coming months, given that Humira’s biosimilars are essentially competitor medicines.

Summary

The things we do for yield. ABBV might appear an attractive defensive healthcare stock, but the reality is its business couldn’t be more cyclical, not necessarily influenced by macroeconomics, but rather an ice-cube business model inherent from the temporary nature of patent exclusivity protection.

For a long, ABBV has fought tooth and nail to protect the market share of Humira, and for good reasons. The drug is one of the best-selling drugs in US history and represents 25% of total sales.

When I looked at ABBV’s new drug rollout and portfolio, none has the scale or growth rates enough to compensate for the expected rapid decline in ABBV sales this year, adding more pressure on its ticker, currently trading at all-time highs. For this reason, I believe that the momentum will fade, and ABBV shares will decline.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.