Summary:

- AbbVie’s recent stock decline is a classic example of how valuation can greatly influence stock performance.

- The pharma giant outperformed the analyst consensus for both net revenue and non-GAAP EPS in Q1.

- AbbVie’s long-term debt remains A-rated by S&P on a stable outlook.

- The company’s shares appear to be 1% overvalued.

- I would be thinking about buying any dips a bit below $150.

$100 U.S. banknotes stacked over each other. Iana Miroshnichenko

Investing can be as simple or as complicated as we make it. Those who know me know that I like to keep things as simple as possible.

In investing, three inputs contribute to the total returns of an investment. First are any dividends that can either be reinvested into the same security, selectively reinvested into other stocks, saved, or spent/donated.

Next is the long-term earnings growth rate that a company delivers to its shareholders. All else equal (e.g., when a stock is fairly valued), dividends plus the long-term earnings growth rate comprise total returns.

But when a stock is priced above its fair value, the valuation multiple will eventually contract to fair value. This can be a drag on total returns.

Alternatively, buying stocks at a discount to fair value can be a boost to total returns. This is what makes it so important to buy dividend stocks (or any stocks for that matter) with a margin of safety.

AbbVie (NYSE:ABBV) (NEOE:ABBV:CA) is the latest case study of what can happen when a stock is valued excessively. When I downgraded the stock to a hold rating in February, it wasn’t because of the operating fundamentals. I appreciated the health of ABBV’s existing product portfolio. I also was optimistic about its pipeline. The A-rated balance sheet was also a plus.

But I simply couldn’t justify the share price at that time relative to fair value. My thesis was proven to be correct, with shares falling 11% in that time as the S&P 500 index (SP500) gained 6%.

Today, I’m reiterating my hold rating. But this comes with the caveat that ABBV stock is a small dip away from swinging back to a buy rating in my view. The company’s double beat in the first quarter was one reason. ABBV’s growth outlook remains intact. Finally, shares are also on the cusp of returning to fair value or better.

The Recovery Is Beginning To Materialize

ABBV Q1 2024 Earnings Press Release

When I previously covered ABBV, I noted how 2024 would probably be the beginning of its multi-year recovery. Starting the year with first-quarter results that were shared on April 26, this proved to be the case.

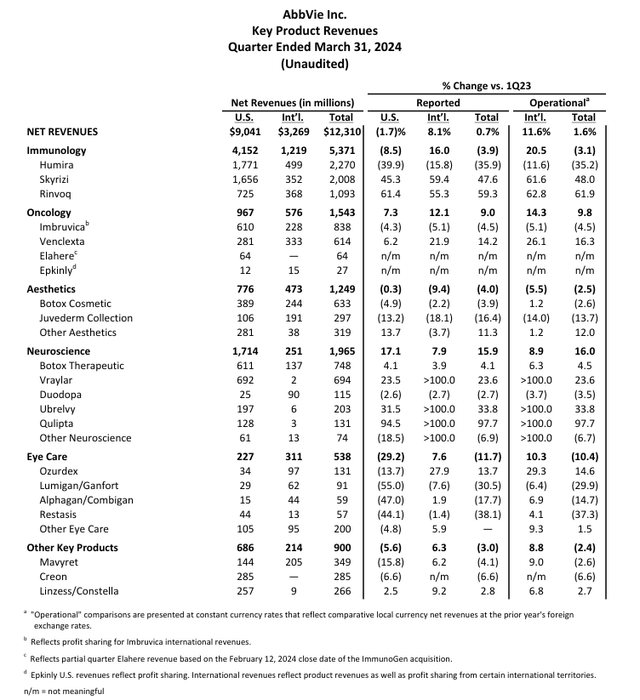

The company’s net revenue grew by 0.7% year-over-year to $12.3 billion during the first quarter. That came in $370 million ahead of the analyst consensus per Seeking Alpha. Adjusting for unfavorable foreign currency translation, operational revenue grew by 1.6% for the quarter.

As competition from generic drugs further intensified in the U.S. and internationally, Humira’s total net revenue slid by 35.9% year-over-year to $2.3 billion in the first quarter.

The good news is that AbbVie’s next-generation immunology drugs are becoming a much larger part of its sales mix and still showing positive momentum.

Skyrizi’s net revenue powered higher by 47.6% year-over-year to surpass $2 billion during the first quarter. According to Chief Commercial Officer Jeff Stewart’s opening remarks during the Q1 2024 Earnings Call, this was driven by a U.S. biologic psoriasis prescription share above 35%. For perspective, that’s more than twice the share of the next closest biologic therapy.

Stewart also noted that share in psoriatic arthritis is beginning to ramp up. As far as inflammatory bowel disease indications are concerned, Skyrizi is on pace to add over $1 billion of incremental sales in 2024. This isn’t even considering that ABBV anticipates the medicine will be approved for an ulcerative colitis launch in the middle of this year. That indication could open up another multi-billion-dollar net revenue opportunity for Skyrizi.

Rinvoq was no slouch, either. The therapy’s net revenue surged 59.3% over the year-ago period to almost $1.1 billion for the first quarter. Stewart pointed to growth throughout all of the indications as propelling the drug’s net revenue higher in the quarter. This is how total immunology revenue only fell by 3.9% during the quarter.

In oncology, a healthy showing from Venclexta and the launches of Elahere and Epkinly more than offset the net revenue decline from Imbruvica. That pushed oncology net revenue up by 9% to $1.5 billion for the first quarter.

Another highlight in the first quarter was continued strength from anti-psychotic Vraylar and migraine therapies Ubrelvy and Qulipta. Continued share gains propelled neuroscience net revenue up by 15.9% to almost $2 billion in the first quarter.

ABBV’s adjusted diluted EPS dipped by 6.1% year-over-year to $2.31 during the first quarter. That was $0.05 better than Seeking Alpha’s analyst consensus.

Higher SG&A expenses and income tax expenses led ABBV’s non-GAAP net profit margin to contract by 240 basis points to 33.5% for the first quarter. That is why adjusted diluted EPS fell a bit as net revenue grew in the quarter.

Management upped its 2024 adjusted diluted EPS guidance from a midpoint of $11.07 ($10.97 to $11.17) to $11.23 ($11.13 to $11.23).

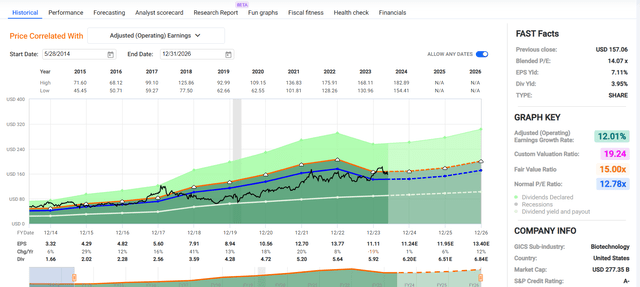

The FAST Graphs analyst consensus of $11.24 in adjusted diluted EPS suggests that analysts share in this optimism. That would equate to a 1.2% growth rate in adjusted diluted EPS over 2023.

As ABBV launches the ulcerative colitis indication for Skyrizi soon and its key growth drugs keep winning share, its bounce back should progress as the quarters unfold. This is why I believe these forecasts are realistic.

Moving to 2025, the consensus is that adjusted diluted EPS will rise by another 6.3% to $11.95. In 2026, another 12.1% growth in adjusted diluted EPS to $13.40 is currently being anticipated.

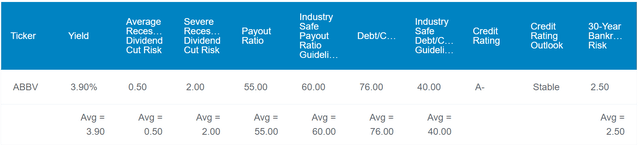

ABBV’s interest coverage ratio was 4.9 during the first quarter. That isn’t bad for this quarter, considering that it should mark the bottom for the company. This is how ABBV still has an A- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to ABBV’s Q1 2024 Earnings Press Release and ABBV’s Q1 2023 Earnings Press Release).

Shares Are Worth Over $150 Each

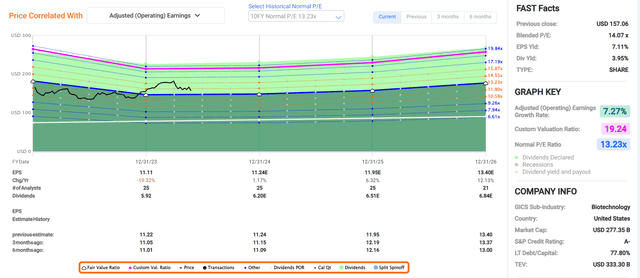

ABBV’s correction in recent months has made the valuation less excessive. It isn’t quite buyable yet, but it’s certainly getting closer.

ABBV’s current-year P/E ratio of 13.7 is just above its 10-year normal P/E ratio of 13.2. Relative to the forward growth consensus of 7.3% annually, this is a forward non-GAAP PEG ratio of 1.9. That’s slightly above the healthcare sector per Seeking Alpha’s Quant System, which is why I believe that a reversion to the 10-year normal P/E ratio is reasonable.

After this week, 2024 will be 42% complete. That means 58% of 2024 and 42% of 2025 lie ahead in the next 12 months. Using these weightings with the $11.24 2024 adjusted diluted EPS consensus and $11.95 2025 adjusted diluted EPS consensus, I get a 12-month forward adjusted diluted EPS input of $11.54.

Plugging that into the 13.2 fair value multiple, I get a fair value of $153 a share. This means ABBV is priced at a 1% premium to fair value from the current $154 share price (as of May 29, 2024).

Still A Free Cash Flow Machine

The Dividend Kings’ Zen Research Terminal

ABBV’s 4% forward dividend yield is substantially higher than the healthcare sector median forward yield of 1.5%. This earns the company an A grade from Seeking Alpha’s Quant System for forward dividend yield.

Even as ABBV is getting the business back on track, it delivered 6.9% annual dividend growth in the past three years. This is about in line with the healthcare sector median of 7%. That’s enough for a C+ grade from Seeking Alpha’s Quant System for 3-year dividend growth.

ABBV’s dividend also appears to be rather sustainable. That’s because the 55% EPS payout ratio is below the 60% EPS payout ratio that rating agencies like to see from the industry.

In the first quarter, ABBV also continued to generate plenty of free cash flow to cover its dividend obligation. The company posted $3.8 billion in free cash flow. Against the $2.8 billion in dividends paid during that time, this left more than $1 billion in excess free cash flow. That almost completely covered the $1.3 billion in share buybacks executed in the quarter as well (info according to ABBV’s Q1 2024 10-Q filing).

This modest free cash flow deficit to pay the dividend and repurchase shares is viable moving forward. That’s because, for one, free cash flow is also going to improve as the business completes its turnaround. As ABBV’s earnings grow, its leverage ratio will also remain just fine.

That’s why I anticipate at least mid-single-digit annual dividend growth for the foreseeable future.

Risks To Consider

ABBV is a quality business, but there are still risks to the long-term investment thesis.

At this point, the company looks like it will successfully pivot beyond Humira. However, the success of Skyrizi and Rinvoq isn’t without its challenges. As the successful indications pile up for the duo, that will make it even more difficult for ABBV to pivot beyond them.

Fortunately, ABBV has 90+ compounds or indications that are currently in development or under collaboration or license within its pipeline. The company can also execute strategic acquisitions to better position itself for the future. Nevertheless, this is a risk that must be occasionally monitored with even the highest-quality pharmaceutical businesses.

There’s also the industry-specific risk of legislation around the world that could crimp profit margins. If that were enacted in major markets, it could weigh on ABBV’s fundamentals.

Lastly, the company’s valuable proprietary information makes it a target of attempted cyber breaches. If any were successful, ABBV’s proprietary data could be compromised, and its competitive positioning could be harmed.

Summary: A World-Class Business Nearing The Buy Zone

ABBV has a 1.7% weighting in my portfolio and is my 12th-biggest holding. I would think about adding below $150 (likely around $145) as that would provide an adequate cushion in my opinion. Until that point, based on improving and solid fundamentals, I am happy to keep holding for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.