Summary:

- AbbVie has successfully managed the patent expiration of its top-selling drug Humira by delaying revenue decay, introducing new products, and expanding its pipeline.

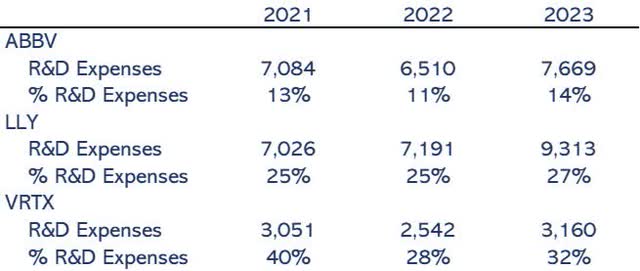

- The company is committed to innovation and has increased its R&D expenses, with a pipeline of 90 compounds and 50 in mid- or late-stage development.

- AbbVie has strengthened its neuroscience portfolio through the acquisition of Cerevel and ImmunoGen, allowing it to enter the solid tumor space and expand its offerings.

- I estimate a value of $300 per share, higher than the current stock price. I recommend the stock for a portfolio with liquidity needs due to its 3.7% dividend yield.

vzphotos

Overview

AbbVie is a research-based biopharmaceutical company with immunology, oncology, aesthetics, and neuroscience expertise. In immunology, AbbVie is known for one of the most sold drugs of all time, Humira, which has generated gross revenue of $21 billion at the peak year.

Pharmaceutical companies are challenging to value because, as in the case of AbbVie, they are exposed to patent expiration. When you are at the beginning of the patent, you will enjoy years of no competition. Still, when the patent expires, your investment faces a very volatile time that damages the return on the investment. This is the case of AbbVie with Humira.

My goal in analyzing a pharmaceutical company is to find one that will assure me of reasonable growth and a stable flow of dividends. I need some liquidity in my portfolio, so I am looking for a company like AbbVie.

I conclude that AbbVie’s management has proven its capabilities in managing its delicate position with Humira, as its patent was terminated in 2023, and management has turned around this situation, putting AbbVie in a position to keep growing. What they have done is 1) delay Humira’s revenue decay, 2) complement Humira with two better products in the immunology space, 3) keep developing its pipeline, 4) strengthen its neuroscience portfolio, and 5) develop solid tumor drugs with ADCs.

In my valuation, I estimate a stock price of $300 per share with a premium of 85%, which is a buy recommendation. AbbVie, with a 3.7% dividend yield, is a good security in a portfolio with liquidity needs.

Delaying Humira’s revenue decay

Management has managed the Humira patent loss using three levers: leading the price reduction, patent extension, and new products in the immunology space to substitute Humira.

AbbVie has been reducing Humira’s price so it doesn’t lose market share or doctor’s relationships. This price reduction also keeps competitors away from the patient and the client. At the same time, they have been working on extending patents over Humira with new applications contending its revenues. These extended patents cover even the drug’s manufacturing processes. Insiders call this model “a pipeline in a pill,” in which a drug increases sales as it gets more approvals from the Food and Drug Administration for related diseases. Humira has extended from Crohn’s disease to rheumatoid arthritis to psoriasis.

Humira’s managers have been completely successful in achieving a target of $4 billion in sales by 2028.

At the same time, Humira has developed two drugs, Skyrizi and Rinvoq (Figure 1), that treat the same diseases as Humira but with greater efficacy. Management expects $27 billion in sales by 2027 from about $16 billion this year, with expected sales estimations revised upwards. AbbVie has done an excellent R&D job as a substitute for its flagship product. Both brands are gaining market share and increasing approved indications, including rheumatology, IBD, and atopic dermatitis.

It is developing its pipeline

AbbVie is a pharmaceutical company compromised with innovation. As shown in Figure 2, R&D expenses over revenue have increased by 9%. Full-year guidance of 8% growth rate, 15% at the end of the year. They are accelerating its innovation pace, which is 14% of its revenue and, in absolute terms, aligns with Eli Lilly and Company (LLY) but lagging. I would expect even more investment in R&D in the coming future, in line with Lilly to get more than $9 billion in 2024

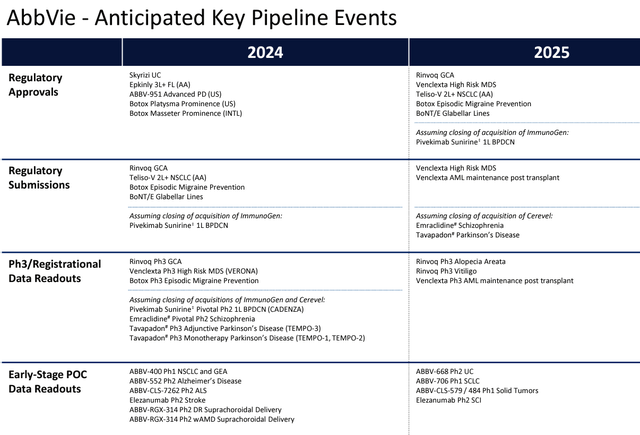

AbbVie’s pipeline comprises 90 compounds, 50 in mid- or late-stage development. Those developments are uncertain, and I am not assuming them in my valuation.

Figure 3: AbbVie Earnings Presentation 4T2023

Strengthen its neuroscience portfolio

In December 2023, AbbVie acquired Cerevel for $8.7 billion. The acquisition fits with its neurological portfolio, adding to its pipeline drugs in schizophrenia, Parkinson’s disease, and mood disorders. In my opinion, it’s an excellent fit because AbbVie complements Cerevel’s expertise with its global commercial capabilities and regulatory expertise.

Cerevel is close to getting approval for a drug to fight schizophrenia. It uses a new class of medications with the best benefit to avoid side effects from current drugs.

The neurological market is $3.82 billion, growing at a CAGR of 5.1%. After approval this year, I expect revenues of $200 million in 2025 (less than 1% of the schizophrenia market at a price of about $1,000). Figure 4 shows they would gain a 2% market share by 2028.

Develop solid tumor drugs with ADCs

In November 2023, AbbVie acquired ImmunoGen for $10.1 billion. This acquisition allows them to enter the solid tumor space. ImmunoGen develops cancer drugs that target malignant cells without damaging sane cells. This technique is called antibody-drug conjugates, or ADCs. Elahere won approval last year for treating ovarian cancer, generating about $246 million in sales in nine months.

Ovarian cancer statistics tell us that there are about 313,000 cases in the world. The market is valued at 4.35 billion and growing at 6.6%. My expectation of the evolution of the market and Elahere revenue is shown in Figure 5. Elahere could generate more than $1.6 billion in sales by 2028.

Valuation

I use the discounted cash flow method. I established for 2024 the $54.2 billion expected from Management, but in following years, I set revenue growth at 8% because Management expects a “high single-digit compound.” I project a 35% EBITDA margin as the margin the company got in 2023, but it is conservative because it is the worst in the last five years. This lower margin is due to increased R&D costs (+3pp) consistent with the context of the investing in the pipeline with Humira’s decrease in revenue and a one-time impairment of some drugs, such as Imbruvica (+8pp).

Amortization and stock-based compensation over revenue are set at 15%, consistent over the years. I put the CAPEX and Net Working Capital investment at -1% and -2%. Net Working Capital variation has been positive in 2023, but I adopt a conservative approach in my projections due to the aggressiveness of the growing strategy.

I discounted free cash flow at a WACC of 7% and assumed a long-term growth rate of 3%. I estimate the value of the shares to be $300, an 85% premium from the current stock price. The total growth rate in my valuation is 3.8% vs. 1.4%, which is the terminal growth rate in the stock price. This indicates that the stock is undervalued, and my valuation is consistent even with a high premium.

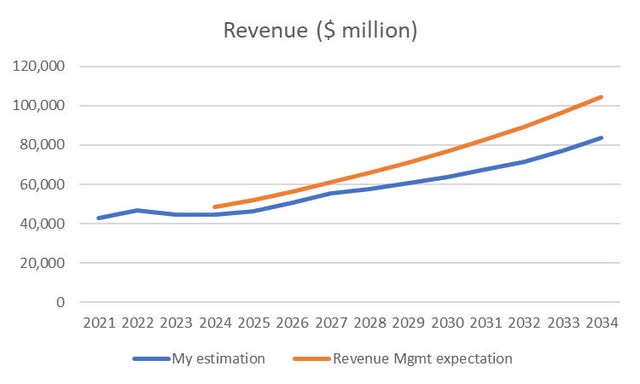

I have checked that a “high single-digit compound” growth rate is feasible. For this purpose, I have estimated the revenue of the main drugs in AbbVie’s portfolio and its new acquisitions. In Humira, I expect to have zero revenues in 2032. Skyrizi and Rinvoq will grow 20% until 2027, which will add up to $27 billion as management expects, and later on, it will grow at 4%. Imbruvica and other decaying products will decrease at -20% per year, and the products in the portfolio, with increasing revenues, will keep growing at 10%-15% until reaching a peak within the ten years of my analysis. As I had estimated, I added Cerevel and ImmunoGen to the projections. I ended up with a graph, as shown in Figure 6, where I compared my estimation with the long-term growth management expectations. You can see a more significant difference from $10 billion in 2029 to $20 billion in 2034. That represents a new blockbuster or two in 10 years. I think getting a new blockbuster of this size is feasible in ten years, but I always consider that they don’t lose revenues from current products because management has demonstrated that it can manage the process of a revenue-decreasing product. In this bottom-up analysis, I conclude that management’s expectation of a “high single-digit” growth rate is feasible.

Risks

The risks in a pharmaceutical company are high because you never know how successful a drug can be or its potential market. You also don’t know how much revenue will decrease in a drug that loses its patent. To balance that, the company can acquire new biotech companies and manage a diverse portfolio of drugs or, as AbbVie has done, manage patents to raise market entry barriers.

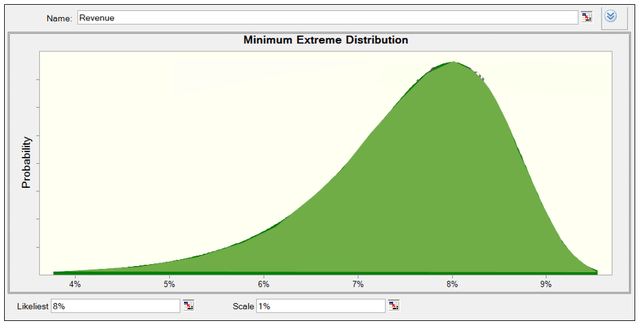

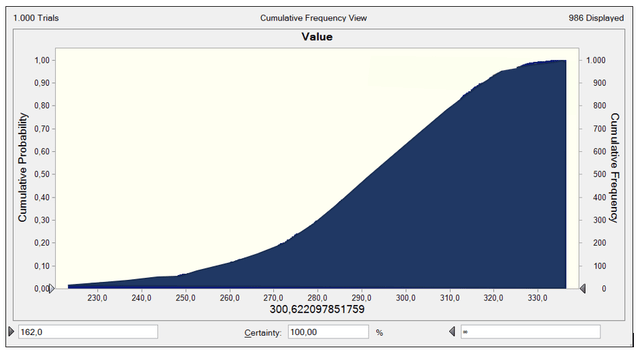

I model the risk based on the revenue growth rate variable that, in my base case, is set at 8%. I use a Minimum Extreme Distribution, as shown in Figure 7. The likeliest value is 8%, and the scale is 1%. You can see that the highest probability is around 8% but can go further to 4%-5%. I model it that way because I want to consider cases where management can’t get the 8% growth rate I have considered in the base case. That way, I establish scenarios with revenue under 9%.

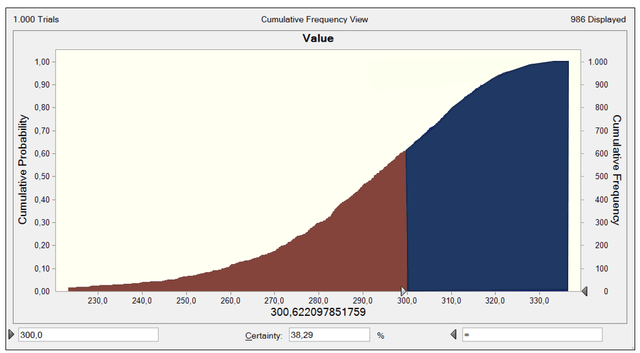

Once I have established that the revenue growth rate can vary with the Minimum Extreme Distribution in Figure 7, I run the DCF model, and the model’s output is the stock value. Figure 8 reflects the cumulative probability of the stock value, a sensitivity graph showing the different ranges of stock value based on each of the different growth rates. For instance, the probability of getting a value greater than my base stock value of $300 per share is 36.31% (the blue area), which is low because the modeled risk is skewed negatively.

As you can see, the probability of getting a value greater than the current stock price at $162 per share is almost 100%, assuming the rest of my above assumptions and inputs for the DCF.

If growth rates are less than stated in the Minimum Extreme Distribution, for instance, less than 3%, the value will get lower than the current stock price. To manage that risk, you have to review the approvals in the pipeline and revenue expectations in the article.

Conclusion

AbbVie is in the final stages of Humira’s patent loss. We are at the beginning of solid revenue growth at 8%, with margins at 35%. The company is managed by a team that has proven its capabilities inside the industry, managing Humira’s crisis. In my model, the shares’ value is around $300, a significant premium over the current stock price. So, I recommend buying the stock, especially with portfolios that need liquidity due to a 3.7% dividend yield.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABBV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.