Summary:

- AbbVie stock has fallen into a correction, declining nearly 16% from its March 2024 highs.

- Despite the pullback, AbbVie remains a highly profitable company with a strong portfolio and robust long-term guidance.

- The stock valuation is not cheap, but ABBV’s 4% dividend yield may provide valuation support.

- I argue why ABBV’s turnaround could finally pick up momentum, suggesting a turnaround could be coming. Read on.

vzphotos

AbbVie Stock Fell Into A Correction

AbbVie Inc. (NYSE:ABBV) is a leading biopharma company navigating the biosimilar erosion of its highly successful immunology drug, Humira. Despite that, AbbVie posted a pretty solid earnings scorecard in April 2024. In addition, AbbVie also raised guidance at its Q1 earnings release. Accordingly, AbbVie’s revised outlook suggests an adjusted EPS guidance range of between $11.13 to $11.33.

Notwithstanding management’s optimism, ABBV has suffered a pullback from its March 2024 highs, dropping into correction territory after declining nearly 16% through this week’s lows. As a result, it has underperformed its healthcare sector (XLV) peers since April, as the market reallocated out of ABBV.

I last updated ABBV investors in March 2024, maintaining my Hold thesis on ABBV. Although I acknowledged that AbbVie investors have proved me wrong as ABBV stock surged to a new high in early 2024, I assessed the surging optimism as unsustainable. As a result, I urged ABBV investors who missed buying its lows to wait patiently for an anticipated pullback to add exposure.

With ABBV’s decline over the past two months putting it into correction territory, I believe it’s timely for me to update investors about my current assessment.

AbbVie Has Rock-Solid Profitability

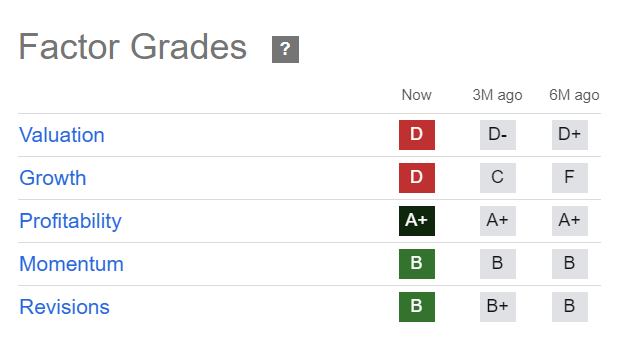

ABBV Quant Grades (Seeking Alpha)

Investors must remember that ABBV is still a highly profitable company, with a best-in-class “A+” profitability grade relative to its healthcare peers. As a result, AbbVie has significant ammo to execute R&D activities or business development opportunities to bolster its well-diversified portfolio (immunology, oncology, neuroscience, eye care).

AbbVie is still expected to deliver a free cash flow margin of nearly 35% this year, notwithstanding the pricing impact from Humira. AbbVie management assured investors that AbbVie has considered competition from biosimilars and changes to formularies from PBMs in its annual guidance. Moreover, AbbVie emphasized that it expects “the significant majority of Humira’s erosion in 2024 will be due to price rather than volume, with solid contracts in place through 2024.” As a result, the company is confident in mitigating Humira’s impact on its bottom line with the robust performances of Skyrizi and Rinvoq. AbbVie also highlighted that it has observed “a significant move” to these drugs, underscoring its visibility and outlook.

AbbVie’s Long-Term Guidance Is Robust

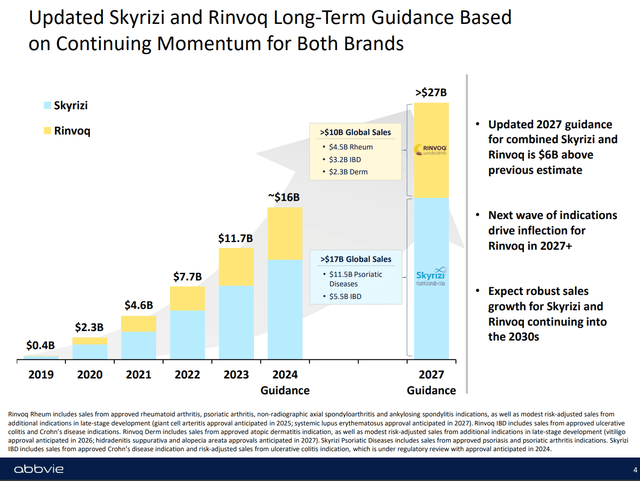

ABBV long-term outlook for Skyrizi and Rinvoq (AbbVie filings)

Therefore, ABBV remains on track to outperform AbbVie’s raised >$27B guidance for Skyrizi and Rinvoq by 2027. Furthermore, expectations of “robust sales growth” into the 2030s should alleviate the market’s concerns about its long-term outlook. As a result, I believe the recent pullback doesn’t suggest a falling knife to avoid. In contrast, the correction should represent a significant dip-buying opportunity for investors who believe in the company’s ability to reignite its growth momentum.

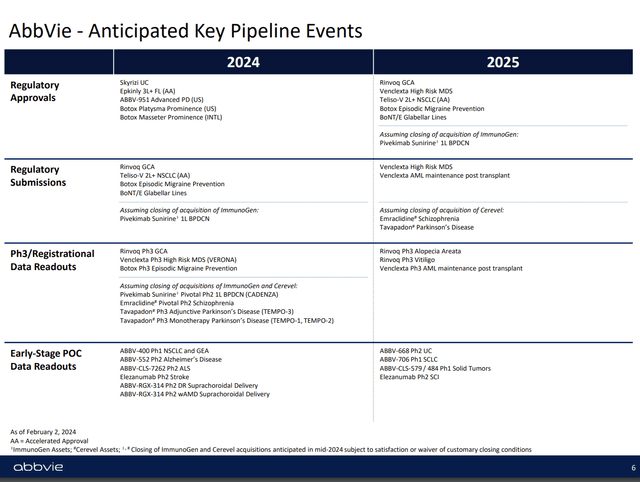

AbbVie key pipeline events through 2025 (AbbVie filings)

Furthermore, the company has several key events lined up through 2025 to maintain investor confidence about its portfolio developments. AbbVie has also completed its ImmunoGen acquisition and integrated its “flagship cancer therapy, Elahere.” Therefore, given its solid profitability profile, it should bolster the market’s confidence in AbbVie’s ability to execute further business development opportunities.

ABBV Stock Valuation Isn’t Cheap Though

However, ABBV isn’t valued at a discount (“D” valuation grade). ABBV’s forward adjusted PEG ratio of 1.9 aligns with its sector median. In addition, its forward adjusted EBITDA multiple of 12.3x is well above its 10Y average of 10.6x.

Hence, I have not assessed a valuation bifurcation in ABBV, suggesting further downside volatility might be possible. Notwithstanding my caution, ABBV’s relatively attractive forward dividend yield of 4% should bolster buying sentiments. It’s markedly higher than its industry average of 3%. With the Fed’s rate hikes likely peaked, income investors are expected to view ABBV’s forward yield favorably, providing much-needed valuation support.

Is ABBV Stock A Buy, Sell, Or Hold?

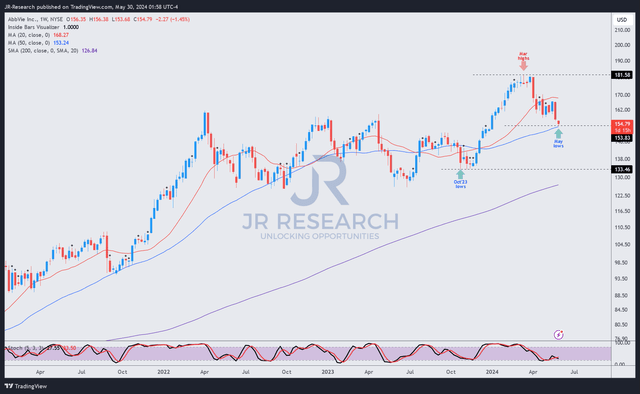

ABBV price chart (weekly, medium-term, adjusted for dividends) (TradingView)

ABBV’s price chart suggests a bullish reversal isn’t imminent. However, it remains in an uptrend bias, suggesting investors should monitor ABBV’s price action carefully for clues to enter.

I expect dip-buyers to return with higher conviction after the consolidation took another tumble last week. If buyers fail to hold above the $154 level, we might see further downside toward the gap between the $135 and $154 zone before a bottom could be assessed.

Notwithstanding the near-term caution, I assess that ABBV’s fundamentally strong business model should underpin the market confidence in AbbVie’s long-term thesis. Although I don’t glean significant undervaluation, I have confidence that the pullback should remain supported close to the $150 level, given the current dynamics.

Consequently, ABBV investors waiting patiently should find the recent pullback an attractive opportunity to buy more shares.

Rating: Upgrade to Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!