Summary:

- AbbVie has shown resilience and strength despite the patent loss of its best-selling drug, Humira.

- The company has reported impressive earnings, robust sales in various segments, and a promising pipeline.

- AbbVie offers a 4% dividend yield, steady dividend growth, and an attractive valuation, making it a top high-yield play.

Matteo Colombo

Introduction

It’s time to discuss AbbVie (NYSE:ABBV) stock, my only drug manufacturing/biotech dividend (growth) holding. When I established my current dividend growth portfolio in 2020, AbbVie was one of the first investments I bought because of its tremendous track record of dividend growth, backed by a solid product portfolio and pipeline.

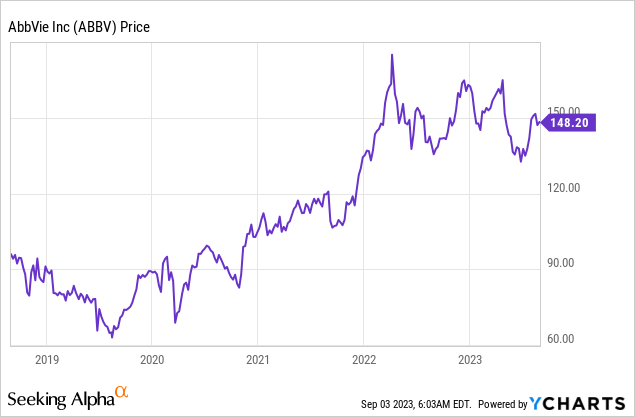

AbbVie experienced high volatility last year following the patent loss for Humira, resulting in increased uncertainty and the always-present risk exposure due to drug pricing and market risks.

On May 3, I wrote my first article on AbbVie, titled AbbVie Sells Off, I’m Buying.

Back then, ABBV shares were down roughly 9% on a year-to-date basis.

After my article, shares continued to drop by roughly 10%, causing me and some readers to question if the value was really that good when I covered the stock.

The good news is that ABBV has bounced back. It is now back at May 3 levels after rising 13% from its 52-week lows.

Even better, I believe that the company is now even more attractive than it was back then.

As we’ll discuss in this article, the company is doing very well. The Humira patent loss is less severe than initially expected, its pipeline remains rock-solid, other drugs are performing better than expected, and its guidance was raised.

On top of that, the company is expected to return to growth next year, followed by potential growth acceleration in 2025.

With its 4% dividend yield, double-digit long-term annual dividend growth, and very attractive valuation, ABBV remains one of my top high-yield plays, which I will continue to buy quite aggressively in the months ahead.

So, let’s dive into the details!

AbbVie’s Patent Loss

I have close to 50% industrial exposure. As most of my readers know, I have significant exposure in railroads, defense companies (my largest sector), and machinery stocks like Deere & Company (DE).

What makes industrial companies so great is that they often come with wide moats. It’s hard to start a railroad, let alone an advanced defense contractor without massive funding.

Healthcare is different. According to the FDA, the average patent lasts 20 years. That’s a long time. However, it means that healthcare companies are consistently forced to stay on top of their game.

Patent terms are set by statute. Currently, the term of a new patent is 20 years from the date on which the application for the patent was filed in the United States. Many other factors can affect the duration of a patent. – FDA (2020)

That’s obviously a great thing for patients, as drugs need to have competition.

For companies, it comes with additional risks. Even if companies have the best drugs in certain areas, that may not be the case in 10-20 years.

It’s also why I own Danaher (DHR), a supplier of high-tech healthcare supplies used to research new drugs. It offsets some of the risks I take by investing in biotech/drug manufacturers.

Having said that, AbbVie lost the patent of its best-selling drug, Humira.

This caused the stock to enter elevated volatility after being a fantastic performer since its spin-off from Abbott Laboratories (ABT).

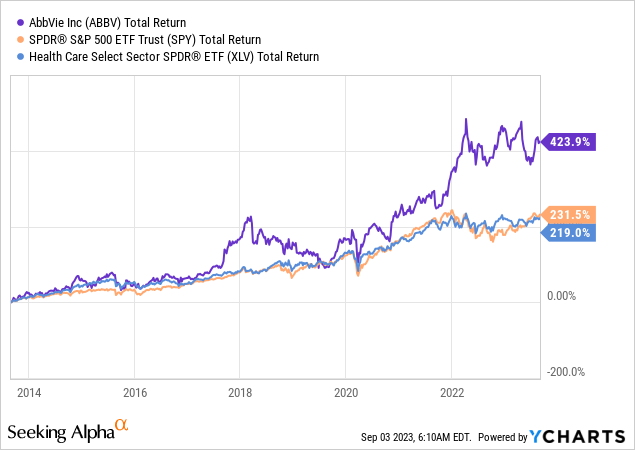

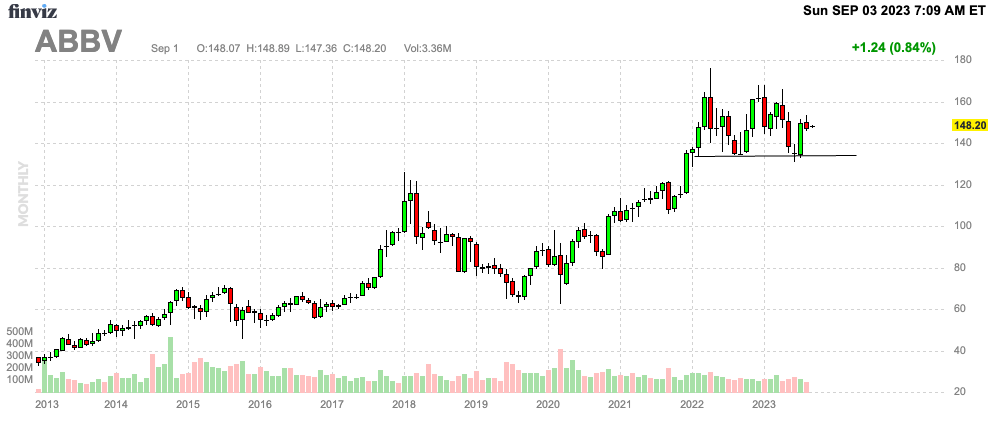

Despite two periods of steep declines, ABBV shares have returned more than 420% over the past ten years, beating the S&P 500 and healthcare sector by a wide margin.

I expect that to continue as ABBV remains in top shape despite its challenges.

AbbVie Remains In Top Shape

So far, I haven’t added a lot of value, as everyone knows that Humira has been a challenge for some time.

What matters is that the company is handling these things much better than most expected.

For example, in its second quarter, the company reported adjusted earnings per share of $2.91 for the second quarter, exceeding its guidance midpoint by $0.11.

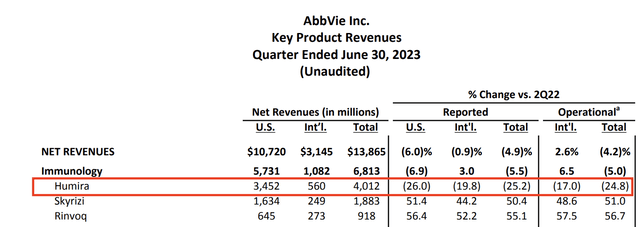

Total net revenues reached nearly $13.9 billion, surpassing guidance by over $350 million.

Sales were down 4.9% year-on-year as a result of severe weakness in Humira, which was expected.

Notably, the company’s ex-Humira growth platform played a significant role in this outperformance.

In immunology, Skyrizi and Rinvoq are achieving impressive growth, with sales up more than 50% compared to the previous year (see the table below).

According to the company, these two agents have differentiated clinical profiles, and they are approved for a wide range of indications, with a forecasted combined revenue growth of over $3.5 billion for the year.

Humira is also performing well, with erosion rates better than expected due to volume. The company also benefited from pricing power – despite its patent loss.

So, despite Humira’s challenges (which turned out to be better than expected), the company also raised its guidance!

This Chicago-based company raised its full-year adjusted earnings per share guidance by $0.23 to a range between $10.90 and $11.10.

- Total net revenues for the year are now anticipated to be approximately $53.4 billion, reflecting a $1 billion increase.

- Key contributors to this outlook include expectations of robust sales for Skyrizi, neuroscience products, and aesthetics, along with a projection of U.S. Humira erosion at approximately 35%.

- In the third quarter, ABBV anticipates net revenues of around $13.7 billion, accounting for U.S. Humira erosion of about 40% and considering modest unfavorable foreign exchange impacts.

Furthermore, with regard to Rinvoq, which did more than $900 million in 2Q23 sales, the company attributed this success to its strong differentiation and broad indications, including rheumatology, IBD, and atopic dermatitis. It stands out as the only daily oral medication with compelling head-to-head data against multiple novel therapies.

With increasing prescriptions across various indications, Rinvoq is making its mark in the market, especially in atopic dermatitis and IBD.

The data for Crohn’s disease launched recently, also shows a robust start, positioning Rinvoq as the only JAK inhibitor approved for this indication.

According to my data, Rinvoq has full patent protection until at least 2036.

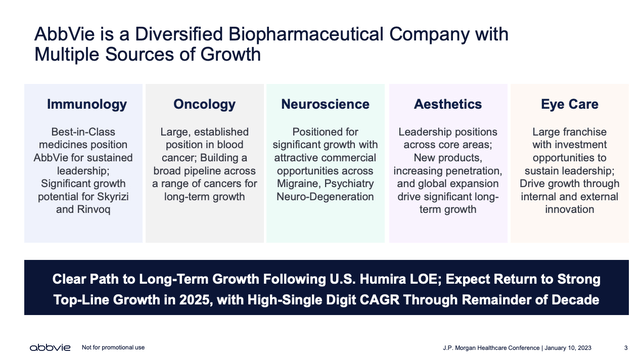

The good news continues, as the company offers a wide range of products beyond immunology.

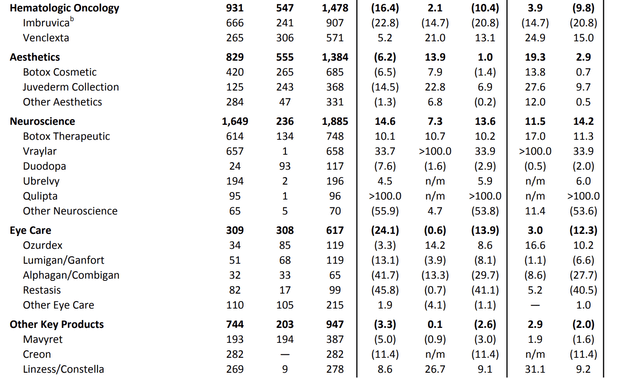

For example, in hematologic oncology, total second-quarter revenues came in close to $1.5 billion.

The neuroscience segment reported revenues of nearly $1.9 billion, with Vraylar exceeding expectations, driven by increasing momentum across all indications. While oncology saw a 10.4% contraction, the bigger neuroscience segment saw 13.6% growth.

ABBV maintains leadership in the migraine treatment market and sees strong demand for its oral CGRP portfolio, contributing $292 million in combined sales.

Adding to that, AbbVie is known for its Botox business. Since its >$60 billion takeover of Allergan, the company is the go-to place for these procedures.

In the second quarter of 2023, ABBV reported global aesthetics sales of approximately $1.4 billion, which is a 2.9% increase on an operational basis.

While the U.S. aesthetic market faced economic challenges, international markets performed strongly. U.S. aesthetics sales amounted to $829 million, down 6.2%, mainly due to lower consumer spending driven by inflationary pressures.

Botox Cosmetic remained a market leader in the U.S., with sales of $420 million, and the Juvederm collection maintained its market leadership despite a 14.5% year-over-year decline in sales.

International aesthetics saw 20% operational growth, led by a strong recovery in China.

By 2029, the company aims to generate sales of more than $9 billion per year in this segment!

The good news is that 2Q23 isn’t an outlier, as the company not only sees strong momentum (ex-Humira) but also a promising pipeline.

- In immunology, Rinvoq received FDA approval for Crohn’s disease, marking its seventh FDA approval across various areas. Rinvoq’s potential extends to multiple other diseases, including systemic lupus and hidradenitis suppurativa, with Phase III studies underway.

- Skyrizi also demonstrated promising results, with positive top-line results in ulcerative colitis and superiority over Otezla in moderate psoriasis. The company expects regulatory approvals for these programs in the near future.

- In oncology, Epkinly received accelerated approval in the U.S. for relapsed or refractory DLBCL, and the Phase II trial for follicular lymphoma showed an overall response rate of 82%.

- ABBV’s navitoclax program saw positive Phase III results for myelofibrosis, with a doubling of improvement over the control group. ABBV plans to engage with regulatory agencies after more comprehensive data becomes available.

I Believe ABBV Is Way Too Cheap

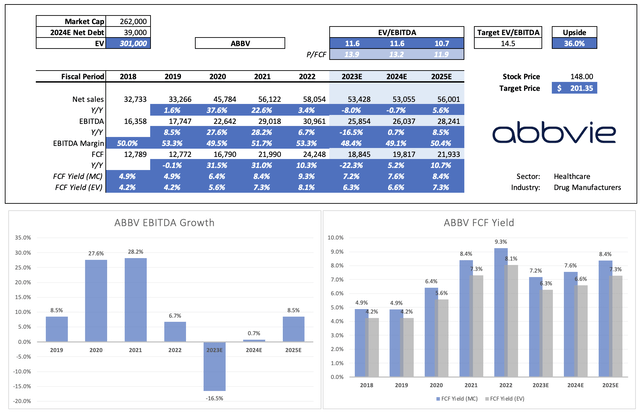

This year isn’t going to be pretty. EBITDA is expected to decline by roughly 17%. However, next year, EBITDA is expected to stabilize, followed by growth acceleration in 2025 and beyond.

Leo Nelissen (Based on analyst estimates)

Given the company’s comments and pipeline, this growth trajectory makes sense and will allow us to quickly leave the Humira troubles behind.

Not only is EBITDA expected to accelerate, but the company is also expected to grow already high free cash flow.

The company could reach an 8.4% free cash flow yield in 2025, which protects its 4.0% dividend yield.

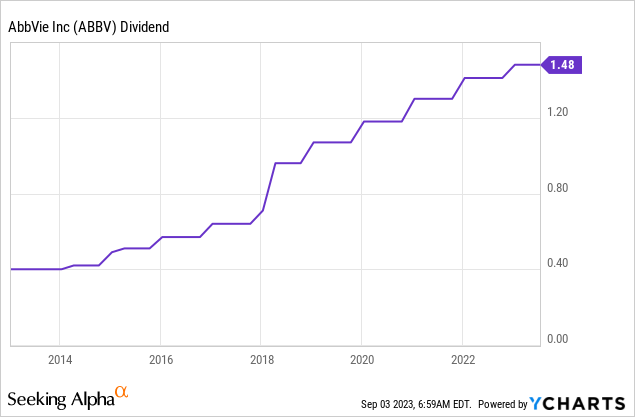

The company has consistently hiked its dividend since spinning off from Abbott. The 5-year dividend CAGR is 12.3%. This is one of the highest growth rates for a 4%-yielding stock I’ve seen this year.

On October 28, 2022, the company hiked by 5%.

I expect dividend growth to pick up after the Humira dust has settled.

The company is generating too much free cash flow. When adding higher expected free cash flow down the road, we get fertile ground for close-to-double-digit annual hikes.

ABBV is also a holding of Morgan Stanley’s dividend portfolio (overweight!)

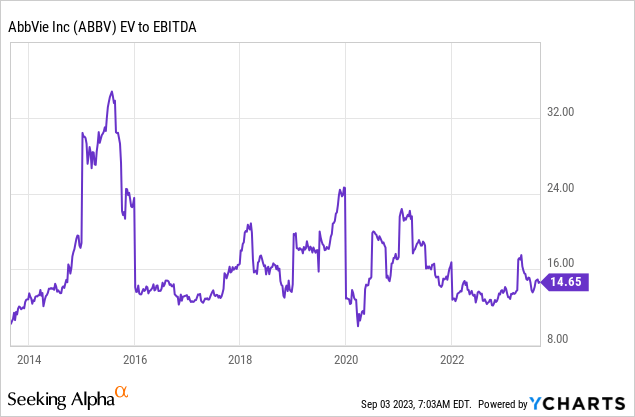

Going back to the company’s valuation, the company tends to trade close to 15x EBITDA, which is fair, given its anti-cyclical behavior and ability to grow both EBITDA and free cash flow by double-digits on a consistent basis.

As seen in the table above, the company currently trades at 11.6x 2023E EBITDA. That number drops to 10.7x by 2025, thanks to an expected acceleration in EBITDA.

Applying a 14.5x valuation would give the stock a fair value of $201 per share, 36% above the current price. This excludes debt reduction beyond 2024, giving this estimate a higher margin of safety.

The current consensus price target is $169.

ABBV is expected to end this year with $46.5 billion in net debt, which is 1.8x EBITDA. It has a BBB+ credit rating.

Given the company’s juicy yield, attractive valuation, and (related) healthy product portfolio and promising long-term growth outlook, I am looking to add on further weakness.

I believe that the stock has strong support close to $133, which means I’m buying more on potential minor corrections down the road.

FINVIZ

While I do not have a main focus on high-yield investments, I try to maintain a yield close to 3.0% in my portfolio. ABBV is a fantastic tool to get the job done, and it will remain the cornerstone of my non-cyclical high-income investments for many decades. At least, that’s the plan.

Takeaway

In the world of dividend growth investing, AbbVie has shown its resilience and strength.

Despite the patent loss of its best-selling drug, Humira, the company is on a solid path, with impressive earnings, robust sales in various segments, and a promising pipeline.

ABBV’s ability to weather challenges and its attractive valuation make it an appealing choice for income investors.

With a 4% dividend yield and a history of consistent dividend hikes, ABBV remains a top high-yield play.

As the company anticipates future growth, investors can expect to benefit from improving dividend growth in the years to come.

While uncertainties exist, ABBV’s potential for long-term value makes it a cornerstone in my portfolio, offering a strong foundation for non-cyclical, high-income investments.

Reasons To Be Bullish

- Steady Dividend Growth: ABBV has a strong history of consistent dividend growth, offering a 4% dividend yield and a 12.3% 5-year dividend CAGR.

- Resilient Post-Humira Performance: Despite losing the Humira patent, ABBV has outperformed expectations, raised guidance, and maintained profitability.

- Diverse Product Portfolio: ABBV’s portfolio includes successful drugs like Skyrizi and Rinvoq in immunology, along with strong segments in neuroscience, oncology, and aesthetics.

- Promising Pipeline: ABBV has promising FDA approvals and positive results in various therapeutic areas, indicating future growth potential.

- Attractive Valuation: The stock is undervalued, trading at 11.6x 2023E EBITDA, with room for EBITDA acceleration.

- Strong Free Cash Flow and Dividend Growth: ABBV’s robust free cash flow supports the potential for future double-digit annual dividend increases.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.