Summary:

- AbbVie continues to navigate Humira’s LOE brilliantly, with the higher rebates and lower pricing ensuring its market-leading share despite the notable impacts on the top/bottom lines.

- The management has also raised their FY2024 guidance despite the multiple adjustments related to the acquired IPR&D and milestones expenses.

- These developments underscore ABBV’s robust ex-Humira portfolio growth and M&A acumen, building upon the +15% YoY growth reported in FQ1’24.

- It goes without saying that our Buy rating has come relatively late. However, it is better to be late than never, especially since ABBV has proven itself as a winner.

- We will also highlight a few metrics to look out for in the upcoming FQ2’24 earnings call on July 25, 2024, underscoring the health of ABBV’s businesses.

cacaroot/iStock via Getty Images

ABBV’s Investment Thesis Remains Robust – We Had Been Too Bearish After All

We previously covered AbbVie Inc. (NYSE:ABBV) in April 2024, discussing how it had outperformed our originally more bearish expectations, with Humira remaining the market leader despite the Loss Of Exclusivity [LOE] and biosimilar headwinds.

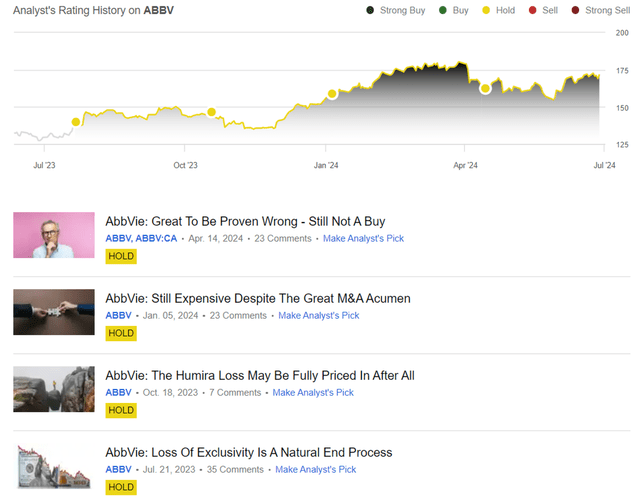

Combined with its pipeline’s recent US FDA approval, the market continued to award the stock with stable FWD P/E valuations, further aided by robust shareholder returns. Despite so, we had maintained our Hold rating then, with there likely to be moderate headwinds to Humira’s sales in 2024 as a directly interchangeable biosimilar had been approved by the US FDA.

Since then, the stock has mostly traded sideways with a +5.1% total return compared to the wider market at +6%. It is apparent over the past few Hold ratings that ABBV has proven itself to be an outperformer in both financial and stock performances, no matter the uncertain LOE issues and macroeconomic conditions.

We will also be highlighting a few metrics to look out for in the upcoming FQ2’24 earnings call on July 25, 2024, underscoring the health of ABBV’s businesses along with near-term prospects.

1. We Had Been Too Bearish On Humira’s LOE

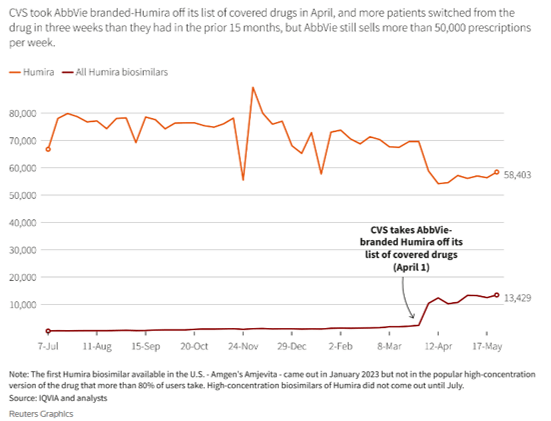

We have been previously concerned about the impact of biosimilars on Humira, and it is apparent that those fears are being overly done. This is why.

For context, ABBV’s patent protection for Humira had expired by the beginning of 2023, with the pharmaceutical company facing impacted Humira sales of $2.27B in FQ1’24 (-31.2% QoQ/ -35.8% YoY/ -59.2% from peak quarterly sales of $5.57B in FQ4’22).

Even so, Humira continues to command the leading market share of over 80% in the US by early June 2024 despite “facing nine lower-priced rivals in the last year.”

These developments underscore why ABBV’s higher rebates and lower Humira pricing have paid off extremely well in retaining market share despite the notable impact on its top/bottom lines.

Weekly Prescriptions For Humira Since July 2023

Reuters

While CVS Health Corporation (CVS) has removed Humira from its list of covered drugs, it seems that the worst may already be over, with the therapy’s weekly prescriptions continuing to grow after the sharp drop in April 2024.

With multiple levers to pull, we believe that ABBV continues to command the leading mindshare in the US market and is likely to remain so in the intermediate future, as similarly commented by the management in the FQ1’24 earnings call:

We continue to anticipate that Humira will maintain parity access to biosimilars for a significant majority of patient lives this year. (Seeking Alpha)

This is especially true since Alvotech’s (ALVO) and Teva Pharmaceutical Industries Limited’s (TEVA) directly interchangeable biosimilar option for Humira, Simlandi, is only slated to enter the US market from February 2025 onwards. The delayed entry may temporarily moderate Humira’s erosion since the region comprises 78% of the therapy’s global sales in FQ1’24 (-5 points YoY).

Perhaps this development has contributed to ABBV’s relatively promising FY2024 guidance, with the US Humira erosion at “approximately -32%” mostly attributed to price rebates and, to a smaller extent, CVS’s formulary change.

2. FQ2’24 Performance & FY2024 Guidance

For context, ABBV has already raised their FY2024 adj EPS guidance to $11.23 at the midpoint (+1% YoY), up from the guidance of $11.15 (+0.3% YoY) offered in the FQ4’23 earnings call and the original $10.85 (-2.3% YoY) offered in the FQ3’23 earnings call.

This is despite the multiple adjustments related to the acquired IPR&D and milestones expenses, including $0.42 from the ImmunoGen and Cerevel Therapeutics Acquisitions to be completed in H1’24.

While there may be further impacts from the recently completed Celsius Therapeutics deal worth $250M, we are not overly concerned for now,.

This is because ABBV continues to report robust ex-Humira portfolio growth at +15% YoY in FQ1’24 while guiding robust FQ2’24 revenues of $14B (+0.9% YoY) and adj EPS of $3.07 (+5.4% YoY) at the midpoint, thanks to the easier YoY comparison.

This development further underscores the pharmaceutical company’s robust pipelines and M&A efforts while allowing it to overlap Humira’s painful LOE and top/ bottom-line erosion.

These factors also demonstrate why ABBV’s stock performance has outperformed Pfizer Inc.’s (PFE) and Bristol Myers Squibb Company’s (BMY) thus far, despite their similar LOE issues thus far.

As a result, we believe that the upcoming earnings call may potentially be another beat and raise, as how it has been over the past four consecutive quarters (barring the -$0.01 adj EPS miss in FQ4’23).

3. Balance Sheet Health & Dividend Hike

It goes without saying that ABBV has been one of the most aggressive pharmaceutical companies in M&A activities thus far, with five acquisitions announced over the past twelve months (on top of multiple partnerships).

This has contributed to its growing long-term debts on balance sheet at $63.8B (+7.6% QoQ/ +7.6% YoY/ -4.3% from FY2019 levels of $66.72B) and deteriorating net-debt-to-EBITDA ratio of 2.53x in FQ1’24 (compared to 1.78x in FQ4’23, 2.40x in FQ1’23, and 1.77x in FY2019).

With this number being higher than the average 2.36x reported by the General Drug Manufacturers, readers may want to monitor ABBV’s execution and balance sheet health over the next few quarters since borrowing costs remain elevated with the Fed yet to pivot.

While the pharmaceutical company remains profitable, the elevated debt load and consequently higher interest expenses may eventually cut into its ability to sustain the historical 5Y dividend growth rate of +8.34% and 10Y rate of +14.1%, with the last hike of +4.7% being somewhat underwhelming.

So, Is ABBV Stock A Buy, Sell, or Hold?

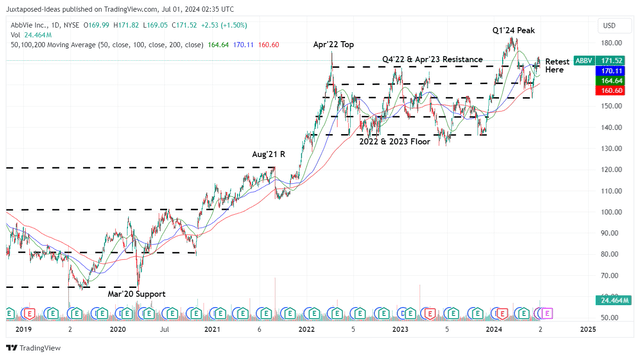

ABBV 5Y Stock Price

For now, ABBV has traded sideways since early 2024, with the stock currently consolidating at $170s as we enter the Q2’24 earnings season.

For context, we had offered a fair value estimate of $167.40 in our last article, based on the FY2023 adj EPS of $11.11 (after including the 2023 acquired IPR&D/milestones expenses) and the FWD P/E valuations of 15.07x.

Based on the ABBV management’s recently raised FY2024 adj EPS guidance to $11.23 and the same FWD P/E mean of 15.07x (near to its 1Y mean of 15.05x), it is apparent that the stock continues to trade near our upgraded fair value estimates of $169.20.

The same may be observed in our reiterated long-term price target of $201, attributed to the stable consensus FY2026 adj EPS estimates of $13.37 (compared to $13.34 in our previous article).

At the same time, ABBV remains a dividend aristocrat, with the robust forward dividend yield of 3.61% still richer than the sector median of 1.43%, and long-term shareholders likely looking forward to the next dividend raise in the FQ3’24 earnings call in October 2024, continuing the trend of ten consecutive years in payout growth.

Combined with its robust ex-Humira portfolio performance and the management’s consistently raised FY2024 guidance, we believe that it is finally time to upgrade our rating for the ABBV stock to a Buy indeed.

Author’s Rating

It goes without saying, that our Buy rating has come relatively late, with us missing out on the +19.3% return since July 2023, compared to the wider market at +20.3%.

However, we believe that it is better to be late than never, especially since ABBV has proven itself to be an outperformer in both financial and stock performance, no matter the uncertain LOE issues and macroeconomic conditions.

At the same time, this Buy rating does not come with a specific entry point since it depends on individual investors’ dollar cost averages and portfolio allocation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.