Summary:

- In recent days, financial market participants have remained pessimistic about AbbVie’s prospects, mainly due to the data on clinical outcomes related to emraclidine.

- However, I believe Mr. Market overreacted to this news, given the increase in dividend payments and the full-year non-GAAP EPS.

- AbbVie continues to be a leader in the global immunology market, thanks in part to the strong performance of its two stars, Skyrizi and Rinvoq.

- In addition to its extremely high dividend yield of over 3.8%, in this article, you will discover why I upgraded AbbVie’s rating from ‘Buy’ to ‘Strong Buy.’

Brothers91/E+ via Getty Images

As I was researching this article about AbbVie (NYSE:ABBV), its price fell 16.8% due to negative data from two Phase 2 clinical trials evaluating the efficacy of emraclidine in treating schizophrenia. The stock fell in five consecutive sessions before reversing slightly.

The first obvious question that comes to investors’ minds is, “Is this failure so negative for AbbVie’s financial position and its investment attractiveness in the eyes of large funds and banks that it led to the evaporation of $60 billion of its market capitalization?”

In this article, in addition to the risks, I will also present the factors that led me to upgrade AbbVie’s rating from ‘Buy’ to ‘Strong Buy.’

Investment thesis

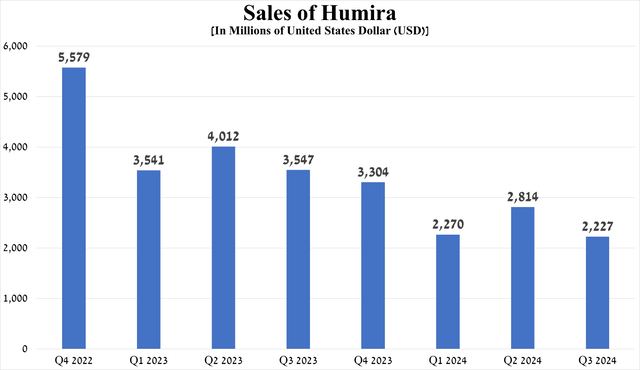

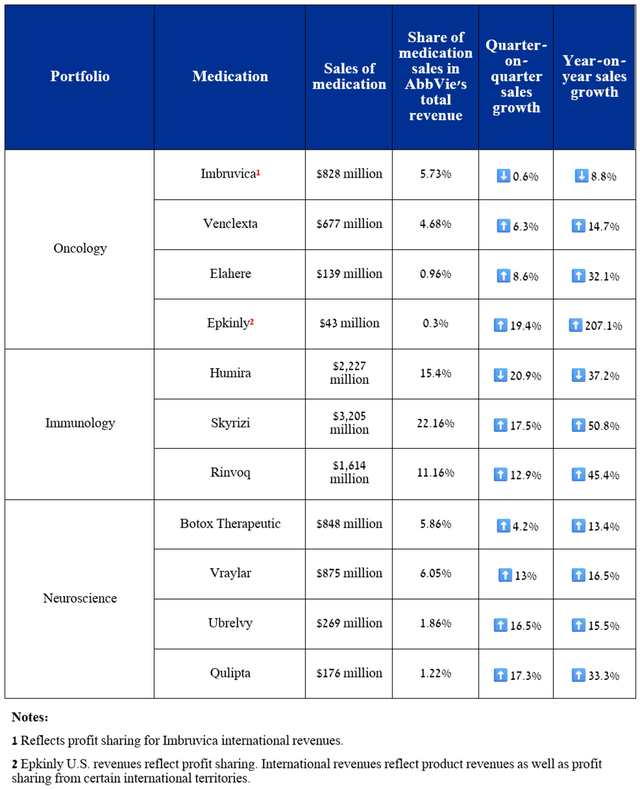

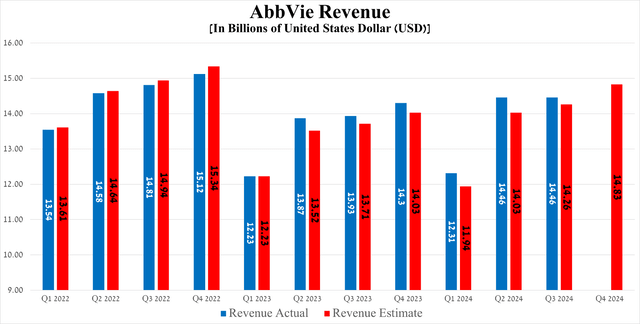

AbbVie’s revenue was about $14.46 billion for the three months ended September 30, 2024, up 3.8% year over year, beating both my expectations as well as Wall Street’s, thanks to stronger sales of Skyrizi, Rinvoq, the Botox franchise, and Elahere, which also helped offset the decline in demand for Humira, a monoclonal antibody for various autoimmune conditions, and Imbruvica, a blockbuster commercialized with Johnson & Johnson (JNJ) for the treatment of various B-cell malignancies.

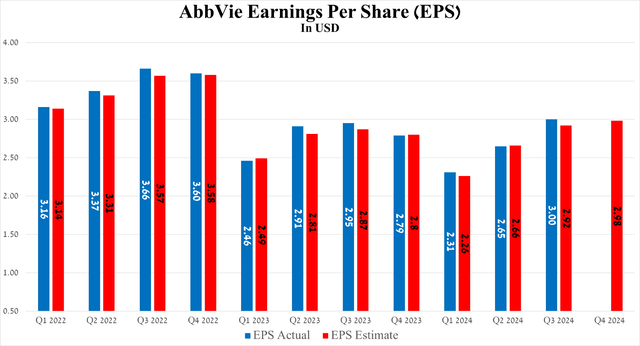

Meanwhile, its non-GAAP earnings per share reached $3.00 for Q3 2024, beating analyst consensus estimates by 8 cents, and more importantly, it remains higher over the last six quarters even as it has sharply increased investment in late-stage clinical development programs and completed M&A deals, including the acquisitions of Aliada Therapeutics [strengthening the neuroscience portfolio], Cerevel Therapeutics [strengthening the neuroscience portfolio] and Celsius Therapeutics [strengthening the immunology portfolio].

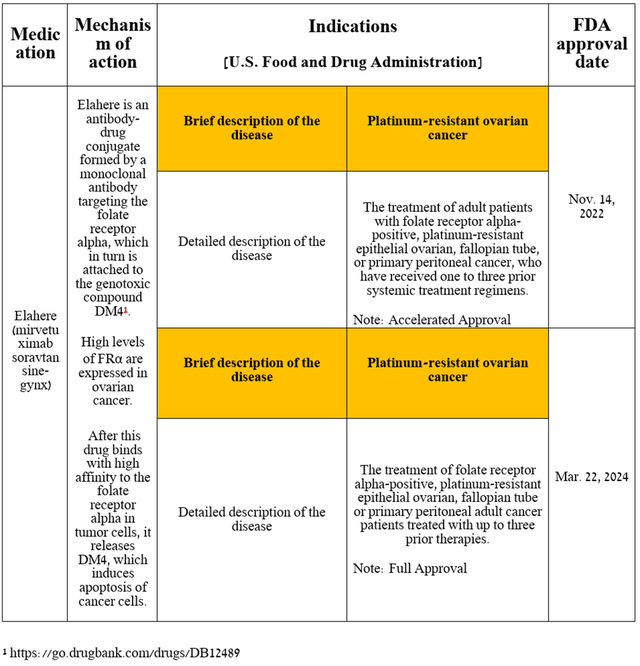

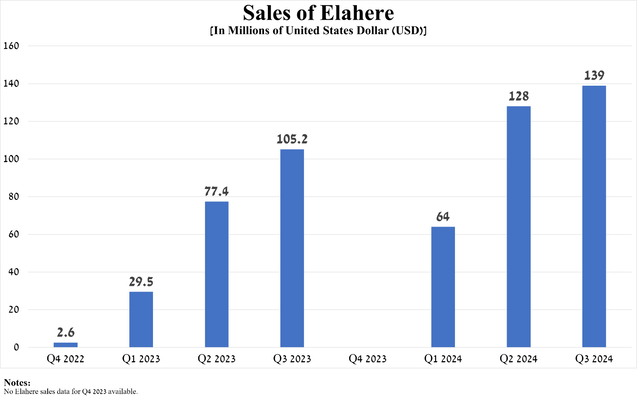

So, right at the beginning of the article, I want to point out the performance of Elahere (mirvetuximab soravtansine-gynx), which, from quarter to quarter, is becoming an increasingly important asset for the prosperity of AbbVie’s oncology franchise. Elahere is an ADC directed against FRα, approved by agencies, including the FDA and EMA, to combat certain types of ovarian cancer.

Source: table was made by Author based on AbbVie press releases

Elahere sales were $139 million in the third quarter of 2024, up 32.1% year over year and 8.6% quarter over quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

Moreover, on November 18, 2024, AbbVie delighted me and investors with the announcement that Elahere had been approved by the EMA for the treatment of certain patients with ovarian cancer who had previously received 1-3 systemic treatment regimens.

AbbVie’s Q3 2024 financial results and outlook beyond 2024

First of all, I want to note that the Q3 2024 financial results for the Illinois-based company were generally better than I expected, which was also reflected in a temporary jump in its share price by 8% and reaching a new record high of around $207 on October 31.

Since Rob Michael took over as CEO in early July 2024, AbbVie has continued to move along a trajectory of prosperity even in the face of a continuing decline in demand for Humira [TNF-α inhibitor] for obvious reasons, including increased competition from its biosimilars produced by Teva Pharmaceutical (TEVA), Amgen (AMGN), Pfizer (PFE), Organon (OGN) and others, as well as less than satisfactory growth rates of sales of Epkinly (epcoritamab-bysp), which in turn is a bispecific antibody for the treatment of certain forms of non-Hodgkin’s lymphoma.

Source: graph was made by Author based on 10-Qs and 10-Ks

In addition to Elahere, whose performance I discussed earlier, I want to highlight the sales, as well as the failures and achievements in the clinical development of some of AbbVie’s key medicines, including those in its oncology, neuroscience, and immunology franchises.

The following products have made and will continue to make significant contributions to strengthening the company’s balance sheet going forward, increasing its operating profit growth rate over at least the next five years, and accelerating the development of next-generation product candidates to combat inflammatory disorders [ABBV-8736, lutikizumab and ABBV-113], solid tumors [budigalimab and ABBV-303], and wet macular degeneration [ABBV-RGX-314].

Source: graph was made by Author based on 10-Qs and 10-Ks

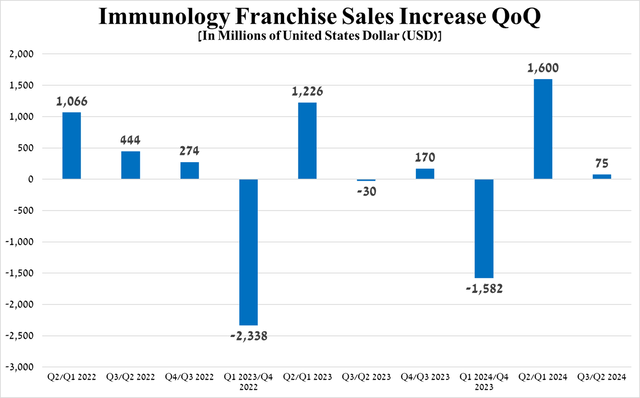

However, for a comprehensive understanding of the current situation and the development of AbbVie’s business, it is also necessary to examine the performance of its immunology franchise.

Why is it necessary to pay attention to this franchise?

The answer is quite simple and lies in the fact that sales of Humira, Skyrizi, and Rinvoq accounted for about 48% of its total revenue for the third quarter of 2024. In addition, Rinvoq and Skyrizi completely offset the decline in demand for Humira, which in turn caused significant concern among investors in the period from 2022 to 2023, but as I said earlier in the article “Unveiling AbbVie’s Winning Strategy In Pharmaceutical Innovation (Rating Upgrade)” these fears remained in the shadow of history.

Source: graph was made by Author based on 10-Qs and 10-Ks

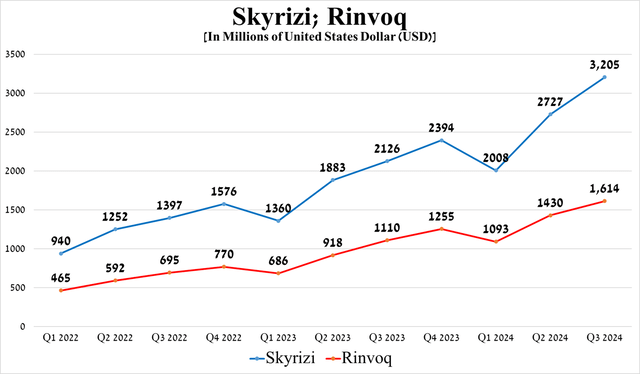

So, sales of Skyrizi [interleukin-23 inhibitor] amounted to about $3.21 billion for the three months ended September 30, 2024, an increase of 50.8% year-on-year and 17.5% quarter-on-quarter, including due to increased demand both in the United States and abroad, as well as its long-awaited approval by the FDA on June 18, 2024, and by the EMA in late July for the treatment of people with moderate to severe ulcerative colitis.

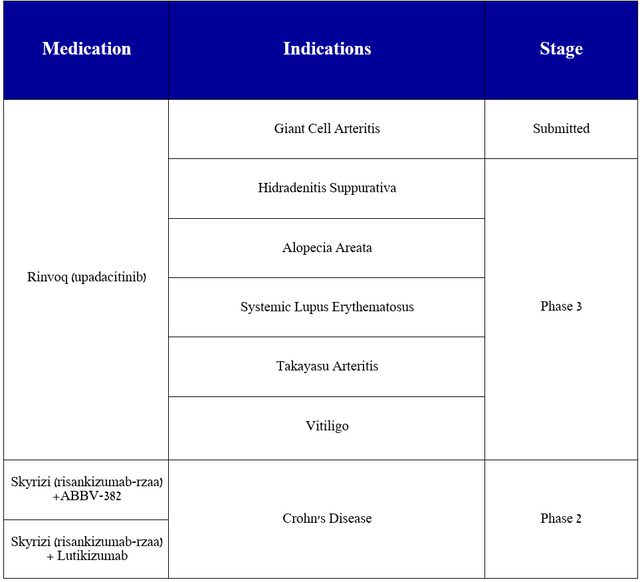

While sales of Rinvoq (upadacitinib), a second-generation selective JAK inhibitor, were approximately $1.61 billion in the third quarter of 2024, up 45.4% year-on-year, driven by broader adoption in clinical practice and its FDA approval on June 4 for the treatment of children over two years of age for two inflammatory diseases, namely psoriatic arthritis and polyarticular juvenile idiopathic arthritis.

Source: graph was made by Author based on 10-Qs and 10-Ks

Historical data is undoubtedly important, but I also want to point out that further label expansions for Skyrizi and Rinvoq are expected in the coming years, and as a result, the impact of the decline in demand for Humira will be minimized.

Source: table was made by Author based on AbbVie pipeline

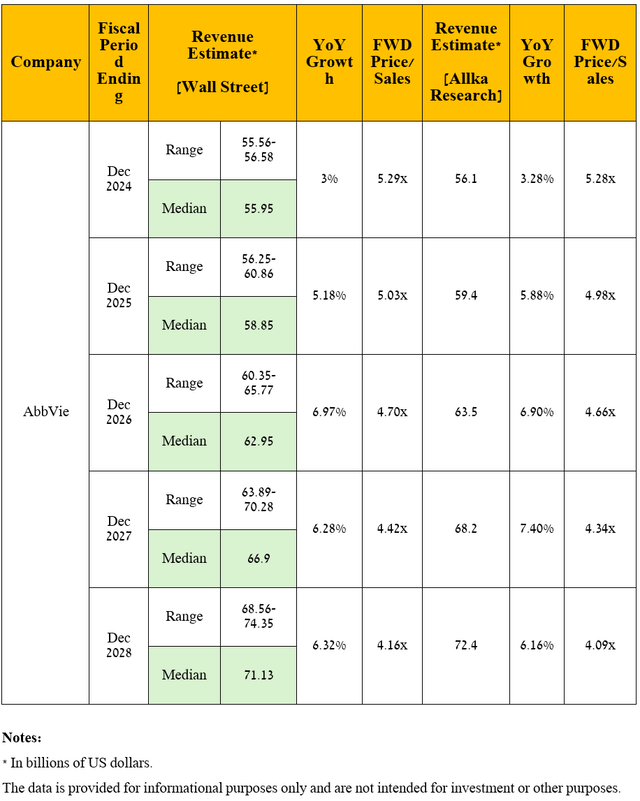

Seeking Alpha offers financial data, as well as Wall Street analysts’ forecasts for AbbVie’s revenue and earnings per share through 2028 and beyond.

So, Wall Street analysts expect AbbVie’s revenue for the fourth quarter of 2024 to be between $14.59 billion and $15.01 billion, which implies growth of 3.5% year-on-year.

Source: Seeking Alpha

Meanwhile, its price/sales [FWD] ratio is 5.42x, which is 22.5% higher than the 5-year average but also on par with or lower than many of its Big Pharma peers, especially those with lower dividend yields, including Eli Lilly [P/S ratio is 14.86x] (LLY), Amgen [P/S ratio is 4.66x], Gilead Sciences [P/S ratio is 3.9x] (GILD) and Regeneron Pharmaceuticals [P/S ratio is 5.65x] (REGN).

Now, I’ll zoom out.

I expect AbbVie’s revenue to continue to grow in the coming years, driven in part by demand growth, as well as label expansions for Epkinly, Skyrizi, Rinvoq, and Elahere, and potential regulatory approvals of its product candidates, including tavapadon, elezanumab, and budigalimab.

In forecasting the company’s revenue and operating income, I took into account the continued decline in sales of the Eye Care franchise, blood cancer treatment Imbruvica, as well as Humira, due to increased competition from its biosimilars.

Overall, I anticipate its total revenue to be $72.4 billion in 2028, which firstly implies its average annual growth over the next five years by single-digit percentages [from 3.2% to 7.4%], and secondly, it is in line with the expectations of 13 analysts [$68.56-$74.35 billion]. Accordingly, AbbVie’s price-to-sales ratio will decrease from 5.34x over the past 12 months to below 4.09x by 2028.

Source: graph was made by the Author

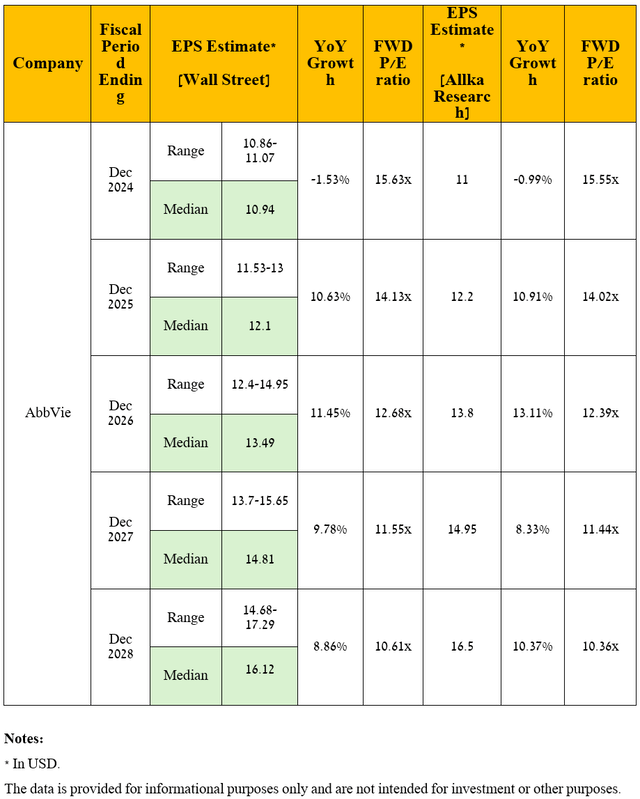

As I have noted in previous articles, let’s move on to a discussion of an equally important financial indicator, namely non-GAAP earnings per share [non-GAAP EPS].

Why?

This needs to be done because it more accurately and comprehensively determines how effective the business strategies implemented under the leadership of Robert Michael are.

So, AbbVie’s non-GAAP EPS is anticipated to be in the range of $2.90 to $3.10 in the fourth quarter of 2024, implying growth of 6.7% year-on-year.

Source: Seeking Alpha

Moving to a longer time frame, I expect AbbVie’s operating income growth trend to continue over the next five years, driven primarily by rising prices and sales of its key medications that I mentioned earlier in the article, which will also partially offset the increase in its R&D expenses, primarily caused by conducting expensive pivotal clinical trials, as well as expanding its portfolio of product candidates due to the acquisition of Aliada Therapeutics at the end of October 2024 and Cerevel Therapeutics.

Ultimately, due to the anticipated resorting of its management to the share repurchase program in the coming years, as well as the increase in its revenue under my forecast, which was stated earlier, I expect the company’s EPS to be $16.50 in 2028, which is slightly above the analysts’ median range due to my more optimistic sales expectations for its immunology and oncology franchises, particularly Skyrizi, Venclexta, and Elahere, and secondly implies a drop in its price-to-earnings ratio from 15.61x to 10.37x.

As a result, this is one of the key factors that, in my opinion, indicate that the company is trading at a discount following the recent drop in its share price.

Source: graph was made by the Author

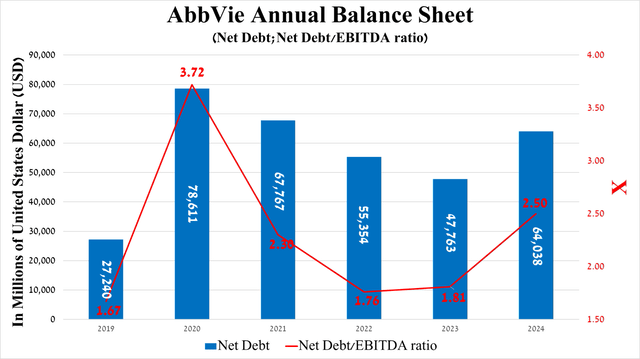

It is equally important to discuss AbbVie’s debt, which does not pose a threat to its financial position. On the other hand, in my opinion, it may become a factor that will discourage some conservative investors from buying its shares, especially those who are more focused on low-risk stocks with net debt/EBITDA below 2x.

Why is AbbVie’s debt not a threat to its financial position?

Its EBITDA amounted to $6.04 billion in the third quarter of 2024, continuing to remain stable in recent years. Secondly, the share of Humira sales in the company’s total revenue is declining due to the strong performance of its other drugs included in AbbVie’s immunology portfolio.

Source: Seeking Alpha

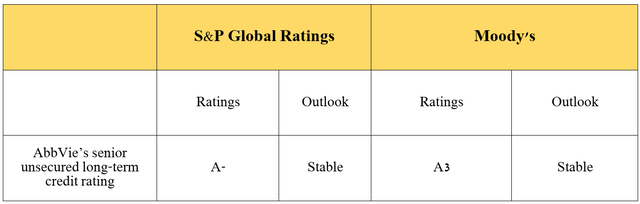

I would also like to point out that AbbVie’s credit ratings from S&P Global Ratings (SPGI) and Moody’s (MCO) remain at investment grade.

Source: graph was made by Author based on AbbVie’s Form 10-K

Risks

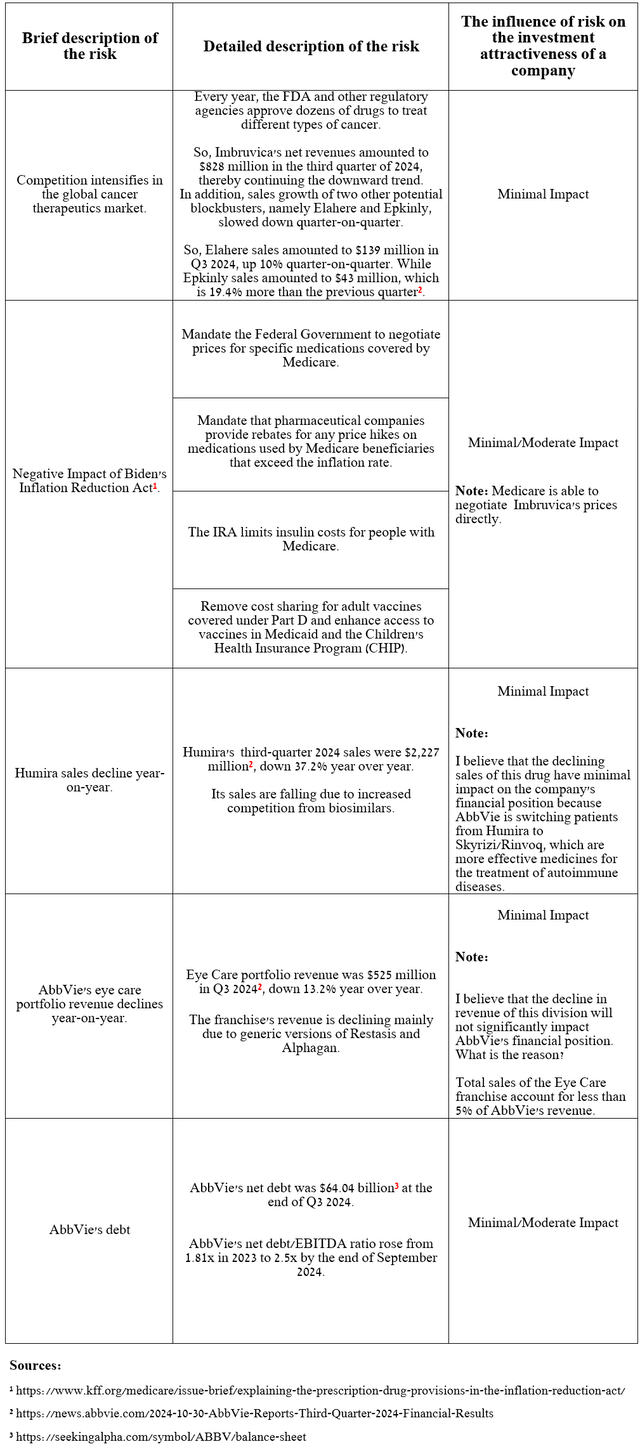

In addition to the disastrous results of the Phase 2 EMPOWER trials evaluating emraclidine’s efficacy in treating schizophrenia, and the slow growth rate of sales of AbbVie’s oncology franchise, I’ve highlighted several risks in the table below, including increased competition from Humira’s biosimilars, that its long-term investors should consider to minimize potential losses.

Source: table was made by Author

Takeaway

On October 30, 2024, AbbVie, one of the leaders in the global autoimmune disease therapeutics market, published financial results for the third quarter of 2024.

Continued high sales growth rates of Skyrizi and Rinvoq have helped to minimize the financial impact of the launches of more and more Humira biosimilars and their introduction into healthcare systems, as well as increasing its quarterly cash dividend by 5.8% from $1.55 to $1.64 in 2025. Moreover, its management again raised its full-year non-GAAP EPS from $10.67-$10.87 to $10.90-$10.94.

Given its rich portfolio of experimental drugs, I believe that after the recent drop in its stock price as a result of Mr. Market’s overreaction to the results of its two Phase 2 EMPOWER trials, AbbVie represents one of the most attractive stocks among Big Pharma.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.