Summary:

- AbbVie stock has been upgraded to a buy again due to its attractive yield and less demanding valuation, despite expectations of a down year in 2023.

- The healthcare company is seen as a resilient investment choice in uncertain economic times, offering a 4.4% dividend yield and a low beta of 0.54.

- Despite a decline in sales of its biggest drug, Humira, AbbVie’s portfolio of growing drugs and promising pipeline suggest potential for long-term growth.

Dilok Klaisataporn

Article Thesis

AbbVie (NYSE:ABBV) is a high-quality Dividend Aristocrat that has seen its shares fall substantially in recent months. We are now upgrading AbbVie stock to a buy again, as the yield has become attractive and since the valuation is now less demanding. While 2023 will be a down year, there is ample growth potential in the long run.

AbbVie: A Resilient Pick For Uncertain Times

There are major uncertainties when it comes to the path of the global economy and when it comes to the near-term and medium-term performance of the broad equity markets. Inflation remains well above the target range of 2%, and central banks could be forced to increase interest rates further. This, in turn, could weaken the global economy, as companies will be less eager to invest for growth when capital becomes costlier, and at the same time, consumers will be less eager to spend money on discretionary consumer goods when debt is expensive. Not surprisingly, there’s a wide range of experts, analysts, and company leaders that expect a recession in the not-too-distant future. That being said, a recession is not guaranteed, and others believe that a “soft landing” might be achieved. Still, there are major uncertainties, and the ongoing war in Ukraine, geopolitical tensions between the US and China, etc. add to the risk factors for the global economy and global markets.

In an environment like this, a resilient company that is crisis-proven and that will not suffer meaningfully from an economic downturn could be a good investment choice. When this company offers an attractive dividend yield on top of that, it looks even more compelling — even if share prices were to pull down temporarily, the ongoing income stream could ease investors’ concerns.

I believe that AbbVie is a good investment choice when it comes to these factors: The healthcare industry isn’t cyclical, as people require treatment during good times and during bad times. AbbVie has a long history of raising its dividend during good times and during bad times, and the stock isn’t very volatile — ABBV’s beta is just 0.54, suggesting that ABBV would decline a lot less than the broad market during a (potential) market crash. Add a dividend yield of 4.4%, which is close to three times as high as the S&P 500’s dividend yield, and AbbVie looks like a good choice for investors that seek a defensive, lower-risk stock for their portfolio.

AbbVie: Time For A Rating Upgrade

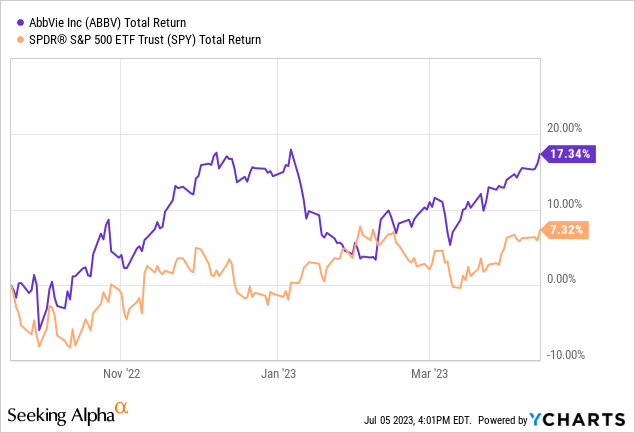

We have covered AbbVie from time to time in the past, including in September 2022, when we rated it a “Buy” at a price of $144. Between then and April 13, AbbVie easily outperformed the broad market:

With a 17% total return over a little more than half a year, AbbVie delivered handsomely for its shareholders. In April, however, shares had run up to a somewhat expensive valuation, which is why we downgraded AbbVie in an article that was released on April, 13 (hence the date shown above).

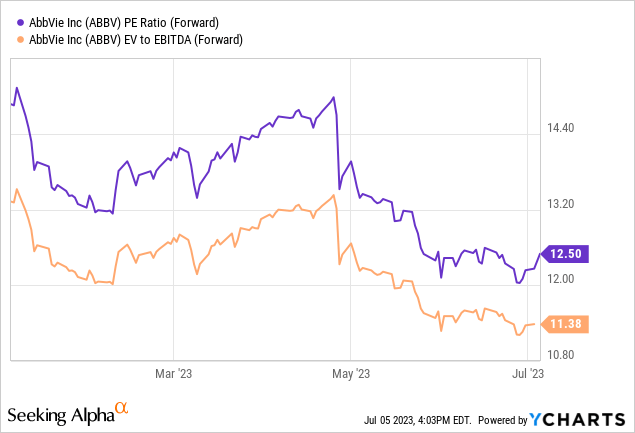

Over the last couple of months, things have changed, however: AbbVie has pulled back, and both its dividend yield and its valuation have become a lot more attractive again. Shares traded north of $160 in April, but have declined to the $130s, which has had a significant impact on the stock’s valuation:

Today, AbbVie trades at a low double-digit earnings multiple and at a low double-digit enterprise value to EBITDA multiple (which accounts for debt and cash on the balance sheet). That’s the best valuation ABBV has traded at so far this year, which naturally means that now is a more opportune time for investment relative to the last couple of months — it is best to buy quality stocks when they are temporarily cheap, after all. Buying stocks when they are cheap has several advantages:

– The likelihood of multiple expansion tailwinds, which boost future returns, is higher the cheaper the stock at the time it is bought. When one buys AbbVie at 15x net profits, multiple expansion is less likely than when one buys AbbVie at 12.5x net profits.

– The margin of safety is larger. Even if things go wrong or broad equity markets are experiencing headwinds, the downside potential is smaller when one buys shares when they are historically cheap.

– Buying at a low valuation means that one buys with a higher starting dividend yield, all else equal. Those that bought AbbVie at $160 will get a yield of 3.7% on their initial investment, while those that buy today will get a 4.4% yield on their initial investment — that equates to ~20% more income per each dollar that is put into AbbVie (the same principle holds true for other stocks as well, of course).

Underlying Execution: 2023 Will Be A Down Year, But There’s Significant Long-Term Potential

While valuations and dividend yields matter, underlying execution is important as well. Let’s take a look at how AbbVie performed since our last article on this Dividend Aristocrat. During the most recent quarter, AbbVie saw its sales decline. That was not a surprise, however, as sales hit the analyst consensus estimate. AbbVie’s biggest drug, Humira, went off-patent, which has resulted in biosimilars from competitors coming to the market. AbbVie has thus lost some market share in the indications that Humira can treat, such as psoriasis and Crohn’s disease. Humira’s sales have not fallen to zero, and they won’t fall to zero anytime soon, but they are declining — during the most recent quarter, global sales for this drug dropped by 25%. It is expected that the drug will continue to experience sales declines in the coming quarters and years as well. The good news is that even if Humira sales continue to drop by 25% per year going forward, the impact on AbbVie will decline over time — a 25% drop from a high absolute level has a larger impact on AbbVie’s company-wide sales than a 25% drop from a lower absolute level. Similar things could be seen in Gilead Sciences’ (GILD) company-wide sales when its HCV franchise started to decline — at first, the impact was large, but as the franchise became less important over time, the impact of this decline on a company-wide basis diminished.

Other drugs in AbbVie’s portfolio are growing, which should also help stabilize the company’s top line in the foreseeable future. Rinvoq and Skyrizi, which can be seen as “next-level” versions of Humira, continue to grow at an attractive pace of 45% and 47%, respectively, on a year-over-year basis — and they have now become quite large in absolute terms as well, with annualized sales of around $8 billion. And there are good reasons to believe that both of these drugs will continue to experience substantial growth going forward. In May, Rinvoq was approved for axial spondyloarthritis in Canada, and during the same month, Rinvoq was also approved for Crohn’s disease in the US. The Crohn’s disease treatment market is worth $12 billion now, a number that is forecasted to grow to $18 billion over the next decade. With AbbVie now being able to sell its (patent-protected) Rinvoq for this indication, future sales for this fast-growing drug should continue to expand. Ongoing studies with promising results in other indications suggest that further approvals could be coming in the not-too-distant future. To me, it looks like AbbVie’s strategy of remaining a major player in immunology via its next-level drugs Rinvoq and Skyrizi is working well so far.

AbbVie also continues to expand in other areas, e.g. with a new B-cell lymphoma therapy that it has developed with Genmab (GMAB) and that has been approved in May. A new antibiotic that is co-developed with Pfizer (PFE) looks promising as well. Of course, not all of AbbVie’s ongoing drug trials will ultimately work out, but the company’s deep pipeline continues to generate new drug approvals, and over time, those will add meaningfully to AbbVie’s sales. The company forecasts that revenues will start to grow again in the coming years, following a decline this year, and analysts agree with that. Due to AbbVie’s solid performance in the past, a strong performance from its next-level immunology portfolio, and promising results in all kinds of other areas, I believe that there is a good chance that AbbVie will indeed get back to growth in 2024 or 2025.

Final Thoughts

2023 will be a down year for AbbVie, but that has been pretty clear for some time. The company’s underlying execution suggests that the Humira patent loss will be a temporary headwind and that results will improve again soon.

With AbbVie now offering a pretty nice yield again, and with shares trading at the lowest valuation so far this year, I upgrade ABBV to a “Buy” again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!