Summary:

- Currently, the S&P 500 and many sectors are outperforming the healthcare sector, presenting an opportunity to explore assets within this sector during the current period of apathy towards it.

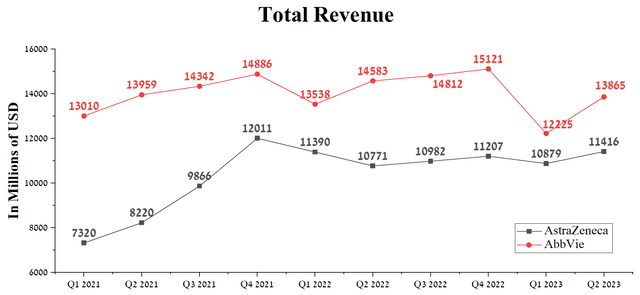

- AstraZeneca’s revenue was $11.42 billion in the second quarter of 2023, up 6% from the prior quarter and beating analysts’ consensus estimates by $0.4 billion.

- At the same time, total sales of AbbVie products continue to decline year over year, amounting to about $13.87 billion for the three months ending June 30, 2023.

- On September 14, the FTC released a document saying companies could face lawsuits if their medicine patents are incorrectly included in the FDA’s catalog called the Orange Book.

- We believe that AstraZeneca is a more promising asset, which will be reflected in higher growth rates of its share price relative to AbbVie.

RyanKing999/iStock via Getty Images

In recent months, clouds have continued to gather over the pharmaceutical industry. This is due not only to the upcoming implementation of key parts of the Inflation Reduction Act, which has already led to the creation of a list of the top ten drugs whose prices are subject to negotiations with Medicare, but also due to increasing pressure from the Federal Trade Commission.

On September 14, the FTC released a document saying companies could face lawsuits if their medicine patents are incorrectly included in the FDA’s catalog called the Orange Book. The federal agency believes that improper listing of patents in the Orange Book leads to artificially higher prices for pharmaceutical companies’ products and delays the entry of cheaper generic versions of brand-name drugs into the market, negatively affecting Americans’ lives.

AstraZeneca (NASDAQ:AZN) and AbbVie (NYSE:ABBV) remain leaders in the healthcare sector despite growing challenges. Their medicines and vaccines generate tens of billions of dollars in annual sales, and physicians still recognize some of their products as gold standards in treating cancer and autoimmune diseases.

AbbVie and AstraZeneca boast broad pipelines of product candidates, stable cash flow, and a track record of distributing dividends to shareholders, making them contenders as long-term investments. However, the CEO of one of these companies demonstrates a more effective approach to business management, which is reflected in bringing more breakthrough drugs to market and entering into commercially successful partnerships.

Financial position of AstraZeneca vs. AbbVie

AstraZeneca’s revenue was $11.42 billion in the second quarter of 2023, up 6% from the prior quarter and beating analysts’ consensus estimates by $0.4 billion. At the same time, total sales of AbbVie products continue to decline year over year, amounting to about $13.87 billion for the three months ending June 30, 2023. Moreover, the company’s actual revenue beat analysts’ consensus estimates in only four of the last ten quarters, five quarters less than AstraZeneca. Consequently, this is one of the signs indicating a greater underestimation of AstraZeneca’s prospects by Wall Street regarding the company, which is beginning to experience pressure due to the appearance of an increasing number of Humira (adalimumab) biosimilars on the market.

Author’s elaboration, based on Seeking Alpha

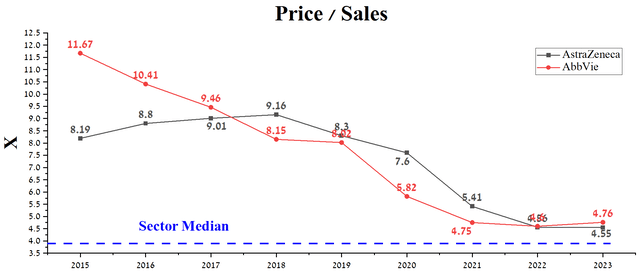

On the other hand, AbbVie’s price/sales ratio [TTM] is 4.76x, which is not only significantly higher than the average for the healthcare sector but also 16.29% higher than the average over the past five years. At the same time, this valuation metric of AstraZeneca is lower and amounts to 4.55x, despite the higher growth rate of its revenue thanks to medicines aimed at combating cardiovascular diseases and cancer.

Author’s elaboration, based on Seeking Alpha

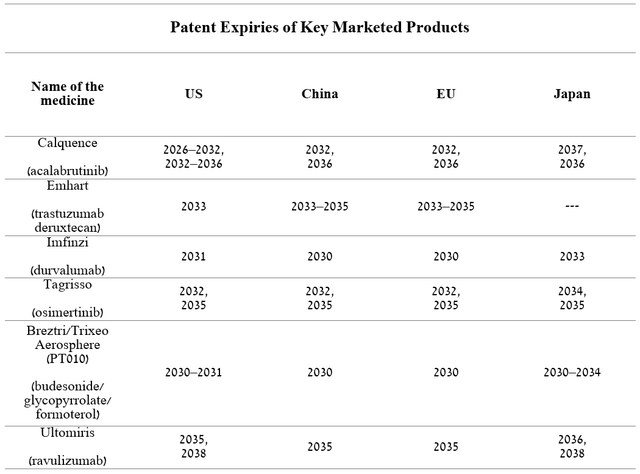

In addition, AstraZeneca’s portfolio is better diversified and does not urgently require rejuvenation since the exclusivity of most blockbusters ends after 2030.

Author’s elaboration, based on AstraZeneca

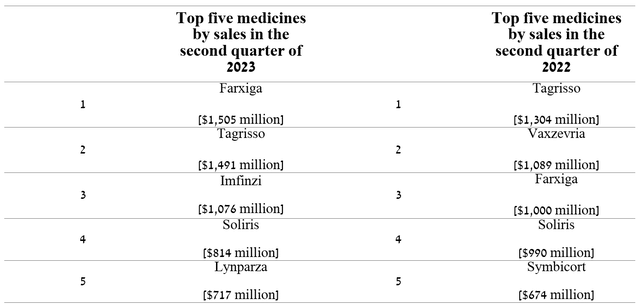

However, not all of AbbVie and AstraZeneca’s drugs are critical to the future growth of their businesses in the highly competitive pharmaceutical industry. So, AstraZeneca’s best-selling products in 2022 and 2023 were as follows.

Author’s elaboration, based on quarterly securities reports

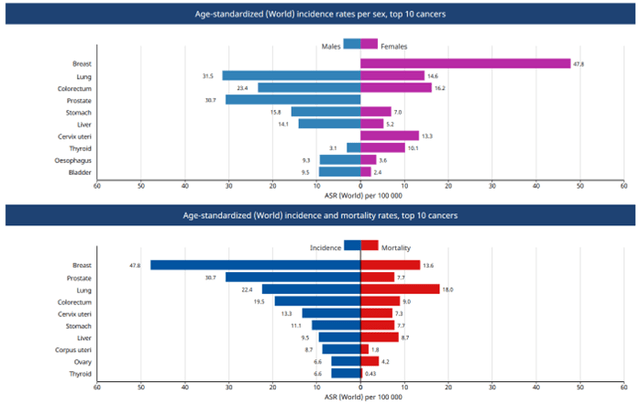

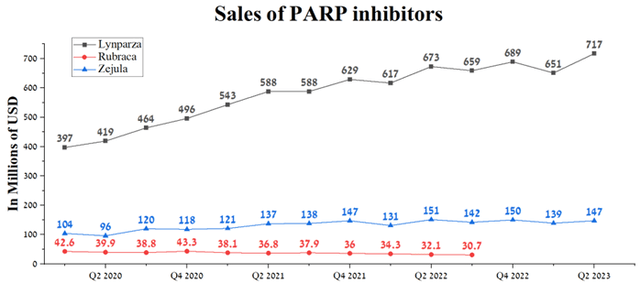

In addition to the high sales growth rates of drugs such as Tagrisso, Imfinzi, Ultomiris, and Breztri, Lynparza remains one of the company’s key products. Lynparza (olaparib) is a medicine whose mechanism of action is based on the inhibition of PARP, facilitating the effective treatment of such widespread types of cancer as ovarian, breast, prostate, and more.

After GSK’s Zejula (GSK) and Clovis Oncology’s Rubraca saw sales halted to some patients with ovarian cancer due to failed phase 3 clinical trials, Pfizer’s Talzenna (PFE) remained one of Lynparza’s main competitors. However, despite increased competition in the global oncology drug market, Lynparza’s total sales were $717 million in Q2 2023, an increase of 10.1% quarter-over-quarter due to raised use to treat ovarian and breast cancer in Europe and China.

Author’s elaboration, based on quarterly securities reports

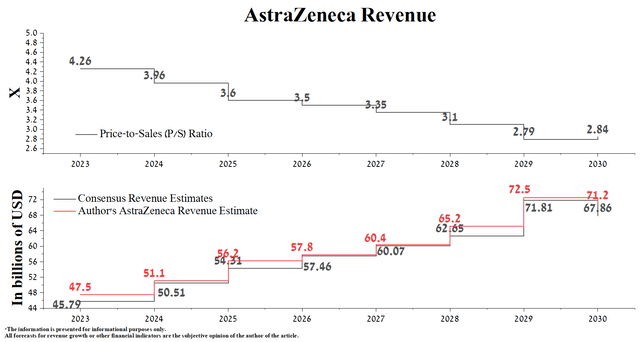

According to Seeking Alpha, AstraZeneca’s revenue for 2023 is expected to be $44.77-$46.62 billion, which is 3% more than analysts’ expectations for 2022. However, according to our model, total revenue for the British-Swedish company will be above the median of this range and reach $47.5 billion, mainly due to stronger sales of Enhertu, Lokelma, and Tagrisso.

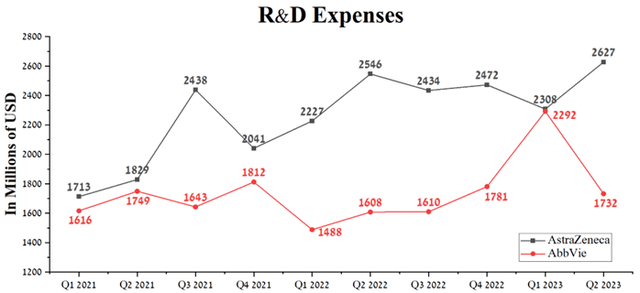

By 2030, we expect the total sales of company products to reach more than $70 billion, not only through label extensions to its already approved drugs but also through the commercialization of breakthrough product candidates such as capivasertib, datopotamab deruxtecan, and camizestrant. At the same time, AstraZeneca continues to pursue an aggressive R&D and M&A policy in recent years, which will positively impact its higher cash flow growth rates in subsequent years relative to AbbVie. Moreover, even though AbbVie’s market capitalization exceeds AstraZeneca’s market capitalization by more than 28%, the R&D spending of one of the leaders in the global autoimmune disease therapeutics market is significantly lower, which also casts doubt on its ability to remain competitive in the healthcare sector.

Author’s elaboration, based on Seeking Alpha

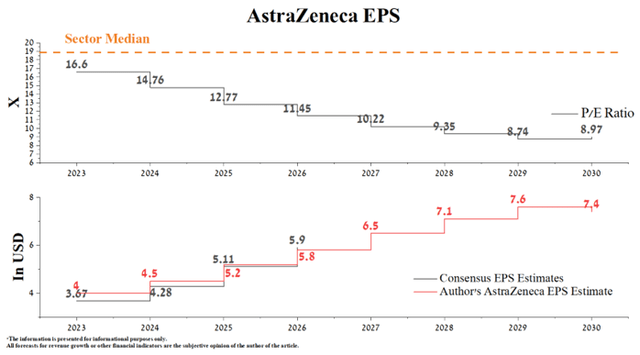

AstraZeneca’s EPS for 2023 is expected to be $3.67, down 11.6% from the prior year. While we believe these are conservative expectations and according to our model, AstraZeneca’s 2023 EPS should come in at $4. Moreover, the company’s net income will continue to grow in the coming years due to synergistic effects following the completion of the acquisitions of Alexion and CinCor Pharma and the launch of next-generation medicines to combat cancer and rare diseases.

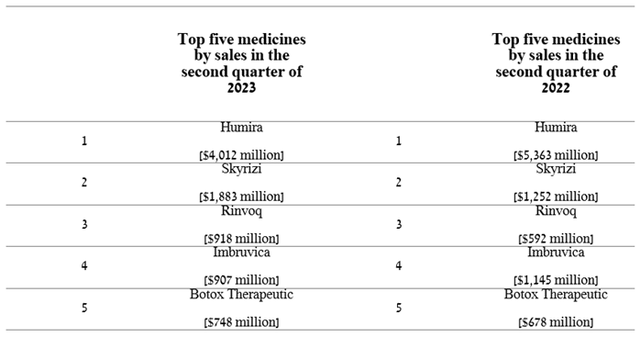

In contrast, AbbVie’ top-selling medicines in 2022 and 2023 were as follows.

Author’s elaboration, based on quarterly securities reports

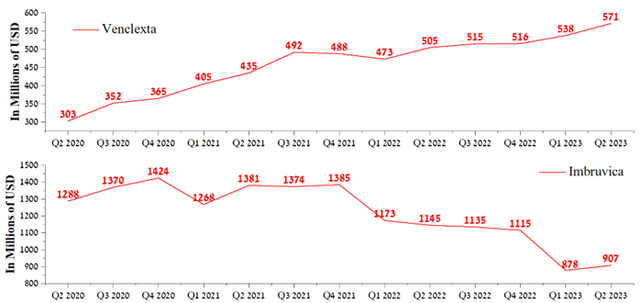

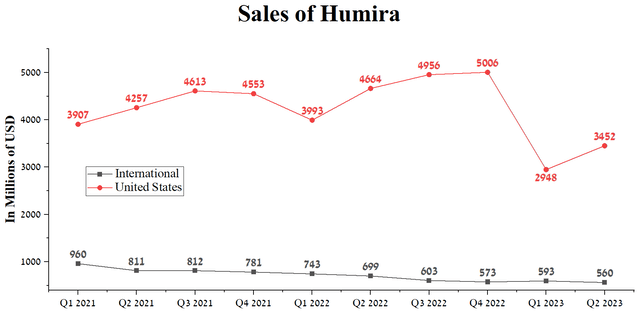

Over the past two years, pressure on the company’s financial position has intensified due to the emergence of more and more Humira biosimilars on the market, leading to a sharp drop in demand for AbbVie’s product. Additionally, the withdrawal of accelerated Imbruvica approvals in the United States for patients with blood cancer mantle cell lymphoma (MCL) and patients with marginal zone lymphoma (MZL) contributed to the company’s revenue decline. So, Imbruvica (ibrutinib) sales amounted to $907 million in the second quarter of 2023, down 20.8% compared to the previous year.

Author’s elaboration, based on quarterly securities reports

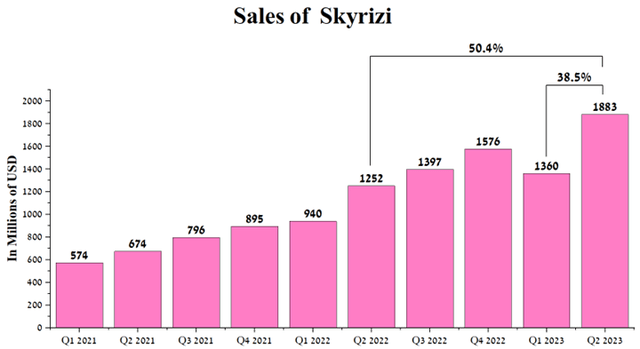

However, we believe that Skyrizi (risankizumab‐rzaa) will become a lifeline for the company, managed under the leadership of Richard Gonzalez. Sales of this blockbuster continue to grow year-over-year at an extremely high rate due to its exceptional efficacy in treating autoimmune diseases such as psoriatic arthritis, plaque psoriasis, and Crohn’s disease.

Author’s elaboration, based on quarterly securities reports

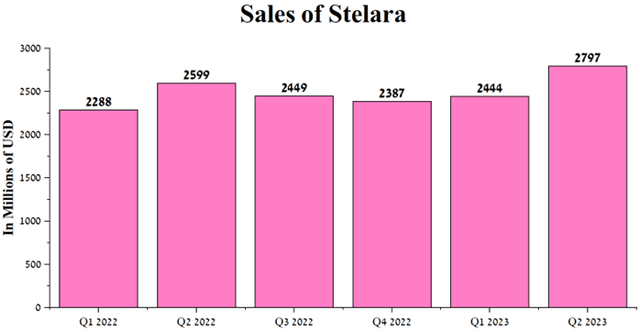

Moreover, on September 12, 2023, AbbVie announced that in a clinical trial involving patients suffering from moderate to severe Crohn’s disease, Skyrizi demonstrated higher efficacy than Johnson & Johnson’s Stelara (JNJ).

Author’s elaboration, based on quarterly securities reports

At the same time, sales of Johnson & Johnson’s blockbuster remain extremely high in anticipation of the start of sales of its biosimilars in the next year and a half. However, until this time, we expect that AbbVie’s product will be able to bite off a share of Stelara’s sales and thereby slightly minimize the decline in demand for Humira.

Author’s elaboration, based on quarterly securities reports

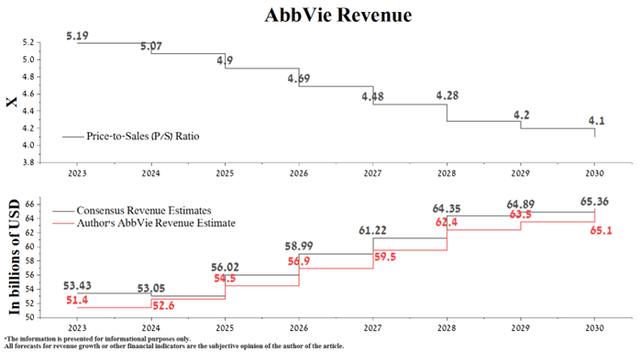

According to Seeking Alpha, AbbVie’s revenue for 2023 is expected to be $52.40-$54.28 billion, which is 8.3% less than analysts’ expectations for 2022. At the same time, under our model, the total revenue of the leader in the global immunology market will be below this range and amount to $51.4 billion, mainly due to weaker sales of Humira, Rinvoq, and Mavyret.

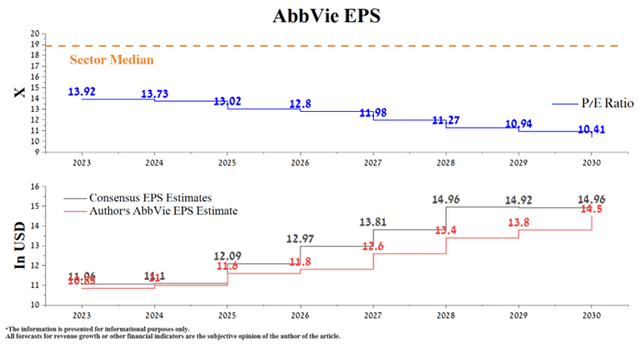

At the same time, AbbVie’s EPS for 2023 is expected to be in the range of $10.75-$11.39, down 19.9% from analysts’ expectations for the previous year. We expect the company’s 2023 EPS to be slightly below its guidance of $10.90-$11.10 due to continued growth in sales of Revance Therapeutics’ Daxxify (RVNC), one of Botox’s main competitors.

AbbVie’s Non-GAAP P/E [TTM] is 12.16x, 33.84% below the sector average and 14.77% below the average over the past five years. Given the company’s current share price of $153.60, our projected growth in AbbVie’s net income, and more active use of its share repurchase program once total sales of AbbVie’s immunology portfolio begin to rise again, its non-GAAP P/E is expected to fall below 10.5x by 2030. As a result, it is one of the financial metrics enticing conservative investors to consider AbbVie a potential long-term investment, even amid the Biden-Harris Administration’s efforts to lower drug prices.

Conclusion

In recent months, clouds have continued to gather over the pharmaceutical industry. This is due not only to the upcoming implementation of key parts of the Inflation Reduction Act, which has already led to the creation of a list of the top ten drugs whose prices are subject to negotiations with Medicare but also due to increasing pressure from the FTC.

Currently, the S&P 500 (SPY) and many sectors are outperforming the healthcare sector, presenting an opportunity to explore assets within this sector during the current period of apathy towards it. We believe that as the Fed lowers interest rates, it will lead to a rapid increase in investment in pharmaceutical companies, which will favorably affect the price of their shares.

On the one hand, AbbVie offers a significantly higher dividend yield compared to AstraZeneca, a factor that might sway conservative investors toward choosing AbbVie for a long-term investment. However, on the other hand, AstraZeneca has more breakthrough medicines and product candidates that will lead to higher revenue and net income growth rates in the coming years. As a result, we believe that AstraZeneca is a more promising asset, which will be reflected in higher growth rates of its share price relative to AbbVie.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.