Summary:

- According to the financial report of Johnson & Johnson, a partner of AbbVie, sales of Imbruvica decreased in the 4th quarter of 2022 due to increased competition.

- In less than six months, Humira’s biosimilars will go on sale in the United States.

- Botox Cosmetic sales were $637 million in Q3 2022, up 16.9% from Q3 2021, but showed a negative trend from the previous quarter.

Group4 Studio

On February 9, 2023, AbbVie (NYSE:ABBV) will report full-year and fourth-quarter 2022 financial results. Reporting results in the second week of February is an unusual practice for major pharmaceutical companies and even more so for AbbVie. The company’s push to release its financial report a week later than usual may indicate AbbVie’s poor financial performance in the last three months of 2022.

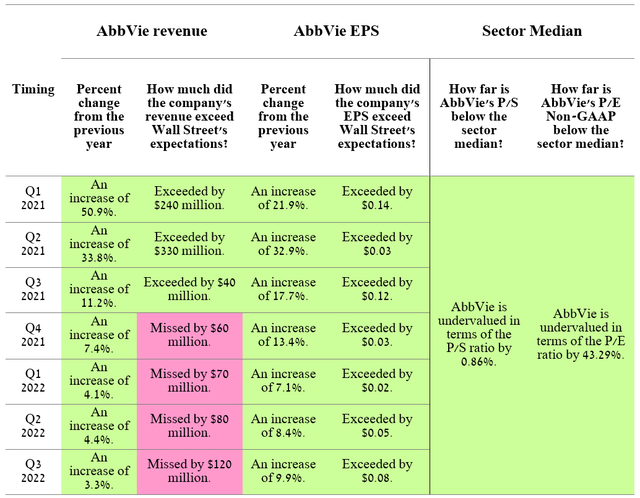

For the past seven quarters, the company’s revenue, although growing year on year, at the same time its growth rate continued to decline, which led not to justify the expectations of Wall Street analysts. Moreover, there is growing tension over how AbbVie will cope with the sharper deterioration in financial performance after the start of sales of Humira biosimilars in the US in mid-2023, as its international sales showed a more than 25% decline in Q3 2022 compared to the previous year. But even before the event happened, Wall Street had already begun to factor the event into the company’s share price, which is reflected in AbbVie’s relatively low P/E ratio of 10.84, down 43.29% from the healthcare industry average.

Source: Author’s elaboration, based on Investing.com

This article will discuss factors, in addition to those presented in my previous article, “AbbVie: Clouds Keep Thickening Due To Lack Of Revolutionary Drugs,” that contribute to continued downward pressure on the company’s share price and my vision for AbbVie’s future in 2023.

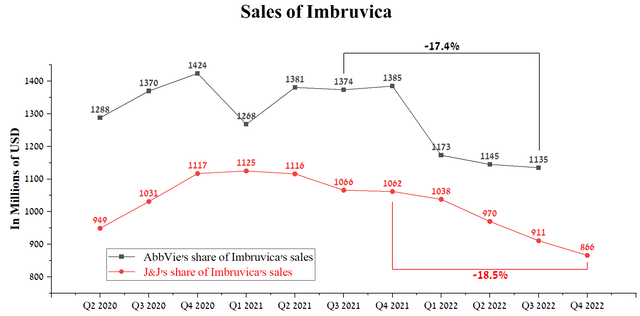

The decline in sales of Imbruvica

In December 2011, Pharmacyclics, a subsidiary of AbbVie, entered into a partnership agreement with Janssen Biotech, part of Johnson & Johnson (NYSE:JNJ), for the development and commercialization of Imbruvica (ibrutinib). Imbruvica is a medicine whose mechanism of action is based on inhibiting a protein called Bruton’s tyrosine kinase (BTK). Thanks to the universal mechanism of action, this medicine is used to combat such deadly diseases as blood cancer, some forms of non-Hodgkin lymphoma, Waldenstrom macroglobulinemia, and not only. Despite the extensive number of indications for use, Imbruvica sales amounted to $1,135 million in 3 quarters of 2022, decreasing by 17.4% relative to the previous year. The main reasons for reducing sales are to tighten competition from more effective drugs produced by companies such as AstraZeneca (AZN) , Merck (NYSE:MRK), BeiGene (BGNE), and Novartis (NVS). Moreover, on January 27, 2023, Jaypirca (pirtobrutinib) received approval from the FDA, which is the fourth inhibitor of BTK for the treatment of blood cancer. Unlike the remaining three, pirtobrutinib is a non-covalent BTK inhibitor, that is, the protein binding mechanism is different, and thereby, it can be used to treat patients that have failed using AstraZeneca’s Calquence, BeiGene’s Brukinsa and Imbruvica.

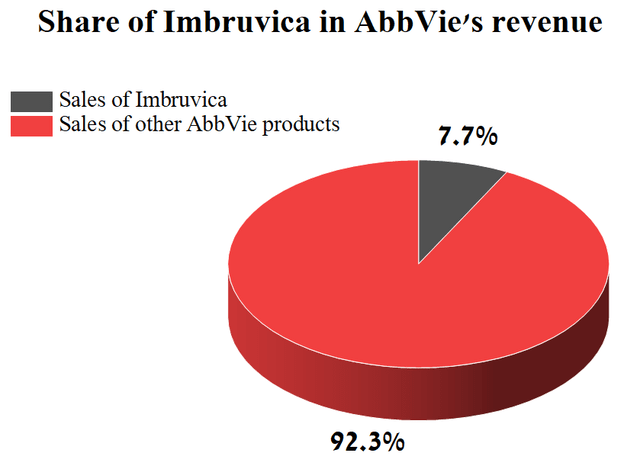

Imbruvica sales amounted to 7.7% of the total revenue of AbbVie. At first glance, the share of Imbruvica in the revenue of AbbVie is not so significant, but this is not entirely true.

Source: Author’s elaboration, based on quarterly securities report

From mid-2023, sales of Humira biosimilars in the United States will begin and, as a result, the company’s revenue will start to fall at a higher rate relative to a decrease in Imbruvica sales, which will lead to an increase in its share in the structure of AbbVie. As a result, analysts with Wall Street and institutional investors will begin to lay the greater weight of Imbruvica on the cash flow and the revenue of AbbVie in their financial models. Given the lowering trend of sales of this drug, with a high probability, this will lead to a decrease in investment interest in the company.

Another factor that reinforces my statement about the lowering vector of Imbruvica sales is the quarterly report of Johnson & Johnson for the 4th quarter of 2022, in which the company said that the sale of this medicine amounted to $866 million, which is 18.5% less relative to the previous year. With this in mind, I expect that the revenue of Imbruvica related to AbbVie will be $1,080-1,090 million in the 4th quarter of 2022, which is $45-55 million lower than in the previous quarter.

Source: Author’s elaboration, based on quarterly securities reports

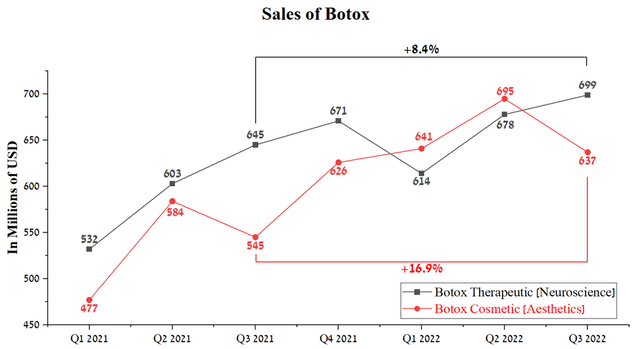

Botox sales at risk due to increased competition

Botox Cosmetic sales were $637 million in Q3 2022, up 16.9% from Q3 2021, but showed a negative trend from the previous quarter. On the other hand, Botox Therapeutic’s sales growth rate has remained more modest in recent quarters and has generated $699 million for AbbVie, an 8.4% year-on-year growth.

Source: Author’s elaboration, based on quarterly securities reports

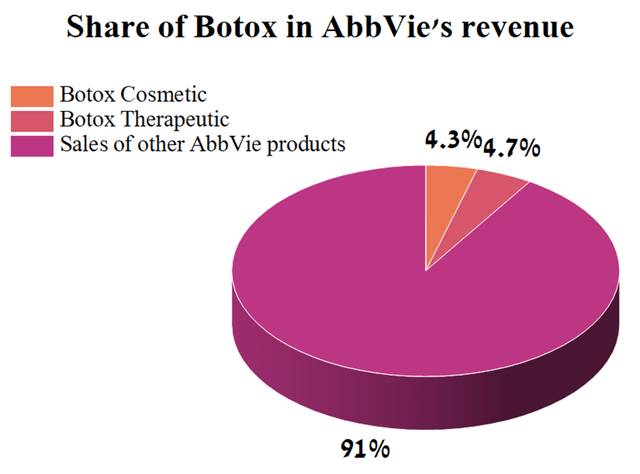

At the same time, sales of Botox accounted for 9% of AbbVie’s total revenue in the 3rd quarter of 2022, thus overtaking Imbruvica in this indicator.

Source: Author’s elaboration, based on quarterly securities report

On September 8, 2022, the FDA approved Revance’s Daxxify (NASDAQ:RVNC) as a cosmetic treatment to temporarily reduce frown lines, finally becoming a long-awaited competitor to Botox. AbbVie’s product and Daxxify are injectable neuromodulators, but Revance’s drug’s key competitive advantage is its duration. For many years, the longevity of the cosmetic effects of botulinum toxins, of which Botox is one, has been a tremendous unmet need. Based on the results of Phase 3 clinical trials, the effect of using Daxxify may last at least three months longer than Botox.

Daxxify’s benefits are reflected in its unaudited sales of $10.5 million to $11.5 million in Q4 2022, the first quarter the drug became commercially available. Revance Therapeutics is not going to rest on its progress and announced on January 6, 2023, that the FDA had accepted an application for Daxxify as a treatment for cervical dystonia, a disease that affects the muscles of the neck. Consequently, I believe that Botox’s sales growth rate will begin to slow down in the coming years due to the influence of Revance ‘s medicine and the development of new-generation injectable neuromodulators.

Conclusion

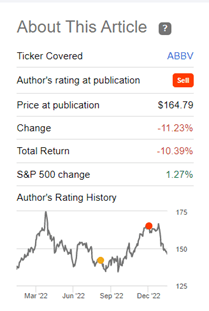

Since writing my last AbbVie bearish article in December 2022, the company’s share price has declined by more than 10%, bringing it closer to the strong support zone I identified. Globally, AbbVie’s share price performance is significantly behind the S&P 500 (SPY), SPDR S&P Biotech ETF (XBI), and iShares Biotechnology ETF (IBB).

Source: Nathan Aisenstadt – Seeking Alpha

At first glance, many of the company’s financial ratios indicate that Wall Street significantly undervalues AbbVie, but in my opinion, this is far from the case. High margins, low P/E ratios, and high dividend yields are investment theses that keep many investors interested, but the situation may change dramatically in the coming quarters. The reasons for this are increased competition in the aesthetics injectables market, in which Botox was the unanimous leader, the increase in Humira biosimilars in Europe, and the start of their commercialization in less than six months in the United States.

The company has an extensive pipeline, but many product candidates are in the early stages of clinical trials or have lower efficacy than those developed by Pfizer (PFE), Bristol-Myers Squibb (BMY), Amgen (AMGN), and others. Skyrizi and Rinvoq are two of AbbVie’s key medicines that the company is spending enormous resources on to slow down the decline in financial performance starting in 2H 2023 due to the factors described in this article. However, the intense competition in the autoimmune disease therapeutics market, which is intensifying year by year with the release of new generation drugs and the impact of the Inflation Reduction Act, may lead to more modest annual sales growth of these two drugs in the coming years. Consequently, I believe the best strategy for long-term investors is to wait for the company’s key drug sales dynamics from the second half of 2023 to reduce risk and avoid falling into the value trap that AbbVie is becoming.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.