Summary:

- Dividend Kings are the most battle-tested dividend payers on Wall Street, with AbbVie being just one of four in the healthcare sector.

- The pharmaceutical’s 4% dividend yield is covered by both earnings and free cash flow and is substantially higher than the 1.6% yield of the S&P 500 index.

- AbbVie’s portfolio of medicines and its pipeline could catalyze a post-Humira rebound.

- Thanks to its decent financial positioning, the company enjoys an investment-grade credit rating from S&P.

- AbbVie stock is trading at a slight premium to its fair value, which doesn’t quite give it the margin of safety needed to make it a buy.

Wall Street sign in New York City with the New York Stock Exchange in the background. naphtalina/iStock via Getty Images

As is the case with anything in life, dividend growth investing can be as simple or as complicated as you’d like. My investing strategy is to buy a stock that I am comfortable owning for at least 10 years. This is based on the following quote from an investing legend you probably know:

If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes. Berkshire Hathaway (BRK.A)(BRK.B) Chairman and CEO Warren Buffett

But how does a dividend growth investor determine whether they would be comfortable owning a stock for at least a decade? My advice is to focus on the likes of Dividend Kings. This is because businesses that have raised their payouts for 50 or more consecutive years have seen it all: Wars, recessions, housing bubbles, etc. Yet, they have come out on top every time. In the business of investing, that is the closest thing that we have to a guarantee.

One business that is a Dividend King with 51 years of dividend growth is the pharmaceutical giant AbbVie (NYSE:ABBV). This earns it the distinction of being one of just four healthcare sector companies with at least 50 years of dividend growth. For those who are curious, the others are Johnson & Johnson (JNJ), Abbott Laboratories (ABT) (the previous parent company of ABBV), and Becton, Dickinson and Co. (BDX). For the first time since July 2022, let’s discuss why I believe AbbVie could be a perfect stock for a dividend growth portfolio – – just not quite at the present valuation.

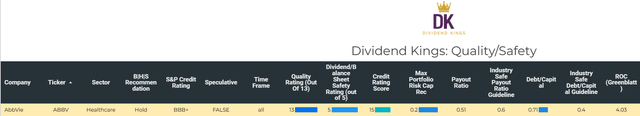

AbbVie’s 4% dividend yield isn’t quite on par with the risk-free 10-year U.S. treasury rate of 4.7%. But it is leaps and bounds ahead of the S&P 500 index’s 1.6% yield. Adding to the company’s intrigue for dividend investors, its EPS payout ratio is just 51%. This is even with its earnings currently at a trough due to substantial Humira biosimilar competition in the U.S. Put into perspective, that is moderately lower than the 60% payout ratio that rating agencies view as safe for the pharmaceutical industry.

One of the few knocks against the company is its 0.71 debt-to-capital ratio is beyond the 0.4 that rating agencies like to see. Even so, rating agency S&P awards a BBB+ credit rating to AbbVie (likely thanks to its robust profitability). This puts the company’s 30-year bankruptcy risk at a still modest 5%.

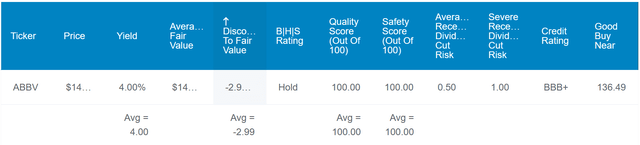

AbbVie’s stock is approximately 3% overvalued at the current $148 share price (as of October 16, 2023). Even with AbbVie’s potentially market-beating return potential, I’d like to see a margin of safety before adding to my position.

- 4% yield + 7% to 9% annual earnings growth + -0.3% annual valuation multiple downside = 10.7% to 12.7% annual total return prospects versus 10% annual total return potential from the S&P 500

Handling A Challenging Situation Like A Champ

AbbVie Q2 2023 Earnings Press Release

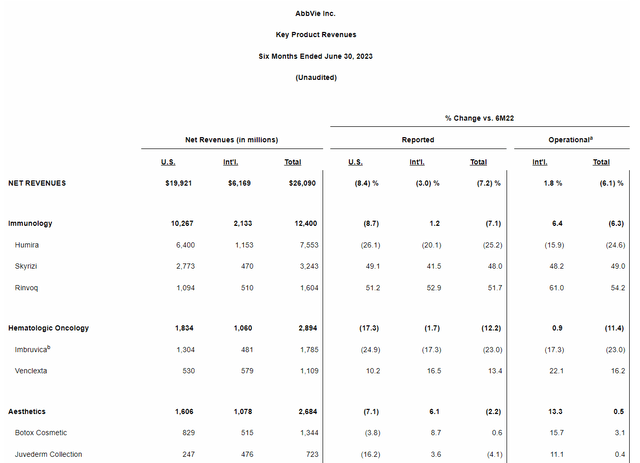

Heading into 2023, everybody knew that this year would be a transitional year for AbbVie. That is because the company was slated to face competition from several Humira biosimilars in the U.S. on January 31, beginning with Amgen’s (AMGN) Amjevita. For context, Humira contributed to 36.6% of AbbVie’s $58.1 billion in total net revenue during 2022. Furthermore, $18.6 billion, or 87.7% of the medicine’s net revenue was derived in the U.S.

With this knowledge in mind, AbbVie has fared reasonably well in the first six months of 2023. The company’s total net revenue dipped 7.2% over the year-ago period to $26.1 billion during the first half. This decline in the topline was driven by a 25.2% drop in AbbVie’s Humira net revenue to $7.6 billion for the first half.

The company’s challenging Humira sales were largely offset by the same drugs that have been central to its future for years. These include immunology drugs Skyrizi and Rinvoq, which posted net revenue growth rates of around 50% in 2023 due to increased market share and additional approved indications. The annualized revenue of these two drugs in the first half would be around $10 billion. Better yet, Skyrizi is likely to be approved for ulcerative colitis and Rinvoq will probably be approved for indications like hidradenitis suppurativa and systemic lupus erythematosus.

With ongoing programs in several additional disease areas, we expect both Skyrizi and Rinvoq to deliver robust growth into the next decade and significantly exceed Humira peak revenue. AbbVie President and COO Rob Michael’s opening remarks during AbbVie’s Q2 2023 earnings call

For these reasons, AbbVie believes that combined Skyrizi and Rinvoq net revenue will be significantly more than Humira’s peak revenue into the 2030s. Considering Humira’s peak net revenue of $21.2 billion, that could mean $15 billion or more of additional net revenue from the two drugs in the coming years from its current $10 billion annualized rate. That would more than replace a complete loss of all Humira revenue by that time.

Add in fast-growing neuroscience drugs Botox Therapeutic and Vraylar, and AbbVie is fundamentally sound. If that wasn’t enough, the company also has over 90 indications that are currently in development individually or under collaboration or license with partners in its pipeline. That suggests AbbVie isn’t just set for the next five- to 10 years beyond this year or 2024.

Due to a lower net revenue base and a downtick in profitability, the company’s adjusted diluted EPS predictably decreased by 17.6% over the year-ago period to $5.37 in the first half. Looking ahead, FactSet Research anticipates that AbbVie will generate 8% annual adjusted diluted EPS growth for the reasons discussed earlier.

AbbVie’s interest coverage ratio came in at approximately 4.4 for the first half of 2023. That isn’t as high of an interest coverage ratio as I’d prefer. But this was because of the downturn in profits more than anything else. AbbVie’s total interest expenses fell moderately in the past year due to debt repayment. That is why rating agency S&P has the confidence to maintain a BBB+ credit rating on a stable outlook for AbbVie (details sourced from AbbVie Q4 2022 earnings press release and AbbVie Q2 2023 earnings press release).

The Dividend Growth Story Isn’t Over

Since its spinoff from Abbott Labs in 2013, AbbVie has hiked its quarterly dividend per share by nearly 300% to the current rate of $1.48. Dividend growth has slowed in recent years, but that would be expected from a business that is working to get back on track post-Humira.

Analysts expect $11.07 in adjusted diluted EPS from AbbVie in 2023. Against the $5.92 in dividends per share that are scheduled to be paid, that is a sustainable 53.5% payout ratio.

AbbVie’s dividend has also been covered easily by free cash flow so far in 2023. The company produced $10.2 billion in free cash flow through the first half of the year. Compared to the $5.3 billion in dividends paid, this is a 52% payout ratio (info according to page 7 of 43 of AbbVie 10-Q). These low payout ratios are why I predict that AbbVie will keep handing out 5% to 6% annual dividend hikes moving forward.

Risks To Consider

AbbVie is tremendous, but it has its risks investors must be able to tolerate before buying the stock.

The company may have a stacked medicine portfolio and pipeline. Yet, this is still not a guarantee that these products will pan out and help AbbVie to keep growing. If the company’s key drugs fall short of expectations, its growth potential could be negatively impacted.

AbbVie’s ability to post amazing free cash flow hasn’t gone unnoticed by regulators. That is why the company and the pharmaceutical industry face the risk of pricing pressures from the U.S. government. This could hurt profit and free cash flow margins if it materializes in a meaningful way (more risks can be further explored on pages 16-27 of 162 of AbbVie’s 10-K filing).

Summary: A Wonderful Blue Chip Buy (At The Right Price)

Thanks to its healthy operating fundamentals, solid growth potential, and investment-grade credit rating, AbbVie is a 13/13 ultra SWAN (sleep well at night). This is especially evidenced by its average recession and severe recession dividend cut risks of just 0.5% and 1%, respectively.

AbbVie’s 4% yield and 7% to 9% annual earnings growth could make it a great wealth compounder in the future. However, AbbVie is trading about 3% above its fair value of $144. Building in a 5% margin of safety for ultra SWANs, the ideal price range to start buying AbbVie would be around the mid- $130s. That is why I will hold my position in AbbVie for now and remain on the sidelines until a pullback occurs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, ABT, AMGN, JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.